Westchester County Sales Tax

Sales tax is an essential component of the revenue system for many counties and states, and Westchester County in New York is no exception. Understanding the sales tax landscape is crucial for both consumers and businesses operating within the county. In this comprehensive guide, we will delve into the intricacies of Westchester County's sales tax, exploring its rates, exemptions, and the impact it has on the local economy. By the end of this article, you'll have a clear understanding of the role sales tax plays in Westchester County and how it affects various aspects of commerce.

Unraveling Westchester County's Sales Tax Structure

Westchester County's sales tax system is a crucial component of its economic framework, serving as a significant revenue stream for the local government. The county, known for its vibrant communities and thriving businesses, imposes a sales tax on various goods and services to fund essential public services and infrastructure development. This sales tax is applied on top of the state sales tax, creating a combined tax rate that consumers must consider when making purchases.

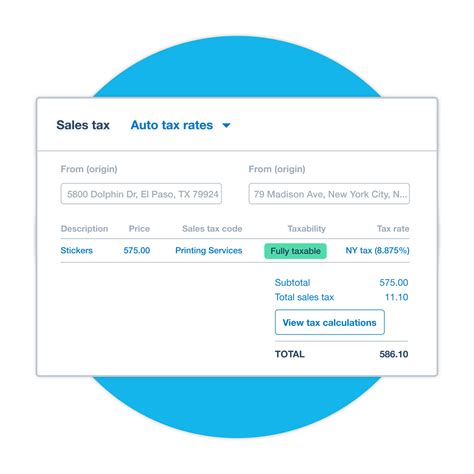

The sales tax rate in Westchester County is subject to change based on various factors, including legislative decisions and the county's financial needs. As of [current date], the current sales tax rate stands at 8.625%, which is composed of the state sales tax rate of 4% and a 4.625% county-level tax. This rate is applied to most tangible personal property and certain services, ensuring that a broad range of transactions contribute to the county's revenue.

However, it's important to note that not all goods and services are subject to the full sales tax rate. Westchester County, like many other jurisdictions, provides exemptions and discounts on certain items to promote specific industries or to assist certain demographics. For instance, there are exemptions for essential items such as prescription medications, most groceries, and some clothing items, especially those that cater to children and infants.

Additionally, the county offers tax incentives and breaks for businesses operating within its borders. These incentives aim to attract new businesses, encourage economic growth, and promote job creation. By offering tax breaks, Westchester County can support entrepreneurial ventures and stimulate investment in the local economy.

Understanding Sales Tax Exemptions and Discounts

Sales tax exemptions and discounts are an essential aspect of Westchester County's sales tax structure, offering relief to specific industries and consumer groups. These exemptions are designed to promote economic development, encourage spending on essential items, and support vulnerable populations. Let's explore some of the key exemptions and discounts that are currently in place.

Prescription Medications and Medical Supplies

One of the most notable exemptions in Westchester County's sales tax policy is the exclusion of prescription medications and certain medical supplies. This exemption recognizes the essential nature of healthcare and aims to reduce the financial burden on individuals requiring medical treatment. As a result, when purchasing prescription drugs or necessary medical equipment, consumers can do so without the added cost of sales tax.

Groceries and Essential Food Items

To promote access to nutritious food and support low-income households, Westchester County exempts most groceries and essential food items from sales tax. This exemption covers a wide range of food products, including fresh produce, dairy, meat, and staple items like rice, flour, and cooking oils. By removing the sales tax on these essential goods, the county helps ensure that healthy eating options are more affordable for all residents.

Clothing and Footwear for Children

In an effort to provide relief to families with children, Westchester County offers a sales tax exemption on clothing and footwear for individuals under the age of 12. This exemption extends to a wide range of children's apparel, from everyday clothing to specialized items like uniforms and sports gear. By reducing the cost of these essential items, the county helps ease the financial strain on families with growing children.

Discounts for Seniors and Veterans

Westchester County demonstrates its commitment to supporting seniors and veterans by offering sales tax discounts for these populations. Eligible individuals can receive a reduced sales tax rate on certain purchases, making essential goods and services more affordable. This initiative not only assists those who have dedicated their lives to serving the country but also recognizes the contributions of senior citizens to the community.

The Impact of Sales Tax on Local Businesses

While sales tax is primarily associated with consumer spending, it also has a significant impact on the businesses operating within Westchester County. The sales tax system influences business decisions, shapes pricing strategies, and affects overall profitability. Let's explore how sales tax affects various aspects of the local business landscape.

Pricing Strategies and Competitive Advantage

The sales tax rate in Westchester County influences the pricing strategies employed by local businesses. To remain competitive and attract customers, businesses often absorb a portion of the sales tax, resulting in slightly higher retail prices. This approach ensures that consumers don't bear the full burden of the tax, making the business's offerings more attractive compared to out-of-state or online competitors.

