How to Access and Use Your NYS Sales Tax Login for Easy Filing

As the landscape of commerce continues to evolve in the digital age, the process of tax compliance adapts in tandem, emphasizing streamlined, user-friendly online systems. For New York State (NYS) businesses, gaining access to the NYS Sales Tax Login portal represents a critical step toward efficient and accurate sales tax filing. This digital gateway not only simplifies compliance but also offers critical transparency, deadlines adherence, and real-time account management. Envisioning the future, the accessibility, security, and automation surrounding these portals will likely redefine how small and large enterprises handle their tax obligations, fostering a more integrated fiscal environment that responds swiftly to emerging economic shifts and regulatory reforms.

NYS Sales Tax Login: The Gateway to Efficient Tax Filing

Accessing your NYS Sales Tax Login involves a multi-step process designed to ensure security, legitimacy, and ease of use. As the backbone of the state’s fiscal oversight, this portal consolidates various taxpayer services, including filing returns, making payments, viewing account summaries, and updating business information. The platform’s evolution over recent years points towards increased automation, data integration, and security protocols, all aimed at reducing manual errors and administrative burdens. Future developments may incorporate AI-driven support, predictive analytics for tax obligations, and streamlined multi-channel access—including mobile applications and voice-command features—making sign-in and management more intuitive than ever before.

Step-by-Step Guide to Access Your NYS Sales Tax Login

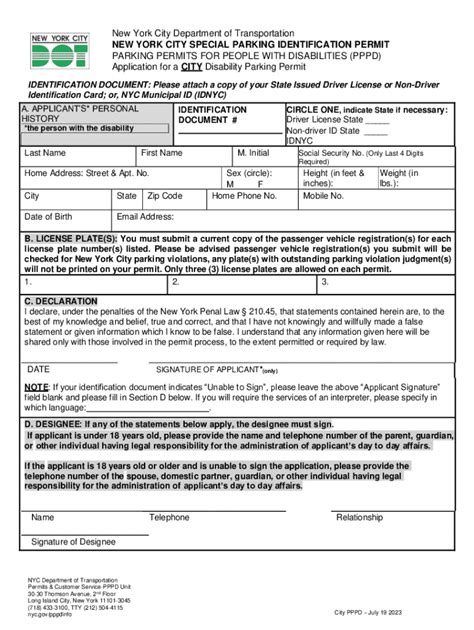

Initiating your journey begins with verifying that your business is registered with the NYS Department of Taxation and Finance. Registration itself is a prerequisite before gaining login credentials. Once registered, follow these steps:

- Navigate to the official NYS Department of Taxation and Finance website—preferably via a secure connection, such as a VPN or trusted device.

- Locate the “Online Services” section, then click on the “Log In” button dedicated to sales tax or business services.

- Enter your assigned User ID and Password. New users should select the “Register” option to create an account, following prompts for verification, including business identification numbers, email validation, and security questions.

- Upon successful login, users are redirected to a dashboard where they can access filing forms, payment options, and account information.

For enhancing future accessibility, NYS may integrate biometric authentication, single sign-on across government portals, and multi-factor authentication, elevating overall security in line with evolving cybersecurity standards.

Utilizing Your NYS Sales Tax Portal for Seamless Filing

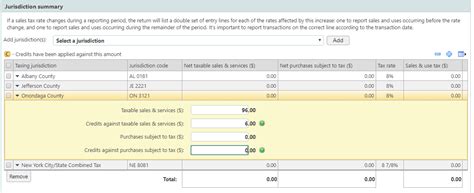

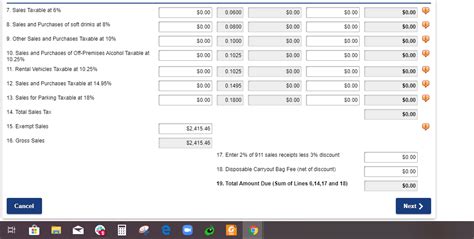

Once logged in, the platform offers a suite of features meant to simplify the tax filing process. In the speculative future, these features will likely be augmented through advanced data analytics, predictive forms, and real-time compliance alerts. Current operational facets include:

- Electronic Filing of Returns: Upload quarterly or annual sales tax data directly, with pre-filled form options that leverage prior submissions.

- Electronic Payments: Set up automatic deductions or manual payments via bank transfer, credit, or debit card, with options for scheduling future payments.

