International Tax Cpa

Welcome to a comprehensive guide on the world of International Tax CPAs, an often complex and intriguing field that plays a crucial role in the global economy. These professionals navigate the intricate web of international tax laws and regulations, offering essential services to individuals and businesses operating across borders. With the increasing globalization of trade and commerce, the demand for experts in this field is on the rise, making it an exciting and rewarding career path to explore.

In this article, we will delve into the realm of International Tax CPAs, exploring their roles, responsibilities, and the impact they have on the global financial landscape. From the complexities of cross-border transactions to the strategies employed to optimize tax efficiency, we will uncover the ins and outs of this specialized field. Whether you're an aspiring professional, a business owner, or simply curious about the world of international taxation, this guide will provide you with valuable insights and a deeper understanding of this critical domain.

Understanding the Role of an International Tax CPA

An International Tax Certified Public Accountant (CPA) is a financial expert who specializes in the intricate field of cross-border taxation. Their role is multifaceted, encompassing a wide range of responsibilities that contribute to the smooth operation of international businesses and individuals with global interests.

At the core of their work, International Tax CPAs provide strategic advice and practical solutions to clients facing complex tax issues arising from international transactions. This involves a deep understanding of the tax laws and regulations of multiple jurisdictions, enabling them to navigate the complexities of cross-border transactions, such as imports, exports, investments, and mergers and acquisitions.

One of the key responsibilities of an International Tax CPA is tax planning. They work closely with clients to develop tax strategies that minimize their tax liabilities while remaining compliant with all applicable laws. This may involve structuring transactions to take advantage of tax incentives, negotiating with tax authorities, and staying abreast of changes in tax legislation that could impact their clients' operations.

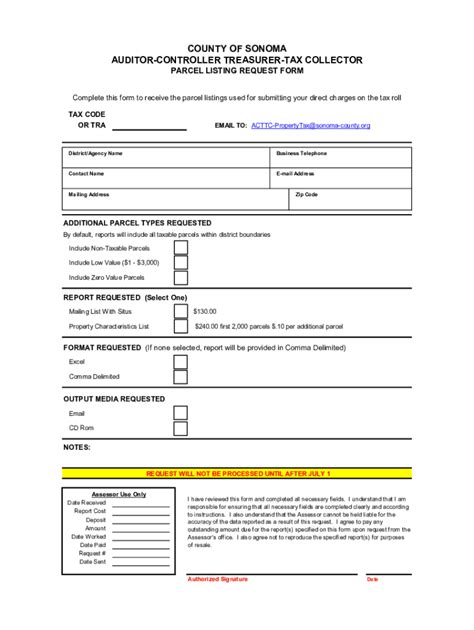

Tax Compliance and Reporting

International Tax CPAs also play a critical role in ensuring tax compliance. They prepare and file tax returns for their clients, ensuring that all relevant information is accurately reported and that taxes are paid on time. This includes calculating and remitting various taxes, such as income tax, value-added tax (VAT), customs duties, and transfer pricing adjustments.

Additionally, they assist clients with tax audits and investigations, providing expert guidance and representation to ensure a fair and favorable outcome. Their knowledge of international tax treaties and double taxation agreements is invaluable in such situations, helping to minimize the risk of double taxation and resolving disputes with tax authorities.

Cross-Border Transaction Management

Managing cross-border transactions is a significant aspect of an International Tax CPA’s work. They advise clients on the tax implications of international trade, including the impact of tariffs, duties, and other trade-related taxes. By understanding the tax regimes of different countries, they can help businesses structure their transactions to optimize profitability and minimize tax burdens.

Furthermore, they assist with the tax aspects of international mergers and acquisitions, ensuring that the transaction is structured in a tax-efficient manner. This involves evaluating the tax implications of different deal structures, negotiating with tax authorities, and providing post-transaction tax planning to ensure ongoing compliance and optimal tax positioning.

| International Tax CPA Specializations | Focus Areas |

|---|---|

| Transfer Pricing | Determining the appropriate pricing for cross-border transactions between related parties to avoid double taxation and ensure compliance with transfer pricing regulations. |

| International Tax Planning | Developing strategies to minimize tax liabilities for individuals and businesses with global operations, including the use of tax treaties and offshore structures. |

| Expatriate Tax | Assisting individuals and companies with the tax implications of international assignments, including income tax, social security, and residency status. |

The Impact of International Tax CPAs on Global Business

The role of International Tax CPAs extends beyond the mere compliance with tax laws. Their expertise has a significant impact on the success and competitiveness of global businesses, influencing key strategic decisions and shaping the landscape of international commerce.

