Iowa State Tax Rate

When it comes to understanding the tax landscape, each state in the United States has its own set of regulations and rates. Iowa, known for its vibrant agricultural industry and thriving tech sector, has a unique tax structure that influences the financial decisions of both residents and businesses. Let's delve into the specifics of the Iowa state tax rate and explore how it impacts the local economy.

Unraveling the Iowa State Tax Rate

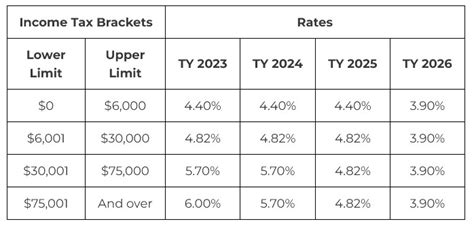

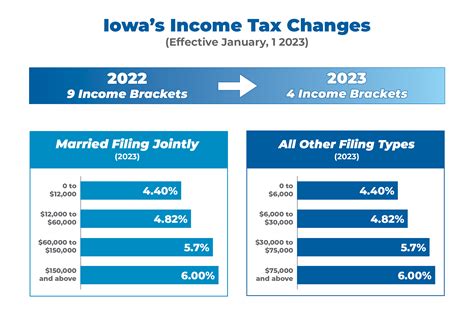

Iowa employs a progressive tax system for individual income taxes, meaning that the tax rate increases as your income rises. This approach aims to ensure that higher-income earners contribute a larger share of their income to the state’s revenue. As of 2023, the state has five income tax brackets, each with its own tax rate, as outlined below:

| Income Bracket | Tax Rate |

|---|---|

| First $6,575 of taxable income | 0.36% |

| Next $23,400 ($29,975 - $6,575) | 2.74% |

| Next $34,025 ($64,000 - $29,975) | 4.58% |

| Next $53,075 ($117,075 - $64,000) | 6.55% |

| Income over $117,075 | 8.98% |

These tax rates apply to both single and joint filers, ensuring a fair and equitable taxation system. It's important to note that these rates are subject to change annually, reflecting the dynamic nature of the state's economy and budgetary requirements.

Corporate Tax Rates in Iowa

Iowa’s corporate income tax structure is designed to encourage business growth and investment. The state imposes a flat tax rate of 8.5% on corporate income, which applies to all corporations operating within Iowa’s borders. This rate is consistent across various industries, making it a predictable and stable environment for businesses to thrive.

In addition to the corporate income tax, Iowa also levies a franchise tax on corporations, which is based on their net worth. This tax serves as a supplementary revenue stream for the state and helps to support public services and infrastructure development.

Sales and Use Tax

Iowa’s sales and use tax is a significant source of revenue for the state. As of 2023, the general sales tax rate in Iowa stands at 6%. This tax applies to a wide range of goods and services, contributing to the overall economic stability of the state. However, it’s important to note that certain items, such as food and prescription drugs, are exempt from this tax, making essential goods more affordable for residents.

Furthermore, Iowa has implemented a use tax to ensure fairness and compliance. The use tax is applicable when goods are purchased from out-of-state vendors and brought into Iowa for use or consumption. This tax prevents residents from avoiding sales tax by making purchases outside the state and ensures a level playing field for local businesses.

Impact on Iowa’s Economy and Residents

The Iowa state tax rate plays a pivotal role in shaping the economic landscape and the overall quality of life for its residents. By implementing a progressive income tax system, the state ensures that its taxation policy is aligned with the principle of fairness. Higher-income earners, who generally have a greater capacity to pay, contribute a larger proportion of their income, helping to fund essential public services and infrastructure projects.

For businesses, Iowa's flat corporate tax rate provides a stable and predictable environment. This consistency encourages long-term investment and economic growth, as companies can plan their financial strategies with confidence. The state's tax incentives and credits, such as the High-Quality Jobs Tax Credit and the Research Activities Credit, further enhance Iowa's appeal as a business-friendly destination.

Supporting Local Communities

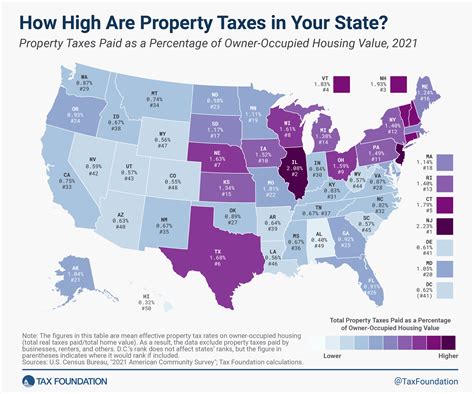

A significant portion of the revenue generated from Iowa’s state taxes is reinvested into local communities. This funding supports vital services such as education, healthcare, and public safety. For instance, property taxes, which are set by local governments, play a crucial role in funding local schools and infrastructure projects. As a result, Iowa’s residents benefit from well-maintained public spaces, efficient emergency services, and a strong educational system.

Additionally, the state's tax system aims to promote economic equality. Through initiatives like the Earned Income Tax Credit, low- and moderate-income families can receive a tax refund, providing a boost to their financial stability. This credit, coupled with other state-level benefits, helps to reduce income inequality and improve the overall well-being of Iowa's residents.

Attracting Talent and Business

Iowa’s tax structure is not only beneficial for residents but also attractive to businesses and talented professionals. The state’s competitive tax rates, coupled with a skilled workforce and a high quality of life, make it an appealing destination for companies looking to expand or relocate. This influx of businesses creates job opportunities and fosters economic growth, contributing to Iowa’s vibrant and diverse economy.

Moreover, Iowa's tax incentives and grants, such as the High-Quality Jobs Program and the Regenerate Iowa Program, provide additional support for businesses to invest in the state. These initiatives encourage job creation, innovation, and community development, further strengthening Iowa's position as a desirable place to live, work, and do business.

Conclusion: Iowa’s Balanced Approach to Taxation

Iowa’s state tax rate is carefully crafted to balance the needs of its residents and businesses. The progressive income tax system ensures fairness, while the flat corporate tax rate promotes stability and investment. By reinvesting tax revenue into local communities and offering targeted incentives, Iowa creates an environment that fosters economic growth, social well-being, and a high quality of life for its residents.

As Iowa continues to evolve and adapt to the changing economic landscape, its tax structure remains a critical tool for shaping a prosperous and sustainable future. By maintaining a balanced and equitable approach to taxation, Iowa can continue to thrive and remain a competitive force in the region and beyond.

How does Iowa’s tax system compare to other states in the region?

+Iowa’s tax system, particularly its income tax rates, is generally more progressive compared to neighboring states like Nebraska and Missouri. This means that Iowa’s tax structure places a relatively higher tax burden on higher-income earners, aiming for a more equitable distribution of tax responsibilities.

Are there any tax incentives for renewable energy projects in Iowa?

+Absolutely! Iowa is known for its strong support for renewable energy initiatives. The state offers various tax incentives, including the Renewable Energy Production Tax Credit and the Property Tax Exemption for Renewable Energy Systems. These incentives encourage the development of clean energy projects, contributing to Iowa’s sustainable future.

How does Iowa’s sales tax compare to the national average?

+Iowa’s sales tax rate of 6% is slightly higher than the national average, which hovers around 5.5%. However, it’s important to note that sales tax rates can vary significantly across states and even within cities. Iowa’s sales tax is used to fund a range of essential services and infrastructure projects.