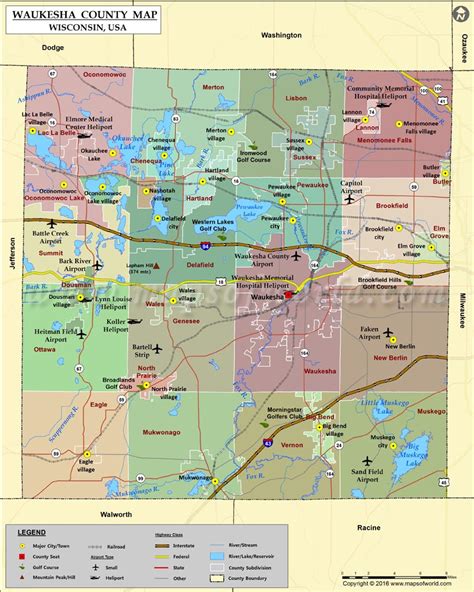

Waukesha County Tax Records

Welcome to an in-depth exploration of the Waukesha County tax records, a vital resource for property owners, investors, and anyone interested in understanding the economic landscape of this vibrant Wisconsin county. Waukesha County, known for its picturesque landscapes and thriving communities, has a robust property tax system that plays a significant role in its economic structure. This article will delve into the intricacies of Waukesha County tax records, providing an insightful guide to their functionality, impact, and importance.

Understanding Waukesha County Tax Records

Waukesha County tax records are a comprehensive database maintained by the county’s Department of Finance and Administration. These records contain essential information about every property within the county’s boundaries, serving as a crucial resource for property assessments, tax calculations, and financial planning.

The tax records encompass a wide range of data, including:

- Property Details: Comprehensive information about each property, such as its address, legal description, size, and zoning.

- Ownership Information: Details about the property owners, including their names, contact information, and any changes in ownership.

- Assessment Data: Critical values such as the assessed value of the property, market value, and any applicable exemptions or special assessments.

- Tax Calculations: Detailed records of the tax rates applied, the calculated tax amounts, and any adjustments or appeals.

- Payment History: A complete timeline of tax payments, including due dates, amounts paid, and any penalties or refunds.

The tax records are not only a valuable tool for the county's financial administration but also serve as a transparent and accessible resource for property owners and the public. They provide a snapshot of the county's economic health, offering insights into property values, tax revenue, and the overall financial landscape.

The Role of Waukesha County Tax Records in Property Assessments

One of the primary functions of Waukesha County tax records is to support accurate property assessments. The county’s assessors use these records to determine the fair market value of each property, ensuring that tax obligations are equitable across all property owners.

The assessment process involves a thorough analysis of the property's characteristics, recent sales data, and market trends. Assessors consider factors such as:

- The property's physical condition and any recent improvements.

- Comparable sales in the area to establish market value.

- The property's income potential for income-producing properties.

- Any applicable exemptions or special assessments, such as homestead credits or senior exemptions.

Once the assessors have determined the property's assessed value, this information is recorded in the tax records. Property owners can then access these records to understand their tax obligations and, if necessary, initiate appeals or apply for exemptions.

Online Access to Waukesha County Tax Records

In a move towards transparency and convenience, Waukesha County has made its tax records accessible online through the Waukesha County Property Tax Records Portal. This user-friendly platform allows property owners, buyers, and the general public to search for and view tax records for any property in the county.

The portal provides a wealth of information, including:

- Detailed property descriptions, including photos and maps.

- Ownership information and transfer history.

- Assessment details, such as assessed value, market value, and tax rates.

- Tax payment history and current tax obligations.

- Information on exemptions and special assessments.

The online accessibility of these records not only benefits property owners but also real estate professionals, investors, and anyone interested in understanding the county's property market. It streamlines the process of accessing vital information, enabling informed decisions and facilitating efficient property transactions.

Tax Records and Waukesha County’s Economic Growth

Waukesha County’s tax records are a vital component of the county’s economic growth and development. They provide a foundation for strategic financial planning, ensuring that the county’s tax revenue is utilized effectively to support essential services, infrastructure development, and community initiatives.

By analyzing the tax records, the county can identify trends in property values, assess the impact of economic fluctuations, and make informed decisions about tax rates and financial policies. This data-driven approach ensures that the county's financial strategies are aligned with its economic goals, fostering a stable and prosperous environment for its residents and businesses.

Tax Records and Community Development

Waukesha County’s tax records also play a pivotal role in community development initiatives. The data within these records can be leveraged to identify areas in need of investment, such as neighborhoods with declining property values or regions experiencing economic challenges.

