Dc Property Tax Records

Welcome to an in-depth exploration of the world of property taxes in Washington, D.C., a complex and essential aspect of real estate ownership in the nation's capital. This comprehensive guide aims to demystify the process of accessing and understanding D.C. property tax records, providing a step-by-step breakdown for both residents and investors. With an emphasis on clarity and accessibility, we aim to empower readers with the knowledge to navigate this critical financial landscape.

The Significance of Property Taxes in D.C.

Property taxes are a vital revenue source for the District of Columbia, funding essential services like education, infrastructure development, and public safety. For homeowners and property owners, understanding these taxes is crucial for financial planning and maintaining good standing with the local government. The District’s Office of Tax and Revenue (OTR) is responsible for assessing and collecting these taxes, ensuring fairness and transparency in the process.

In the District, property taxes are assessed annually, based on the estimated market value of a property as of January 1st of each year. This market value is determined through a combination of factors, including recent sales of comparable properties, income approach (for income-producing properties), and cost approach (for special assessment properties). The OTR employs a team of professional appraisers who conduct these assessments, ensuring accuracy and consistency.

Accessing D.C. Property Tax Records: A Step-by-Step Guide

Obtaining property tax records in Washington, D.C., is a straightforward process, thanks to the OTR’s online portal and dedicated customer service team. Here’s a detailed guide to help you navigate this process seamlessly:

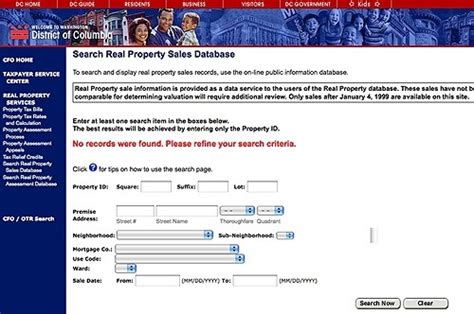

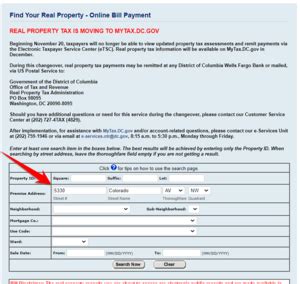

Step 1: Visit the OTR’s Online Portal

The first step is to access the OTR’s official website, which serves as the primary portal for all property tax-related services. Here, you’ll find a wealth of information, including tax rates, assessment notices, and payment options. The website is designed to be user-friendly, with clear navigation and a search function to quickly locate the information you need.

Step 2: Search for Your Property

Once you’re on the OTR’s website, locate the “Property Search” or “Property Tax Records” section. Here, you’ll be prompted to enter your property’s details, such as the address, lot number, or assessment number. This search function is designed to provide precise results, ensuring you access the correct tax records for your property.

Step 3: Review Your Property Tax Records

After entering your property’s details, the OTR’s system will display a comprehensive overview of your property’s tax records. This typically includes the current year’s assessed value, the tax rate, and the total amount due. You’ll also find information on any applicable exemptions or discounts, such as the homestead exemption or senior citizen tax relief.

Additionally, the records will provide a breakdown of the tax due, including the general fund tax, the special tax, and any additional assessments or fees. This transparency allows property owners to understand exactly where their tax dollars are allocated.

Step 4: Explore Additional Resources

The OTR’s website offers a range of additional resources to enhance your understanding of property taxes in D.C. These resources include:

- Assessment Notices: These provide detailed information on how your property's value was determined, including the methods and factors considered by the OTR's appraisers.

- Payment Options: The website outlines various payment methods, including online payments, e-checks, credit/debit cards, and traditional mail-in payments. It also provides information on payment deadlines and any potential penalties for late payments.

- Appeal Process: If you disagree with your property's assessed value, the OTR's website provides clear instructions on how to initiate an appeal. This process typically involves submitting documentation to support your claim, and the OTR will guide you through each step.

- Tax Relief Programs: The District offers several tax relief programs to assist eligible homeowners. These programs include the Homestead Deduction, Senior Citizen Tax Relief, and the Disabled Veteran Exemption. The website provides eligibility criteria and application processes for each program.

Understanding the Data: A Deep Dive

Diving deeper into D.C.’s property tax records reveals a wealth of information that can be invaluable for both homeowners and investors. Here’s a closer look at some key data points and their significance:

Assessed Value vs. Market Value

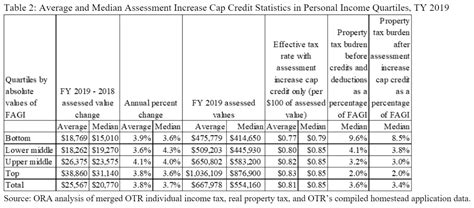

The assessed value of a property is determined by the OTR’s appraisers and is used to calculate the property tax due. This value is not necessarily the same as the property’s market value, which is the price it would likely sell for on the open market. The assessed value is typically lower than the market value, as it’s based on a formula that considers various factors, including recent sales of comparable properties.

Tax Rates and Millage Rates

D.C. property taxes are calculated using a millage rate, which is the amount of tax per $1,000 of assessed value. This rate is set annually by the District’s government and can vary based on the property’s location and usage. For example, residential properties may have a different tax rate than commercial properties.