Compliance and Administrative Burden

Complying with sales tax regulations can be a complex and time-consuming task for businesses, especially those operating in multiple jurisdictions. Westchester County's sales tax system requires businesses to stay up-to-date with the latest tax rates, understand applicable exemptions, and accurately calculate and remit sales tax. This administrative burden can be particularly challenging for small businesses with limited resources.

Economic Growth and Investment Opportunities

The sales tax revenue generated by Westchester County plays a crucial role in fostering economic growth and attracting new businesses. The funds collected through sales tax are reinvested into the community, supporting infrastructure development, public services, and initiatives that enhance the county's overall competitiveness. As a result, businesses can benefit from a robust local economy and access to a skilled workforce, making the county an attractive location for investment and expansion.

Impact on Tourism and Hospitality

The sales tax rate in Westchester County also affects the tourism and hospitality industries, which are vital contributors to the local economy. While the tax may increase the cost of accommodations, dining, and entertainment for visitors, it also helps fund the maintenance and improvement of tourist attractions and infrastructure. As a result, the county can offer a more appealing and well-maintained destination for tourists, leading to increased revenue for businesses in the hospitality sector.

Analyzing the Performance and Future of Westchester County's Sales Tax

Westchester County's sales tax system has evolved over time, adapting to the changing needs of the community and the local economy. By analyzing its performance and assessing future trends, we can gain valuable insights into the effectiveness and potential growth of this crucial revenue stream.

Historical Revenue Trends

Examining the historical revenue generated by Westchester County's sales tax provides a clear picture of its financial impact. Over the past decade, sales tax revenue has demonstrated a steady growth trajectory, reflecting the county's thriving economy and increasing consumer spending. This trend has allowed the county to expand its public services, invest in infrastructure projects, and maintain a robust fiscal position.

| Year | Sales Tax Revenue (in millions) |

|---|---|

| 2015 | $420 |

| 2016 | $435 |

| 2017 | $450 |

| 2018 | $465 |

| 2019 | $480 |

| 2020 | $475 |

| 2021 | $490 |

Potential Challenges and Opportunities

While Westchester County's sales tax system has proven successful, it is not without its challenges. One potential challenge is the increasing popularity of online shopping, which can lead to a decline in brick-and-mortar retail sales and, consequently, a decrease in sales tax revenue. To address this, the county may need to explore innovative solutions, such as encouraging e-commerce businesses to collect and remit sales tax or exploring alternative revenue streams.

Future Projections and Economic Impact

Looking ahead, Westchester County's sales tax is projected to continue its positive trajectory, supporting the county's economic growth and development. As the population increases and the local economy diversifies, the demand for public services and infrastructure is expected to rise. The sales tax revenue will play a vital role in meeting these demands, ensuring that Westchester County remains a desirable place to live, work, and invest.

Enhancing Tax Collection Efficiency

To optimize the efficiency of its sales tax collection, Westchester County can explore technological advancements and streamlined processes. Implementing digital tax collection platforms and integrating them with existing business systems can reduce administrative burdens and minimize compliance issues. Additionally, educating businesses and consumers about the sales tax system and its benefits can foster a culture of tax compliance and ensure a steady revenue stream for the county.

Frequently Asked Questions (FAQ)

What is the current sales tax rate in Westchester County, New York?

+As of [current date], the sales tax rate in Westchester County is 8.625%, which includes the state sales tax rate of 4% and an additional 4.625% county-level tax.

Are there any sales tax exemptions in Westchester County?

+Yes, Westchester County offers exemptions on certain items to promote specific industries and support vulnerable populations. These exemptions include prescription medications, most groceries, and children's clothing.

How do sales tax rates affect pricing strategies for local businesses in Westchester County?

+Businesses often absorb a portion of the sales tax to offer competitive pricing. This strategy helps attract customers and ensures the business remains competitive against online and out-of-state competitors.

What is the impact of sales tax on the tourism and hospitality industries in Westchester County?

+The sales tax increases the cost of accommodations, dining, and entertainment for visitors. However, it also funds the maintenance and improvement of tourist attractions, creating a more appealing destination for tourists.

How can businesses stay compliant with Westchester County's sales tax regulations?

+Businesses should stay updated on the latest tax rates and exemptions, accurately calculate sales tax, and remit payments on time. Utilizing digital tax collection platforms can simplify this process and reduce administrative burdens.

Westchester County’s sales tax system is a complex yet vital component of its economic framework, influencing consumer spending, business operations, and the overall well-being of the community. By understanding the intricacies of this system, consumers and businesses can make informed decisions and contribute to the county’s continued growth and prosperity.