Tax Free Wealth

Welcome to an in-depth exploration of the fascinating world of tax-free wealth and the strategies that empower individuals to optimize their financial portfolios. In a world where tax obligations can significantly impact net worth, the concept of tax-free wealth has become increasingly popular among investors seeking to maximize their financial growth and long-term prosperity.

Tax-free wealth refers to the accumulation and management of assets that are exempt from taxation, allowing individuals to retain a higher portion of their earnings and investments. This financial strategy is not merely about minimizing tax liabilities; it's about leveraging tax-efficient vehicles and planning to achieve substantial growth over time. In this article, we will delve into the intricacies of tax-free wealth, uncovering the key principles, strategies, and benefits that make it an attractive option for savvy investors.

The Fundamentals of Tax-Free Wealth

At its core, tax-free wealth revolves around understanding the tax landscape and utilizing legal mechanisms to reduce or eliminate taxes on specific assets. This strategy involves a careful selection of investment vehicles, proper financial planning, and a thorough grasp of the tax codes and regulations that govern different jurisdictions.

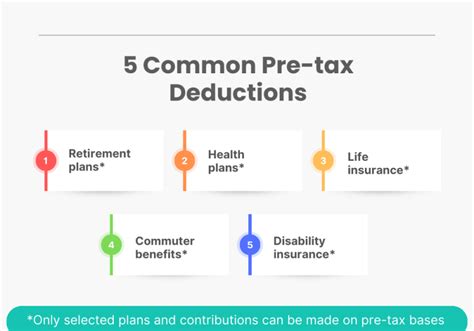

The foundation of tax-free wealth is built upon a solid understanding of the following key concepts:

- Tax-Efficient Investments: These are financial instruments designed to minimize the tax impact on investors. Examples include tax-free municipal bonds, certain types of retirement accounts, and offshore investment structures.

- Tax Deferral: This strategy involves postponing taxes on investment gains until a later date, often when the investor is in a lower tax bracket or when tax rates are more favorable. Common tools for tax deferral include traditional IRAs and 401(k) plans.

- Tax-Exempt Status: Some investments, such as certain municipal bonds, are exempt from federal, state, and local taxes, making them attractive options for tax-free wealth accumulation.

- Tax-Loss Harvesting: This technique involves selling losing investments to offset capital gains taxes on profitable investments, effectively lowering the overall tax liability.

- Estate Planning: Strategic estate planning can help individuals pass on wealth to their heirs with minimal tax implications, ensuring that the full value of the estate is preserved.

Maximizing Tax-Free Wealth: Strategies and Insights

Now, let’s explore some practical strategies and insights that can help individuals maximize their tax-free wealth potential.

Diversifying Your Investment Portfolio

A well-diversified investment portfolio is crucial for long-term financial success. When it comes to tax-free wealth, diversification takes on an even more critical role. By spreading your investments across various asset classes, you not only reduce risk but also increase your chances of finding tax-efficient opportunities.

Consider the following tax-free investment options:

- Municipal Bonds: These bonds are issued by state and local governments to fund public projects. The interest earned on municipal bonds is typically exempt from federal taxes and often from state and local taxes as well. This makes them an attractive choice for tax-conscious investors.

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate. They offer investors the opportunity to participate in the real estate market without the hassle of direct property ownership. REITs often provide tax advantages, as they are required to distribute most of their taxable income to shareholders, resulting in reduced tax liabilities.

- Life Insurance Policies: Certain life insurance policies, such as permanent life insurance, can provide tax-free benefits. The cash value within these policies grows tax-deferred, and death benefits are typically paid out tax-free to beneficiaries.

- International Investment Vehicles: Investing in international markets can open up opportunities for tax-free wealth. Some countries offer favorable tax regimes for certain types of investments, making them attractive destinations for tax-conscious investors. However, it's crucial to navigate these waters with expert guidance to ensure compliance with local regulations.

Optimizing Retirement Accounts

Retirement accounts are a cornerstone of tax-free wealth strategies. Traditional IRAs and 401(k) plans allow for tax-deferred growth, where contributions and investment gains are not taxed until withdrawal, typically during retirement when tax rates may be lower.

Here are some tips for maximizing the tax benefits of retirement accounts:

- Maximize Contributions: Contribute the maximum allowed amount to your retirement accounts each year. This not only takes advantage of tax-deferred growth but also helps you build a substantial retirement nest egg.

- Rollover Strategies: If you change jobs or want to consolidate your retirement savings, consider rolling over your old 401(k) or IRA into a new account. This ensures that you maintain the tax-deferred status of your investments.

- Roth IRA Considerations: While Roth IRAs don't offer tax-deductible contributions like traditional IRAs, they provide tax-free withdrawals in retirement. This can be an attractive option for younger investors, as it allows them to grow their retirement savings tax-free.

Estate Planning and Trusts

Estate planning is an essential component of tax-free wealth management. By implementing strategic estate planning techniques, individuals can ensure that their wealth is passed on to their heirs with minimal tax implications.

Here's how you can utilize trusts and estate planning to protect your tax-free wealth:

- Revocable Living Trusts: These trusts allow you to maintain control over your assets during your lifetime while specifying how they should be distributed after your death. They can help avoid probate, reducing the time and costs associated with settling your estate.

