Michigan State Tax Return Status

Tax season is a critical period for individuals and businesses, as it involves the timely filing of tax returns and the anticipation of potential refunds or the settlement of any outstanding tax liabilities. In the state of Michigan, the tax authority provides a convenient online service for taxpayers to check the status of their state tax returns. This article aims to delve into the process of checking Michigan state tax return status, offering a comprehensive guide to taxpayers seeking clarity and peace of mind during this annual financial ritual.

Navigating the Michigan State Tax Return Status Portal

The Michigan Department of Treasury understands the importance of keeping taxpayers informed about the status of their tax returns. To this end, they have developed an intuitive online platform, accessible through their official website, which allows taxpayers to check the progress of their state tax returns with just a few clicks.

Step-by-Step Guide to Checking Your Michigan State Tax Return Status

-

Access the Michigan Tax Return Status Portal: Start by visiting the official website of the Michigan Department of Treasury. Look for the “Check Your Refund Status” or “Tax Return Status” link, which is usually prominently displayed on the homepage.

-

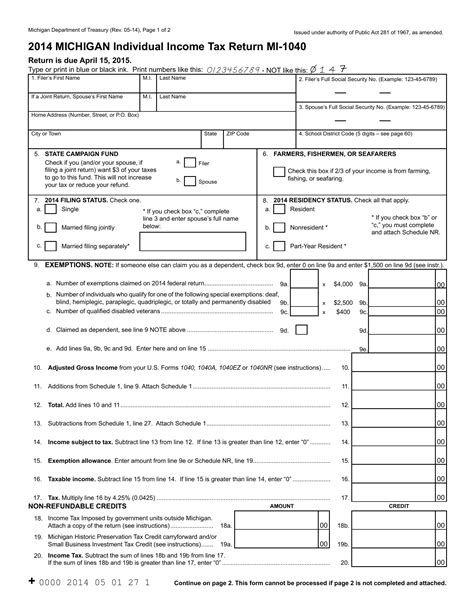

Enter Your Information: On the designated page, you will be required to provide specific details to access your tax return status. This typically includes your Social Security Number, Tax Year, and the Exact Amount of Your Refund or the Amount You Paid. Ensure that you enter this information accurately, as it is a security measure to protect your tax records.

-

Submit Your Request: After entering your details, click the “Submit” or “Check Status” button to initiate the process. The website will then search its records based on the information you provided.

-

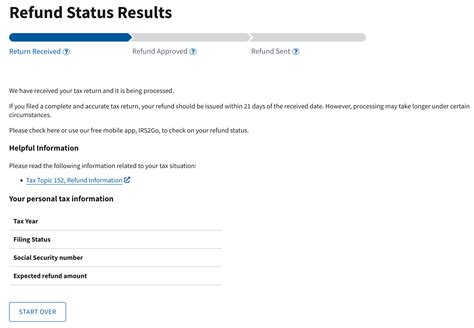

View Your Tax Return Status: Within a few moments, the website will display the current status of your Michigan state tax return. The status may indicate whether your return has been received, is being processed, or if a refund has been issued. It might also provide an estimated date for when you can expect your refund, should you be due one.

-

Additional Resources: In some cases, the website might offer further resources or instructions based on your specific tax situation. This could include links to forms, instructions for correcting errors, or information on how to resolve any potential issues with your return.

It's important to note that the Michigan Department of Treasury strives to process tax returns as quickly and efficiently as possible. However, during peak tax season or in cases of complex returns, processing times may vary. Regularly checking your tax return status can provide valuable updates and help you plan your finances accordingly.

Understanding Your Michigan State Tax Return Status

When checking your Michigan state tax return status, you will typically encounter one of several standard status messages. Understanding these messages can help you interpret the progress of your tax return and anticipate the next steps in the process.

Common Status Messages and Their Meanings

| Status Message | Explanation |

|---|---|

| Return Received | Your tax return has been successfully received by the Michigan Department of Treasury. This is the first step in the processing journey. |

| Processing Your Return | Your tax return is currently being reviewed and processed by the department. This status indicates that your return is in the queue and will be assessed in due course. |

| Refund Issued | Congratulations! Your refund has been approved and processed. This status means that the department has issued your refund, and you should receive it shortly via your preferred payment method (e.g., direct deposit or check). |

| Refund Sent | Your refund has been dispatched, and it is on its way to you. This status typically means that the refund has been processed and sent, but there may be some delay in the delivery process. |

| Refund Mailed | In cases where a physical check is issued, this status indicates that your refund check has been mailed. You should receive it within a reasonable timeframe. |

| Error or Correction Needed | If you encounter this status, it means that the department has identified an error or inconsistency in your tax return. You will likely receive a notice or instructions on how to correct the error and resubmit your return. |

Remember, the Michigan Department of Treasury aims to provide clear and timely communication regarding your tax return status. If you have any questions or concerns about the status of your return, you can always reach out to their dedicated taxpayer assistance line for further guidance.

