Corporate Tax Extension Filing

Corporate tax filing is a critical aspect of running a business, and understanding the extension process is essential for companies to maintain compliance and avoid penalties. This comprehensive guide will delve into the intricacies of corporate tax extension filing, offering an expert analysis of the process, its benefits, and the key considerations for businesses.

Understanding Corporate Tax Extension Filing

A corporate tax extension provides businesses with additional time to prepare and file their Form 1120, the U.S. Corporation Income Tax Return. This extension is particularly beneficial for corporations that require more time to gather necessary financial information, complete complex tax calculations, or address other compliance-related matters. It is important to note that an extension to file does not extend the time to pay any taxes due.

The Internal Revenue Service (IRS) grants these extensions under specific conditions, and they are a vital tool for corporations to manage their tax obligations effectively. By providing a longer timeframe, extensions allow businesses to ensure the accuracy of their tax returns and reduce the risk of errors or omissions that could lead to audits or penalties.

The Process of Requesting an Extension

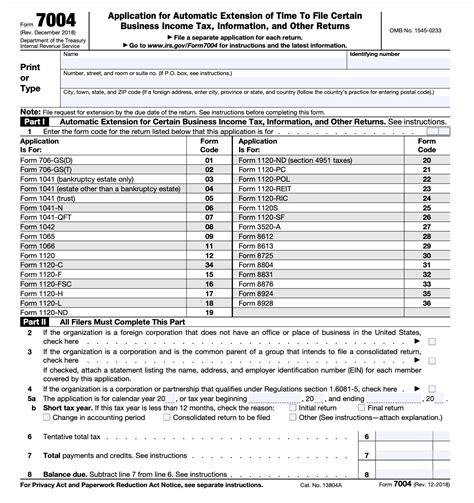

To request a corporate tax extension, businesses must complete and submit Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. This form is typically due on the regular tax filing deadline, which is March 15th for calendar year taxpayers. By filing Form 7004, corporations automatically receive a six-month extension, pushing the due date to September 15th.

It is crucial to note that while the extension provides additional time to file, it does not extend the deadline for paying any taxes owed. Corporations must estimate their tax liability accurately and pay the estimated amount by the original due date to avoid penalties and interest. The IRS provides a guide for making estimated tax payments, which can assist businesses in managing their tax obligations effectively.

Key Considerations and Best Practices

- Timely Submission: While the IRS grants an automatic six-month extension, it is essential to submit Form 7004 by the original due date. Late submissions may result in penalties and could complicate the extension process.

- Accurate Estimation: Corporations must estimate their tax liability carefully. Underestimating taxes owed can lead to additional penalties and interest, while overestimating may result in an unnecessary financial burden.

- Documentation: Retain all records and documentation related to the extension request. This includes a copy of the filed Form 7004 and any supporting documentation used to estimate tax liability. Proper documentation can be crucial if the IRS requests additional information.

- Communication: If there are any changes or updates to the corporation's tax situation after filing the extension, it is advisable to communicate these to the IRS. This ensures that the tax authorities have accurate and up-to-date information.

- Seek Professional Advice: Corporate tax laws and regulations can be complex, and seeking advice from a tax professional or accountant can help ensure compliance and accuracy. They can also provide valuable insights into optimizing tax strategies and minimizing liabilities.

| Form | Description |

|---|---|

| Form 1120 | U.S. Corporation Income Tax Return |

| Form 7004 | Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns |

Benefits of Corporate Tax Extension Filing

Corporate tax extension filing offers several advantages to businesses, allowing them to navigate the complex world of tax compliance with greater ease and accuracy.

Time Management and Compliance

The primary benefit of a corporate tax extension is the additional time it provides for corporations to prepare their tax returns accurately. This extended timeframe is particularly valuable for larger corporations with complex financial structures or those with international operations, as it allows for a more meticulous review of financial data and tax strategies.

By taking advantage of the extension, businesses can ensure they meet their tax obligations without rushing the process. This reduces the risk of errors, which could lead to audits or penalties. The extra time also enables corporations to address any compliance-related concerns and implement necessary changes to their tax strategies.

Enhanced Accuracy and Transparency

A corporate tax extension promotes a culture of accuracy and transparency in tax reporting. With the additional time, corporations can conduct a thorough review of their financial records, ensuring that all relevant information is accounted for and properly classified. This level of scrutiny can identify potential errors or inconsistencies before the tax return is filed, enhancing the overall quality of the submission.

Moreover, the extension provides an opportunity for corporations to engage in proactive tax planning. By analyzing their financial performance and tax strategies during the extended period, businesses can make informed decisions to optimize their tax positions. This may involve adjusting tax strategies, claiming relevant deductions or credits, or even restructuring certain aspects of their operations to achieve greater tax efficiency.

Improved Cash Flow Management

For many corporations, tax extension filing can also have a positive impact on cash flow management. By estimating their tax liability accurately and paying the estimated amount by the original due date, businesses can maintain a healthy cash flow throughout the extension period. This is particularly beneficial for corporations with fluctuating revenues or those facing temporary financial constraints.

Additionally, the extension allows corporations to align their tax payments with their financial cycle. For instance, a business with a peak revenue season after the original tax deadline can use the extension period to generate sufficient funds to cover their tax obligations. This strategic approach to tax payment can provide a more stable financial outlook and reduce the need for short-term financing.

Potential Challenges and How to Mitigate Them

While corporate tax extension filing offers numerous benefits, it also presents certain challenges that businesses must be prepared to address.

Accurate Estimation and Payment

One of the key challenges associated with tax extension filing is accurately estimating tax liability. Underestimating taxes owed can lead to significant penalties and interest charges, while overestimating may result in a missed opportunity to optimize cash flow. To mitigate this risk, corporations should engage experienced tax professionals who can provide accurate estimates based on the latest tax regulations and the corporation's specific financial circumstances.

