Sales Tax Denver

Sales tax in Denver, Colorado, is an important aspect of the city's economic landscape and a key revenue source for the state and local governments. With a unique tax structure, Denver's sales tax rates can vary depending on the type of goods or services purchased and the specific jurisdiction in which the transaction takes place. Understanding the sales tax system is crucial for both consumers and businesses operating within the city.

Sales Tax Rates and Structures in Denver

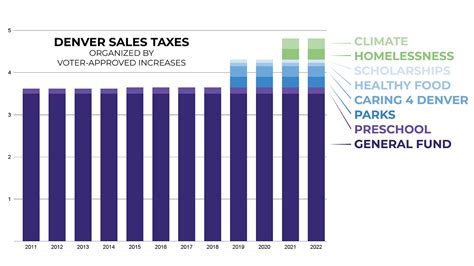

Denver’s sales tax is a combination of state, county, and municipal taxes, resulting in a composite rate that can be applied to various transactions. The state of Colorado imposes a state sales tax of 2.9%, which is a fixed rate across the state. However, when it comes to the city of Denver, the sales tax rate is not uniform.

The Denver City Sales Tax is set at 4.62%, which is added to the state tax, resulting in a combined rate of 7.52% for most goods and services. This rate is applied within the city limits of Denver and is a significant source of revenue for the city's operations and infrastructure development.

In addition to the state and city sales taxes, special districts may also impose additional taxes. These special districts, often formed for specific purposes like transportation or cultural initiatives, can add extra percentages to the sales tax rate. For instance, the Regional Transportation District (RTD) in Denver levies an additional 1% tax, bringing the total sales tax for certain transactions to 8.52%.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Denver City Sales Tax | 4.62% |

| Regional Transportation District (RTD) Tax | 1% |

Examples of Sales Tax Scenarios in Denver

To illustrate how these taxes work in practice, consider the following examples:

- Scenario 1: Purchasing a new laptop within Denver city limits would incur a sales tax of 7.52%, combining the state and city taxes. This means that for a 1,000 laptop, the sales tax would amount to 75.20.

- Scenario 2: If you are taking public transportation within the RTD service area, the sales tax on your transit pass would be 8.52%, including the RTD tax. For a 50 monthly pass, the tax component would be 4.26.

Taxable and Exempt Items in Denver

Not all goods and services are subject to sales tax at the same rate in Denver. The Colorado Department of Revenue provides detailed guidelines on what is taxable and what is exempt. Some common items and their tax treatments include:

- Groceries: Essential food items, including non-prepared foods, are generally exempt from sales tax. However, non-essential groceries like soda, candy, and certain snacks are taxable.

- Clothing: Clothing items under 100 are <strong>exempt</strong> from sales tax, while those above 100 are subject to the full sales tax rate.

- Prescription Drugs: Sales of prescription drugs are exempt, providing relief for individuals with medical needs.

- Internet Services: The sale of internet access and related services is subject to a reduced sales tax rate of 4.24% in Denver, which includes the state and city taxes but not the RTD tax.

| Item | Tax Treatment |

|---|---|

| Groceries (Essential) | Exempt |

| Clothing (Under $100) | Exempt |

| Prescription Drugs | Exempt |

| Internet Services | Reduced Rate (4.24%) |

Understanding Taxable Events

A taxable event is any transaction that triggers the application of sales tax. In Denver, this includes the sale of tangible personal property, certain services, and rentals. The concept of a taxable event is critical for businesses to identify when they need to collect and remit sales tax to the appropriate authorities.

Sales Tax Compliance and Reporting

Businesses operating in Denver must comply with the sales tax regulations set by the state and local governments. This involves registering with the Colorado Department of Revenue, obtaining a sales tax license, and regularly filing sales tax returns. The frequency of filing depends on the business’s sales volume and can range from monthly to quarterly.

Proper record-keeping is essential for sales tax compliance. Businesses should maintain records of all taxable sales, including the tax amount collected, to accurately report and remit the tax to the government. Failure to comply with sales tax regulations can result in penalties and interest charges.

Sales Tax Registration and Remittance

To register for sales tax in Denver, businesses can visit the Colorado Department of Revenue’s website and complete the online registration process. Once registered, they will receive a unique sales tax number and instructions on how to file and remit sales tax. The department provides resources and guidance to help businesses understand their sales tax obligations.

What is the difference between the sales tax rate in Denver and other cities in Colorado?

+The sales tax rate in Denver is higher compared to many other cities in Colorado due to the additional city sales tax and special district taxes. While the state sales tax is uniform across Colorado, city and local taxes can vary, leading to differences in the composite sales tax rate.

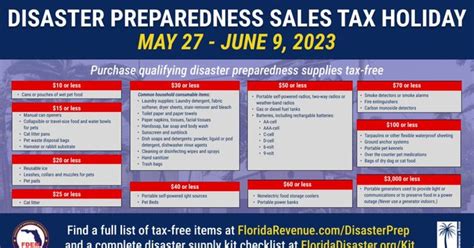

Are there any special sales tax holidays in Denver?

+Denver, like many other places in Colorado, does not typically have sales tax holidays. However, there are specific exemption days, such as Back-to-School Sales Tax Holiday, which exempt certain purchases from sales tax during a designated period.

How do online retailers handle sales tax for Denver customers?

+Online retailers are required to collect and remit sales tax for Denver customers if they have a physical presence or economic nexus in the state. This includes situations where the retailer has warehouses, offices, or even employees in Colorado.