Enhancing Business Competitiveness

By providing strategic tax planning and advice, International Tax CPAs help businesses optimize their tax positions, reducing the financial burden of taxation and improving their bottom line. This is particularly crucial for businesses operating in multiple jurisdictions, where tax efficiency can be a key differentiator in a competitive market.

For instance, they may advise businesses on the optimal location for their operations, taking into account the tax regimes of different countries. They can also assist with the tax aspects of expanding into new markets, ensuring that the business is structured in a way that minimizes tax liabilities and maximizes profitability.

Managing Compliance Risks

With the increasing complexity of international tax laws and the heightened focus on tax compliance, businesses face significant risks if they fail to stay abreast of changing regulations. International Tax CPAs play a vital role in managing these risks, ensuring that businesses remain compliant with the tax laws of all jurisdictions in which they operate.

They keep businesses informed about changes in tax legislation, helping them adapt their operations and tax strategies accordingly. By staying ahead of the curve, businesses can avoid costly penalties, fines, and legal issues associated with non-compliance.

Strategic Tax Planning for Growth

International Tax CPAs are not just focused on compliance; they also contribute to the growth and expansion of businesses. By providing strategic tax planning, they help businesses identify opportunities for tax-efficient growth, such as through the use of tax incentives, grants, and other government initiatives.

For example, they may advise businesses on how to structure their investments to take advantage of tax breaks for research and development, or how to navigate the tax implications of mergers and acquisitions to achieve optimal tax outcomes. This strategic approach to tax planning can be a powerful tool for businesses looking to expand their operations and enhance their financial performance.

The Evolution of International Tax CPAs

The field of international taxation has undergone significant changes in recent years, driven by technological advancements, changing global economic dynamics, and the increasing complexity of tax laws. International Tax CPAs have had to adapt to these changes, developing new skills and strategies to meet the evolving needs of their clients.

Technological Innovations

The rise of digital technologies has transformed the way International Tax CPAs operate. They now leverage advanced software and data analytics tools to streamline tax compliance processes, improve accuracy, and enhance efficiency. These technologies enable them to process vast amounts of data quickly, identify potential issues, and provide timely advice to their clients.

Additionally, they utilize digital platforms and secure online systems to communicate with clients and access relevant information, ensuring a more collaborative and efficient working relationship.

Changing Global Economic Landscape

The global economy is in a constant state of flux, with new trade agreements, shifting geopolitical dynamics, and changing tax policies. International Tax CPAs must stay abreast of these developments to provide accurate and timely advice to their clients. This requires a deep understanding of the economic and political landscape, as well as the ability to anticipate and adapt to future changes.

For example, they must be aware of the implications of Brexit for businesses operating in the UK and the EU, or the potential impact of new trade agreements, such as the US-Mexico-Canada Agreement (USMCA), on cross-border trade and taxation.

Tax Policy and Regulatory Changes

The tax landscape is continually evolving, with governments around the world implementing new policies and regulations to address issues such as tax evasion, base erosion, and profit shifting. International Tax CPAs must stay informed about these changes to ensure their clients remain compliant and take advantage of any new opportunities that may arise.

One notable example is the OECD's Base Erosion and Profit Shifting (BEPS) project, which has led to significant changes in international tax regulations. International Tax CPAs have had to adapt their strategies to align with these new rules, ensuring that their clients' tax structures are compliant and optimized for the post-BEPS era.

| Key Tax Policy Changes | Impact on International Tax CPAs |

|---|---|

| Global Minimum Tax | Assisting clients in understanding and implementing the global minimum tax, ensuring compliance and providing strategic advice to minimize the impact on their operations. |

| Country-by-Country Reporting | Advising clients on the requirements for country-by-country reporting and helping them navigate the process to ensure accurate and timely submissions. |

| Digital Services Tax | Providing guidance to digital businesses on the implications of digital services taxes and strategies to manage their tax obligations in various jurisdictions. |

Future Outlook and Emerging Trends

Looking ahead, the field of international taxation is poised for continued growth and evolution. As the world becomes increasingly interconnected, the demand for International Tax CPAs will continue to rise, driven by the complex tax challenges posed by cross-border transactions and global business operations.

Growing Demand for Specialized Services

As businesses expand their global footprint, they will increasingly seek specialized tax advice to navigate the complexities of international taxation. International Tax CPAs with expertise in specific industries or regions will be in high demand, as they can provide tailored solutions that meet the unique needs of their clients.

For example, CPAs with expertise in the healthcare or technology sectors can offer industry-specific tax planning and compliance services, helping businesses in these sectors optimize their tax positions and stay ahead of regulatory changes.

