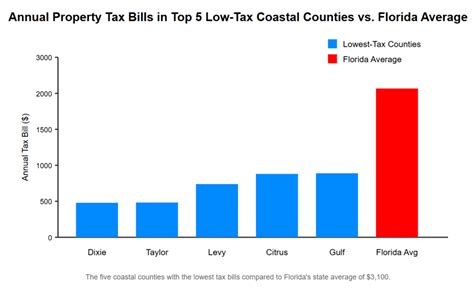

Levy County Florida Property Tax

In the heart of Florida's picturesque landscape lies Levy County, a place known for its natural beauty, rich history, and diverse communities. One of the primary concerns for property owners in this region is the property tax system, which plays a significant role in the local economy and community development. Understanding how this system works is crucial for homeowners and prospective buyers alike. This comprehensive guide aims to shed light on the intricacies of Levy County's property tax, offering a detailed analysis of its components, assessment processes, payment options, and potential exemptions.

The Levy County Property Tax System

The property tax system in Levy County, like many other counties in Florida, is a vital source of revenue for local governments and is used to fund essential services such as public schools, emergency services, road maintenance, and more. It is a progressive system, meaning that the assessed value of properties and the subsequent tax rates can vary significantly across the county.

The property tax in Levy County is primarily levied on real property, which includes land, buildings, and other permanent structures. This tax is calculated based on the assessed value of the property, which is determined through a complex assessment process.

Assessment Process

The Property Appraiser’s Office in Levy County is responsible for assessing the value of all properties within the county. This assessment is a critical step in determining the property tax bill for each owner. The process involves several key stages:

- Data Collection: The Property Appraiser's Office collects data on all properties, including physical characteristics, sales history, and market trends. This data is used as a foundation for the assessment process.

- Property Inspection: In some cases, property inspectors are dispatched to physically inspect the property to ensure the data collected is accurate and up-to-date. This step is particularly important for new constructions or significant renovations.

- Market Analysis: The Property Appraiser's Office conducts a thorough market analysis to determine the fair market value of properties. This involves comparing similar properties that have recently sold in the area.

- Assessment Calculation: Using the collected data and market analysis, the assessed value of each property is calculated. This value is then subject to a cap rate, which limits the annual increase in the assessed value to a maximum of 3% or the Consumer Price Index (CPI), whichever is lower.

The assessed value is a crucial factor in determining the property tax, as it is this value that is multiplied by the millage rate to calculate the tax amount.

| Property Type | Assessment Ratio |

|---|---|

| Homestead Properties | 10% |

| Non-Homestead Properties | 100% |

The assessment ratio is a key factor in the calculation. For homestead properties, which are primary residences that meet certain criteria, the assessed value is calculated at 10% of the fair market value. For non-homestead properties, such as second homes or rental properties, the assessed value is based on 100% of the fair market value.

Millage Rates and Tax Calculation

The millage rate, set by local government bodies, is a critical factor in determining the property tax. It is expressed as the number of mills, with one mill equating to 1 of tax for every 1,000 of assessed value. For example, if a property has an assessed value of $200,000 and the millage rate is 10 mills, the property tax would be calculated as follows:

Property Tax = Assessed Value x Millage Rate

Property Tax = $200,000 x 0.010 = $2,000

The millage rate is not uniform across Levy County. Different taxing authorities, such as the county government, school districts, and special districts, set their own rates based on their budgetary needs. These rates can vary significantly, leading to substantial differences in property taxes across the county.

Payment Options and Due Dates

Property taxes in Levy County are due annually, typically with a discount for early payment. The tax bills are mailed to property owners in November, and the payment deadline is usually in early April. However, to encourage timely payment, a discount is offered for payments made before a certain date. For example, a 4% discount may be offered for payments made before the end of November.

Property owners have several payment options, including online payment through the county's website, payment by mail, or in-person payment at the Tax Collector's Office. It's important to note that failure to pay property taxes can result in penalties, interest, and potential tax certificates being sold to third parties.

Property Tax Exemptions and Discounts

Levy County offers various property tax exemptions and discounts to eligible property owners. These exemptions can significantly reduce the tax burden and are designed to support specific groups or encourage certain behaviors.

