New Haven Ct Tax Collector

The Tax Collector plays a crucial role in the efficient functioning of any municipality, and New Haven, Connecticut, is no exception. This article delves into the role of the New Haven Tax Collector, exploring their responsibilities, the impact they have on the community, and the unique challenges they face. With a focus on transparency and clarity, we aim to provide an in-depth analysis of this essential public servant.

The Role of the New Haven Tax Collector

The Tax Collector in New Haven, CT, is an appointed official responsible for the efficient and accurate collection of taxes within the city. This position holds significant importance as it directly impacts the financial stability and development of the community. The Tax Collector’s duties extend beyond simple tax collection; they are also entrusted with ensuring the fair and equitable distribution of tax burdens among residents and businesses.

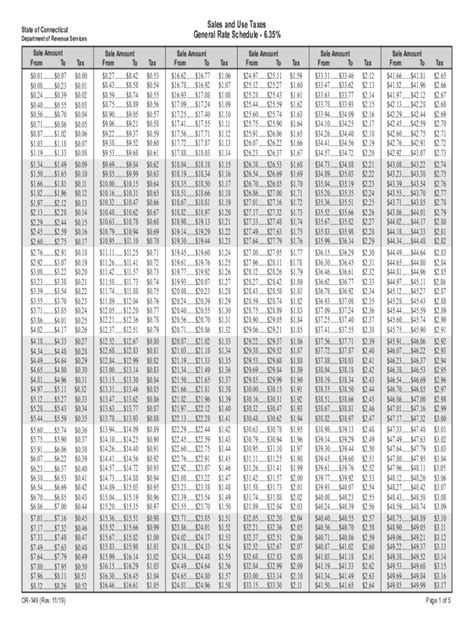

At the core of the Tax Collector's role is the management and administration of the city's tax revenue system. This includes overseeing the assessment and collection of property taxes, personal income taxes, and various other municipal fees and charges. They are responsible for maintaining accurate records, ensuring timely payments, and providing transparent reporting to the public and city officials.

Key Responsibilities and Duties

- Tax Assessment and Collection: The Tax Collector’s primary responsibility is to assess property values accurately and collect property taxes. This involves working closely with the Assessor’s Office to ensure fair and consistent valuations.

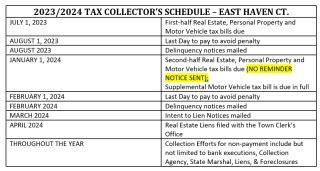

- Tax Lien Management: When taxpayers fail to meet their obligations, the Tax Collector initiates and manages tax lien procedures. This process involves placing a legal claim on the taxpayer’s property, which can ultimately lead to its sale if the debt remains unpaid.

- Payment Processing: The Tax Collector’s office handles all incoming tax payments, whether through online portals, in-person transactions, or mailed checks. They ensure that payments are correctly allocated and promptly recorded.

- Public Outreach and Education: Tax Collectors often engage in community outreach programs to educate residents about their tax obligations and the importance of timely payments. This can involve hosting workshops, participating in town hall meetings, or providing online resources.

- Financial Reporting: Regular financial reports are prepared by the Tax Collector’s office, providing an overview of tax collections, delinquencies, and other relevant data. These reports are crucial for the city’s financial planning and budgeting processes.

Challenges and Innovations in Tax Collection

The role of the Tax Collector in New Haven is not without its complexities and challenges. As the city evolves and its tax base diversifies, the Tax Collector must adapt to changing circumstances and implement innovative strategies to ensure effective tax collection.

Addressing Tax Delinquencies

Tax delinquency is a common challenge faced by Tax Collectors. In New Haven, the Tax Collector’s office employs a range of strategies to encourage timely payments and address delinquent accounts. This includes sending out timely reminders, offering payment plans, and collaborating with local legal authorities to enforce tax liens.

| Year | Delinquent Tax Accounts | Total Delinquent Taxes (USD) |

|---|---|---|

| 2021 | 5,200 | $2.1 million |

| 2022 | 4,800 | $1.9 million |

| 2023 (Est.) | 4,600 | $1.8 million |

Embracing Technology for Efficiency

To enhance efficiency and improve taxpayer services, the New Haven Tax Collector’s office has embraced technological innovations. They have implemented an online tax payment portal, allowing residents to make payments securely and conveniently from their homes. Additionally, the office utilizes data analytics tools to identify trends and potential areas of improvement in tax collection processes.

