Sales Tax For Denver Co

In the realm of fiscal administration, sales tax stands as a pivotal revenue stream for states and municipalities, including the vibrant city of Denver, Colorado. The intricacies of sales tax policies and their impact on businesses and consumers alike warrant close examination, especially within the context of Denver's dynamic economic landscape.

Unraveling Denver’s Sales Tax Landscape

Denver’s sales tax structure is a nuanced system, comprising various layers of taxation, each serving a distinct purpose in the city’s financial framework.

Understanding the Basics

At its core, Denver imposes a state sales tax rate of 2.9%, a figure that remains consistent across the state of Colorado. This foundational tax forms the bedrock of Denver’s sales tax policy, applying to a wide array of goods and services.

However, the story doesn't end there. Denver, much like many other municipalities, has its own local sales tax, tailored to address the city's unique fiscal needs. This local sales tax currently stands at 4.62%, effectively augmenting the state sales tax to create a combined rate of 7.52%.

This composite tax rate is applied to most retail transactions within the city limits of Denver, encompassing a broad spectrum of products, from clothing and electronics to restaurant meals and entertainment services.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Local Sales Tax | 4.62% |

| Total Sales Tax | 7.52% |

It's worth noting that specific categories of goods and services may be subject to additional special district taxes, further elevating the total tax burden in certain cases. These special district taxes are often earmarked for specific public initiatives, such as transportation infrastructure or cultural programs.

Exemptions and Considerations

While the sales tax landscape in Denver is comprehensive, it’s not without its exemptions and nuances. Certain goods and services are exempt from sales tax, including most unprepared food items, prescription medications, and selected manufacturing equipment.

Additionally, Denver offers a temporary sales tax rebate for qualifying businesses, aimed at promoting economic growth and job creation within the city. This rebate can significantly reduce the tax burden for eligible enterprises, making Denver an attractive hub for new businesses.

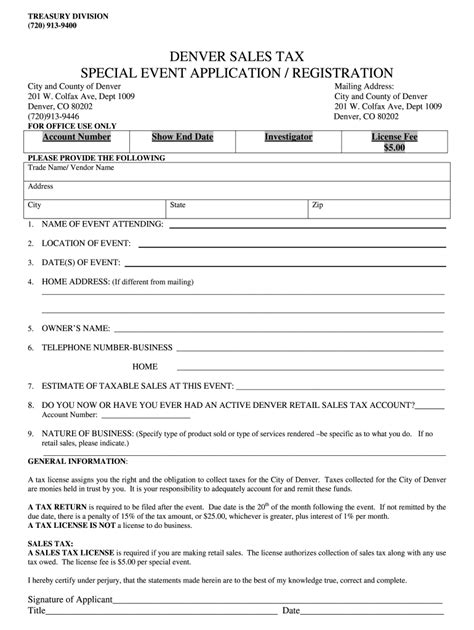

Compliance and Administration

The administration and compliance with Denver’s sales tax regime are overseen by the Colorado Department of Revenue, which provides a comprehensive online portal for businesses to register, file returns, and manage their sales tax obligations. This platform ensures transparency and ease of access for taxpayers.

For businesses operating in Denver, compliance with sales tax regulations is non-negotiable, with penalties and interest accruing for late or incorrect filings. The Colorado Department of Revenue conducts regular audits to ensure compliance, emphasizing the importance of accurate record-keeping and timely tax remittances.

Impact on Businesses and Consumers

The sales tax structure in Denver has a profound influence on both businesses and consumers within the city.

Business Implications

For businesses, the sales tax in Denver represents a significant cost component that needs careful consideration in pricing strategies. The tax can affect a business’s competitive position, especially when compared to online retailers, which may not be subject to the same sales tax obligations.

Moreover, the administrative burden of managing sales tax compliance can be substantial, requiring dedicated resources for registration, reporting, and payment processes. This is particularly true for businesses with complex supply chains or a diverse product portfolio.

However, the sales tax regime also offers incentives for businesses to locate and expand in Denver. The city's temporary sales tax rebate, for instance, can provide a substantial boost to businesses, especially those in the early stages of development.

Consumer Perspective

From a consumer standpoint, the sales tax in Denver directly affects purchasing power and the overall cost of living. The tax adds a substantial percentage to the price of goods and services, which can be a significant consideration for budget-conscious shoppers.

However, the sales tax also contributes to the overall fiscal health of the city, funding essential public services and infrastructure projects that benefit the community. In this way, the sales tax is a tangible manifestation of the social contract between taxpayers and the government, ensuring the provision of critical services.

Navigating the Future

As Denver continues to evolve as a dynamic urban center, its sales tax policies will remain a critical component of the city’s financial strategy. The city’s leaders and policymakers will need to balance the need for revenue generation with the competitive realities of the business environment and the financial well-being of its citizens.

The future may see Denver explore innovative tax policies, such as incentivizing green technologies or supporting local entrepreneurship through targeted tax breaks. These initiatives could further enhance Denver's appeal as a business destination while also fostering a more sustainable and equitable economy.

What is the total sales tax rate in Denver, Colorado?

+

The total sales tax rate in Denver is currently 7.52%, which includes the state sales tax rate of 2.9% and the local sales tax rate of 4.62%.

Are there any sales tax exemptions in Denver?

+

Yes, Denver has specific exemptions from sales tax, including most unprepared food items, prescription medications, and certain manufacturing equipment.

How can businesses comply with Denver’s sales tax regulations?

+

Businesses can comply by registering with the Colorado Department of Revenue, filing regular tax returns, and remitting the appropriate sales tax amounts. The Department provides an online portal for streamlined compliance.

What are the potential impacts of Denver’s sales tax on businesses?

+

Sales tax can affect a business’s pricing strategies and competitive position. It also entails administrative costs for compliance. However, Denver’s temporary sales tax rebate can offer significant benefits to qualifying businesses.

How does Denver’s sales tax affect consumers?

+

Sales tax directly impacts the cost of goods and services for consumers, influencing purchasing decisions. However, it also funds essential public services and infrastructure, contributing to the overall well-being of the community.