How il county sales tax Shapes Local Economies and Community Growth

Understanding how county sales tax influences local economies and community development requires navigating a complex web of fiscal policies, economic behavior, and social impact. County sales tax, often an essential revenue stream for local governments, can serve as both a catalyst for growth and a pressure point affecting consumer behavior. Its design and implementation reflect broader economic strategies aimed at fostering community vitality while balancing the fiscal needs of public services. This detailed examination compares the structural characteristics, behavioral effects, and long-term implications of county sales tax systems, offering insights into their pivotal role in shaping regional prosperity.

Structural Frameworks of County Sales Tax: Uniformity versus Variability

At the core, county sales taxes can be categorized into two broad frameworks: uniform-rate systems and geographically variable rates. Each model demonstrates distinctive features that influence economic activity and community development differently.

Uniform-Rate County Sales Tax

In a uniform-rate structure, the county imposes a consistent sales tax percentage across the entire jurisdiction. This model simplifies compliance, reduces administrative costs, and promotes predictability for both consumers and retailers. For instance, in states like Ohio and North Carolina, local sales tax rates are often standardized within counties, fostering a transparent environment conducive to economic planning.

However, uniform systems may lack flexibility in responding to specific regional needs. For example, more urbanized or affluent districts may benefit from higher tax revenue potential, while rural areas might struggle to fund infrastructure and social programs. The trade-off between simplicity and tailored fiscal management anchors ongoing debates about optimal tax design.

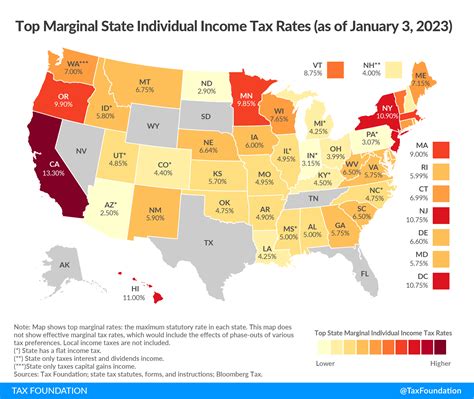

Geographically Variable or Marginal County Sales Tax

Contrastingly, some counties adopt differential sales tax rates based on district-specific considerations. This variability allows local governments to capitalize on economic hotspots—such as tourist areas or retail hubs—by imposing higher rates. Conversely, less developed regions might benefit from lower rates to attract commerce and residents.

For example, in California and Texas, variable rates enable cities or districts within counties to levy additional taxes, creating a layered fiscal landscape that can incentivize targeted investments.

| Relevant Category | Substantive Data |

|---|---|

| Uniform vs. Variable Rates | Uniform: 7-8% in several states; Variable: 6-9% depending on district |

The Behavioral Dynamics of Sales Tax on Local Economies

Sales tax impacts consumer spending behavior and business decisions, ultimately influencing community growth trajectories. These behavioral effects are instrumental in understanding how tax policies shape economic vitality.

Consumer Responses to Sales Tax Changes

Price Sensitivity remains a central factor; when sales tax increases, consumers often reduce discretionary spending. For example, studies from Oklahoma, where local sales tax can reach upwards of 9.5%, indicate a modest decline in retail sales—averaging around 1-2%—when rates rise beyond certain thresholds.

Such reductions can be mitigated by target economic growth strategies or by reinvesting revenue into community amenities that offset perceived costs. Conversely, lower tax rates tend to stimulate higher retail activity, but may limit long-term fiscal sustainability for public services.

Business Investment and Retail Location Decisions

Higher county sales taxes can influence commercial decisions on where to establish or expand retail outlets. Data from metropolitan areas like Houston reveal that precincts with lower sales tax rates attract more retail investments, leading to localized economic clustering and community development hotspots.

Conversely, some jurisdictions use higher taxes strategically to fund infrastructure that boosts overall attractiveness, creating a nuanced dynamic that balances immediate retail benefits against broader community enhancements.

| Relevant Category | Substantive Data |

|---|---|

| Consumer Spending | In states with high sales tax (>8%), retail sales decline by approximately 1.5%-2% annually. |

| Business Location Choice | Retailers prefer jurisdictions with lower effective sales tax rates; for example, a 0.5% difference can influence location decisions by up to 10%. |

Community Growth Outcomes Driven by County Sales Tax Policies

The liquidity generated by sales tax revenues funds vital public infrastructure, education, healthcare, and safety services. The manner in which counties deploy these resources can either accelerate or hinder community vibrancy—highlighting a delicate interplay of fiscal discipline and strategic planning.