The tax rate is applied to the assessed value to determine the total tax due. For instance, if a property has an assessed value of $500,000 and the millage rate is 0.8%, the annual property tax would be $4,000 ($500,000 x 0.008 = $4,000). Understanding these rates is crucial for budgeting and financial planning.

Special Assessments and Fees

In addition to the general property tax, D.C. property owners may be subject to special assessments or fees. These can include charges for services like trash collection, water and sewer fees, or special district assessments for specific improvements or services in certain neighborhoods. These additional charges can significantly impact the total tax bill, so it’s important to review them carefully.

Exemptions and Discounts

The District offers several exemptions and discounts to reduce the tax burden for eligible homeowners. The most common is the Homestead Deduction, which reduces the taxable value of a primary residence by up to $76,000. Other exemptions include the Senior Citizen Tax Relief, which provides a reduction in the tax rate for homeowners aged 65 and older, and the Disabled Veteran Exemption, which exempts a portion of the assessed value for qualifying veterans.

Tax Relief Programs

In addition to the standard exemptions, D.C. also offers several tax relief programs to assist low-income homeowners. These programs include the Property Tax Abatement Program, which provides a partial or full abatement of property taxes for eligible homeowners, and the Low-Income Housing Tax Credit Program, which offers tax credits to developers who create or preserve affordable housing units.

Historical Tax Data

Accessing historical tax data can provide valuable insights into a property’s value and tax trends over time. This data can be particularly useful for investors looking to understand the financial health of a property or neighborhood. The OTR’s website offers tools to access historical tax records, allowing users to track changes in assessed values and tax rates over multiple years.

Future Implications and Strategies

As the District continues to grow and develop, property taxes are likely to play an increasingly significant role in funding essential services and infrastructure projects. For homeowners and investors, staying informed about tax policies and initiatives is crucial for financial planning and decision-making.

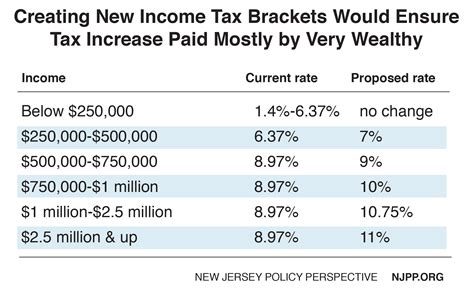

Property Tax Initiatives

The District government periodically introduces initiatives to address various issues related to property taxes. These can include proposals to adjust tax rates, implement new exemptions or relief programs, or modify the assessment process. Staying updated on these initiatives is essential to understanding how they might impact your property taxes.

Community Engagement

Engaging with your local community and government representatives can provide valuable insights into tax policies and potential changes. Attending town hall meetings, participating in community forums, and staying connected with local news sources can keep you informed about upcoming tax-related developments.

Financial Planning and Strategy

For homeowners, understanding your property tax obligations is a critical aspect of financial planning. Budgeting for annual tax payments and exploring potential exemptions or relief programs can help reduce your tax burden. Additionally, considering the long-term financial implications of property ownership, such as the impact of tax increases on resale value, can inform your overall financial strategy.

Investing Strategies

For investors, property taxes are a key factor in evaluating the financial viability of an investment property. Understanding the tax landscape, including potential tax incentives or disincentives, can significantly impact investment decisions. Additionally, staying informed about tax trends and initiatives can help investors anticipate changes in the market and adjust their strategies accordingly.

Conclusion: Empowering Property Owners

In the complex world of property taxes, knowledge is power. By understanding the process of accessing and interpreting D.C. property tax records, homeowners and investors can make informed decisions about their financial future. This guide aims to provide a comprehensive roadmap, ensuring that navigating the District’s tax landscape is not only manageable but also empowering.

Frequently Asked Questions

How often are property taxes assessed in D.C.?

+Property taxes in Washington, D.C. are assessed annually, as of January 1st of each year. This assessment determines the property’s value for tax purposes and is used to calculate the tax due for the upcoming year.

What factors determine a property’s assessed value in D.C.?

+The assessed value of a property in D.C. is determined by the Office of Tax and Revenue’s (OTR) appraisers. They consider various factors, including recent sales of comparable properties, income approach (for income-producing properties), and cost approach (for special assessment properties). These appraisers ensure that the assessed value is fair and accurate.

Are there any exemptions or discounts available for property taxes in D.C.?

+Yes, the District offers several exemptions and discounts to reduce the tax burden for eligible homeowners. The most common is the Homestead Deduction, which reduces the taxable value of a primary residence by up to $76,000. Other exemptions include the Senior Citizen Tax Relief and the Disabled Veteran Exemption.

How can I appeal my property’s assessed value in D.C.?

+If you disagree with your property’s assessed value, you can initiate an appeal through the OTR’s website. The process involves submitting documentation to support your claim, and the OTR will guide you through each step. It’s important to note that appeals must be filed within a specific timeframe, so timely action is crucial.

What payment options are available for D.C. property taxes?

+The OTR offers various payment options for D.C. property taxes, including online payments, e-checks, credit/debit cards, and traditional mail-in payments. The website provides detailed information on each option, including any potential fees or penalties associated with each method. It’s important to note that timely payments are crucial to avoid late fees and potential penalties.