Az Property Tax

Welcome to an in-depth exploration of the intricate world of Az Property Tax, a topic that impacts every homeowner and real estate investor in the state of Arizona. This article aims to shed light on the nuances of property taxation in Arizona, providing an insightful guide to help you navigate this complex but essential aspect of homeownership.

Understanding the Basics: What is Az Property Tax?

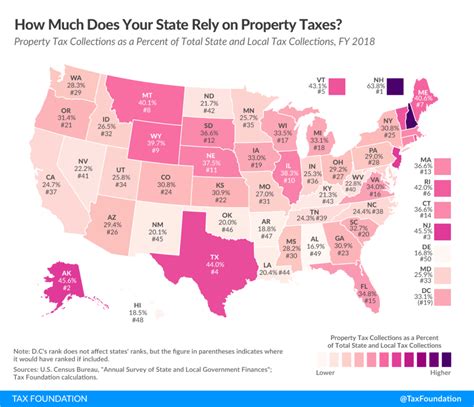

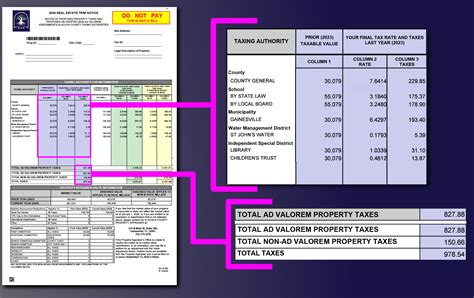

Property tax, also known as ad valorem tax, is a levy imposed on the value of real estate property. In the context of Arizona, Az Property Tax is a crucial component of the state’s revenue system, contributing significantly to the funding of essential services such as education, infrastructure, and public safety.

The Arizona Department of Revenue (ADOR) oversees the assessment and collection of property taxes across the state. This process involves a meticulous evaluation of each property's value, ensuring a fair and equitable tax burden for all property owners.

How is Az Property Tax Calculated?

The calculation of Az Property Tax involves a few key steps. First, the assessed value of a property is determined. This value is typically 10% of the full cash value of the property, as assessed by the county assessor’s office. It’s important to note that the assessed value can differ from the market value of the property.

Once the assessed value is established, it is multiplied by the property tax rate, which varies depending on the location of the property within the state. This rate is expressed as a percentage and is set by local governments, including cities, towns, and special districts.

| County | Average Property Tax Rate (%) |

|---|---|

| Maricopa County | 1.05 |

| Pima County | 1.27 |

| Pinal County | 1.03 |

| Yavapai County | 1.14 |

For instance, if your property has an assessed value of $200,000 and you reside in Maricopa County with a property tax rate of 1.05%, your annual property tax bill would be calculated as follows:

$200,000 (assessed value) x 1.05% (tax rate) = $2,100 in annual property taxes.

Property Tax Assessment and Appeals

Property tax assessments are conducted regularly to ensure that the tax burden remains fair and accurate. In Arizona, properties are typically assessed every two years, although some counties may assess more frequently.

The Assessment Process

The assessment process involves a comprehensive evaluation of a property’s characteristics, including its size, location, condition, and recent sales data of similar properties in the area. This data is then used to estimate the property’s full cash value, which forms the basis for the assessed value.

Property owners have the right to review their assessment and dispute any inaccuracies. The process for appealing an assessment varies by county, but typically involves submitting documentation to support your claim and potentially attending a hearing before the county's Board of Equalization.

Tax Exemptions and Credits

Arizona offers various property tax exemptions and credits to eligible homeowners. These can significantly reduce the tax burden for qualifying individuals. Some of the common exemptions and credits include:

- Homeowner's Property Value Protection Program (H-PVPP): This program limits the increase in assessed value to 5% per year, ensuring that property taxes do not escalate rapidly.

- Residential Property Tax Credit: Provides a credit of up to $250 to offset the cost of property taxes for qualifying homeowners.

- Veterans' Exemption: Offers a property tax exemption to honorably discharged veterans who have served during wartime.

- Disabled Veterans' Exemption: Provides an additional exemption for disabled veterans, increasing the tax-exempt portion of their property value.

It's important to research and understand the eligibility criteria for these exemptions and credits to ensure you're taking advantage of all the benefits available to you.

The Impact of Az Property Tax on Homeownership

Property taxes play a significant role in the overall cost of homeownership. For many homeowners, property taxes are a substantial expense that must be planned for and budgeted accordingly.

Planning for Property Taxes

When considering the purchase of a property in Arizona, it’s essential to factor in the potential property tax liability. This can be done by researching the average property tax rates in the desired area and estimating the assessed value of the property. This information can then be used to project the annual tax liability.

Additionally, homeowners should be aware of potential increases in property taxes over time. While the H-PVPP program limits annual increases, special levies and bond initiatives can still result in higher property tax bills.

Strategies for Managing Property Taxes

There are several strategies homeowners can employ to manage their property tax burden effectively. These include:

- Appealing Assessments: As mentioned earlier, property owners can appeal their assessments if they believe the assessed value is inaccurate. Successful appeals can lead to lower property taxes.

- Claiming Exemptions and Credits: Ensuring you're aware of and claiming all eligible exemptions and credits can significantly reduce your property tax liability.

- Property Tax Loans: For those facing financial difficulties, property tax loans can provide a temporary solution. These loans allow homeowners to pay off their property taxes in installments, often with more flexible terms.

Conclusion: Navigating Az Property Tax

Understanding and effectively managing Az Property Tax is a crucial aspect of homeownership in Arizona. By familiarizing yourself with the assessment process, tax rates, and available exemptions, you can make informed decisions and ensure you’re not paying more than your fair share.

Stay informed, research thoroughly, and don't hesitate to seek professional advice when needed. Property taxes can be complex, but with the right knowledge and strategies, you can navigate them successfully.

Frequently Asked Questions

When are property taxes due in Arizona?

+

Property taxes in Arizona are typically due twice a year, with the first installment due on October 1st and the second installment due on March 1st of the following year. However, some counties may have different due dates, so it’s essential to check with your local county treasurer’s office for the exact schedule.

How can I estimate my property tax bill before purchasing a home in Arizona?

+

To estimate your property tax bill, you can use the assessed value of the property and multiply it by the average property tax rate for the county where the property is located. You can find the assessed value on the property’s tax records, and the average tax rate is typically available from the county assessor’s office or online resources.

Are there any property tax relief programs for seniors in Arizona?

+

Yes, Arizona offers the Senior Citizen Property Tax Deferral Program, which allows eligible seniors to defer their property taxes until after their death or when they sell their home. To qualify, individuals must be at least 65 years old, have a household income of less than 35,000, and meet other specific criteria. It's recommended to consult the Arizona Department of Revenue for detailed eligibility requirements.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What happens if I don't pay my property taxes on time in Arizona?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Late payment of property taxes in Arizona can result in penalties and interest charges. If taxes remain unpaid, the county treasurer may place a lien on the property, which could lead to foreclosure if the taxes and associated fees are not paid within a specified period. It's crucial to stay current on your property tax payments to avoid these consequences.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I deduct my property taxes on my federal income tax return?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, under certain circumstances, you may be able to deduct your property taxes on your federal income tax return. This deduction is subject to the limitations of the Tax Cuts and Jobs Act of 2017, which caps the state and local tax (SALT) deduction at 10,000 per year. Consult with a tax professional to determine if you’re eligible for this deduction and to maximize your tax benefits.