Business And Occupation Tax

The Business and Occupation (B&O) tax is a critical component of the revenue system in many states across the United States. It is a gross receipts tax, often regarded as one of the most significant sources of revenue for state governments, contributing substantially to their overall economic landscape. The B&O tax is a measure of a business's gross income or gross proceeds, serving as a key indicator of economic activity and growth.

This article aims to delve deep into the intricacies of the Business and Occupation tax, exploring its historical context, its implications for businesses, and its role in shaping the economic environment. By examining real-world examples and providing expert insights, we will navigate through the complexities of this tax system, offering a comprehensive understanding for businesses and individuals alike.

The Historical Context of the B&O Tax

The origins of the Business and Occupation tax can be traced back to the early 20th century, with its inception rooted in the need for states to diversify their revenue streams beyond traditional property and income taxes. The B&O tax was designed as a measure to capture a broader base of economic activity, particularly in the growing service sector.

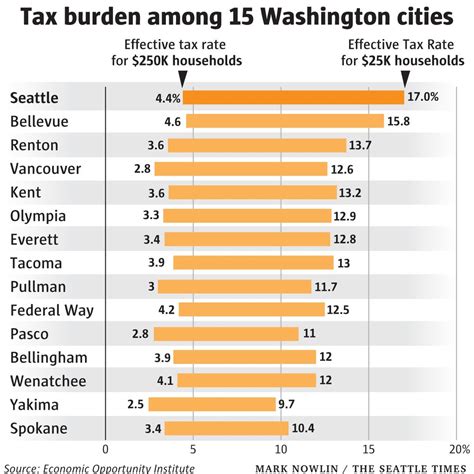

One of the earliest adopters of the B&O tax was the state of Washington, which implemented it in 1933 as a response to the economic challenges of the Great Depression. Washington's B&O tax was initially a flat-rate tax, levied at a rate of 1% on the gross income of businesses, with certain exemptions for specific industries. This innovative tax structure was soon recognized as a potential solution to revenue shortfalls, leading to its adoption by several other states in the following decades.

Evolution of the B&O Tax System

Over time, the B&O tax system has evolved significantly. States have introduced multiple tax rates and classifications to cater to the diverse nature of businesses and industries. For instance, Washington, which initially had a flat rate, now employs a complex system with multiple tax classifications, each with its own rate. These classifications are determined by the business activity code (BAC) of the enterprise, ensuring a more nuanced and fair taxation process.

The table below illustrates the current tax rates for different business activities in the state of Washington, offering a glimpse into the complexity of the modern B&O tax system.

| Business Activity Code (BAC) | Tax Rate |

|---|---|

| Retail Sales | 0.471% |

| Wholesale Sales | 0.484% |

| Manufacturing | 0.484% |

| Service & Other Activities | 1.5% |

Understanding the B&O Tax: How it Works

The Business and Occupation tax is a gross receipts tax, meaning it is calculated based on the total income a business generates from its activities, regardless of its profitability. This approach differs significantly from income taxes, which are levied on the net income of a business after accounting for various expenses and deductions.

Key Components of the B&O Tax

Several critical components make up the B&O tax system:

- Taxable Activities: The B&O tax applies to a wide range of business activities, including retail sales, wholesale operations, manufacturing, and various service industries. Each of these activities is assigned a specific tax rate.

- Tax Rates: As mentioned earlier, different business activities have distinct tax rates. These rates are set by the state and can vary significantly, making it essential for businesses to understand their applicable rate.

- Tax Base: The tax base is the total amount on which the B&O tax is calculated. In most cases, it is the gross income or gross proceeds of the business, although certain deductions and exemptions may apply.

- Tax Returns: Businesses are required to file B&O tax returns periodically, usually on a quarterly or annual basis. These returns involve calculating the tax due based on the applicable rate and the tax base.

- Payments: Once the tax liability is determined, businesses must remit the payment to the state. Late payments or non-compliance can result in penalties and interest charges.

The Impact of B&O Tax on Businesses

The Business and Occupation tax has a profound impact on the operations and financial health of businesses. While it is a critical source of revenue for states, it can also present challenges and opportunities for enterprises.

