Property Tax Tennessee

Property taxes are an essential aspect of local governance and revenue generation in Tennessee, playing a significant role in funding various public services and infrastructure projects. The state's property tax system is designed to provide a stable source of income for local governments, ensuring the smooth operation of essential services such as education, emergency response, and road maintenance.

Understanding Property Taxes in Tennessee

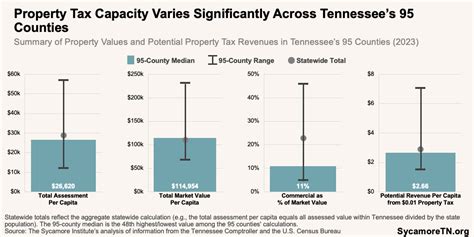

Tennessee’s property tax system operates on a local level, with taxes being administered by county governments. Each county has its own tax rate, which is determined by the local government based on the revenue needed to cover its annual budget. This means that property tax rates can vary significantly across the state, reflecting the diverse needs and financial situations of different communities.

The state's property tax is primarily levied on real property, which includes land and any permanent structures attached to it. This can encompass residential homes, commercial buildings, agricultural land, and other types of property. Personal property, such as vehicles, furniture, and other moveable items, is typically not subject to the state's property tax.

The tax rate is expressed as a percentage and is applied to the assessed value of the property. The assessed value is determined by the local tax assessor's office, which appraises the property's market value. This value can be influenced by factors such as the property's location, size, age, and condition. It is important to note that the assessed value may not always reflect the property's true market value, as it is subject to the assessor's evaluation.

Calculating Property Taxes in Tennessee

The calculation of property taxes in Tennessee involves a simple formula: Tax Rate x Assessed Value = Property Taxes Owed. For example, if a property has an assessed value of 200,000 and the county's tax rate is 2.5%, the property taxes owed would be 5,000 (200,000 x 0.025 = 5,000). This calculation provides a clear understanding of how the tax burden is distributed among property owners.

| County | Tax Rate | Average Property Value | Estimated Taxes |

|---|---|---|---|

| Davidson County | 2.25% | $275,000 | $6,187.50 |

| Shelby County | 2.5% | $180,000 | $4,500 |

| Knox County | 2% | $220,000 | $4,400 |

These estimates provide a glimpse into the varying tax burdens across Tennessee's counties, highlighting the impact of different tax rates and property values on the taxes owed by residents.

Tax Exemptions and Relief Programs

Tennessee offers several tax exemptions and relief programs to ease the burden on certain property owners. These initiatives aim to support specific groups, such as seniors, veterans, and low-income individuals, by reducing their property tax obligations.

- Senior Citizen Exemption: Tennessee provides a property tax exemption for seniors aged 65 and above. This exemption reduces the assessed value of the property by up to $12,500, resulting in lower taxes for qualifying individuals.

- Veteran's Exemption: The state offers a property tax exemption to honorably discharged veterans and their surviving spouses. This exemption can reduce the assessed value of the property by up to $17,500, providing significant tax relief.

- Low-Income Relief: Certain counties in Tennessee offer programs to assist low-income homeowners with their property taxes. These programs often provide grants or credits to help cover a portion of the tax burden.

The Impact of Property Taxes on Local Communities

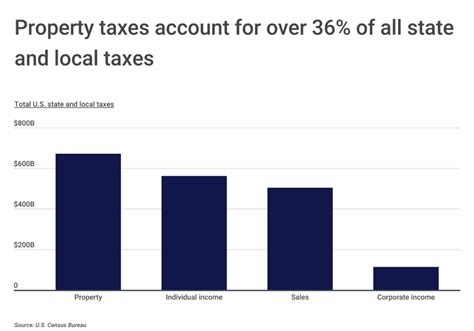

Property taxes are a critical component of local economies, as they provide a stable revenue stream for county governments to fund essential services and infrastructure. These funds are used to maintain and improve roads, bridges, and other public works projects, ensuring the smooth functioning of the community.

Moreover, property taxes are a significant contributor to local education budgets. A large portion of property tax revenue is allocated to support public schools, ensuring that students have access to quality education. This funding is crucial for maintaining teacher salaries, purchasing educational materials, and investing in school infrastructure.

Property Taxes and Economic Development

Tennessee’s property tax system also plays a role in economic development initiatives. By providing a stable tax environment, the state attracts businesses and investors, fostering job creation and economic growth. The tax revenue generated can be reinvested into local communities, supporting initiatives such as business incubators, workforce development programs, and other initiatives that promote economic prosperity.

However, it is essential to strike a balance between generating revenue and maintaining a competitive tax environment. High property tax rates can discourage investment and impact the affordability of housing, potentially leading to a decline in property values and economic stagnation.

Property Tax Appeals and Challenges

Property owners in Tennessee have the right to appeal their assessed property value if they believe it is inaccurate or unfair. This process, known as a property tax appeal, allows homeowners to dispute the tax assessor’s evaluation and potentially reduce their tax burden.

The appeal process involves submitting evidence and arguments to support the claim that the assessed value is excessive. This can include recent sale prices of similar properties, appraisals, or other relevant information. If the appeal is successful, the assessed value may be adjusted, resulting in lower property taxes.

It is crucial for property owners to stay informed about their rights and the appeal process to ensure they are not overpaying on their property taxes. Seeking professional advice or assistance from tax consultants can be beneficial in navigating the complexities of the property tax system.

Future Implications and Trends

Tennessee’s property tax system is constantly evolving to adapt to changing economic conditions and community needs. As the state’s population grows and urban areas expand, the demand for public services and infrastructure increases, putting pressure on county governments to generate sufficient revenue.

One trend that is gaining attention is the use of technology to improve the property tax assessment process. Advanced data analytics and property valuation tools are being employed to enhance accuracy and efficiency, ensuring fair and consistent assessments across the state. This modernization effort aims to reduce administrative burdens and streamline the tax collection process.

Additionally, there is a growing focus on equity and fairness in property tax distribution. Counties are exploring strategies to ensure that the tax burden is distributed equitably among property owners, considering factors such as income levels and property values. This shift towards a more progressive tax system aims to alleviate the financial strain on lower-income households while maintaining a stable revenue stream for essential services.

Frequently Asked Questions

How often are property taxes assessed in Tennessee?

+Property taxes in Tennessee are typically assessed annually. The assessment process involves evaluating the property’s value based on various factors, such as location, size, and improvements made. This assessment determines the tax base for the upcoming year.

Are there any online resources to estimate my property taxes in Tennessee?

+Yes, many counties in Tennessee provide online tools and calculators to estimate property taxes. These tools consider the property’s assessed value and the applicable tax rate to provide an estimated tax amount. However, it’s important to note that these estimates may not be exact and should be used as a guide.

What happens if I don’t pay my property taxes in Tennessee?

+Failure to pay property taxes in Tennessee can result in serious consequences. The county may place a lien on the property, which could lead to foreclosure if the taxes remain unpaid. Additionally, interest and penalties may accrue, increasing the overall debt. It is crucial to stay current on property tax payments to avoid these legal and financial complications.