Louisiana Income Tax Refund

The Louisiana Income Tax Refund is a crucial financial aspect for residents of the state, offering a potential reprieve from the financial burdens of tax obligations. This refund, when applicable, can provide much-needed relief to individuals and families, making it a significant topic of interest for taxpayers in Louisiana. In this comprehensive guide, we will delve into the intricacies of the Louisiana Income Tax Refund, covering its eligibility criteria, calculation methods, and the process of claiming it.

Understanding the Louisiana Income Tax Refund

The Louisiana Income Tax Refund, often simply referred to as the Louisiana tax refund, is a financial benefit offered by the state to eligible taxpayers. It is a form of tax relief, providing a refund of a portion of the income taxes paid by individuals or businesses during a given tax year. This refund is a crucial aspect of Louisiana’s tax system, designed to support taxpayers and stimulate the local economy.

The state of Louisiana operates under a progressive tax system, which means that the amount of income tax you pay is determined by your taxable income. This system ensures that those with higher incomes contribute a larger share of their income towards state revenue. However, the Louisiana Income Tax Refund acts as a counterbalance, providing a means for taxpayers to reclaim a portion of their payments, especially if they have overpaid during the year.

Eligibility and Criteria

Eligibility for the Louisiana Income Tax Refund is determined by various factors, including income level, residency status, and tax obligations. Generally, individuals and businesses that have paid income taxes to the state of Louisiana during the tax year are eligible for a refund if they meet certain criteria.

For individual taxpayers, the eligibility criteria include having a taxable income below a certain threshold, typically set by the Louisiana Department of Revenue (LDR). This threshold is adjusted annually to account for inflation and changing economic conditions. Additionally, individuals must have filed their tax returns accurately and on time to be considered for a refund.

Businesses, on the other hand, must meet specific criteria based on their type of business, revenue, and tax obligations. For instance, small businesses with a certain level of revenue may be eligible for tax refunds or credits, especially if they have invested in certain state-approved initiatives or met specific employment criteria.

| Taxpayer Type | Eligibility Criteria |

|---|---|

| Individuals | Taxable income below the LDR-set threshold, timely and accurate tax filing |

| Businesses | Dependent on business type, revenue, and adherence to specific state initiatives |

Calculation and Estimation

The calculation of the Louisiana Income Tax Refund involves a complex process that takes into account various factors, including the taxpayer’s income, deductions, credits, and the applicable tax rates. The LDR provides guidelines and tools to help taxpayers estimate their potential refund before filing their tax returns.

For individual taxpayers, the refund is typically calculated based on a percentage of their taxable income. This percentage varies depending on their filing status (single, married filing jointly, etc.) and the specific tax brackets they fall into. Additionally, certain deductions and credits can further impact the refund amount.

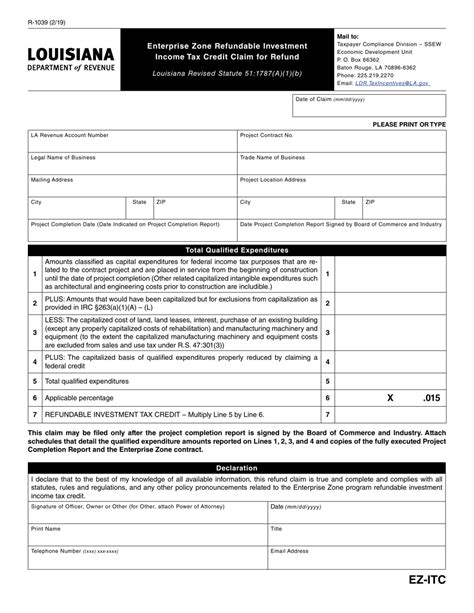

Businesses, especially small businesses, may be eligible for various tax credits and incentives. These can include credits for investing in renewable energy, hiring veterans, or locating in certain designated areas of the state. The specific calculations for these credits can be complex and often require professional tax advice.

The Process of Claiming Your Refund

Claiming your Louisiana Income Tax Refund involves a series of steps that ensure the process is efficient and accurate. The LDR provides clear guidelines and resources to assist taxpayers in navigating this process.

Preparing Your Tax Return

The first step in claiming your refund is to prepare your tax return accurately. This involves gathering all relevant financial documents, such as pay stubs, investment statements, and receipts for eligible deductions and credits. It’s essential to ensure that all information is up-to-date and accurate to avoid delays or penalties.

The LDR provides online tools and resources, such as the Louisiana Individual Income Tax Booklet, which offers detailed instructions and worksheets to help taxpayers calculate their taxable income and potential refund. These resources also provide information on common deductions and credits that taxpayers might be eligible for.

Filing Your Return

Once your tax return is prepared, the next step is to file it with the LDR. Taxpayers have the option to file their returns electronically or by mail. Electronic filing is often the faster and more efficient method, as it reduces the chances of errors and provides a quicker refund processing time.

