Track New Mexico Tax Refund

Navigating the world of tax refunds can be a complex and often confusing process, especially when dealing with state-specific regulations. In the case of New Mexico, understanding how to track your tax refund is essential for efficient financial management. This comprehensive guide will delve into the intricacies of tracking your New Mexico tax refund, offering a detailed breakdown of the process and providing valuable insights to ensure a smooth experience.

Understanding the New Mexico Tax Refund Process

The journey of a tax refund begins with the submission of your tax return, which is the official document that outlines your financial transactions and deductions for the tax year. In New Mexico, the tax authority, known as the New Mexico Taxation and Revenue Department (TRD), is responsible for processing these returns and issuing refunds accordingly.

When you file your tax return, whether it's electronically or via traditional mail, you initiate a series of processes within the TRD. The department first verifies the accuracy of the information provided and then calculates the amount of tax you owe or the refund you are entitled to. This process can vary in duration, depending on factors such as the complexity of your return and the volume of returns the department is handling.

It's important to note that New Mexico operates on a biennial tax filing system, which means that tax returns are typically filed every two years. This unique system sets New Mexico apart from many other states and can impact the timing and frequency of tax refunds.

Key Factors Affecting Refund Processing Time

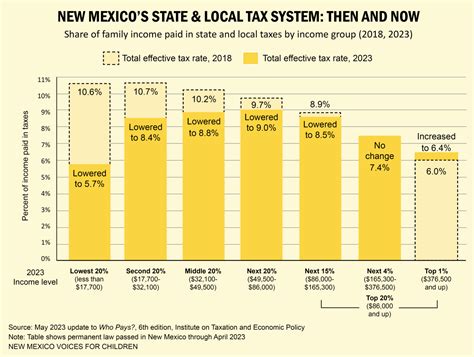

Several factors can influence the speed at which your tax refund is processed. These include the method of filing (electronic vs. paper), the accuracy of the information provided, and the overall workload of the TRD during the tax season. Additionally, if you claim certain deductions or credits, such as the Working Family Tax Credit or the Low Income Tax Credit, the processing time might be slightly longer as these require additional verification.

For instance, if you file your return electronically and it contains no errors or discrepancies, the processing time is typically faster compared to paper returns, which often require manual data entry and review.

| Filing Method | Estimated Processing Time |

|---|---|

| Electronic | 2-4 weeks |

| Paper | 6-8 weeks |

It's worth mentioning that these are general estimates, and actual processing times may vary. The TRD aims to process returns as quickly as possible, but unforeseen circumstances or a high volume of returns can occasionally lead to delays.

Tracking Your New Mexico Tax Refund

Once you’ve filed your tax return, the next step is to track the status of your refund. The TRD provides several convenient methods to check the progress of your refund, ensuring that you stay informed throughout the process.

Online Tracking Tools

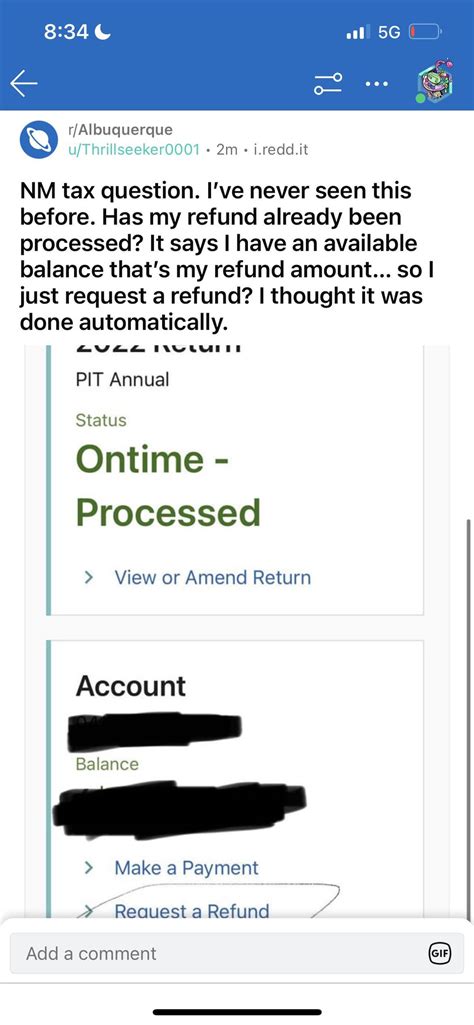

The most efficient way to track your New Mexico tax refund is through the TRD’s online portal. By accessing their Where’s My Refund tool, you can quickly check the status of your refund by providing some basic information. This tool updates daily, giving you the most up-to-date information on your refund’s progress.

To use this tool, you'll need to have the following details handy:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- The exact amount of your expected refund

- The filing status (single, married filing jointly, etc.)