Advantages and Disadvantages for Businesses

One of the key advantages of the B&O tax for businesses is its simplicity. Unlike income taxes, which require intricate calculations and the tracking of numerous expenses, the B&O tax is straightforward, focusing on gross income. This can simplify the tax compliance process for businesses.

However, the B&O tax can also be seen as a significant cost for businesses, particularly those with high revenue but narrow profit margins. Since it is a tax on gross income, businesses with high turnover but low profit margins may find themselves paying a substantial amount in B&O taxes. This can affect their cash flow and profitability, especially if they are unable to pass on the tax burden to their customers.

Case Study: Impact on Small Businesses

Let’s consider a hypothetical example of a small retail business, “Maverick Crafts,” located in a state with a B&O tax system. Maverick Crafts generates $1 million in revenue annually, with a gross profit margin of 15%. In this state, the B&O tax rate for retail sales is 0.471%.

Based on its revenue, Maverick Crafts would owe $4,710 in B&O taxes annually. This amount may seem insignificant compared to the business's overall revenue, but it represents a substantial portion of its profit. With a gross profit of $150,000, the B&O tax takes up 3.14% of its profits, which could impact the business's ability to invest in growth, hire new staff, or offer competitive pricing.

B&O Tax and Economic Growth

The B&O tax system plays a pivotal role in the economic growth and development of states. It provides a stable and predictable source of revenue, which is essential for funding public services, infrastructure development, and other state initiatives.

Encouraging Economic Activity

The B&O tax, with its focus on gross income, incentivizes businesses to increase their economic activity. By taxing businesses based on their turnover, the state encourages enterprises to grow their revenue, which can lead to job creation and overall economic prosperity.

Moreover, the B&O tax system can also encourage innovation and entrepreneurship. With a flat or low tax rate, it reduces the barrier to entry for new businesses, making it more feasible for startups to launch and operate. This fosters a dynamic business environment, driving economic growth and competitiveness.

Challenges and Future Prospects

While the B&O tax has proven to be an effective revenue generator, it is not without its challenges. One of the primary concerns is the potential impact on businesses, particularly small and medium-sized enterprises (SMEs), as highlighted in the previous section. High B&O tax rates can put a strain on the cash flow of these businesses, affecting their ability to compete and grow.

To address these concerns, states are increasingly focusing on tax reform and modernization. This includes initiatives to simplify the tax system, reduce rates for certain industries, and provide tax incentives for businesses that invest in research, development, and job creation. By striking a balance between revenue generation and business support, states aim to create an environment that fosters economic growth while remaining fiscally responsible.

Conclusion: Navigating the B&O Tax Landscape

The Business and Occupation tax is a complex yet crucial component of the state’s revenue system. It offers a unique approach to taxation, focusing on gross income rather than net profit, which has both advantages and challenges for businesses. Understanding the intricacies of the B&O tax system is essential for businesses to effectively manage their tax obligations and navigate the economic landscape.

As we've explored, the B&O tax system has evolved significantly since its inception, adapting to the changing needs of states and businesses. With a continued focus on tax reform and modernization, states aim to strike a balance between generating revenue and supporting economic growth. By staying informed and engaged with the evolving tax landscape, businesses can make informed decisions and contribute to a healthy and vibrant economy.

What is the B&O tax rate in my state?

+

B&O tax rates vary significantly from state to state. It’s essential to check with your state’s Department of Revenue or Taxation for the most accurate and up-to-date information on tax rates applicable to your business activities.

How often do I need to file B&O tax returns?

+

The frequency of filing B&O tax returns depends on your state’s regulations and your business’s revenue. Some states require quarterly filings, while others may have annual filing requirements. It’s crucial to consult your state’s guidelines to ensure compliance.

Are there any exemptions or deductions available for the B&O tax?

+

Yes, many states offer exemptions and deductions for specific business activities or industries. These can include exemptions for certain types of sales, such as interstate or export sales, or deductions for research and development expenses. Check with your state’s tax authority for a comprehensive list of available exemptions and deductions.

What happens if I fail to pay my B&O taxes on time?

+

Late payment of B&O taxes can result in penalties and interest charges. It’s important to stay on top of your tax obligations to avoid these additional costs. If you anticipate difficulties in meeting your tax payments, consider reaching out to your state’s tax authority to discuss potential payment plans or relief options.