State Of Mi Income Tax

The State of Michigan, often referred to as the "Great Lakes State," is known for its diverse economy, vibrant cities, and a rich history that dates back to the early days of American colonization. As a significant economic hub in the Midwest, Michigan's tax system plays a crucial role in shaping its fiscal landscape. The income tax, in particular, is a vital source of revenue for the state, supporting various public services and infrastructure development.

The Michigan Income Tax: A Comprehensive Overview

Michigan’s income tax structure is a crucial component of its overall tax system, designed to provide a stable and sustainable source of revenue for the state’s operations and development. The income tax is levied on both individuals and businesses, with rates and regulations varying based on specific circumstances.

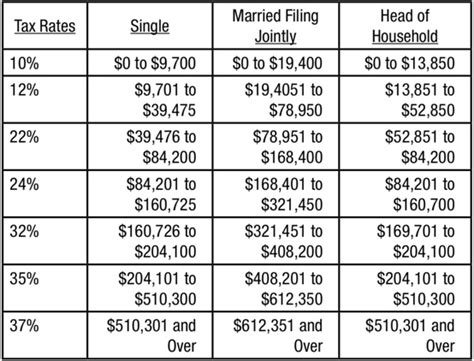

The state's income tax system is progressive, meaning that higher income earners are taxed at a higher rate than those with lower incomes. This progressive structure aims to promote fairness and equity, ensuring that those who benefit the most from the state's economy contribute proportionally.

Individual Income Tax

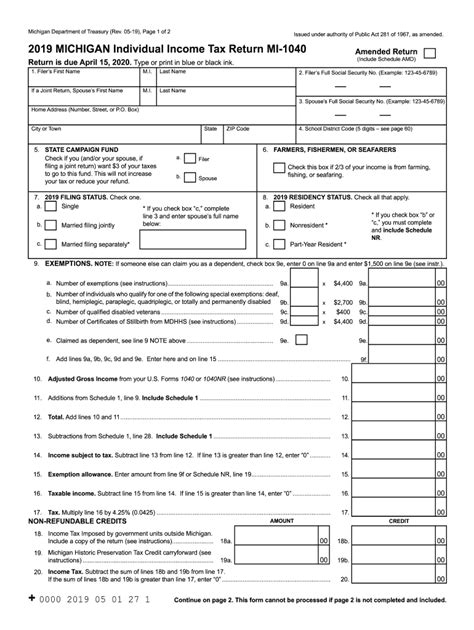

For individuals, Michigan’s income tax is based on a combination of federal-adjusted gross income and specific state adjustments. The tax rates for individuals range from 4.25% to 4.60%, with various deductions and credits available to reduce the overall tax burden. Michigan offers standard deductions, as well as personal and dependency exemptions, to assist taxpayers in lowering their taxable income.

Michigan's tax code also allows for itemized deductions, which can further reduce taxable income. These deductions include expenses such as medical costs, charitable contributions, and certain state and local taxes.

Additionally, Michigan provides tax credits for specific circumstances, such as the Homestead Property Tax Credit, which provides relief for homeowners, and the Michigan Education Tax Credit, which supports residents pursuing higher education.

Business Income Tax

Michigan’s business income tax structure is designed to encourage economic growth and investment. The state offers a single business tax (SBT) system, which is a value-added tax that applies to most business activities. The SBT replaces traditional corporate income taxes and is calculated based on a business’s adjusted tax base, taking into account various factors such as payroll, investment, and sales.

The SBT has a flat rate of 1.9% and is applied to the adjusted tax base, with certain deductions and credits available to reduce the tax liability. This system aims to simplify tax obligations for businesses and promote a competitive business environment.

Michigan also provides various tax incentives for businesses, such as the Business Tax Credit, which encourages investment in certain sectors, and the Economic Growth Authority (EGA) credits, which support job creation and retention.

Michigan’s Taxable Income Brackets

The state’s income tax brackets are divided into five categories, each with its own tax rate. These brackets are designed to ensure a fair and progressive tax system, where higher earners contribute a larger share of their income to the state’s revenue.

| Income Bracket | Tax Rate |

|---|---|

| 0 to $37,100 | 4.25% |

| $37,101 to $98,000 | 4.35% |

| $98,001 to $219,900 | 4.40% |

| $219,901 to $425,000 | 4.50% |

| Over $425,000 | 4.60% |

Recent Developments and Reforms

In recent years, Michigan has undertaken significant tax reforms to enhance its economic competitiveness and simplify its tax system. One notable reform was the elimination of the Michigan Business Tax (MBT) and its replacement with the Single Business Tax (SBT) in 2011. This reform aimed to reduce the tax burden on businesses and encourage investment.

