Definition Of Tax Deducted At Source

Tax Deducted at Source (TDS) is a critical component of India's indirect tax system, playing a pivotal role in the country's revenue collection. It's a method where the payer, typically the employer or a person making a payment, deducts a certain percentage of the payment as tax and remits it to the government on behalf of the payee. This system ensures a steady inflow of tax revenue for the government and simplifies the tax payment process for both taxpayers and the tax administration.

The Concept of Tax Deducted at Source (TDS)

TDS is a mechanism introduced to facilitate the collection of tax at the source of income generation. It’s an indirect method of tax collection where the responsibility of deducting tax at the time of making specified payments lies with the payer. This approach not only ensures a continuous flow of revenue for the government but also simplifies the tax compliance process for both the payer and the payee.

The concept of TDS is based on the principle of "pay as you earn." It's designed to collect tax in a phased manner, making it convenient for taxpayers to pay their taxes as and when they earn their income. By deducting tax at the source, the government aims to widen the tax base and increase compliance, as the onus of tax deduction and remittance is on the payer, who is typically a registered entity with the tax department.

Key Aspects of TDS

TDS is applicable to various types of payments, including salaries, interest, dividends, commissions, professional fees, rent, and contract payments. The rate of TDS deduction varies based on the type of payment and the payee’s status, such as whether they are an individual or a company, and their tax residency. For instance, the TDS rate for interest earned on bank deposits differs from the rate applicable to professional fees.

The deducted tax is then deposited with the government by the payer within a specified timeframe. The payer is also responsible for issuing a TDS certificate to the payee, which serves as a proof of tax deduction. This certificate is crucial for the payee as it allows them to claim a refund or adjust the TDS against their final tax liability.

| Payment Type | TDS Rate |

|---|---|

| Salaries | As per the Income Tax Slab Rates |

| Interest on Bank Deposits | 10% for individuals, 20% for companies |

| Professional Fees | 10% for individuals, 20% for companies |

Benefits of Tax Deducted at Source (TDS)

The Tax Deducted at Source (TDS) system, an integral part of India’s tax regime, offers a multitude of benefits to both the government and taxpayers. It’s a streamlined approach to tax collection, ensuring a steady flow of revenue for the government while simplifying tax compliance for individuals and businesses.

Revenue Collection for the Government

TDS is a powerful tool for the government to collect taxes efficiently. By deducting tax at the source of income, the government ensures a consistent inflow of revenue. This is particularly beneficial for planning and implementing various development projects and welfare schemes. The TDS system helps in reducing tax evasion, as the onus of deduction and remittance lies with the payer, who is typically a registered entity with the tax department.

Simplicity for Taxpayers

For taxpayers, TDS simplifies the tax payment process. Instead of making a lump sum payment at the end of the financial year, taxpayers can pay their taxes in a phased manner as and when they earn their income. This approach reduces the financial burden and makes tax compliance more manageable. Moreover, TDS certificates issued by the payer serve as proof of tax deduction, allowing taxpayers to claim refunds or adjust their TDS against their final tax liability.

Widening the Tax Base

TDS plays a significant role in widening the tax base. By deducting tax at the source, the government can bring more taxpayers into the tax net. This is particularly beneficial for capturing the informal sector, where transactions are often cash-based and difficult to track. TDS ensures that even small transactions are taxed, leading to a more equitable distribution of the tax burden.

Compliance and Transparency

The TDS system promotes compliance and transparency. The responsibility of tax deduction and remittance lies with the payer, who is typically a registered entity. This accountability ensures that tax is deducted and remitted to the government in a timely manner. Additionally, the issuance of TDS certificates provides transparency, as taxpayers can track their tax deductions and ensure they are not overpaying or underpaying their taxes.

Impact on the Economy

TDS has a positive impact on the economy. By collecting tax at the source, the government can allocate resources more efficiently. The steady flow of revenue helps in maintaining fiscal discipline and stability. Moreover, the simplified tax compliance process encourages economic activities, as businesses and individuals can focus more on their core operations without the burden of complex tax procedures.

