Wyoming Income Tax

Wyoming, a state known for its stunning natural beauty and wide-open spaces, has a unique tax system that has attracted businesses and individuals alike. The state's income tax structure is relatively straightforward and offers some interesting features when compared to other states. In this comprehensive guide, we will delve into the intricacies of Wyoming's income tax system, exploring its rates, deductions, and the impact it has on individuals and businesses.

Understanding Wyoming’s Income Tax Structure

Wyoming’s income tax system is based on a flat tax rate, meaning that all taxpayers, regardless of their income level, pay the same percentage of their income in taxes. This approach differs from many other states that have progressive tax systems with varying rates for different income brackets. Wyoming’s flat tax rate currently stands at 4.0%, making it one of the lowest income tax rates in the country.

The state's tax system is designed to be simple and efficient, with few deductions or exemptions. However, Wyoming does offer some specific tax credits and deductions that can help reduce the overall tax burden for residents.

Taxable Income and Filing Requirements

Wyoming residents are required to file an individual income tax return if their gross income exceeds a certain threshold. For the tax year 2022, the filing threshold was set at 12,700</strong> for single filers and <strong>25,400 for married couples filing jointly. It’s important to note that this threshold may change annually based on adjustments for inflation.

The state uses a form known as the Wyoming Individual Income Tax Return (Form WY-40) for tax filing. This form is straightforward and can be completed online or through traditional paper filing. Wyoming also offers e-filing options for added convenience.

Tax Rates and Brackets

As mentioned earlier, Wyoming’s income tax is a flat tax system, meaning there are no tax brackets based on income levels. All taxpayers, regardless of their income, pay the same 4.0% rate on their taxable income. This simplicity makes it easy for taxpayers to calculate their tax liability.