- Irrevocable Trusts: Irrevocable trusts are a more complex estate planning tool that can provide significant tax benefits. By transferring assets into an irrevocable trust, you remove them from your taxable estate, potentially reducing estate taxes. These trusts are often used to protect assets for future generations.

- Gifting Strategies: Gifting assets to family members during your lifetime can reduce the value of your taxable estate. However, it's important to stay within the annual gift tax exclusion limits to avoid triggering gift taxes.

Tax-Loss Harvesting and Tax Strategies

Tax-loss harvesting is a technique used to offset capital gains taxes by selling losing investments. This strategy can be particularly beneficial for tax-free wealth management, as it helps reduce the overall tax liability on profitable investments.

Here's how tax-loss harvesting works:

- Identify Losing Investments: Regularly review your investment portfolio to identify assets that have declined in value. These investments can be potential candidates for tax-loss harvesting.

- Sell at a Loss: By selling the losing investment, you create a capital loss. This loss can be used to offset capital gains taxes on profitable investments, reducing your overall tax liability.

- Wash Sale Rule: Be mindful of the wash sale rule, which states that you cannot repurchase the same or substantially identical securities within 30 days before or after the sale to claim a loss. This rule is in place to prevent tax avoidance strategies.

- Tax-Loss Harvesting Services: Consider utilizing tax-loss harvesting services or tools that automate the process. These services can help you identify and execute tax-loss harvesting strategies efficiently.

Real-World Success Stories

To illustrate the power of tax-free wealth strategies, let’s explore some real-world success stories:

| Investor | Strategy | Outcome |

|---|---|---|

| John D. | Diversified his portfolio with a focus on tax-free municipal bonds and REITs. He also utilized tax-loss harvesting to optimize his capital gains. | John successfully reduced his tax liability by 20% over a 5-year period, allowing him to retain more of his investment earnings. |

| Emily S. | Maximized her retirement savings by contributing the annual maximum to her 401(k) and rolling over her old retirement accounts. She also invested in tax-efficient mutual funds. | Emily's tax-free wealth strategy helped her accumulate a substantial retirement nest egg, with a tax-deferred growth rate of 8% annually. |

| David P. | Implemented a comprehensive estate plan, including a revocable living trust and strategic gifting to reduce his taxable estate. He also utilized offshore investment structures. | David successfully passed on a significant portion of his wealth to his heirs, minimizing estate taxes and ensuring the preservation of his legacy. |

The Future of Tax-Free Wealth

As tax laws and regulations continue to evolve, the strategies for achieving tax-free wealth must adapt as well. Here are some key considerations for the future:

- Stay Informed: Tax laws can change rapidly, so it's crucial to stay informed about any updates or amendments that may impact your tax-free wealth strategies. Work with a financial advisor who specializes in tax planning to ensure you're taking advantage of the latest opportunities.

- Diversification: Diversification will remain a key principle for tax-free wealth. By spreading your investments across different asset classes and jurisdictions, you can mitigate risk and take advantage of a wider range of tax-efficient opportunities.

- Technology and Automation: The rise of fintech and financial technology has made tax-loss harvesting and other tax-efficient strategies more accessible. Consider utilizing automated tools and platforms that can help you optimize your tax position with minimal effort.

- International Opportunities: As the world becomes more interconnected, international investment opportunities will continue to play a role in tax-free wealth strategies. However, it's essential to navigate these opportunities with caution and seek expert advice to ensure compliance with international tax laws.

Conclusion

Tax-free wealth is a powerful strategy for individuals seeking to maximize their financial growth and preserve their hard-earned assets. By understanding the fundamentals, diversifying investment portfolios, optimizing retirement accounts, and implementing strategic estate planning, investors can achieve substantial tax savings and long-term financial prosperity.

As you embark on your journey towards tax-free wealth, remember that it's not just about minimizing taxes; it's about making your money work harder for you. With the right strategies and a comprehensive understanding of the tax landscape, you can achieve financial freedom and leave a lasting legacy for future generations.

What are the key benefits of tax-free wealth strategies?

+Tax-free wealth strategies offer several key benefits, including reduced tax liabilities, increased investment growth potential, and the ability to preserve wealth for future generations. By minimizing taxes, investors can retain more of their earnings and investments, leading to long-term financial prosperity.

Are there any limitations or risks associated with tax-free wealth strategies?

+While tax-free wealth strategies can be highly beneficial, there are some limitations and risks to consider. For example, certain tax-efficient investments may have lower liquidity or higher fees. Additionally, tax laws can change, and staying compliant with evolving regulations is crucial. It’s important to consult with financial and tax professionals to understand the potential risks and ensure a well-rounded financial plan.

How can I get started with tax-free wealth planning?

+Getting started with tax-free wealth planning begins with educating yourself about the principles and strategies discussed in this article. Consult with a qualified financial advisor or tax professional who can guide you through the process and tailor a plan to your specific financial goals and circumstances. Remember, tax-free wealth planning is a long-term strategy, so patience and consistency are key.