Sales Tax Anaheim California

Sales tax in Anaheim, California, is an important aspect of doing business in this vibrant city. Anaheim, located in Orange County, is not only a popular tourist destination but also a hub for various industries. The sales tax rate here plays a crucial role in the city's economy and affects both businesses and consumers. In this comprehensive guide, we will delve into the specifics of sales tax in Anaheim, exploring its rates, how it's calculated, and its implications for different industries and consumers.

Understanding Sales Tax in Anaheim

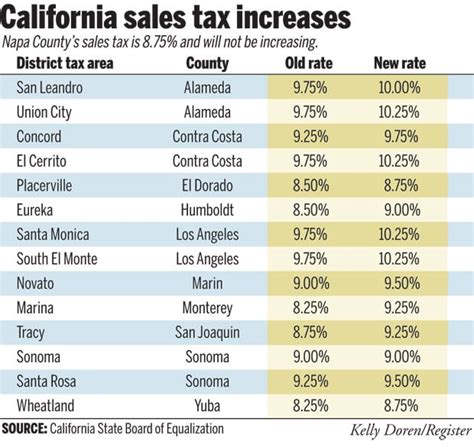

Sales tax in California is governed by state laws and regulations, with additional local taxes imposed by counties and cities. Anaheim, like many other cities, has its own sales tax rate, which is added to the state’s base rate. This local tax contributes to the city’s revenue and is used to fund essential services and infrastructure.

Sales Tax Rates

The current sales tax rate in Anaheim consists of three components: the state rate, the county rate, and the city rate. As of [insert most recent update date], the state sales tax rate in California is set at 7.25%. The Orange County sales tax rate adds another 0.25%, bringing the total countywide rate to 7.50%. Finally, the Anaheim city sales tax rate is 1.00%, making the total combined sales tax rate in Anaheim 8.50%.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Orange County | 0.25% |

| City of Anaheim | 1.00% |

| Total Combined Sales Tax Rate | 8.50% |

It's important to note that sales tax rates are subject to change, and it is the responsibility of businesses and consumers to stay informed about the latest rates. These changes can occur due to legislative actions or special district taxes, so regular updates are essential.

Taxable Items and Services

In California, sales tax applies to most tangible personal property and certain services. This includes items such as clothing, electronics, furniture, and groceries. However, there are some notable exceptions and exemptions, such as certain foods, prescription medications, and some types of manufacturing equipment.

The California Code of Regulations provides a comprehensive list of taxable and exempt items and services. It's crucial for businesses to understand these regulations to ensure proper tax compliance.

Calculating Sales Tax

Calculating sales tax in Anaheim involves a straightforward process. For a purchase of $100, the sales tax would be calculated as follows:

- Apply the state sales tax rate of 7.25% to the purchase price: $100 x 0.0725 = $7.25.

- Add the county sales tax rate of 0.25%: $7.25 + ($100 x 0.0025) = $7.50.

- Finally, include the city sales tax rate of 1.00%: $7.50 + ($100 x 0.01) = $8.50.

- So, the total sales tax for a $100 purchase in Anaheim is $8.50, and the total amount to be paid is $108.50.

Businesses often use point-of-sale systems or tax calculators to ensure accurate tax calculations. These tools can help streamline the process and reduce the risk of errors.

Sales Tax Compliance and Registration

Businesses operating in Anaheim must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit authorizes the business to collect and remit sales tax to the state.

Registration Process

The registration process typically involves the following steps:

- Completing an online application or submitting a paper form.

- Providing business information, such as the legal name, address, and taxpayer identification number.

- Choosing a tax filing frequency (monthly, quarterly, or annually) based on estimated sales volume.

- Submitting the application and awaiting approval.

Once registered, businesses receive a seller's permit number, which must be displayed at the point of sale and included on all sales tax returns.

Sales Tax Collection and Remittance

Businesses are responsible for collecting sales tax from customers at the time of purchase. This tax is then remitted to the CDTFA on a regular basis, as determined by the business’s filing frequency.

