States Which Don't Tax Pensions

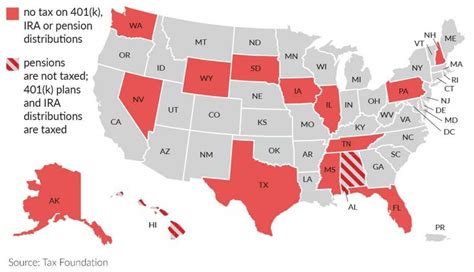

When it comes to personal finance and retirement planning, understanding the tax implications of your state of residence is crucial. One key aspect that retirees often consider is the taxation of pensions. In the United States, the tax treatment of pensions can vary significantly from state to state, offering unique advantages and considerations for retirees.

Exploring the Tax Landscape: States That Offer Pension Tax Exemptions

In the complex world of retirement planning, one critical factor that significantly impacts retirees is the tax treatment of their pension income. While federal tax laws apply universally across the United States, individual states possess the autonomy to establish their own tax codes, often resulting in varied tax treatments for pensioners. This article delves into the states that have implemented pension tax exemptions, offering a unique advantage to retirees.

It's essential to recognize that the tax landscape is dynamic, and state tax laws are subject to change. Therefore, it's advisable to consult with tax professionals or utilize reputable online resources to obtain the most current and accurate information regarding state tax policies.

Understanding Pension Taxation

Pensions, a significant source of income for retirees, are subject to varying tax treatments across different states. While some states exempt pension income from taxation entirely, others may offer partial exemptions or impose taxes on pension income under specific circumstances. The table below provides an overview of the tax treatment of pensions in select states:

| State | Pension Tax Treatment |

|---|---|

| Alaska | No state income tax, including on pensions. |

| Florida | Pensions from government or private employers are exempt from state income tax. |

| Nevada | No state income tax, exempting pensions from taxation. |

| South Dakota | Pension income is exempt from state income tax. |

| Texas | Retirees benefit from the absence of state income tax on pensions. |

| Washington | Pension income is exempt from state income tax. |

| Wyoming | No state income tax, making pensions tax-free. |

These states provide an attractive proposition for retirees, offering a tax-free environment for their pension income. However, it's crucial to note that while these states do not tax pensions, they may still impose taxes on other forms of income, such as investment earnings or Social Security benefits.

The Benefits of Pension Tax Exemptions

The absence of pension taxation in these states presents retirees with a range of benefits. Firstly, it allows pensioners to maximize their retirement income without the burden of state taxes, potentially leading to a higher standard of living. Additionally, these states become desirable destinations for retirees seeking tax efficiency, which can drive economic growth and development in these regions.

Moreover, pension tax exemptions can attract professionals in their pre-retirement years, creating a positive cycle of talent migration. This influx of retirees can stimulate local economies, benefiting businesses and communities alike.

Considerations and Caveats

While pension tax exemptions offer undeniable advantages, it's essential to approach these opportunities with a comprehensive understanding of the broader tax landscape. States with no income tax may rely on other revenue streams, such as sales tax or property tax, which could indirectly impact retirees.

Furthermore, the absence of state income tax does not preclude the possibility of federal income tax obligations. Retirees should consult tax professionals to navigate the intricacies of federal tax laws and ensure compliance.

State-by-State Analysis: A Deeper Dive

Alaska: A Pensioner's Paradise

Alaska stands out as a beacon for retirees due to its unique tax structure. As one of the seven states with no income tax, Alaska offers a tax-free environment for pensioners. This exemption extends to all types of pension income, including those from private and government employers.

However, it's important to note that Alaska's tax code is not without its complexities. While pensions are exempt, other forms of income, such as capital gains and investment earnings, may be subject to taxation. Additionally, Alaska's Permanent Fund Dividend program, which provides an annual dividend to eligible residents, further enhances the state's appeal for retirees.

Florida: A Sunshine State for Pensioners

Florida, renowned for its sunny climate and retirement communities, also offers a favorable tax environment for pensioners. The state exempts pension income from taxation, regardless of the source. This exemption applies to both government and private pensions, making Florida an attractive destination for retirees seeking tax efficiency.

Beyond the pension tax exemption, Florida boasts a vibrant culture, a diverse range of recreational activities, and a strong healthcare infrastructure, making it an ideal choice for retirees seeking an active and healthy retirement lifestyle.

