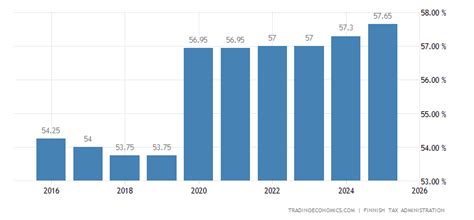

Finland Tax Rate

Understanding tax rates is crucial for individuals and businesses, especially when it comes to navigating the unique tax system of a country like Finland. Finland's tax structure is known for its efficiency and transparency, offering a comprehensive system that includes income, corporate, and value-added taxes, among others. This article aims to provide an in-depth analysis of Finland's tax rates, their impact on the economy, and how they affect individuals and businesses operating within the country.

Income Tax in Finland: A Comprehensive Overview

Finland’s income tax system is progressive, meaning that higher incomes are taxed at higher rates. This structure ensures that individuals with higher earnings contribute a larger share of their income to the country’s revenue. The income tax rate in Finland is divided into various brackets, with each bracket having its own tax rate.

| Income Bracket | Tax Rate |

|---|---|

| Up to €17,700 | 0% |

| €17,701 - €28,800 | 6.5% |

| €28,801 - €53,200 | 14.5% |

| €53,201 - €81,700 | 24.5% |

| €81,701 - €133,600 | 30.5% |

| Over €133,600 | 31.5% |

It's important to note that these tax rates are subject to change annually, and the brackets may be adjusted to reflect inflation and economic growth. Additionally, Finland offers various tax deductions and credits, such as the basic deduction, which is a fixed amount that reduces the taxable income for all taxpayers.

Income Tax for Residents vs. Non-Residents

Finland distinguishes between resident and non-resident taxpayers when it comes to income tax. A resident individual is taxed on their worldwide income, while a non-resident is taxed only on their Finnish-sourced income. The residence status is determined based on various factors, including the duration of stay and the intention to reside in Finland.

For non-residents, the tax rate on Finnish-sourced income is typically 30%, but this can be reduced through tax treaties between Finland and the individual's home country. These treaties aim to prevent double taxation and provide a more favorable tax environment for international workers.

Withholding Taxes and Salary Deductions

Employers in Finland are responsible for deducting income tax from their employees’ salaries. This process, known as withholding tax, ensures that individuals pay their taxes incrementally throughout the year. The tax is calculated based on the employee’s expected annual income and the applicable tax rate.

In addition to income tax, employees in Finland also contribute to social security, which includes health insurance and pension plans. These deductions are mandatory and are calculated as a percentage of the employee's gross salary.

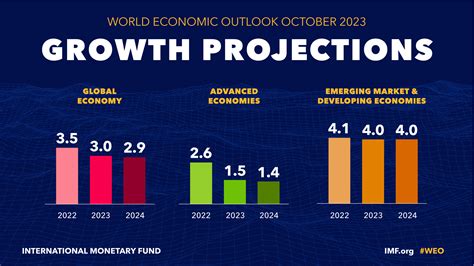

Corporate Tax: Attracting Investments and Promoting Growth

Finland’s corporate tax rate is a significant factor in attracting foreign investments and fostering economic growth. As of [current year], the corporate tax rate in Finland stands at 20%, which is relatively competitive compared to other European countries.

The corporate tax system in Finland is straightforward, with a single tax rate applicable to all companies, regardless of their size or industry. This flat rate structure simplifies the tax system and provides a stable environment for businesses to operate and plan their finances.

Tax Incentives for Businesses

To encourage innovation and economic development, Finland offers various tax incentives and deductions for businesses. These incentives are designed to support research and development, investments in new technologies, and the creation of new jobs.

One notable incentive is the R&D tax credit, which allows companies to deduct a portion of their research and development expenses from their taxable income. This credit aims to promote innovation and make Finland an attractive hub for tech-focused companies.

| Incentive | Description |

|---|---|

| R&D Tax Credit | Allows companies to deduct 25% of their R&D expenses from taxable income. |

| Investment Deduction | Provides a tax deduction for investments in machinery, equipment, and certain types of intangible assets. |

| Accelerated Depreciation | Allows businesses to write off the value of certain assets more quickly, reducing taxable income. |

International Tax Agreements

Finland has entered into numerous tax treaties with other countries to prevent double taxation and promote international trade and investment. These treaties ensure that businesses operating across borders are not subject to double taxation on their profits.

For instance, the tax treaty between Finland and the United States allows US companies operating in Finland to reduce their tax burden by taking advantage of the lower Finnish corporate tax rate. This treaty, along with others, makes Finland an appealing destination for international businesses seeking to expand their operations.

Value-Added Tax (VAT): A Major Revenue Generator

Value-Added Tax, commonly known as VAT, is a consumption tax that is added to the price of goods and services at each stage of production and distribution. In Finland, VAT is a significant source of revenue for the government and plays a crucial role in funding public services.