By entering this information into the Where's My Refund tool, you'll be able to see if your refund has been approved, is in process, or if there are any issues that require your attention.

Telephone Inquiries

If you prefer not to use the online portal or encounter issues with the online tracking tool, you can opt for a telephone inquiry. The TRD has a dedicated telephone line for refund inquiries, which you can use to speak with a representative and get real-time updates on your refund status.

The telephone number for refund inquiries is (877) 443-4221. When calling, be prepared to provide the same information as you would for the online tool, along with any additional details the representative may request to verify your identity.

Mail Correspondence

While not the fastest method, you can also track your refund status via mail correspondence. This involves sending a written request to the TRD, asking for an update on your refund. While this method may take longer than online or telephone inquiries, it can be useful if you prefer a paper trail or if you encounter technical issues with the other methods.

To request a refund status update via mail, send a letter to the following address:

New Mexico Taxation and Revenue Department

PO Box 25127

Santa Fe, NM 87504-5127

In your letter, include your full name, SSN or ITIN, the tax year for which you are inquiring, and a daytime phone number where you can be reached.

What to Do If Your Refund Is Delayed

In some cases, your tax refund may be delayed due to various reasons, such as errors in your return, missing information, or additional verification required by the TRD. If you find that your refund is taking longer than expected, there are steps you can take to investigate and potentially speed up the process.

Checking for Errors

Start by reviewing your tax return for any errors or discrepancies. Even a minor mistake, such as a misspelled name or an incorrect SSN, can delay the processing of your refund. If you identify an error, amend your return as soon as possible, providing the correct information to the TRD.

Contacting the TRD

If you’ve confirmed that your return is error-free but your refund is still delayed, it’s time to reach out to the TRD. Their customer service representatives are trained to handle refund inquiries and can provide specific insights into the status of your refund. They may also be able to guide you on any additional steps you need to take.

You can contact the TRD's customer service team via the following methods:

- Telephone: (877) 443-4221 (toll-free)

- Email: tax.info@state.nm.us

- In-Person: Visit your local TRD office (appointments are recommended)

Checking Your Bank Account

In some cases, the TRD may attempt to deposit your refund into your bank account, but due to various reasons (such as a change of account details or an incorrect account number), the deposit may be unsuccessful. If this happens, the TRD will send you a notification, often via mail, informing you of the failed deposit and providing instructions on how to update your banking information.

It's crucial to promptly respond to such notifications to ensure that your refund is not further delayed. Check your mail regularly, especially during the tax season, to avoid missing any important updates from the TRD.

Receiving Your New Mexico Tax Refund

Once your tax refund has been processed and approved, the TRD will issue your refund using the payment method you specified when filing your return. The two primary methods of refund disbursement are direct deposit and paper check.

Direct Deposit

If you chose direct deposit when filing your tax return, the TRD will transfer your refund directly into your bank account. This is the fastest and most efficient method of refund disbursement, as it typically takes 1-2 weeks from the date of approval for the funds to appear in your account.

Paper Check

If you did not provide banking information or if there was an issue with your direct deposit, the TRD will issue your refund via a paper check. These checks are typically mailed within 3-4 weeks of the refund approval date. Ensure that the TRD has your correct mailing address on file to avoid any delays or misdeliveries.

Tracking Your Disbursement

To track the status of your refund disbursement, you can use the same Where’s My Refund tool mentioned earlier. This tool will provide updates on whether your refund has been sent out, the method of disbursement (direct deposit or paper check), and the estimated date of arrival (for paper checks).

Frequently Asked Questions (FAQ)

How long does it typically take to receive my New Mexico tax refund?

+The processing time for New Mexico tax refunds can vary, but on average, it takes 2-4 weeks for electronic filings and 6-8 weeks for paper filings. However, factors like the accuracy of your return and the volume of returns can influence the actual processing time.

What should I do if I haven’t received my refund after the estimated time?

+If your refund is delayed beyond the estimated time, check for errors in your return, and then contact the TRD’s customer service to inquire about the status. They can provide specific details and guide you on any necessary actions.

Can I change my refund payment method after filing my return?

+Yes, you can change your refund payment method by submitting a written request to the TRD. Include your name, SSN, the tax year, and your new payment details. Keep in mind that changing your payment method may delay your refund.

How can I ensure the TRD has my correct contact information?

+To ensure the TRD has your correct contact information, update your details with the department whenever there’s a change. You can do this by filing a Change of Address form with the TRD or by updating your information when filing your next tax return.

Are there any penalties for filing my tax return late in New Mexico?

+Yes, New Mexico imposes penalties for late tax return filings. The penalty is typically 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%. Interest may also be charged on the unpaid tax amount.