Focus on Sustainability and Ethical Practices

With a growing emphasis on sustainability and corporate social responsibility, International Tax CPAs will play a crucial role in helping businesses align their tax strategies with these values. This may involve advising businesses on how to structure their operations to support sustainable development goals or how to navigate the tax implications of transitioning to more sustainable business models.

Additionally, there is an increasing focus on ethical tax practices, with businesses and individuals being held to higher standards of tax compliance and transparency. International Tax CPAs will need to ensure that their clients' tax strategies not only comply with the law but also align with these ethical expectations.

Emerging Technologies and Automation

The continued advancement of technology will have a significant impact on the field of international taxation. International Tax CPAs will need to embrace new technologies, such as artificial intelligence and blockchain, to enhance their efficiency and accuracy in tax planning and compliance.

For instance, blockchain technology has the potential to revolutionize tax reporting and compliance, providing a secure and transparent way to record and verify cross-border transactions. International Tax CPAs will need to stay abreast of these developments to ensure they can provide the most innovative and effective solutions to their clients.

The Journey to Becoming an International Tax CPA

The path to becoming an International Tax CPA is challenging but rewarding, offering a unique opportunity to make a significant impact on the global financial landscape. It requires a combination of education, experience, and a deep understanding of international tax laws and regulations.

Education and Credentials

The first step towards becoming an International Tax CPA is obtaining a relevant degree. Most CPAs hold a bachelor’s degree in accounting, finance, or a related field, although a master’s degree or specialized certifications in international taxation can provide a competitive edge.

After completing their education, aspiring International Tax CPAs must pass the Uniform CPA Examination, a rigorous test administered by the American Institute of Certified Public Accountants (AICPA). This examination assesses their knowledge of financial accounting and reporting, auditing and attestation, regulation, and business environment and concepts.

Experience and Specialization

Gaining practical experience is a crucial aspect of becoming an International Tax CPA. Many professionals start their careers in public accounting firms, where they can work on a variety of tax engagements and learn from experienced mentors. This provides a solid foundation for understanding the complexities of international taxation.

As they progress in their careers, International Tax CPAs often specialize in specific areas, such as transfer pricing, international tax planning, or expatriate tax. This specialization allows them to develop deep expertise in a particular field, providing highly specialized services to their clients.

Continuous Learning and Professional Development

The field of international taxation is dynamic, with constant changes in tax laws and regulations. International Tax CPAs must commit to continuous learning and professional development to stay abreast of these changes and provide the most up-to-date advice to their clients.

This may involve attending conferences, workshops, and seminars, as well as completing advanced certifications, such as the Certified International Tax Professional (CITP) credential offered by the AICPA. These opportunities allow CPAs to deepen their knowledge, expand their network, and stay at the forefront of their field.

Conclusion

In a world where global trade and commerce are becoming increasingly interconnected, the role of International Tax CPAs is more critical than ever. These professionals navigate the complex landscape of international taxation, providing essential guidance and support to individuals and businesses operating across borders.

From tax planning and compliance to strategic advice on cross-border transactions, International Tax CPAs contribute to the success and competitiveness of global businesses. Their expertise helps businesses optimize their tax positions, manage compliance risks, and adapt to changing economic and regulatory environments.

As the field continues to evolve, International Tax CPAs will need to embrace new technologies, adapt to changing global dynamics, and focus on sustainability and ethical practices. With a combination of specialized knowledge, practical experience, and a commitment to continuous learning, these professionals are well-equipped to meet the challenges and opportunities of the future.

What are the key skills required to become an International Tax CPA?

+Aspiring International Tax CPAs should possess a strong foundation in accounting and taxation, as well as excellent analytical and problem-solving skills. They must be able to work with complex data, interpret tax laws and regulations, and provide strategic advice to clients. Additionally, strong communication and interpersonal skills are essential for building trust and collaborating effectively with clients and colleagues.

How can International Tax CPAs stay updated with changing tax laws and regulations?

+International Tax CPAs should actively engage in continuous professional development, attending seminars, conferences, and webinars to stay informed about the latest changes in tax laws and regulations. They can also subscribe to reputable tax publications and follow reputable tax news sources to stay updated on emerging trends and developments in the field.

What are some common challenges faced by International Tax CPAs in their work?

+International Tax CPAs often encounter challenges such as the complexity of international tax laws, varying interpretations across jurisdictions, and the need to stay updated with frequent regulatory changes. They must also manage the expectations of clients who may not fully understand the intricacies of international taxation, while ensuring compliance and providing strategic advice.