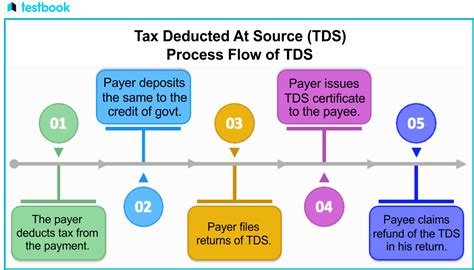

The Process of Tax Deducted at Source (TDS)

The process of Tax Deducted at Source (TDS) is a well-defined procedure that ensures a systematic approach to tax collection. It involves several key steps, from the deduction of tax to its final remittance to the government. Understanding this process is crucial for both payers and payees to ensure compliance and manage their tax obligations effectively.

Deduction of Tax

The first step in the TDS process is the deduction of tax at the time of making specified payments. The payer, such as an employer or a person making a payment, is responsible for deducting tax at the applicable rate. The rate of TDS varies based on the type of payment and the payee’s status. For instance, the TDS rate for salaries is different from the rate applicable to interest earned on bank deposits.

The payer must ensure that they deduct tax correctly and accurately. They need to consider factors such as the payee's tax residency, their income tax slab, and any applicable exemptions or deductions. This requires a thorough understanding of the tax laws and regulations to avoid any errors or discrepancies.

Depositing TDS with the Government

Once the tax is deducted, the next step is to deposit the TDS amount with the government. The payer is responsible for remitting the deducted tax to the appropriate tax authority within a specified timeframe. The due date for TDS payment varies based on the type of payment and the payer’s turnover.

The payer must ensure timely payment of TDS to avoid penalties and interest charges. They should also retain proof of payment, such as the Challan 280, which serves as evidence of TDS remittance. This document is crucial for maintaining compliance and for future reference.

Issuing TDS Certificate

After depositing the TDS, the payer must issue a TDS certificate to the payee. This certificate, Form 16 for salaries and Form 16A for other payments, serves as proof of tax deduction. It contains crucial details such as the amount of tax deducted, the payer’s and payee’s PAN, the TDS rate, and the due dates of deduction.

The TDS certificate is essential for the payee as it allows them to claim a refund or adjust the TDS against their final tax liability. It's also a valuable document for record-keeping and future reference, especially during tax audits or assessments.

Filing TDS Returns

The payer must also file TDS returns, which is a statement of all TDS deductions made during a financial year. This return, Form 26Q or Form 27Q, is filed quarterly with the tax department. It provides a comprehensive overview of all TDS deductions, including the amount deducted, the payee’s details, and the TDS rate.

Filing TDS returns is crucial for maintaining compliance and transparency. It allows the tax department to track TDS payments and ensure that the correct amount of tax is deducted and remitted. Non-compliance or errors in TDS returns can lead to penalties and interest charges.

Types of Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) encompasses a wide range of payments and transactions, each with its own specific rate of deduction. Understanding the different types of TDS and their applicable rates is crucial for both payers and payees to ensure compliance and manage their tax obligations effectively. Here’s an overview of the major types of TDS and their respective rates.

TDS on Salaries

TDS on salaries is one of the most common types of TDS. It’s deducted from the salary paid to employees by their employers. The rate of TDS on salaries is based on the income tax slab rates applicable to individuals. The deduction is made at the time of payment of salary, and the employer is responsible for deducting the correct amount of tax based on the employee’s income and tax residency.

| Income Slab | TDS Rate |

|---|---|

| Up to ₹2,50,000 | 0% |

| ₹2,50,001 - ₹5,00,000 | 5% |

| ₹5,00,001 - ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

TDS on Interest Income

TDS is also deducted on interest income earned from various sources, such as bank deposits, post office savings schemes, and fixed deposits. The rate of TDS on interest income varies based on the payee’s tax residency and the type of account. For individuals, the TDS rate is typically 10%, while for companies, it’s 20%.

| Type of Account | TDS Rate for Individuals | TDS Rate for Companies |

|---|---|---|

| Bank Deposits | 10% | 20% |

| Post Office Savings Schemes | 10% | 20% |

| Fixed Deposits | 10% | 20% |

TDS on Rent

TDS is applicable on rent payments made for the use of land, building, furniture, plant, machinery, or equipment. The rate of TDS on rent is 5% if the rent exceeds ₹50,000 per month. The deduction is made by the person paying the rent, and the responsibility lies with them to deduct the correct amount of tax.

