Nba Luxury Tax

The NBA luxury tax is a financial mechanism in place to regulate spending on player salaries and encourage teams to maintain a balanced payroll. It is a key component of the league's collective bargaining agreement (CBA) and has significant implications for franchise operations, player acquisitions, and overall league competitiveness.

Understanding the NBA Luxury Tax

The NBA luxury tax threshold, also known as the apron, is determined annually and represents the maximum payroll a team can have before incurring luxury tax penalties. If a team’s payroll exceeds this threshold, they are subject to a progressive tax system that penalizes them based on the extent of the payroll surplus.

The current NBA luxury tax system is a two-tiered structure. Teams that exceed the luxury tax threshold by a certain amount are subject to a recurring tax for each season they remain above the threshold. This recurring tax applies to all teams above the threshold, regardless of the amount they surpass it by. However, teams that exceed the threshold by a larger margin are subject to an additional repeater tax, which is levied on top of the recurring tax.

For instance, in the 2022-2023 season, the luxury tax threshold was set at $147.1 million. Teams exceeding this threshold by up to $5.125 million paid a recurring tax of $1.50 for each dollar over the threshold. Teams surpassing the threshold by more than $5.125 million incurred the additional repeater tax, which amounted to $2.50 for each dollar over the threshold.

| Threshold | Recurring Tax Rate | Repeater Tax Rate |

|---|---|---|

| $147.1 million | $1.50 per dollar | $2.50 per dollar |

Impact on Team Operations

The luxury tax has a profound impact on team operations and roster construction. Teams that pay the luxury tax often find themselves in a difficult position, as the financial burden can limit their flexibility in free agency and restrict their ability to make trades. Additionally, the tax can lead to a significant financial strain on the franchise, affecting their long-term sustainability and competitiveness.

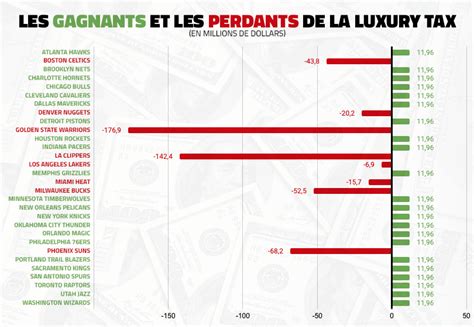

For instance, the Brooklyn Nets, one of the most prominent luxury tax payers in recent years, have had to make creative roster moves to accommodate their high payroll. In the 2022-2023 season, the Nets paid a luxury tax bill of $60.7 million, the highest in the league. This financial burden not only limits their ability to sign free agents but also affects their future flexibility, as they will continue to pay the recurring tax unless they can reduce their payroll significantly.

Strategies to Avoid the Luxury Tax

Teams employ various strategies to avoid incurring the luxury tax. One common approach is to trade away expensive contracts for more affordable players or draft picks. This allows teams to shed salary and potentially acquire valuable assets in return. For instance, the Philadelphia 76ers, who were projected to pay a significant luxury tax bill in the 2022-2023 season, made a trade with the Oklahoma City Thunder to send away Al Horford’s large contract, thus avoiding the tax.

The Stretch Provision

Another strategy to alleviate luxury tax burden is through the use of the stretch provision. This provision allows teams to spread the remaining salary of a player over multiple years, reducing the team’s annual salary cap hit. While this strategy provides short-term relief, it also ties up cap space for the future, limiting the team’s flexibility in future seasons.

For example, the Los Angeles Lakers utilized the stretch provision to waive Luol Deng's contract in 2020. By doing so, they were able to avoid a substantial luxury tax bill but also committed to paying Deng's remaining salary over a longer period, impacting their cap space for years to come.

The Luxury Tax and Competitive Balance

The NBA luxury tax is designed to promote competitive balance by discouraging teams from accumulating excessive talent through high payrolls. By implementing a progressive tax system, the league aims to ensure that teams with larger markets and deeper pockets do not have an unfair advantage in signing top players.

Financial Disparity

Despite the luxury tax, there remains a significant financial disparity between teams. Some franchises, like the New York Knicks and Los Angeles Lakers, consistently generate higher revenues due to their market size and fan base, allowing them to absorb the luxury tax penalties without significant financial strain. On the other hand, smaller market teams, such as the Utah Jazz or Memphis Grizzlies, may find it more challenging to compete financially.

For instance, the New York Knicks, despite their large market, have consistently been above the luxury tax threshold in recent years. In the 2022-2023 season, they paid a luxury tax bill of $68.4 million, the second-highest in the league. However, due to their market size and revenue generation, the tax burden is more manageable compared to smaller market teams.

Future Implications and Potential Reforms

The NBA luxury tax system is subject to periodic reviews and potential reforms as part of the collective bargaining process. As the league’s financial landscape evolves, so too might the tax thresholds and penalties. The current CBA, which was signed in 2020, includes a luxury tax provision that will remain in place until the end of the 2023-2024 season.

Potential Reforms

Discussions surrounding potential reforms often focus on finding a balance between promoting competitive balance and allowing teams the flexibility to build competitive rosters. Some proposed reforms include adjusting the tax thresholds and penalties, implementing a soft salary cap, or introducing mechanisms to redistribute revenues more equitably among teams.

For instance, the idea of a soft salary cap, which would allow teams to exceed the salary cap but with diminishing returns, has been proposed as a potential solution to promote competitive balance while still allowing teams to pursue star players. This could involve a system where teams pay a luxury tax but also have the ability to retain their own free agents at a discounted rate, encouraging player retention and stability.

Conclusion

The NBA luxury tax is a complex and essential component of the league’s financial landscape. It shapes team operations, influences roster construction, and plays a crucial role in maintaining competitive balance. As the league continues to evolve, the luxury tax will likely undergo periodic revisions to adapt to changing economic conditions and maintain its effectiveness in promoting fairness and competitiveness.

What is the purpose of the NBA luxury tax?

+

The NBA luxury tax is designed to promote competitive balance and discourage teams from accumulating excessive talent through high payrolls. It aims to ensure that teams with larger markets and deeper pockets do not have an unfair advantage in signing top players.

How does the luxury tax threshold change annually?

+

The luxury tax threshold is determined annually and is based on the league’s overall revenue. It is set as a percentage of the league’s basketball-related income (BRI), which includes ticket sales, broadcasting rights, and other revenue streams. As the league’s revenue increases, so does the luxury tax threshold.

What are the potential consequences of paying the luxury tax?

+

Teams that pay the luxury tax face significant financial burdens, which can impact their long-term sustainability and competitiveness. The tax limits their flexibility in free agency and restricts their ability to make trades. Additionally, the recurring tax can lead to a cumulative financial strain, affecting the team’s overall financial health.

How do teams avoid paying the luxury tax?

+

Teams employ various strategies to avoid the luxury tax, including trading away expensive contracts, using the stretch provision to waive players, and carefully managing their payroll. Some teams also try to retain their own free agents by offering them maximum contracts, which can help keep their payroll below the luxury tax threshold.