New Orleans Louisiana Sales Tax

The city of New Orleans, Louisiana, is renowned for its vibrant culture, rich history, and unique charm. However, one aspect that often comes into play when discussing business and consumer activities is the sales tax system. Understanding the sales tax in New Orleans is crucial for both local businesses and consumers, as it directly impacts their financial decisions and transactions. This article aims to provide an in-depth analysis of the New Orleans sales tax, covering its history, current rates, exemptions, and implications for the local economy.

The Evolution of Sales Tax in New Orleans

The implementation of sales tax in New Orleans dates back to the mid-20th century, with the primary purpose of generating revenue for the state and local governments. Over the years, the sales tax structure has undergone several revisions and adjustments to address changing economic needs and to ensure fairness and competitiveness in the market.

In the early days, the sales tax was relatively straightforward, with a uniform rate applied across various goods and services. However, as time progressed, the tax system became more complex, introducing different rates for specific items and providing exemptions for certain categories of products and services.

One significant milestone in the history of New Orleans sales tax was the introduction of the Local Option Sales Tax (LOST) in the late 1980s. This tax allowed local governments to impose an additional sales tax to fund specific projects or initiatives, such as infrastructure development or tourism promotion. The LOST has since become an essential tool for municipalities to generate revenue and drive local economic growth.

Current Sales Tax Rates and Structures

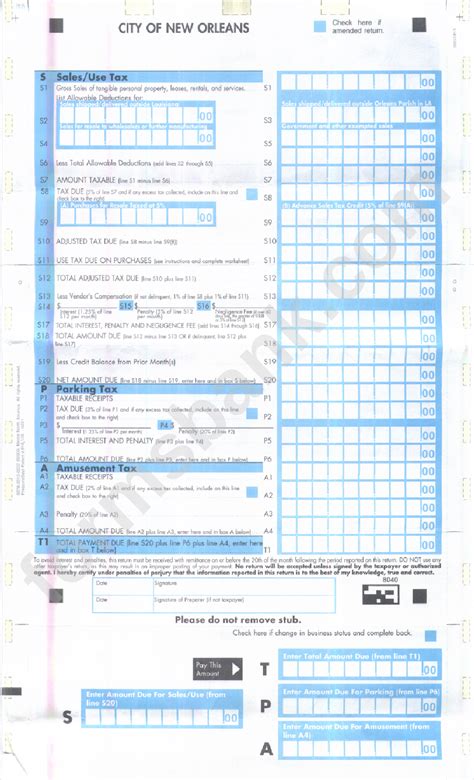

As of [current year], the sales tax system in New Orleans consists of a combination of state, local, and special taxes, resulting in a complex but well-regulated framework.

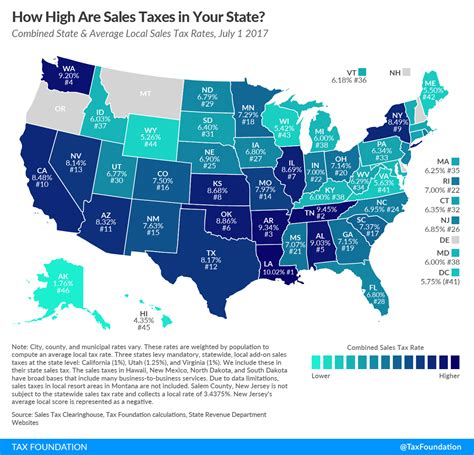

The state sales tax rate in Louisiana stands at 4.45%, which is applied uniformly across the state. This base rate is imposed on most retail sales, with a few notable exceptions and exemptions.

On top of the state tax, New Orleans imposes its own local sales tax of 5%, bringing the total combined state and local tax rate to 9.45%. This local tax is used to fund various city initiatives and services, including public safety, education, and infrastructure maintenance.

In addition to the state and local taxes, there are also special taxes applicable in certain situations. For instance, a food tax of 4% is imposed on prepared food items, while a lodging tax of 14.75% is applied to hotel and lodging services. These special taxes are designed to support specific industries and generate revenue for related infrastructure and promotional activities.

It is worth noting that these tax rates can vary slightly depending on the parish or municipality within the New Orleans metropolitan area. However, the core structure and principles remain consistent throughout the region.