Additionally, Michigan has implemented various tax credits and incentives to support specific industries and promote economic growth. These include the Renaissance Zone Program, which offers tax incentives to businesses operating in designated areas, and the Michigan Main Street Program, which encourages investment in downtown and neighborhood business districts.

Impact and Analysis

Michigan’s income tax system has a significant impact on the state’s economy and its residents. By providing a stable revenue source, the income tax enables the state to invest in essential public services, infrastructure, and economic development initiatives. This, in turn, contributes to a healthier economy and improved quality of life for Michigan’s residents.

The progressive nature of Michigan's income tax ensures that those who can afford to contribute more do so, promoting social and economic equity. The availability of deductions and credits further enhances the tax system's fairness, allowing individuals and businesses to reduce their tax burden based on their unique circumstances.

Moreover, Michigan's tax reforms and incentives have played a crucial role in attracting businesses and investments to the state. By offering a competitive and simplified tax environment, the state has become an attractive destination for businesses seeking to expand or relocate.

Case Study: The Impact of Tax Reforms on Small Businesses

Let’s consider the case of a small business owner, Sarah, who operates a local bakery in Michigan. Prior to the implementation of the Single Business Tax (SBT), Sarah’s business was subject to the Michigan Business Tax (MBT), which had a complex and often burdensome structure. The MBT’s multiple tax rates and bases made it challenging for small businesses like Sarah’s to navigate and plan their tax obligations.

However, with the introduction of the SBT, Sarah's tax obligations became much simpler. The flat tax rate of 1.9% on her business's adjusted tax base provided clarity and reduced administrative burdens. This simplification allowed Sarah to focus more on growing her business and less on navigating complex tax regulations.

Furthermore, the availability of tax credits and incentives, such as the Renaissance Zone Program, provided an additional boost to Sarah's bakery. By locating her business in a designated Renaissance Zone, Sarah was able to take advantage of tax breaks and incentives, reducing her overall tax burden and allowing her to reinvest those savings into her business.

This case study illustrates how Michigan's tax reforms and incentives can directly benefit small businesses, promoting growth and contributing to the state's overall economic development.

Future Implications and Considerations

As Michigan continues to evolve and adapt to changing economic conditions, its income tax system will play a critical role in shaping the state’s fiscal health and competitiveness. Here are some key considerations for the future:

- Economic Growth: Michigan's tax system should continue to support economic growth and development, encouraging investment and job creation.

- Equity and Fairness: The progressive nature of the income tax should be maintained to ensure a fair distribution of tax burdens among residents.

- Tax Simplification: Ongoing efforts to simplify the tax system, such as the SBT, should be continued to reduce administrative burdens for businesses and individuals.

- Tax Incentives: Strategic use of tax incentives can continue to attract businesses and investment, particularly in targeted sectors or regions.

- Public Services: Adequate funding for public services, such as education, healthcare, and infrastructure, should be a priority to maintain a high quality of life for Michigan residents.

By striking a balance between these considerations, Michigan can maintain a sustainable and equitable tax system that supports its economic growth and the well-being of its residents.

What is the current income tax rate in Michigan for individuals?

+

The current income tax rate for individuals in Michigan ranges from 4.25% to 4.60%, depending on income brackets.

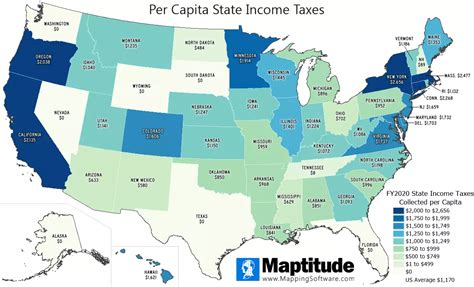

How does Michigan’s income tax compare to other states?

+

Michigan’s income tax rates are generally in line with other midwestern states, offering a competitive tax environment.

Are there any tax incentives for businesses in Michigan?

+

Yes, Michigan offers various tax incentives for businesses, including the Renaissance Zone Program and Economic Growth Authority (EGA) credits.

Can I deduct my mortgage interest from my Michigan income tax return?

+

Yes, you can deduct mortgage interest on your Michigan income tax return, subject to certain conditions and limitations.

What is the deadline for filing Michigan income tax returns?

+

The deadline for filing Michigan income tax returns is typically aligned with the federal deadline, which is usually around April 15th of each year.