Me State Sales Tax

The state sales tax system in the United States is a complex network of varying tax rates, exemptions, and regulations, making it crucial for businesses and individuals to understand the specifics of each state they operate in or make purchases from. This article aims to provide an in-depth analysis of state sales tax, covering its fundamentals, variations, and the impact it has on businesses and consumers alike.

Understanding the Basics of State Sales Tax

State sales tax is a consumption tax levied by state governments on the sale of goods and services. It is a percentage of the purchase price added to the cost of the item, with the revenue collected by the state government to fund various public services and infrastructure projects.

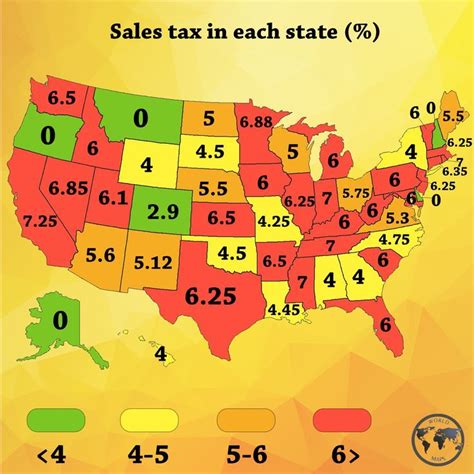

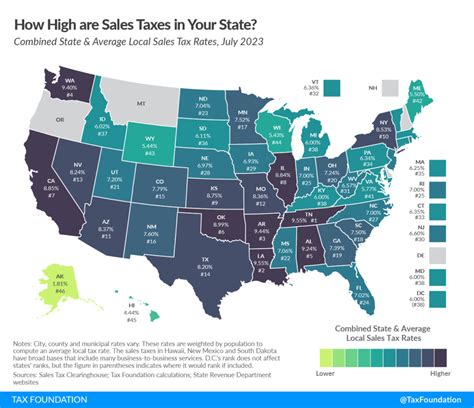

The implementation of state sales tax varies widely across the country. While some states, like Alaska, Delaware, Montana, New Hampshire, and Oregon, do not impose a state sales tax, others have rates that can range from 2.9% to 7.25%.

Additionally, many states allow local governments, such as cities or counties, to impose their own local sales tax on top of the state rate, leading to a more complex tax structure. These local sales taxes can further increase the overall tax burden on consumers and businesses.

| State | State Sales Tax Rate | Notable Local Sales Tax Rates |

|---|---|---|

| California | 7.25% | San Francisco: 8.5% |

| Texas | 6.25% | Houston: 8.25% |

| New York | 4% | New York City: 8.875% |

| Florida | 6% | Miami-Dade County: 7% |

| Illinois | 6.25% | Chicago: 10.25% |

Exemptions and Special Considerations

Not all goods and services are subject to state sales tax. Each state has its own list of exemptions, which can include items like prescription drugs, groceries, clothing, and educational materials. Additionally, certain industries, such as tourism and hospitality, may have specific tax rates or exemptions applied to their sales.

Furthermore, state sales tax regulations often differ based on the seller's location. For instance, a business based in one state may need to collect and remit sales tax to the state where the customer is located, even if the business itself is not physically present in that state. This concept, known as nexus, has significant implications for online retailers and businesses with remote operations.

The Impact of State Sales Tax on Businesses

State sales tax has a profound effect on businesses, influencing their operational strategies, tax obligations, and overall profitability. Here are some key considerations for businesses navigating the state sales tax landscape.

Tax Compliance and Registration

Businesses must register for and comply with state sales tax regulations in every state where they have a taxable presence or nexus. This includes businesses with physical stores, warehouses, or offices in multiple states, as well as those with online operations that reach customers across state lines.

The process of registering for state sales tax can be complex, requiring businesses to understand the specific tax laws and regulations of each state they operate in. Failure to comply with these regulations can result in penalties, interest, and even legal consequences.

Sales Tax Collection and Remittance

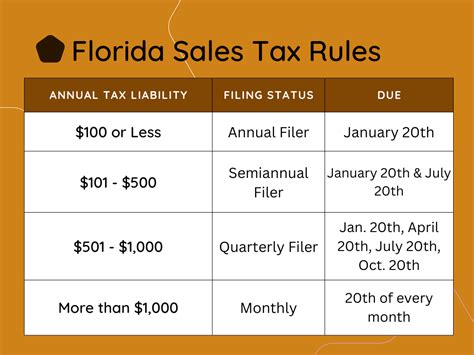

Businesses are responsible for collecting the appropriate state sales tax from customers at the point of sale. This tax is then remitted to the state government on a regular basis, typically monthly or quarterly. The process of collecting and remitting sales tax can be time-consuming and requires accurate record-keeping to ensure compliance.