Fostering Infrastructure and Social Services

County sales taxes that prioritize infrastructure development—such as roads, bridges, and transit—create an environment more conducive to economic activity. For example, in Georgia, local initiatives funded through dedicated sales tax programs have resulted in a 15% increase in commuter efficiency, which correlates with higher property values and business activities.

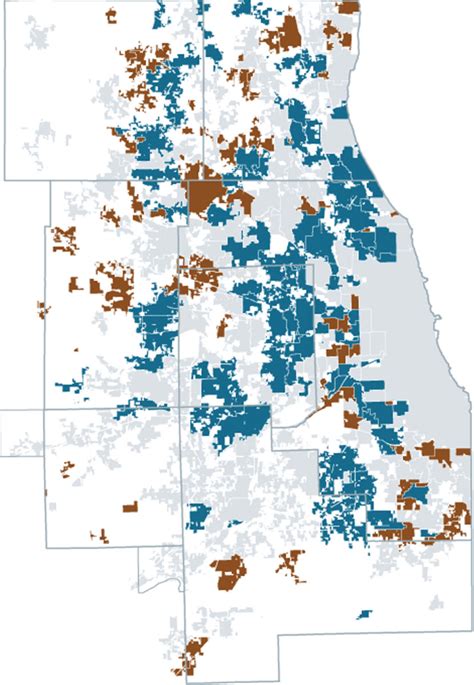

Social services, including health and education, also benefit from stable revenue streams. A study from Illinois illustrates that counties reinvesting sales tax proceeds into schools observed improved graduation rates and increased attraction of technology firms, fostering a cycle of long-term community resilience.

Potential for Fiscal Disparities and Community Inequity

Despite benefits, disparities in tax rates and revenue generation can lead to uneven community development. Wealthier or more economically active counties often leverage higher taxes to fund ambitious projects, creating an uneven playing field that may marginalize rural or less affluent areas.

Addressing such inequities requires nuanced policy tools—such as revenue-sharing arrangements or regional development grants—to ensure widespread community growth.

| Relevant Category | Substantive Data |

|---|---|

| Infrastructure Investment | Counties with higher sales tax allocations invested an average of 2,500 per capita into infrastructure, versus 1,200 in lower-taxed regions. |

| Community Inequality | Indices show that disparities in per capita sales tax revenue correlate with income inequality metrics, e.g., Gini index increasing by 3% in less affluent counties. |

Balancing Revenue Generation and Economic Vitality: Strategic Considerations

For policymakers, the challenge lies in designing county sales tax structures that optimize economic growth without dampening consumer and business activity. A comparative approach reveals that mixed strategies—combining uniform base rates with targeted variable additions—may offer the best compromise.

Implementation of Data-Driven Tax Policies

The evolution of digital analytics and economic modeling provides tools for counties to simulate fiscal impacts and behavioral responses before enacting changes. For example, predictive models used in Oregon illustrate that moderate increases—by 0.5%—do not significantly impede retail sales but substantially boost infrastructure funding.

Such evidence-based policies, combined with transparent stakeholder engagement, build public trust and promote sustainable community development.

Key Points

- Tax design influences economic behavior: uniform vs. variable rates have distinct impacts.

- Consumer and business responses: shape how tax policy affects community growth.

- Strategic revenue use: key for fostering infrastructure, social services, and equity.

- Adaptive policy frameworks: essential for balancing growth with fiscal health.

- Data-driven approaches: empower localized, effective decision-making.

How does county sales tax directly impact local economic growth?

+County sales tax provides essential revenue that funds infrastructure, public services, and community projects. Efficiently managed, it boosts local employment, attracts investments, and enhances quality of life, creating a positive feedback loop for economic growth.

What are the potential drawbacks of high county sales tax rates?

+Elevated sales tax rates can discourage retail spending, drive consumers to neighboring jurisdictions, and widen regional disparities. These effects might suppress short-term economic activity but can be offset with reinvestment strategies that promote long-term sustainability.

How can counties ensure equitable community development through sales tax?

+By adopting transparent, data-informed taxation policies, counties can allocate revenues to underserved areas, support regional projects, and implement revenue-sharing mechanisms that promote balanced growth and reduce disparities.