By targeting these areas with strategic investments, the county can stimulate economic growth, attract new businesses, and enhance the overall quality of life for its residents. This proactive approach to community development, guided by the insights from tax records, is a testament to the county's commitment to creating a vibrant and sustainable future.

The Impact of Waukesha County Tax Records on Property Owners

For property owners in Waukesha County, the tax records are a valuable resource for understanding their financial obligations and rights. These records provide transparency and clarity regarding tax assessments, payments, and any applicable exemptions or credits.

Property owners can use the tax records to:

- Verify their assessed value and ensure it aligns with the property's actual market value.

- Track their tax payment history and plan for future obligations.

- Identify and apply for exemptions or credits they may be eligible for, such as the Homestead Exemption or Senior Citizen Tax Credit.

- Appeal their assessed value if they believe it is inaccurate or unfair.

By actively engaging with the tax records, property owners can ensure they are treated fairly and equitably in the tax assessment process. This empowers them to make informed decisions about their properties and financial planning, fostering a sense of trust and confidence in the county's tax system.

Tips for Navigating Waukesha County Tax Records

Here are some practical tips for property owners and individuals interested in exploring Waukesha County tax records:

- Understand the Assessment Process: Familiarize yourself with how the county assesses property values. This knowledge will help you interpret the assessed value and identify potential areas for appeal or negotiation.

- Stay Informed about Exemptions: Keep up-to-date with the various exemptions and credits offered by the county. This can significantly reduce your tax obligations, so ensure you are aware of any programs you may be eligible for.

- Regularly Review Your Records: Make it a habit to review your tax records annually. This practice helps you stay on top of any changes in your assessed value, tax rates, or payment history.

- Utilize Online Resources: Take advantage of the online tax record portal. It offers a convenient way to access and explore tax records, saving you time and effort.

- Seek Professional Advice: If you have complex tax situations or need assistance understanding your obligations, consider consulting a tax professional or financial advisor.

By following these tips and staying engaged with Waukesha County's tax records, property owners can actively participate in the county's economic landscape and ensure their financial interests are well-served.

Future Implications and Innovations in Waukesha County Tax Records

As technology continues to advance, Waukesha County is exploring innovative ways to enhance its tax record system. The county is committed to staying at the forefront of technological advancements to improve efficiency, transparency, and accessibility.

Some potential future developments include:

- Real-Time Data Updates: Implementing a system that allows for real-time updates to tax records, ensuring that property owners and stakeholders have access to the most current information.

- Advanced Analytics: Utilizing sophisticated data analytics tools to identify trends, predict property value changes, and optimize tax assessment processes.

- Blockchain Integration: Exploring the use of blockchain technology to enhance security, transparency, and immutability of tax records, ensuring data integrity and trust.

- Artificial Intelligence (AI) Assistance: Developing AI-powered tools to assist with tax record searches, analysis, and decision-making, improving efficiency and accuracy.

These future innovations aim to further strengthen Waukesha County's tax record system, making it even more robust, accessible, and beneficial for all stakeholders.

Frequently Asked Questions

How often are Waukesha County tax records updated?

+Waukesha County tax records are updated annually, reflecting the assessed values and tax obligations for the current fiscal year. The updates typically occur in the spring, with the new records becoming available for public access by the summer.

Can I access my tax records online?

+Yes, Waukesha County offers an online portal called the Waukesha County Property Tax Records Portal where you can access your tax records and those of any property in the county. The portal provides a user-friendly interface to search, view, and download tax record information.

How do I appeal my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you can initiate an appeal process. The first step is to contact the Waukesha County Assessor’s Office to discuss your concerns. They will guide you through the formal appeal process, which typically involves submitting documentation to support your claim.

Are there any exemptions or credits available for property owners in Waukesha County?

+Yes, Waukesha County offers a range of exemptions and credits to eligible property owners. These include the Homestead Exemption, which reduces the assessed value of your primary residence, and the Senior Citizen Tax Credit, which provides a tax credit for eligible seniors. There are also other credits and exemptions available for veterans, disabled individuals, and certain income-producing properties.

How can I stay informed about changes to Waukesha County’s tax records and policies?

+To stay updated on changes and developments related to Waukesha County’s tax records and policies, you can subscribe to the Waukesha County Finance and Administration newsletter. This newsletter provides regular updates on tax record releases, policy changes, and other important announcements. Additionally, you can follow the county’s official website and social media channels for timely updates.