It's crucial for businesses to maintain accurate records of sales and tax collections to ensure compliance. Failure to collect and remit sales tax can result in penalties and legal consequences.

Impact on Industries and Consumers

The sales tax rate in Anaheim can have significant implications for various industries and consumers. Here are some key considerations:

Retail and Tourism

Anaheim’s retail sector, which caters to both locals and tourists, is directly impacted by the sales tax rate. A higher tax rate can potentially discourage consumers from making purchases, especially when compared to neighboring cities or online retailers. However, the city’s vibrant tourism industry, anchored by attractions like Disneyland, may mitigate some of these effects.

E-commerce and Online Sales

With the rise of e-commerce, businesses selling goods online must consider the impact of sales tax. In California, remote sellers with significant economic nexus in the state are required to collect and remit sales tax. This includes online retailers who have a certain level of sales or a physical presence in the state. The collection of sales tax on online sales ensures a level playing field for local brick-and-mortar businesses.

Small Businesses and Startups

For small businesses and startups in Anaheim, the sales tax system can present both challenges and opportunities. On one hand, collecting and remitting sales tax adds to the administrative burden. On the other hand, a well-managed sales tax system can contribute to the business’s credibility and compliance with local regulations.

Consumer Impact

Consumers in Anaheim bear the brunt of sales tax, which adds to the cost of goods and services. While this may influence purchasing decisions, it’s important to note that sales tax revenues fund essential services, infrastructure, and public amenities that benefit the community.

Future Implications and Trends

The sales tax landscape in California and Anaheim is subject to ongoing changes and trends. Here are some key considerations for the future:

Legislative Changes

The California legislature has the authority to modify sales tax rates and regulations. While the current rates are stable, future legislative actions could lead to changes, either increasing or decreasing the tax burden.

Online Sales Tax Collection

The collection of sales tax on online sales is a growing trend. As more businesses establish an online presence, the state and local governments may continue to refine their policies to ensure fair taxation of remote sellers.

Sales Tax Simplification

Efforts to simplify the sales tax system in California are ongoing. Initiatives such as the Streamlined Sales Tax Project aim to reduce the administrative burden on businesses by standardizing sales tax rates and regulations across states.

Local Tax Initiatives

Anaheim and other cities may explore additional local taxes to fund specific initiatives or address local needs. These taxes could be in the form of special district taxes or bond measures, further impacting the overall sales tax rate.

Conclusion

Understanding sales tax in Anaheim is crucial for businesses and consumers alike. The city’s sales tax rate, while higher than the state average, contributes to the funding of essential services and infrastructure. Businesses must navigate the complexities of sales tax collection and remittance to ensure compliance, while consumers should be aware of the impact of sales tax on their purchases.

Staying informed about sales tax rates, regulations, and trends is essential for both parties. By staying up-to-date, businesses can adapt their strategies, and consumers can make informed purchasing decisions. As Anaheim continues to thrive as a business and tourism hub, the sales tax system will remain a critical aspect of its economic landscape.

Are there any sales tax holidays in Anaheim, California?

+Yes, California occasionally offers sales tax holidays for specific items or during certain periods. These holidays provide an opportunity for consumers to purchase eligible items tax-free. However, it’s important to note that these holidays are not common and may not occur annually. It’s advisable to stay informed about any upcoming sales tax holidays through official state announcements.

How do online businesses determine whether they need to collect sales tax in Anaheim?

+Online businesses with significant economic nexus in California are required to collect and remit sales tax. This includes businesses that meet certain sales thresholds or have a physical presence in the state. To determine if your online business needs to collect sales tax in Anaheim, you should consult the California Department of Tax and Fee Administration’s guidelines and consider seeking professional advice.

Are there any sales tax exemptions for specific industries or products in Anaheim?

+Yes, California offers various sales tax exemptions for specific industries and products. These exemptions can vary based on the nature of the business or the type of goods being sold. It’s crucial for businesses to stay informed about these exemptions and consult the California Code of Regulations for detailed information. Seeking professional tax advice can also help ensure compliance with specific industry or product exemptions.