VAT Rates in Finland

Finland has a standard VAT rate of 24%, which is applicable to most goods and services. However, there are also reduced VAT rates for specific products and services, such as:

- 14%: This rate is applied to food products, books, newspapers, and certain transportation services.

- 10%: This rate is used for restaurant services, hotel accommodation, and some cultural events.

- 0%: Certain services and exports are exempt from VAT, including healthcare, education, and international trade.

The VAT system in Finland is designed to be transparent and easy to understand, with clear guidelines for businesses and consumers. Businesses are responsible for collecting and remitting VAT to the tax authorities, ensuring that the tax is accurately calculated and paid.

VAT Registration and Compliance

Businesses in Finland are required to register for VAT if their annual turnover exceeds a certain threshold, which is currently set at €10,000. Once registered, businesses must charge and account for VAT on their sales and purchases, and submit regular VAT returns to the tax authorities.

Compliance with VAT regulations is essential for businesses to avoid penalties and ensure a smooth flow of tax revenue. The Finnish tax authorities provide extensive resources and support to help businesses understand and fulfill their VAT obligations.

Taxation for Digital Services and E-Commerce

With the rise of digital services and e-commerce, Finland, like many other countries, has had to adapt its tax system to address the challenges posed by the digital economy. The country has implemented measures to ensure that digital businesses, both domestic and foreign, contribute fairly to the tax system.

Digital Services Tax

Finland introduced a digital services tax in [year], targeting large tech companies that provide digital services to Finnish consumers. The tax is levied on the revenue generated from certain digital services, such as online advertising, data brokerage, and certain digital content services.

The digital services tax aims to address the issue of tax avoidance by tech giants and ensure that these companies pay their fair share of taxes in the countries where they operate and generate revenue. Finland's digital services tax has been welcomed as a step towards a more equitable tax system in the digital age.

E-Commerce and VAT

For e-commerce businesses, Finland has implemented a distance selling threshold of €35,000. This means that non-EU businesses selling goods to Finnish consumers via the internet are required to register for VAT in Finland once their annual distance sales exceed this threshold. This measure ensures that e-commerce businesses contribute to the country’s tax revenue and level the playing field for domestic and foreign online retailers.

Tax Administration and Compliance in Finland

The Finnish tax system is known for its efficiency and low level of corruption. The tax administration, overseen by the Finnish Tax Administration, is well-organized and provides comprehensive support to taxpayers. The administration offers online services, making it convenient for individuals and businesses to file tax returns, make payments, and access tax-related information.

Tax Filing and Payment Deadlines

For individuals, the tax filing deadline in Finland is typically in early April, following the tax year. Businesses, on the other hand, have more flexible deadlines, with the due date depending on the size and complexity of the company. Larger corporations often have a filing deadline of up to 12 months after the financial year-end.

Tax payments in Finland are typically made in quarterly installments, with the final payment due by the end of the tax year. Late payments may incur interest and penalties, so it's crucial for taxpayers to stay on top of their tax obligations.

Tax Audits and Enforcement

The Finnish Tax Administration conducts audits to ensure compliance with tax laws and regulations. These audits are typically conducted randomly, with a focus on high-risk areas and industries. The administration also has the power to investigate tax evasion and take legal action against taxpayers who fail to comply with their tax obligations.

While audits can be intimidating, the Finnish tax system is generally fair and transparent. Taxpayers who cooperate with the tax authorities and provide accurate information are likely to have a positive experience during an audit.

The Impact of Finland’s Tax Rates on the Economy

Finland’s tax rates play a significant role in shaping the country’s economic landscape. The progressive income tax system ensures a fair distribution of wealth, while the competitive corporate tax rate attracts investments and fosters economic growth.

The value-added tax, although high, provides a stable source of revenue for the government, allowing it to fund essential public services such as healthcare, education, and infrastructure. The digital services tax and e-commerce regulations ensure that the digital economy contributes to Finland's tax revenue, supporting the country's transition to a more digitalized economy.

Overall, Finland's tax system is designed to be efficient, transparent, and supportive of economic development. The country's tax rates, combined with its strong social welfare system, contribute to a high quality of life for its residents and a favorable business environment for companies operating within its borders.

What is the income tax rate for residents in Finland?

+The income tax rate for residents in Finland is progressive, with tax rates ranging from 0% to 31.5%. The rate depends on the individual’s income bracket.

How does Finland’s corporate tax rate compare to other European countries?

+Finland’s corporate tax rate of 20% is relatively competitive compared to other European countries. Many countries have higher corporate tax rates, making Finland an attractive destination for businesses.

What is the standard VAT rate in Finland, and are there any reduced rates?

+The standard VAT rate in Finland is 24%. However, there are reduced rates of 14% and 10% for specific goods and services, and some services are exempt from VAT altogether.

How does Finland address tax challenges posed by the digital economy?

+Finland has introduced a digital services tax targeting large tech companies providing digital services to Finnish consumers. It has also implemented measures for e-commerce businesses to ensure fair tax contributions.