Waterbury Ct Taxes

When discussing taxes in the context of Waterbury, Connecticut, it's essential to delve into the various tax structures and implications that impact both residents and businesses within this vibrant community. Waterbury, with its rich history and diverse population, faces unique tax considerations that shape the financial landscape of the city.

Understanding Waterbury’s Tax Landscape

Waterbury, like many other municipalities, relies on a combination of property taxes, sales taxes, and various other revenue streams to fund its operations and provide essential services to its residents. The city’s tax system is designed to ensure fair and equitable contributions from its citizens while also promoting economic growth and development.

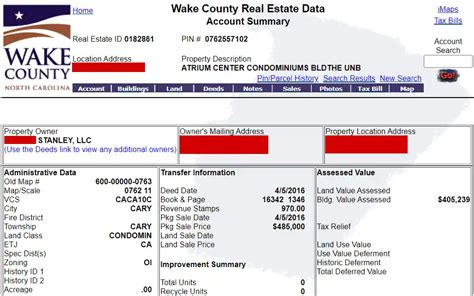

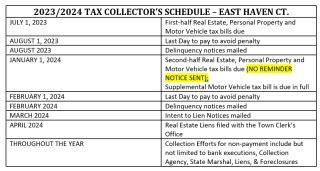

The property tax is a significant component of Waterbury's tax revenue. Property taxes are calculated based on the assessed value of real estate properties within the city limits. The assessed value is determined by the Waterbury Grand List, which is updated annually, taking into account factors such as property improvements, market conditions, and inflation. Residents and business owners are responsible for paying property taxes, which help fund local services like schools, public safety, and infrastructure maintenance.

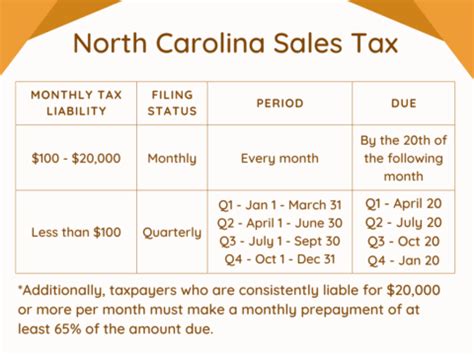

In addition to property taxes, Waterbury also imposes a sales and use tax on various goods and services. This tax is levied on retailers and is typically passed on to consumers at the point of sale. The sales tax revenue contributes to the city's general fund, which supports a range of public services and initiatives. Waterbury's sales tax rate is aligned with the state of Connecticut's rate, ensuring a consistent tax environment for businesses and consumers alike.

Tax Incentives and Strategies for Residents and Businesses

Waterbury recognizes the importance of fostering a business-friendly environment and encouraging economic growth. As such, the city offers a range of tax incentives and strategies to attract and retain businesses. These initiatives aim to reduce the tax burden on businesses while promoting job creation and investment.

Tax Abatement Programs

Waterbury has implemented tax abatement programs to encourage the rehabilitation and redevelopment of abandoned or underutilized properties. These programs offer reduced tax rates for a specified period, providing an incentive for businesses to invest in these properties and bring new life to the community. The city works closely with developers and investors to structure tax abatements that align with their business plans and development goals.

For example, the Waterbury Tax Increment Financing (TIF) Program allows for the diversion of a portion of property taxes generated by new development projects back into the project itself. This strategy incentivizes developers to invest in larger-scale projects, knowing that a portion of their tax contributions will be reinvested in the project's success.

Business Tax Credits

The city also offers a range of tax credits to support businesses operating within Waterbury. These credits can offset various business expenses, including payroll taxes, energy costs, and research and development activities. By providing these incentives, Waterbury aims to create a competitive business environment that attracts innovative companies and fosters economic growth.

One notable tax credit program is the Waterbury Business Enterprise Zone (BEZ) Program. This initiative provides tax credits to businesses operating within designated BEZ areas, which are typically economically distressed neighborhoods. By offering tax incentives, the city aims to stimulate economic development and improve the overall well-being of these communities.

Tax Planning and Compliance for Waterbury Residents

For Waterbury residents, understanding the city’s tax landscape is crucial for effective tax planning and compliance. While property taxes are a significant expense, residents can take advantage of various tax deductions and credits to minimize their tax burden.

Property Tax Deductions

Waterbury residents who itemize their deductions on their federal tax returns can often claim a portion of their property taxes as a deduction. This strategy can help reduce the overall tax liability for homeowners. Additionally, certain improvements to residential properties, such as energy-efficient upgrades, may qualify for tax credits, further reducing the tax impact.

Sales Tax Strategies

When it comes to sales taxes, Waterbury residents can employ strategies to minimize their exposure. For instance, purchasing certain exempt items, such as groceries and prescription medications, can help reduce the overall sales tax burden. Additionally, residents who frequently make online purchases should be mindful of the potential for sales tax on these transactions, as many online retailers are now required to collect and remit sales tax.

The Impact of Waterbury’s Tax Structure on Economic Development

Waterbury’s tax structure plays a pivotal role in shaping the city’s economic development trajectory. By offering a balanced approach to taxation, the city attracts businesses and investors while ensuring a stable revenue stream for essential services. The tax incentives and strategies implemented by Waterbury demonstrate a commitment to fostering economic growth and creating a vibrant business environment.

The success of these initiatives is evident in the city's recent economic developments. Waterbury has seen a surge in business investments, particularly in the downtown area, where abandoned properties are being transformed into vibrant commercial spaces. The tax abatement programs and targeted tax credits have played a significant role in driving this redevelopment, creating a positive feedback loop of investment and economic growth.

Collaborative Efforts for Tax Efficiency

Waterbury’s tax structure is not static; it is continuously evaluated and refined to meet the evolving needs of the community. The city actively engages with local businesses, residents, and economic development experts to ensure that tax policies are fair, efficient, and aligned with the city’s long-term goals. This collaborative approach ensures that Waterbury remains a competitive and attractive destination for businesses and residents alike.

Conclusion

Waterbury’s tax landscape is a dynamic and integral part of the city’s economic ecosystem. From property taxes to sales taxes and targeted incentives, the city’s tax structure supports its residents and businesses while funding essential services. By understanding and effectively utilizing the available tax strategies, Waterbury’s citizens can contribute to the city’s growth and prosperity while managing their financial obligations.

How often are property taxes assessed in Waterbury?

+Property taxes in Waterbury are assessed annually, based on the Waterbury Grand List, which is updated every year to reflect changes in property values.

Are there any tax breaks or incentives for homeowners in Waterbury?

+Yes, Waterbury offers various tax breaks and incentives for homeowners, including property tax deductions for itemized federal tax returns and tax credits for energy-efficient upgrades. Additionally, the city has implemented programs like the Waterbury Business Enterprise Zone (BEZ) Program, which provides tax credits to homeowners in designated BEZ areas.

How does Waterbury’s tax structure compare to other Connecticut cities?

+Waterbury’s tax structure, including its property tax rates and sales tax rates, is generally aligned with other Connecticut cities. However, the city’s targeted tax incentives and abatement programs set it apart, offering unique opportunities for businesses and investors.