| Income Tax Rate | Percentage |

|---|---|

| Wyoming Flat Tax Rate | 4.0% |

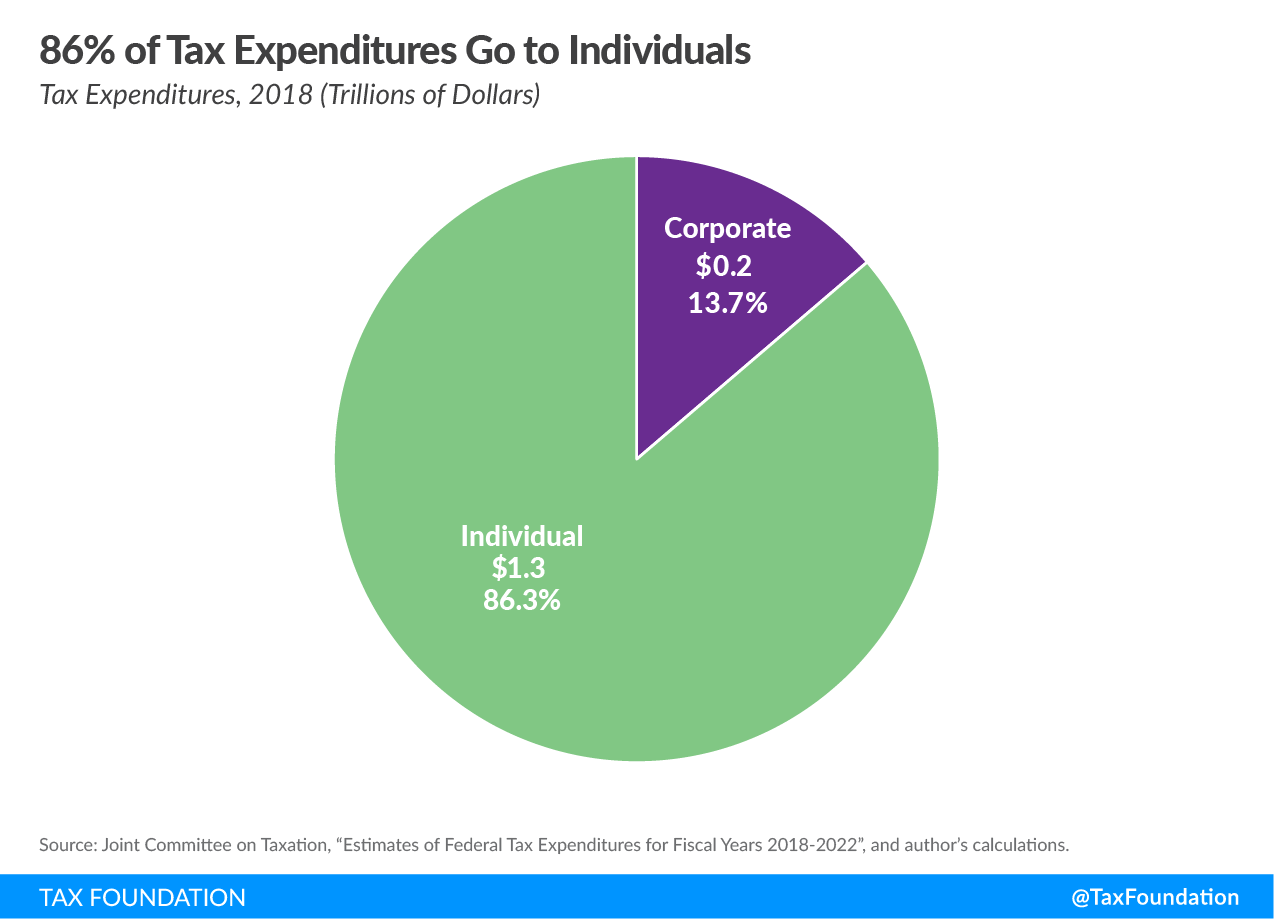

It's worth noting that Wyoming does not impose a corporate income tax, which is a significant advantage for businesses operating within the state. This absence of a corporate tax is one of the factors that has made Wyoming an attractive location for businesses seeking to reduce their tax obligations.

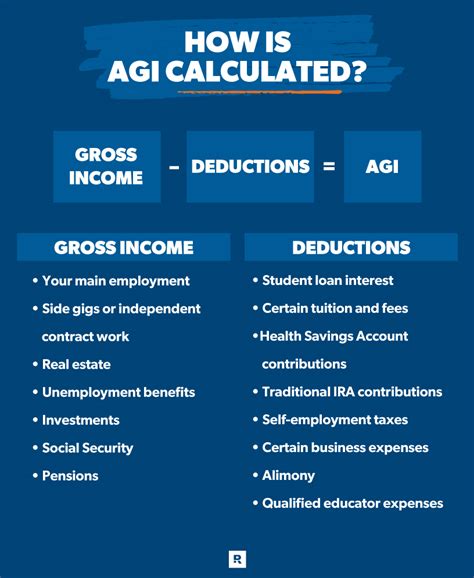

Deductions and Credits in Wyoming

While Wyoming’s income tax system is relatively simple, the state does offer certain deductions and credits that can provide tax relief to residents. These deductions and credits are designed to encourage specific behaviors or support certain sectors of the economy.

Standard Deduction

Wyoming provides a standard deduction, which is a fixed amount that taxpayers can subtract from their taxable income. For the tax year 2022, the standard deduction was set at 2,400</strong> for single filers and <strong>4,800 for married couples filing jointly. This deduction helps reduce the overall tax burden for individuals, especially those with lower incomes.

Personal Exemptions

Wyoming also allows taxpayers to claim personal exemptions for themselves and their dependents. Each exemption reduces the taxpayer’s taxable income, providing additional tax savings. For the 2022 tax year, the personal exemption amount was $120 per exemption.

Wyoming Tax Credits

The state offers a range of tax credits, each designed to support specific initiatives or industries. Some of the notable tax credits available in Wyoming include:

- Low-Income Housing Tax Credit (LIHTC): This credit encourages the development of affordable housing by providing a tax credit to developers who invest in low-income housing projects.

- Research and Development Tax Credit: Aimed at promoting innovation, this credit offers a tax incentive to businesses that invest in research and development activities within the state.

- Historic Preservation Tax Credit: Wyoming provides a tax credit for the rehabilitation of historic buildings, encouraging the preservation of the state's rich historical heritage.

- Energy Tax Credits: To promote the use of renewable energy, Wyoming offers tax credits for the installation of solar, wind, and geothermal energy systems.