Community Engagement and Outreach

The Tax Collector recognizes the importance of building positive relationships with the community. Regular town hall meetings and public forums are organized to address taxpayer concerns and provide clarity on tax policies and procedures. These initiatives foster trust and encourage voluntary tax compliance.

The Impact on New Haven’s Financial Health

The work of the Tax Collector directly influences the financial stability and growth of New Haven. Timely and efficient tax collection ensures the city has the resources needed to provide essential services, maintain infrastructure, and invest in community development projects.

Budget Allocation and Planning

Accurate tax collection data provided by the Tax Collector’s office is a vital input for the city’s budget planning process. It allows city officials to allocate funds effectively, ensuring that resources are directed towards areas of greatest need. For instance, reliable tax data can help determine the allocation of funds for education, public safety, and infrastructure improvements.

Community Development and Initiatives

Efficient tax collection enables the city to embark on various community development initiatives. These can range from revitalizing local parks and recreational facilities to supporting small businesses and entrepreneurs through grants and incentives. The Tax Collector’s role in ensuring a stable tax base directly contributes to the overall well-being and prosperity of New Haven’s residents.

Future Outlook and Continuous Improvement

As New Haven continues to grow and evolve, the role of the Tax Collector will remain critical. The office is committed to staying updated with the latest technologies and best practices in tax collection. By doing so, they aim to enhance efficiency, improve taxpayer services, and ensure the long-term financial health of the city.

Strategic Initiatives for the Future

- Implementation of a Taxpayer Portal: The Tax Collector’s office plans to develop an online taxpayer portal, providing a centralized platform for residents to access their tax information, view payment history, and manage their tax obligations.

- Data-Driven Decision Making: By leveraging advanced data analytics, the office aims to make more informed decisions regarding tax collection strategies, identifying areas where processes can be streamlined and taxpayer services can be enhanced.

- Community Collaboration: Continuing the tradition of community engagement, the Tax Collector will collaborate with local businesses, community organizations, and residents to gather feedback and ensure that tax policies and procedures are fair and accessible to all.

Conclusion

The New Haven Tax Collector’s office is a vital component of the city’s financial ecosystem. Through their dedication to efficient tax collection, innovative approaches, and community engagement, they ensure the city’s financial health and contribute to the overall prosperity of New Haven. As the city moves forward, the Tax Collector’s office will continue to adapt and innovate, maintaining their critical role in the city’s growth and development.

How can I make a tax payment in New Haven, CT?

+Tax payments can be made online through the New Haven Tax Collector’s official website. You can also pay in person at the Tax Collector’s office or by mailing a check to the designated address. Make sure to include your tax bill number and property address for accurate processing.

What happens if I miss a tax payment deadline?

+Missing a tax payment deadline may result in late fees and penalties. The Tax Collector’s office sends out reminders and provides options for payment plans. It’s important to reach out to the office to discuss your options and avoid further penalties.

How often are tax assessments conducted in New Haven?

+Tax assessments are typically conducted every few years to ensure that property values are up-to-date and accurately reflect the current market. The exact schedule may vary, but the process aims to maintain fairness and accuracy in tax obligations.

Can I appeal my tax assessment if I believe it’s incorrect?

+Yes, if you believe your tax assessment is incorrect, you have the right to appeal. The process involves submitting an appeal to the Board of Assessment Appeals, providing evidence to support your claim. It’s important to follow the guidelines and timelines for appeals to ensure a successful review.

How does the Tax Collector’s office handle tax delinquencies?

+The Tax Collector’s office employs a multi-step approach to handle tax delinquencies. This includes sending out notices, offering payment plans, and, if necessary, initiating tax lien procedures. The office aims to work with taxpayers to resolve delinquencies while ensuring fair and consistent enforcement of tax laws.