Nevada: Tax-Free Living in the Silver State

Nevada, known for its vibrant entertainment scene and tax-friendly policies, extends its allure to retirees through its absence of state income tax. This exemption encompasses all forms of pension income, providing tax-free retirement benefits for pensioners.

However, it's essential to recognize that Nevada's tax code is not entirely tax-free. While pensions are exempt, sales tax and property tax may apply, impacting retirees' overall tax burden. Nevertheless, Nevada's vibrant economy, diverse recreational offerings, and strong job market make it an attractive destination for retirees seeking an active and engaging retirement lifestyle.

South Dakota: A Quiet Retirement Haven

South Dakota, with its picturesque landscapes and tranquil environment, offers more than just scenic beauty for retirees. The state exempts pension income from state income tax, providing a tax-free retirement environment. This exemption applies to all types of pension income, making South Dakota an appealing choice for pensioners seeking a peaceful retirement.

Beyond its tax advantages, South Dakota boasts a low cost of living, a strong sense of community, and a thriving healthcare sector, ensuring retirees can enjoy a comfortable and healthy retirement lifestyle.

Texas: A Diverse Retirement Destination

Texas, known for its vibrant culture and diverse offerings, extends its appeal to retirees through its tax-friendly policies. The state does not impose income tax on pensions, providing tax-free retirement benefits for pensioners. This exemption applies to all types of pension income, making Texas an attractive destination for retirees seeking tax efficiency.

However, it's important to note that while pensions are exempt, Texas may impose taxes on other forms of income, such as investment earnings or Social Security benefits. Retirees should carefully evaluate their overall tax burden when considering a move to Texas.

Washington: A Retirement Destination with a View

Washington, with its breathtaking natural beauty and thriving economy, offers a compelling proposition for retirees. The state exempts pension income from state income tax, providing a tax-free environment for pensioners. This exemption applies to all types of pension income, making Washington an appealing choice for retirees seeking a scenic and tax-efficient retirement.

Beyond its tax advantages, Washington boasts a strong healthcare infrastructure, a vibrant culture, and a diverse range of recreational activities, ensuring retirees can lead an active and fulfilling retirement lifestyle.

Wyoming: The Cowboy State's Pension Tax Advantage

Wyoming, known for its wide-open spaces and cowboy heritage, offers a unique tax environment for retirees. As one of the states with no income tax, Wyoming exempts pension income from taxation, providing a tax-free retirement for pensioners. This exemption applies to all types of pension income, making Wyoming an attractive destination for retirees seeking a peaceful and tax-efficient retirement.

However, it's important to note that Wyoming's tax code may impose taxes on other forms of income, such as sales tax or property tax. Retirees should carefully evaluate the overall tax landscape when considering a move to Wyoming.

Conclusion: Navigating the Pension Tax Landscape

The taxation of pensions varies significantly across the United States, offering retirees a range of options and considerations. The states highlighted in this article provide a tax-free environment for pension income, presenting attractive opportunities for retirees seeking tax efficiency. However, it's crucial to approach these opportunities with a comprehensive understanding of the broader tax landscape and consult tax professionals for expert guidance.

By carefully evaluating the tax implications, retirees can make informed decisions about their retirement destinations, ensuring they maximize their retirement income and lead a comfortable and fulfilling retirement lifestyle.

Which states exempt all types of pension income from taxation?

+Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming exempt all types of pension income from state income tax, providing a tax-free environment for pensioners.

Are there any other states with no income tax that may be attractive to retirees?

+Yes, in addition to the states mentioned in the article, Tennessee and New Hampshire also have no income tax, making them potential destinations for retirees seeking tax efficiency.

How do these pension tax exemptions impact the overall tax burden for retirees?

+Pension tax exemptions can significantly reduce the overall tax burden for retirees, allowing them to maximize their retirement income. However, it’s important to consider other taxes, such as sales tax or property tax, which may apply in these states.

What should retirees consider when evaluating retirement destinations based on tax advantages?

+Retirees should carefully assess the overall tax landscape, including property taxes, sales taxes, and potential federal tax obligations. Additionally, they should consider the cost of living, healthcare infrastructure, and recreational opportunities to ensure a well-rounded retirement experience.

Are there any potential drawbacks to living in a state with no income tax?

+While states with no income tax offer significant tax advantages, they may rely on other revenue streams, such as sales tax or property tax, which could indirectly impact retirees. Additionally, these states may have limited public services or infrastructure, which retirees should consider when evaluating their retirement destination.