Impact on Individuals and Businesses

Wyoming’s income tax structure has a significant impact on both individuals and businesses operating within the state. The low flat tax rate and absence of a corporate income tax make Wyoming an attractive destination for businesses, particularly those looking to minimize their tax liabilities.

Advantages for Individuals

For individuals, Wyoming’s flat tax rate and standard deduction can result in a lower overall tax burden compared to states with progressive tax systems. This can be especially beneficial for those with lower incomes, as they may pay a higher percentage of their income in taxes in states with higher tax brackets.

The availability of tax credits, such as the Low-Income Housing Tax Credit, also provides an opportunity for individuals to invest in affordable housing and receive tax benefits. Additionally, the state's commitment to historic preservation and renewable energy initiatives offers tax incentives for those who support these causes.

Benefits for Businesses

Businesses operating in Wyoming enjoy the advantage of a low flat tax rate and the absence of a corporate income tax. This can significantly reduce their tax obligations, making Wyoming an attractive location for business expansion or relocation. The state’s simple tax system also reduces the administrative burden for businesses, allowing them to focus on their core operations.

Furthermore, the availability of tax credits, such as the Research and Development Tax Credit, encourages businesses to invest in innovation and growth within the state. This can lead to job creation and economic development, benefiting both businesses and the local community.

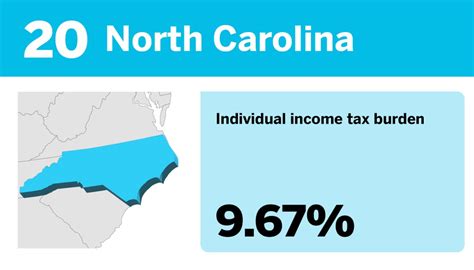

Comparative Analysis: Wyoming vs. Other States

When compared to other states, Wyoming’s income tax system stands out for its simplicity and low tax rates. Many states have progressive tax systems with higher tax rates for higher income levels, which can result in a higher overall tax burden for taxpayers.

For instance, California, a state with a progressive tax system, has tax rates ranging from 1.0% to 13.3%, depending on income brackets. In contrast, Wyoming's flat 4.0% rate provides a significant advantage for taxpayers, especially those with higher incomes.

| State | Income Tax Rate |

|---|---|

| Wyoming | 4.0% |

| California | 1.0% - 13.3% |

| New York | 4.0% - 8.82% |

| Texas | No Income Tax |

Additionally, Wyoming's decision not to impose a corporate income tax sets it apart from many other states. This absence of a corporate tax can be a major factor in attracting businesses, as it significantly reduces their tax liabilities.

Performance Analysis and Future Implications

Wyoming’s flat tax rate and simple tax system have contributed to the state’s economic growth and business-friendly environment. The low tax burden has attracted numerous businesses and individuals, leading to increased economic activity and job creation.

However, it's important to note that Wyoming's tax system relies heavily on revenue from other sources, such as sales tax and natural resource extraction. While this has worked well in the past, it may not be sustainable in the long term, especially if the state's natural resource industry experiences downturns.

Looking ahead, Wyoming may need to carefully consider its tax structure to ensure long-term sustainability and continued economic growth. The state could explore additional revenue streams or consider implementing a modest corporate income tax to diversify its tax base and reduce its reliance on a single industry.

Frequently Asked Questions

What is the deadline for filing Wyoming income tax returns?

+The deadline for filing Wyoming income tax returns is typically April 15th of the following year. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day.

Are there any income tax reciprocity agreements with neighboring states?

+Wyoming does not have income tax reciprocity agreements with any neighboring states. This means that individuals who work in Wyoming but live in another state must file income tax returns in both states.

Can Wyoming residents deduct federal income taxes paid on their state tax returns?

+No, Wyoming does not allow its residents to deduct federal income taxes paid on their state tax returns. However, they can deduct certain state and local taxes, including property taxes and sales taxes, if they itemize their deductions.

Are there any special tax considerations for remote workers in Wyoming?

+Remote workers in Wyoming are subject to the same income tax laws as other residents. If they earn income while working remotely within the state, they must pay Wyoming income tax. However, if they work remotely for an out-of-state employer, they may not be subject to Wyoming income tax, depending on the state’s tax laws.