Tips for a Smooth Tax Season Experience in Michigan

Tax season can be a busy and stressful time, but with a bit of preparation and organization, you can ensure a smoother process and avoid potential pitfalls. Here are some expert tips to navigate tax season in Michigan with confidence.

Key Strategies for a Stress-Free Tax Season

-

Start Early: Begin gathering your tax documents and organizing your records well in advance of the filing deadline. This proactive approach helps reduce last-minute stress and allows you to file accurately.

-

Utilize Tax Preparation Software: Michigan taxpayers can benefit from user-friendly tax preparation software that guides you through the filing process. These tools can simplify complex tax situations and ensure you claim all eligible deductions and credits.

-

Understand State-Specific Tax Laws: Michigan has unique tax laws and regulations. Take the time to familiarize yourself with these laws to ensure compliance and take advantage of any state-specific tax benefits.

-

Seek Professional Assistance: If you have a complex tax situation or simply prefer professional guidance, consider engaging a tax preparer or accountant. They can provide personalized advice and ensure your return is filed accurately.

-

Keep Records and Documentation: Maintain organized records of your income, expenses, and tax-related documents. This practice simplifies the process of filing and helps support your return in case of an audit.

-

Set Reminders for Important Dates: Mark your calendar with key tax dates, including filing deadlines and payment due dates. This simple step can help you avoid late fees and penalties.

-

Stay Informed: Keep yourself updated on any changes to Michigan’s tax laws or procedures. The Michigan Department of Treasury often provides valuable resources and updates to help taxpayers stay compliant.

-

Check Your Refund Status Regularly: As mentioned earlier, regularly checking your Michigan state tax return status can provide peace of mind and help you plan your finances accordingly.

By implementing these strategies and staying informed, you can navigate tax season in Michigan with confidence and efficiency. Remember, a well-prepared tax return can lead to a smoother refund process and a more positive tax season experience.

Conclusion: Empowering Michigan Taxpayers

Checking your Michigan state tax return status is an essential part of the tax season journey. The Michigan Department of Treasury’s online portal provides a convenient and secure way for taxpayers to stay informed about the progress of their returns. By understanding the process and interpreting the status messages, taxpayers can make informed decisions and plan their finances effectively.

The tips and strategies outlined in this article aim to empower Michigan taxpayers to navigate tax season with confidence and ease. With the right tools, knowledge, and a proactive mindset, tax season can be a stress-free and even rewarding experience. So, whether you're an individual filer or a business owner, take control of your tax obligations and enjoy a seamless journey through the Michigan tax landscape.

FAQ

What is the estimated processing time for Michigan state tax returns?

+

The processing time for Michigan state tax returns can vary depending on factors such as the complexity of the return, the time of year, and the method of filing. On average, simple returns may take around 4 to 6 weeks to process, while more complex returns could take longer. It’s always a good idea to file early to allow for timely processing and potential refund issuance.

Can I check my Michigan state tax return status by phone?

+

Yes, you can contact the Michigan Department of Treasury’s taxpayer assistance line to inquire about your state tax return status. Their representatives can provide you with the current status of your return and answer any questions you may have. However, the online portal is often the fastest and most convenient way to check your status.

What should I do if my Michigan state tax return status shows an error or correction needed?

+

If your status indicates an error or correction needed, it’s important to address the issue promptly. You will likely receive a notice from the Michigan Department of Treasury explaining the error and providing instructions on how to correct it. Follow the instructions carefully and ensure you resubmit your return with the necessary corrections. If you have any questions or need further guidance, don’t hesitate to reach out to their taxpayer assistance line.

How can I ensure my Michigan state tax return is processed accurately and efficiently?

+

To ensure accurate and efficient processing of your Michigan state tax return, it’s crucial to file your return completely and correctly. Double-check all the information you provide, including your personal details, income, deductions, and credits. Utilize tax preparation software or seek professional assistance if you’re unsure about any aspect of your return. Additionally, filing your return electronically can speed up the processing time and reduce the risk of errors.

What are some common reasons for delays in Michigan state tax return processing?

+

Delays in Michigan state tax return processing can occur for various reasons. Some common causes include errors or inconsistencies in the return, missing or incomplete information, complex tax situations, and high volumes of returns during peak tax season. It’s important to file your return accurately and promptly to minimize the risk of delays. If you’re concerned about a potential delay, you can check your status regularly and reach out to the Michigan Department of Treasury for further assistance.