State Of Kansas Income Tax

The state of Kansas, located in the central region of the United States, has a rich history when it comes to its tax system. Understanding the income tax structure in Kansas is essential for both residents and businesses operating within the state. In this comprehensive article, we will delve into the intricacies of the Kansas income tax system, providing an in-depth analysis of its rates, brackets, deductions, and other crucial aspects. By the end of this guide, you'll have a thorough understanding of how Kansas taxes its residents and the unique features of its income tax system.

Understanding the Kansas Income Tax Structure

The Kansas Department of Revenue is responsible for administering and enforcing the state’s tax laws, including income tax. Kansas operates on a graduated income tax system, which means that the tax rate increases as your income level rises. This progressive taxation aims to ensure fairness and balance in the tax system. Let’s explore the key components of the Kansas income tax structure.

Tax Rates and Brackets

Kansas has four income tax brackets, each with its own tax rate. These brackets are designed to distribute the tax burden fairly across different income levels. As of the 2023 tax year, the tax rates and corresponding income brackets are as follows:

| Tax Rate | Income Bracket |

|---|---|

| 2.9% | Up to $15,000 |

| 3.1% | $15,001 - $30,000 |

| 5.25% | $30,001 - $50,000 |

| 5.7% | Over $50,000 |

It's important to note that these tax rates apply to Kansas residents' taxable income, which is calculated after deductions and exemptions are applied.

Taxable Income and Deductions

Kansas allows residents to claim various deductions to reduce their taxable income. These deductions can significantly impact the amount of tax you owe. Some common deductions available in Kansas include:

- Standard Deduction: All taxpayers are entitled to claim a standard deduction, which reduces taxable income. The amount of the standard deduction varies based on filing status.

- Itemized Deductions: Taxpayers can choose to itemize their deductions instead of claiming the standard deduction. This allows for deductions on expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Personal Exemptions: Kansas allows personal exemptions for the taxpayer, their spouse, and dependents. These exemptions further reduce taxable income.

- Retirement Plan Contributions: Contributions to certain retirement plans, such as 401(k)s and IRAs, can be deducted from taxable income.

By claiming these deductions, Kansas residents can effectively lower their taxable income and, consequently, the amount of tax they owe.

Filing Status and Exemptions

Kansas recognizes the following filing statuses for income tax purposes:

- Single: Unmarried individuals with no qualifying dependents.

- Married Filing Jointly: Married couples filing a joint tax return.

- Married Filing Separately: Married couples choosing to file separate tax returns.

- Head of Household: Unmarried individuals who maintain a household for a qualifying dependent.

Each filing status has its own set of rules and tax rates. For example, married couples filing jointly often benefit from lower tax rates compared to those filing separately.

Taxable Income Sources

Kansas taxes a wide range of income sources, including:

- Wages and salaries

- Business income

- Interest and dividends

- Rental income

- Gains from the sale of assets

- Pensions and annuities

- Unemployment compensation

- Certain government benefits

However, it's important to note that Kansas has a reciprocity agreement with certain neighboring states. This agreement allows individuals who work in Kansas but reside in a reciprocating state to exclude certain income from Kansas taxation. The reciprocating states include Missouri and Oklahoma.

Tax Benefits and Incentives

Kansas offers various tax benefits and incentives to encourage economic growth and support certain industries. These incentives can significantly impact the tax liabilities of individuals and businesses.

Business Tax Incentives

Kansas provides a range of tax incentives to attract and support businesses. These incentives aim to stimulate economic development and job creation. Some notable business tax incentives include:

- Kansas Pass-Through Entity Tax Deduction: This deduction allows owners of pass-through entities, such as S-corporations and partnerships, to deduct a percentage of their business income from their Kansas taxable income.

- High-Performance Incentive Program (HPIP): The HPIP provides tax credits to businesses that meet specific performance criteria, such as job creation and investment.

- Targeted Small Business Program: This program offers tax credits to small businesses that create jobs and invest in certain targeted industries.

Personal Tax Credits

Kansas residents can also benefit from various personal tax credits. These credits can reduce the amount of tax owed or increase the taxpayer’s refund. Some common personal tax credits include:

- Child and Dependent Care Tax Credit: This credit provides a tax benefit for individuals who incur expenses for child or dependent care while working or attending school.

- Property Tax Refund Credit: Kansas offers a credit to certain homeowners to help offset property taxes paid.

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit for low- to moderate-income working individuals and families. It aims to reduce the tax burden and provide financial support.

Tax Filing and Payment

Kansas residents are required to file their income tax returns annually, typically by April 15th. The Kansas Department of Revenue provides online filing options through its website, making the process more convenient and efficient. Taxpayers can also choose to file their returns manually and mail them to the department.

Payment Options

Kansas offers various payment methods for income tax liabilities. Taxpayers can pay online, by phone, or through traditional methods such as mailing a check. The Kansas Department of Revenue provides detailed instructions and payment options on its website.

