California Orange County Sales Tax

Sales tax is an essential component of the tax system in the United States, and it plays a significant role in generating revenue for state and local governments. In California, sales tax rates vary across different counties, and one of the most prominent counties in the state is Orange County. Orange County, known for its vibrant cities, beautiful beaches, and thriving economy, has its own unique sales tax structure. In this article, we will delve into the intricacies of the California Orange County Sales Tax, exploring its rates, calculation methods, exemptions, and the impact it has on businesses and consumers.

Understanding the California Sales Tax System

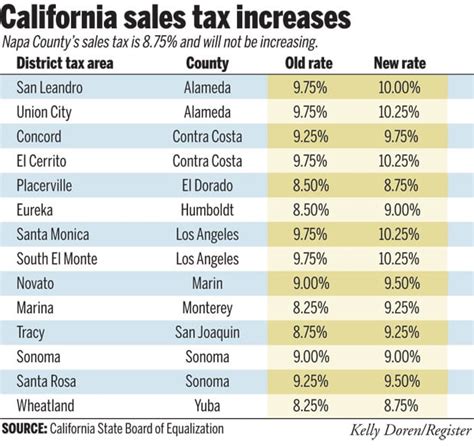

Before we dive into the specifics of Orange County, it’s crucial to grasp the broader context of California’s sales tax system. California imposes a state sales and use tax on the sale of most tangible personal property, as well as certain services. The state sales tax rate is set by the California State Board of Equalization (BOE) and is applied uniformly across the state.

However, California allows local governments, including counties and cities, to impose additional sales taxes. These local sales taxes are often referred to as "add-on taxes" and are layered on top of the state sales tax rate. The purpose of these local taxes is to provide additional revenue for specific projects or services within the community.

California Orange County Sales Tax Rates

Orange County, located in Southern California, is renowned for its tourism, entertainment industry, and diverse economy. As such, it has a complex sales tax structure that includes both the state sales tax and various local add-on taxes. The sales tax rates in Orange County can vary depending on the specific jurisdiction and the types of goods or services being sold.

State Sales Tax Rate

As of my last update in January 2023, the statewide sales and use tax rate in California is 7.25%. This rate is applied uniformly across the state and is set by the BOE.

Orange County Local Sales Tax Rates

In addition to the state sales tax, Orange County has several local jurisdictions that impose their own sales taxes. These local taxes are typically used to fund specific projects or services within the community, such as transportation improvements, education, or public safety.

As of January 2023, the average local sales tax rate in Orange County is approximately 1.25%, which is added to the state sales tax rate. However, it's important to note that the local sales tax rates can vary significantly depending on the specific city or district within the county.

For example, some cities in Orange County have higher local sales tax rates to fund specific initiatives. Newport Beach, a popular coastal city, has a local sales tax rate of 1.50%, bringing the total sales tax rate to 8.75%. On the other hand, cities like Anaheim, known for its theme parks, have a lower local sales tax rate of 0.75%, resulting in a total sales tax rate of 8.00%.

Here's a table illustrating the sales tax rates in various cities within Orange County:

| City | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Newport Beach | 1.50% | 8.75% |

| Anaheim | 0.75% | 8.00% |

| Santa Ana | 1.00% | 8.25% |

| Irvine | 1.25% | 8.50% |

| Huntington Beach | 1.00% | 8.25% |

It's worth mentioning that these rates are subject to change, and it's always recommended to refer to official sources for the most up-to-date information.

Calculation of Sales Tax

Calculating the sales tax in Orange County involves a simple process. The sales tax is typically calculated as a percentage of the selling price of the goods or services being purchased. Here’s a step-by-step breakdown of the calculation:

- Determine the selling price of the item or service.

- Apply the state sales tax rate (7.25%) to the selling price to calculate the state sales tax amount.

- Add the local sales tax rate (varies by jurisdiction) to the selling price and calculate the local sales tax amount.

- Sum up the state and local sales tax amounts to arrive at the total sales tax payable.

For example, if you purchase an item with a selling price of $100 in a city with a local sales tax rate of 1.25%, the calculation would be as follows:

- State sales tax: 7.25% of $100 = $7.25

- Local sales tax: 1.25% of $100 = $1.25

- Total sales tax: $7.25 + $1.25 = $8.50

So, the total sales tax payable on a $100 item in this scenario would be $8.50.

Sales Tax Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax in Orange County, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the overall sales tax burden.

Exempt Goods and Services

California has a list of specific goods and services that are exempt from sales tax. These exemptions are outlined in the California Sales and Use Tax Law and can vary depending on the nature of the item or service.

Some common examples of exempt goods and services in California include:

- Prescription medications

- Certain food items, such as unprepared groceries

- Non-profit organizations' fundraising sales

- Select manufacturing machinery and equipment

- Certain agricultural products

It's important for businesses to stay updated on the latest exemptions to ensure they are compliant with the law.

Special Considerations for Businesses

Businesses operating in Orange County need to navigate the complex sales tax landscape to ensure they are meeting their tax obligations accurately. Here are some key considerations for businesses:

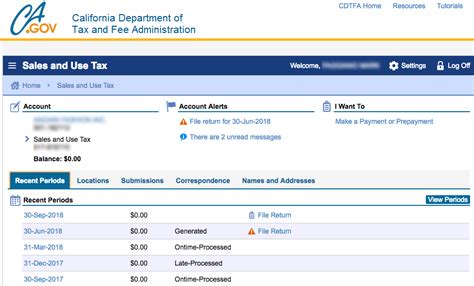

- Registration and Permits: Businesses selling taxable goods or services must obtain a Seller's Permit from the California Department of Tax and Fee Administration (CDTFA). This permit allows them to collect and remit sales tax.