TDS on Professional Fees

TDS is deducted on payments made to professionals, such as lawyers, chartered accountants, doctors, and consultants. The rate of TDS on professional fees is 10% for individuals and 20% for companies. The deduction is made at the time of payment, and the payer is responsible for ensuring the correct rate is applied.

TDS on Commission and Brokerage

TDS is applicable on payments made as commission or brokerage for various services. The rate of TDS on commission and brokerage varies based on the nature of the service. For instance, the TDS rate on commission for life insurance agents is 5%, while for non-life insurance agents, it’s 10%.

| Type of Commission | TDS Rate |

|---|---|

| Life Insurance Agents | 5% |

| Non-Life Insurance Agents | 10% |

| Brokerage for Sale of Securities | 10% |

Impact of Tax Deducted at Source (TDS) on the Economy

The implementation of Tax Deducted at Source (TDS) has had a profound impact on India’s economy, shaping various sectors and influencing the overall economic landscape. TDS, as a mechanism for tax collection, has not only brought about a paradigm shift in revenue generation but has also had far-reaching effects on businesses, taxpayers, and the government. Here’s an in-depth analysis of the impact of TDS on the economy.

Revenue Generation and Fiscal Stability

TDS has been a game-changer for the government in terms of revenue generation. By deducting tax at the source of income, the government has been able to collect taxes in a more efficient and systematic manner. This has resulted in a consistent and stable flow of revenue, which is crucial for the government to fund various development projects and welfare schemes. The steady income from TDS has helped the government maintain fiscal discipline and stability, enabling them to plan and execute long-term economic strategies.

Encouraging Formalization of the Economy

TDS has played a significant role in formalizing the Indian economy. By bringing more transactions into the tax net, TDS has reduced the scope for tax evasion and informal activities. The requirement of TDS deduction and remittance has incentivized businesses and individuals to register with the tax department, leading to a larger tax base. This formalization has not only increased tax compliance but has also made it easier for the government to track economic activities, thus improving governance and transparency.

Impact on Businesses and Taxpayers

For businesses, TDS has simplified the tax payment process. Instead of making a lump sum payment at the end of the financial year, businesses can pay taxes in a phased manner through TDS deductions. This has reduced the financial burden and made tax compliance more manageable. Moreover, the issuance of TDS certificates provides transparency and allows businesses to claim refunds or adjust their TDS against their final tax liability.

For taxpayers, TDS has brought about a sense of discipline and awareness regarding tax compliance. The deduction of tax at the source has made taxpayers more conscious of their tax obligations. The simplified tax payment process has encouraged individuals to file their tax returns and stay updated with their tax liabilities. This has led to a more responsible and compliant taxpayer base, which is essential for a healthy economy.

Impact on Investment and Savings

TDS has had a positive impact on investment and savings in the economy. By deducting tax at the source, the government has been able to collect taxes from a wider range of income sources. This has encouraged individuals to invest in various financial instruments, such as bank deposits, mutual funds, and insurance policies, as they can earn interest or dividends with TDS deducted at the source. The systematic tax collection through TDS has also promoted long-term savings, as individuals can plan their investments with a clear understanding of their tax obligations.

Challenges and Way Forward

While TDS has brought about numerous benefits, it also presents certain challenges. One of the key challenges is ensuring compliance and preventing tax evasion. The government needs to continue its efforts to streamline the TDS process, simplify tax laws, and enhance taxpayer education. Additionally, the use of technology and digital platforms can further improve the efficiency and transparency of TDS collection.

In conclusion, Tax Deducted at Source (TDS) has emerged as a powerful tool for tax collection and economic development in India. Its impact on revenue generation, formalization of the economy, and taxpayer compliance is undeniable. As the economy evolves, the role of TDS will continue to be crucial in shaping India's economic future.