The LDR's website offers a secure online platform for electronic filing. Taxpayers can create an account, enter their tax information, and submit their return digitally. This method also allows for real-time updates on the status of their refund.

For those who prefer traditional methods, paper returns can be mailed to the LDR. However, it's crucial to ensure that the return is complete and accurate, as incomplete or incorrect returns may lead to delays or additional scrutiny.

Tracking Your Refund

After filing your tax return, you can track the status of your Louisiana Income Tax Refund using the LDR’s online tools. The LDR provides a dedicated section on its website where taxpayers can enter their personal information to check the status of their refund. This service offers real-time updates, ensuring taxpayers are kept informed throughout the process.

In the event of a delay or issue with your refund, the LDR's website provides resources and contact information for taxpayers to reach out for assistance. The LDR's customer service team is available to help resolve any issues and ensure that taxpayers receive their refunds promptly.

Maximizing Your Louisiana Income Tax Refund

While the Louisiana Income Tax Refund is a valuable benefit for eligible taxpayers, it’s essential to understand strategies to maximize this refund. By taking advantage of certain deductions, credits, and planning initiatives, taxpayers can potentially increase the amount of their refund.

Deductions and Credits

Louisiana offers various deductions and credits that can reduce the amount of tax you owe or increase the size of your refund. These deductions and credits are designed to support specific groups or encourage certain behaviors, such as investing in the local economy or supporting education.

For instance, taxpayers who have made contributions to certain charities or educational institutions may be eligible for tax credits. Similarly, those who have invested in renewable energy initiatives or who have specific medical expenses may also be entitled to deductions or credits.

| Deduction/Credit | Description |

|---|---|

| Charitable Contributions Credit | A credit for donations to qualifying charitable organizations |

| Educational Assistance Credit | A credit for contributions to qualifying educational institutions |

| Renewable Energy Credit | A credit for investing in renewable energy systems |

Tax Planning Strategies

Engaging in strategic tax planning can also help maximize your Louisiana Income Tax Refund. This involves making informed decisions throughout the year to optimize your tax position. For instance, contributing to tax-advantaged retirement accounts, such as IRAs or 401(k)s, can reduce your taxable income and potentially increase your refund.

Additionally, timing certain purchases or investments can also impact your refund. For example, purchasing energy-efficient appliances or making energy-related home improvements before the end of the tax year can qualify you for tax credits, thus increasing your refund.

Conclusion: The Value of the Louisiana Income Tax Refund

The Louisiana Income Tax Refund is a significant financial benefit for eligible taxpayers, providing much-needed relief and support. By understanding the eligibility criteria, calculation methods, and the process of claiming this refund, taxpayers can ensure they receive the full benefits they are entitled to. Furthermore, by implementing strategic tax planning and taking advantage of available deductions and credits, taxpayers can maximize their refund and optimize their financial position.

For Louisiana residents, the Income Tax Refund is not just a financial windfall; it's a reflection of the state's commitment to supporting its citizens and encouraging economic growth. As such, it's an essential aspect of the state's tax system, one that taxpayers should understand and utilize to their advantage.

Frequently Asked Questions

When will I receive my Louisiana Income Tax Refund?

+The processing time for Louisiana Income Tax Refunds can vary, but typically, refunds are issued within 4-6 weeks after the LDR receives your complete and accurate tax return. However, factors like the filing method (electronic vs. paper), the complexity of your return, and the volume of returns being processed can affect this timeline.

What if my Louisiana Income Tax Refund is delayed or incorrect?

+If you believe your refund is delayed or has been calculated incorrectly, you can contact the Louisiana Department of Revenue’s Customer Service Center. They will assist you in resolving the issue and provide guidance on the next steps. It’s important to keep all your tax documents and correspondence for reference.

Are there any penalties for filing my Louisiana Income Tax Return late?

+Yes, there are penalties for filing your Louisiana Income Tax Return late. These penalties can include a late filing fee and interest on any unpaid tax. However, the LDR may waive these penalties under certain circumstances, such as for taxpayers affected by natural disasters or other unforeseen circumstances.

Can I claim a Louisiana Income Tax Refund if I’m a part-year resident of the state?

+Yes, you may be eligible for a Louisiana Income Tax Refund even if you were a part-year resident. The eligibility and calculation of your refund will depend on the specific circumstances of your residency and your income during the tax year. It’s advisable to consult the LDR’s guidelines or a tax professional for more detailed information.

What happens if I move out of Louisiana before receiving my Income Tax Refund?

+If you move out of Louisiana before receiving your Income Tax Refund, the LDR will still process and issue your refund. They will send the refund to the address you provided on your tax return. It’s essential to keep your contact information updated with the LDR to ensure you receive your refund promptly.