- Sales Tax Collection: Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. They must clearly display the applicable sales tax rate and provide receipts to customers.

- Sales Tax Remittance: Businesses must periodically file sales tax returns and remit the collected taxes to the CDTFA. The frequency of filing and remittance depends on the business's sales volume and tax liability.

- Recordkeeping: Businesses are required to maintain accurate records of sales transactions, including the breakdown of taxable and exempt sales. These records are essential for audit purposes and to ensure compliance.

Impact on Businesses and Consumers

The California Orange County Sales Tax has both positive and negative implications for businesses and consumers alike.

Benefits for Businesses

For businesses, the sales tax system provides several advantages. Firstly, it generates a steady stream of revenue for local governments, which can be invested back into the community through various projects and services. This can lead to improved infrastructure, enhanced public services, and a more attractive business environment.

Additionally, the sales tax system simplifies tax collection for businesses. By having a straightforward calculation process and clear guidelines, businesses can easily determine the sales tax due and incorporate it into their pricing strategies.

Challenges for Businesses

However, the sales tax system also presents challenges for businesses. The varying rates across different jurisdictions can make it complex for businesses with multiple locations or online sales to manage their tax obligations accurately. Businesses must ensure compliance with the specific sales tax rates and regulations in each jurisdiction they operate in.

Furthermore, the sales tax can impact pricing strategies and competitiveness. Businesses may need to factor in the sales tax when setting their prices, which can affect their profit margins and market positioning.

Impact on Consumers

For consumers, the sales tax in Orange County can influence their purchasing decisions and overall spending habits. The higher sales tax rates in some areas may deter consumers from making certain purchases, especially for high-value items.

On the other hand, the sales tax can also provide a sense of security and stability for consumers. The revenue generated from sales tax is often used to fund essential services and infrastructure, which directly benefit the community. Consumers may view the sales tax as a necessary contribution to maintaining a high quality of life in the county.

Future Implications and Potential Changes

The California Orange County Sales Tax system is subject to ongoing changes and updates. The state and local governments regularly review and adjust tax rates and regulations to meet their revenue needs and address changing economic conditions.

In recent years, there has been a growing discussion around the potential for simplifying the sales tax system in California. Some proposals suggest consolidating local sales taxes into a single rate, which could make it easier for businesses and consumers to understand and comply with the tax structure. However, such changes require careful consideration and collaboration between state and local authorities.

Additionally, with the rise of e-commerce and online sales, the sales tax system is facing new challenges. The collection and remittance of sales tax for online transactions can be complex, especially when businesses have customers in multiple jurisdictions. The state and local governments are working to adapt their tax systems to accommodate these evolving trends.

Conclusion

The California Orange County Sales Tax is a crucial component of the county’s revenue generation and economic landscape. While it provides benefits in terms of funding essential services and simplifying tax collection for businesses, it also presents challenges and considerations for both businesses and consumers.

As Orange County continues to thrive and evolve, the sales tax system will likely undergo further adjustments to meet the changing needs of the community. Businesses and consumers should stay informed about any updates to the sales tax rates and regulations to ensure compliance and make informed financial decisions.

How often are sales tax rates updated in Orange County, California?

+

Sales tax rates in Orange County, California, can be updated periodically. While the state sales tax rate is set by the California State Board of Equalization (BOE) and remains stable, local sales tax rates can change more frequently. Local governments have the authority to adjust their sales tax rates to meet their funding needs. It’s important to check with the specific city or jurisdiction within Orange County for the most current sales tax rates.

Are there any sales tax holidays in Orange County, California?

+

Yes, California, including Orange County, has designated sales tax holidays. These holidays are typically announced by the state government and offer temporary exemptions or reduced sales tax rates on specific types of items. Sales tax holidays often occur during back-to-school season or other significant shopping events. It’s advisable to check the official California government websites or local news sources for information on sales tax holidays.

How do online retailers handle sales tax in Orange County, California?

+

Online retailers are required to collect and remit sales tax in Orange County, California, just like brick-and-mortar businesses. The sales tax rate applied to online purchases depends on the location of the customer and the shipping destination. Online retailers must comply with the sales tax regulations set by the state and local governments. Some online retailers provide tools or resources to help calculate and collect sales tax accurately.

What happens if a business fails to collect or remit sales tax in Orange County, California?

+

Businesses that fail to collect or remit sales tax in Orange County, California, may face penalties and legal consequences. The California Department of Tax and Fee Administration (CDTFA) enforces sales tax compliance and can impose fines, penalties, and even criminal charges for non-compliance. It’s crucial for businesses to understand their sales tax obligations and stay up-to-date with the latest regulations to avoid any issues.

Are there any tax incentives or programs for businesses in Orange County, California, related to sales tax?

+

Yes, Orange County, California, and its local governments may offer various tax incentives and programs to attract and support businesses. These incentives can include sales tax exemptions or reduced rates for specific industries or qualifying investments. It’s beneficial for businesses to research and explore these opportunities, as they can provide significant savings and support for business growth.