For businesses with online sales, the Economic Nexus laws, which were a result of the Supreme Court case South Dakota v. Wayfair, have significant implications. These laws require businesses to collect and remit sales tax in states where they have a certain level of economic activity, even if they lack a physical presence.

Pricing Strategies and Competitiveness

State sales tax can influence a business’s pricing strategy. In states with higher sales tax rates, businesses may need to adjust their pricing to remain competitive and attract customers. This can be particularly challenging for businesses operating in multiple states with varying tax rates.

Additionally, state sales tax can impact a business's competitive advantage. For instance, a business located in a state with no sales tax may have a pricing advantage over competitors in states with higher tax rates. This can lead to a strategic advantage in attracting customers from neighboring states or online.

The Consumer Perspective: Navigating State Sales Tax

For consumers, understanding state sales tax is crucial for making informed purchasing decisions and managing their financial obligations. Here’s how state sales tax affects consumers.

Comparative Shopping and Tax Awareness

When shopping, consumers should be aware of the state sales tax rates in their state and in the states where they make purchases. This awareness can influence their purchasing decisions, especially when shopping across state lines or online. Understanding the tax rates can help consumers budget effectively and compare prices accurately.

For instance, a consumer living in a state with a high sales tax rate may choose to make certain purchases in a neighboring state with a lower tax rate, especially for big-ticket items. This practice, known as cross-border shopping, can result in significant savings for consumers.

Online Shopping and Sales Tax

With the rise of e-commerce, consumers now have access to a global marketplace. However, this also means that they may be subject to state sales tax even when shopping from out-of-state retailers. The Wayfair ruling has made it easier for states to collect sales tax from online retailers, which means consumers may see more consistent tax rates applied to their online purchases.

Tax Refunds and Exemptions

In certain situations, consumers may be eligible for tax refunds or exemptions. For instance, businesses and individuals who purchase goods for resale or use in manufacturing may be exempt from sales tax. Additionally, some states offer sales tax holidays, during which certain types of purchases are exempt from tax.

Understanding these exemptions and refunds can help consumers save money and ensure they are not overpaying on their purchases.

The Future of State Sales Tax

The landscape of state sales tax is constantly evolving, driven by technological advancements, changing consumer behaviors, and legal decisions. Here’s a look at some of the potential future implications and trends.

Online Sales and Tax Collection

As e-commerce continues to grow, the collection of sales tax from online retailers will likely become more standardized and efficient. This could lead to a more uniform tax rate for online purchases, simplifying the process for both businesses and consumers.

However, the increased ease of collecting sales tax from online retailers may also result in states becoming more aggressive in their tax collection efforts, which could mean higher tax burdens for consumers and businesses.

Tax Reform and Simplification

The complexity of the state sales tax system has led to calls for tax reform and simplification. Some proposals suggest a national sales tax or a streamlined tax system that would make it easier for businesses to comply and for consumers to understand. While these reforms are complex and may face political challenges, they could significantly impact the future of state sales tax.

Impact of Remote Work and E-commerce

The rise of remote work and the continued growth of e-commerce have blurred the lines of tax jurisdiction. As more businesses operate remotely and more consumers shop online, the concept of Economic Nexus may need to be reevaluated to ensure fairness and simplicity in tax collection.

How do I know if my business needs to collect and remit state sales tax in a particular state?

+Determining your business’s tax obligations in a state depends on several factors, including your physical presence (nexus) in the state, the location of your customers, and the specific tax laws of that state. It’s crucial to consult with tax professionals or use tax software to ensure accurate compliance.

What happens if I make a purchase online from an out-of-state retailer, and they don’t charge me sales tax?

+If an out-of-state retailer fails to collect sales tax from you, you may still be responsible for paying the tax. This is known as “use tax,” which you would remit directly to your state government. It’s important to be aware of your use tax obligations to ensure compliance.

Are there any advantages for businesses operating in states with no sales tax?

+Yes, businesses operating in states with no sales tax may have a pricing advantage over competitors in states with higher tax rates. This can make their products more attractive to consumers, both locally and from neighboring states. However, they still need to comply with other state and local taxes.