Late Filing and Penalties

Failing to file your Kansas income tax return by the due date can result in penalties and interest. The department imposes penalties for late filing, which can accumulate over time. It’s important to file your return on time to avoid these additional charges.

Compliance and Enforcement

The Kansas Department of Revenue is committed to ensuring tax compliance and enforcing tax laws. It employs various measures to detect and deter tax evasion. Here are some key aspects of Kansas’ tax compliance and enforcement:

- Audits: The department conducts audits to review the accuracy of tax returns and verify compliance with tax laws. Audits can be selected at random or based on specific criteria.

- Penalty Structure: Kansas has a comprehensive penalty structure for various tax violations, including late filing, underpayment, and negligence. Penalties can be significant, so it's crucial to comply with tax laws.

- Tax Amnesty Programs: From time to time, Kansas offers tax amnesty programs, providing taxpayers with an opportunity to settle outstanding tax liabilities without incurring penalties or interest. These programs encourage voluntary compliance.

Future Implications and Tax Reform

Kansas, like many other states, is continuously evaluating its tax system and considering potential reforms. The state aims to strike a balance between generating sufficient revenue for essential services and providing a competitive tax environment for residents and businesses. Here are some potential future implications and ongoing discussions regarding Kansas’ income tax system:

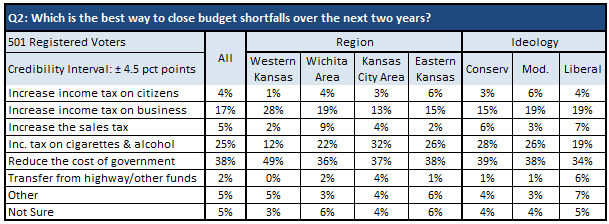

Tax Rate Adjustments

There have been ongoing debates about adjusting the tax rates and brackets in Kansas. Some propose lowering tax rates to make the state more attractive to businesses and individuals, while others advocate for progressive tax reforms to ensure a fair distribution of the tax burden. Any changes to tax rates and brackets would require legislative approval.

Tax Simplification

Kansas, like many states, aims to simplify its tax system to reduce complexity and improve compliance. Efforts are being made to streamline tax forms, instructions, and processes to make filing and paying taxes more straightforward for taxpayers.

Tax Reform Initiatives

Kansas is actively engaged in tax reform initiatives to address various economic and social issues. These initiatives aim to create a more equitable and efficient tax system. Some potential areas of focus include:

- Income Tax Reform: Exploring alternatives to the current graduated income tax system, such as a flat tax or a consumption-based tax, is a topic of discussion.

- Sales Tax Reform: Discussions are ongoing regarding the expansion or modification of the sales tax base to generate additional revenue without increasing the tax burden on lower-income individuals.

- Property Tax Reform: Kansas is considering reforms to its property tax system to provide relief to homeowners and ensure fairness across different property types.

Conclusion

The Kansas income tax system is a crucial aspect of the state’s fiscal landscape, impacting residents and businesses alike. Understanding the tax rates, brackets, deductions, and incentives is essential for effective tax planning and compliance. Kansas’ progressive tax structure, along with its various tax benefits and incentives, aims to create a balanced and supportive environment for its residents and businesses.

As Kansas continues to evaluate and reform its tax system, taxpayers can expect ongoing efforts to streamline processes, reduce complexity, and address economic and social challenges. Staying informed about these developments is key to making informed financial decisions and ensuring compliance with Kansas' tax laws.

FAQ

When is the Kansas income tax filing deadline for the 2023 tax year?

+The filing deadline for Kansas income tax returns for the 2023 tax year is typically April 15th. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a natural disaster or if a taxpayer is serving in the military overseas.

Can I e-file my Kansas income tax return?

+Yes, Kansas offers electronic filing (e-filing) as a convenient and secure way to file your income tax return. The Kansas Department of Revenue provides an online platform where taxpayers can prepare and submit their returns electronically. E-filing is generally faster and reduces the risk of errors compared to manual filing.

Are there any tax credits available for renewable energy investments in Kansas?

+Yes, Kansas offers tax incentives for renewable energy investments. The state provides a Renewable Energy Production Tax Credit, which allows taxpayers to claim a credit for the production of electricity from renewable energy sources. This credit aims to encourage the development and use of renewable energy in Kansas.

How can I estimate my Kansas income tax liability before filing my return?

+The Kansas Department of Revenue provides a tax estimator tool on its website. This tool allows taxpayers to input their income, deductions, and other relevant information to estimate their tax liability. It’s a helpful resource to get an idea of how much tax you may owe before filing your return.

Can I claim a tax credit for adopting a child in Kansas?

+Yes, Kansas offers a tax credit for adoption expenses. The Adoption Tax Credit allows taxpayers to claim a credit for qualified adoption-related expenses. This credit provides financial support to families who choose to adopt a child and helps offset some of the costs associated with the adoption process.