Homestead Exemption

One of the most significant exemptions is the Homestead Exemption, which is available to Florida residents who own and occupy their primary residence as their homestead. This exemption can reduce the assessed value of the property by up to $50,000, resulting in substantial tax savings. To qualify, homeowners must meet certain residency and ownership requirements and file an application with the Property Appraiser’s Office by March 1st of each year.

Other Exemptions and Discounts

In addition to the Homestead Exemption, Levy County offers several other exemptions and discounts, including:

- Senior Exemption: Property owners who are 65 years or older and meet certain income and residency requirements may qualify for an additional exemption, further reducing their property taxes.

- Widow/Widower Exemption: Spouses of deceased homeowners who meet specific criteria may be eligible for an exemption, allowing them to retain the homestead status and its associated tax benefits.

- Military Discounts: Active-duty military personnel and veterans may qualify for property tax discounts or exemptions based on their service status and length of service.

- Greenbelt Exemption: Property owners who use their land for agricultural or timber purposes may qualify for an exemption, which can significantly reduce the assessed value of their property.

Impact on the Local Economy

The property tax system in Levy County has a profound impact on the local economy and community development. It is a primary source of revenue for local governments, schools, and special districts, funding essential services that directly benefit residents.

Property taxes contribute to the maintenance and improvement of local infrastructure, including roads, bridges, and public utilities. They also support public safety services, such as fire and emergency medical services, ensuring the well-being and safety of residents. Additionally, property taxes are a crucial component in funding public education, with a significant portion of the tax revenue allocated to local schools.

Community Development and Revitalization

The property tax system also plays a role in community development and revitalization efforts. Tax revenues are often used to invest in community projects, such as park improvements, recreational facilities, and cultural initiatives. These investments not only enhance the quality of life for residents but also attract new businesses and residents, fostering economic growth and development.

Furthermore, the property tax system encourages property ownership and investment in the community. With various exemptions and discounts available, especially for primary residences and agricultural lands, the county promotes long-term residency and sustainable land use practices.

Conclusion

The property tax system in Levy County, Florida, is a complex yet essential component of the local economy and community development. It is a progressive system that varies based on property type, assessed value, and millage rates set by local authorities. Understanding this system is crucial for property owners, as it directly impacts their financial obligations and contributes to the overall well-being of the community.

From the assessment process to payment options and potential exemptions, property owners in Levy County have a range of considerations and opportunities. By staying informed and actively participating in the property tax system, homeowners can ensure they are fairly assessed and take advantage of available benefits. This comprehensive guide aims to provide a clear understanding of the Levy County property tax system, empowering property owners to make informed decisions and actively contribute to their community.

Frequently Asked Questions

How often is the assessed value of my property updated in Levy County?

+

The assessed value of properties in Levy County is updated annually. The Property Appraiser’s Office conducts regular assessments to ensure that property values remain accurate and up-to-date.

Are there any online resources to help me estimate my property tax in Levy County?

+

Yes, the Levy County Property Appraiser’s Office provides an online property search tool that allows homeowners to estimate their property tax based on the assessed value and the current millage rates. This tool can be a valuable resource for homeowners to get an idea of their potential tax liability.

Can I appeal my property’s assessed value if I believe it is incorrect?

+

Absolutely. If you believe that your property’s assessed value is incorrect, you have the right to appeal to the Levy County Value Adjustment Board (VAB). The VAB is an independent body that reviews and makes decisions on property value appeals. It’s important to note that there are specific deadlines and processes for filing an appeal, so it’s advisable to review the guidelines provided by the Property Appraiser’s Office.

Are there any property tax discounts or exemptions available for low-income homeowners in Levy County?

+

Yes, Levy County offers a Low-Income Senior Exemption for homeowners who are 65 years or older and meet certain income and residency requirements. This exemption can provide significant tax relief for eligible low-income seniors. Additionally, the county also offers other exemptions and discounts, such as the Homestead Exemption, which can further reduce property taxes for eligible homeowners.

How can I stay informed about changes to the millage rates in Levy County?

+

To stay informed about changes to the millage rates, it’s recommended to regularly check the websites of the local taxing authorities, such as the Levy County Board of County Commissioners, school districts, and special districts. These authorities are required to publish their proposed millage rates and provide public notice of any changes. Additionally, you can sign up for email updates or newsletters from these organizations to receive timely notifications.