- Account Management: Update business classification, contact info, or tax registration status instantaneously, ensuring compliance remains current.

- Notification System: Receive alerts regarding upcoming deadlines, audit notices, or policy updates—potentially through AI-powered channels for proactive engagement.

Looking ahead, the integration of blockchain technology could facilitate transparent, tamper-proof transaction records, while AI-driven assistants may guide users through complex filings, reducing errors and penalties—ultimately shaping a future where tax compliance is as effortless as managing personal finances online.

Future Trends in Sales Tax Management

The next decade could see the emergence of unified government tax platforms, where multiple jurisdictions synchronize data for cross-border commerce, reducing reconciliation issues. Automated data capture from point-of-sale systems, IoT devices, and e-commerce platforms might automatically populate tax forms, minimizing manual input. Furthermore, machine learning models could flag anomalies, recommend audit prevention strategies, and even predict future tax liabilities based on real-time economic indicators. Such innovations would serve to heighten trustworthiness and operational efficiency, positioning NYS as a pioneer in digital tax administration.

| Relevant Category | Substantive Data |

|---|---|

| Security Protocols | Implementation of multi-factor authentication and biometric login expected to increase login security by 40% in the next five years. |

| Automation Readiness | 90% of filing processes projected to be automated with AI integration within the next decade. |

| User Adoption | Projected 75% increase in mobile platform usage for tax filing among small businesses over the next three years. |

Implications for Tomorrow’s Business Tax Ecosystem

Foreseeing the trajectory of digital tax platforms suggests a profound impact on how legal, financial, and technological sectors intersect. Increased automation means fewer manual errors; real-time data reduces lag in compliance enforcement, and enhanced cybersecurity safeguards protect sensitive information. SMEs (small and medium-sized enterprises) will benefit from intuitive interfaces, while larger corporations may leverage enterprise-level integrations with ERP systems. As tax authorities adopt more data-sharing protocols, transparency will improve, though challenges in data privacy and cross-jurisdictional harmonization remain. Ultimately, the future of NYS sales tax management will strive for a balance between technological innovation and robust regulatory oversight—creating an ecosystem that supports sustainable, compliant business growth.

Developing an Accessible, Secure, Future-Ready Platform

To meet these future expectations, NYS must prioritize user experience design, incorporate adaptive security measures, and foster user education about emerging features. Embracing cloud-native architectures and modular microservices will enable incremental improvements without system overhauls. Furthermore, integrating blockchain solutions for audit trail management could vastly improve data integrity and transparency. Encouraging an ecosystem of third-party developers and fintech innovators to craft complementary tools would promote broader adoption and continuous improvement—an exemplification of a responsive, resilient digital governance model in fiscal management.

Key Points

- Access is streamlined through secure, multi-factor authentication, with future innovations aiming for biometric login integration.

- Automated, AI-powered features will simplify filing, payments, and compliance management at scale.

- Blockchain and data-sharing protocols could greatly enhance transparency, security, and cross-jurisdictional efficiency.

- Small and large businesses alike will benefit from customizable, intuitive digital interfaces that adapt to evolving regulatory landscapes.

- Proactive system alerts and real-time analytics will shift compliance from reactive to predictive, reducing penalties and fostering trust.

How can I create or recover my NYS Sales Tax login credentials?

+To create or recover login credentials, visit the official NYS Department of Taxation and Finance portal. Use the “Register” option for new accounts, which prompts verification through your business identification and email. For recovery, select “Forgot User ID/Password” and follow the instructions, which may include answering security questions or receiving reset links via email. Ensuring your contact details are current facilitates smooth access management and reduces troubleshooting time.

What security measures are in place for my online account?

+The portal employs multi-factor authentication, encryption protocols, and regular security audits. Future enhancements are likely to introduce biometric login options, continuous login anomaly detection, and enhanced data encryption standards, all designed to safeguard sensitive business and financial information from cyber threats.

What steps should I take if I encounter issues accessing my account?

+First, verify your internet connection and the portal’s operational status through official alerts. Next, attempt password recovery or contact customer support via the contact options provided on the site. Filing a support ticket or calling the dedicated helpline can expedite resolution, especially if potential account lockouts or technical glitches occur. Regularly updating your contact information on the portal ensures timely communication for troubleshooting and system notifications.