Tax Exemptions and Special Considerations

While the sales tax in New Orleans generally applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of.

One notable exemption is for groceries, which are exempt from sales tax in Louisiana. This exemption is designed to alleviate the financial burden on households and promote access to essential food items. However, it is important to note that the exemption applies only to qualifying grocery items and not to prepared foods or meals.

Additionally, there are tax holidays in New Orleans, during which certain items are exempt from sales tax for a limited period. These tax-free events typically occur during specific seasons or holidays and are aimed at stimulating consumer spending and providing temporary relief to shoppers.

For businesses, there are various sales tax incentives and abatement programs available, particularly for those operating in specific industries or zones. These incentives can reduce the sales tax burden on businesses and encourage economic development in targeted areas.

Impact on Local Economy and Business Environment

The sales tax system in New Orleans plays a crucial role in shaping the local economy and business landscape. The revenue generated through sales taxes contributes significantly to the city’s financial stability and ability to provide essential services and infrastructure.

For businesses, the sales tax has both positive and negative implications. On the one hand, it can increase the cost of doing business and impact profitability, especially for those operating in sectors with high sales tax rates. On the other hand, the tax revenue generated can indirectly benefit businesses by supporting a strong local economy, infrastructure development, and a favorable business environment.

Moreover, the sales tax structure in New Orleans influences consumer behavior and spending patterns. The varying tax rates for different items and the presence of tax holidays can encourage consumers to make strategic purchasing decisions, impacting the overall sales performance of various industries.

The city’s unique approach to sales tax, including the Local Option Sales Tax and special industry taxes, allows for targeted revenue generation and support for specific sectors, contributing to the diverse and resilient nature of the New Orleans economy.

Future Implications and Potential Changes

As with any tax system, the sales tax structure in New Orleans is subject to ongoing evaluation and potential revisions. The changing economic landscape, technological advancements, and shifting consumer preferences can all influence the future direction of the sales tax system.

One potential area of focus is the simplification of the sales tax structure. While the current system is well-regulated, the presence of multiple tax rates and exemptions can create complexity for businesses and consumers alike. Simplifying the tax structure could enhance transparency, reduce administrative burdens, and improve compliance.

Additionally, the adoption of technology in tax administration and collection could revolutionize the sales tax system in New Orleans. Digital tools and platforms can streamline tax filing processes, improve accuracy, and enable more efficient revenue generation. This could also open up opportunities for tax reform and the exploration of alternative tax structures.

Furthermore, the ongoing debate surrounding tax fairness and the potential for a statewide sales tax reform cannot be overlooked. While the current system provides local control and flexibility, there are arguments for a more uniform and simplified approach across the state. The future of the New Orleans sales tax will likely be influenced by these broader discussions and potential policy changes.

Conclusion: Navigating the New Orleans Sales Tax Landscape

The sales tax system in New Orleans is a complex yet vital component of the city’s economic framework. Understanding the tax rates, exemptions, and implications is crucial for both businesses and consumers operating within the city. As the city continues to evolve and adapt to changing economic dynamics, the sales tax system will play a pivotal role in shaping the local business environment and contributing to the vibrant and resilient nature of the New Orleans economy.

What is the current state sales tax rate in Louisiana?

+

The current state sales tax rate in Louisiana is 4.45%.

Are there any sales tax holidays in New Orleans?

+

Yes, New Orleans, like many other regions, offers sales tax holidays during specific periods. These tax-free events encourage consumer spending and provide relief for shoppers.

How does the Local Option Sales Tax (LOST) work in New Orleans?

+

The LOST allows local governments to impose an additional sales tax to fund specific projects or initiatives. This tax provides municipalities with a tool to generate revenue and drive local economic growth.

Are there any sales tax incentives for businesses in New Orleans?

+

Yes, New Orleans offers various sales tax incentives and abatement programs to attract and support businesses, particularly in targeted industries and zones.

How does the sales tax system in New Orleans impact consumer behavior?

+

The sales tax structure influences consumer spending patterns, with varying tax rates and tax holidays encouraging strategic purchasing decisions. This can impact the sales performance of different industries.