Furthermore, corporations should establish robust internal processes for tax estimation and payment. This includes regular reviews of financial data, thorough analysis of tax regulations, and timely communication with relevant stakeholders. By treating tax estimation as a critical business function, corporations can enhance accuracy and reduce the risk of penalties.

Compliance with State and Local Regulations

Corporate tax extension filing is primarily governed by federal regulations, but businesses must also consider state and local tax requirements. State tax regulations can vary significantly, and corporations operating in multiple states may face a complex web of compliance obligations. To ensure compliance, businesses should consult with tax professionals who have expertise in state and local tax laws. Additionally, staying updated with tax news and regulations through reputable sources can help businesses anticipate and address potential changes.

Addressing Time Constraints and Resource Management

While the extension provides additional time, it does not eliminate the need for efficient resource management. Corporations must allocate sufficient resources to tax compliance tasks, including data gathering, analysis, and filing. This may involve investing in tax software, training internal staff, or outsourcing certain tax-related functions to specialized firms.

By treating tax compliance as a strategic business function, corporations can optimize their resource allocation. This may include establishing dedicated tax teams or working closely with tax professionals who can provide efficient and cost-effective solutions. Moreover, businesses should aim to build a culture of tax awareness, where tax compliance is viewed as a critical aspect of overall business success.

The Future of Corporate Tax Extension Filing

The landscape of corporate tax extension filing is continually evolving, driven by technological advancements, changing tax regulations, and shifts in business practices. As we look ahead, several trends and developments are shaping the future of this process.

Technological Innovations

The integration of technology into tax compliance processes is transforming the way corporations approach tax extension filing. Advanced tax software and digital platforms are making it easier for businesses to manage their tax obligations, with features such as automated data collection, real-time tax calculation, and seamless filing processes. These technologies not only enhance efficiency but also reduce the risk of errors, ensuring greater accuracy in tax reporting.

Furthermore, the use of data analytics and machine learning is enabling corporations to gain deeper insights into their tax strategies. By analyzing historical tax data and identifying patterns, businesses can optimize their tax planning and make more informed decisions. These technological advancements are not only streamlining the extension filing process but also empowering corporations to achieve greater tax efficiency and compliance.

Changing Tax Regulations

The tax landscape is dynamic, with frequent changes in regulations and policies at both the federal and state levels. Corporations must stay updated with these changes to ensure compliance and take advantage of any new opportunities. For instance, recent tax reforms, such as the Tax Cuts and Jobs Act (TCJA), have introduced significant changes to corporate tax rates and deductions, impacting the way businesses approach tax planning.

As tax regulations continue to evolve, corporations must adapt their strategies accordingly. This may involve reevaluating tax structures, exploring new tax incentives, or restructuring certain aspects of their operations to align with changing tax laws. Staying informed about tax reforms and consulting with tax professionals can help businesses navigate these changes effectively and make the most of the tax extension filing process.

International Business Considerations

In today's globalized business environment, many corporations operate across international borders. This introduces a layer of complexity to tax extension filing, as businesses must navigate the tax regulations of multiple jurisdictions. Corporations with international operations must ensure compliance with both domestic and foreign tax laws, which can be a challenging task.

To address this challenge, corporations should consider partnering with tax professionals who have expertise in international tax matters. These experts can provide guidance on tax treaties, transfer pricing, and other aspects of international tax compliance. By staying informed about international tax developments and seeking expert advice, corporations can manage their tax obligations effectively, even in the face of complex global operations.

Embracing a Culture of Tax Awareness

As the corporate tax landscape becomes increasingly complex, fostering a culture of tax awareness within organizations is becoming increasingly important. This involves educating employees about tax compliance, promoting transparency, and encouraging a proactive approach to tax planning. By integrating tax considerations into everyday business decisions, corporations can ensure that tax obligations are addressed from the outset, rather than as an afterthought.

Furthermore, a culture of tax awareness can lead to more efficient tax processes and better utilization of resources. By involving tax professionals in strategic business decisions, corporations can identify tax implications early on and develop tax-efficient strategies. This collaborative approach not only enhances compliance but also contributes to the overall success and sustainability of the business.

Frequently Asked Questions

What happens if I miss the extension deadline for corporate tax filing?

+If you miss the extension deadline for corporate tax filing, you may be subject to penalties and interest charges. It’s important to note that the extension only grants additional time to file the tax return, not to pay any taxes owed. To avoid penalties, ensure you file the extension request (Form 7004) by the original due date, which is typically March 15th for calendar year taxpayers.

Can I extend the payment deadline for corporate taxes?

+The corporate tax extension (Form 7004) provides additional time to file your tax return but does not extend the deadline for paying taxes owed. However, you can request an installment agreement with the IRS if you are unable to pay the full amount by the original due date. This allows you to pay your taxes in installments over time, but you must still pay interest and potentially penalties on the outstanding balance.

Are there any advantages to filing a corporate tax extension early?

+Filing a corporate tax extension early can provide several benefits. It ensures that you have ample time to gather all the necessary financial information, review your tax calculations, and address any compliance-related matters. Additionally, filing early can help reduce the risk of errors and the likelihood of facing penalties or audits. It also demonstrates good faith and proactive tax management to the IRS.

Can I file a corporate tax extension online?

+Yes, you can file a corporate tax extension online through the IRS’s electronic filing system. The IRS provides an online tool called “e-file” that allows you to submit Form 7004 electronically. This method is convenient, secure, and ensures timely submission. However, it’s important to ensure that you have all the required information and documentation before filing online.

What should I do if I need more time beyond the six-month extension period?

+If you require more time beyond the six-month extension period, you may need to request an additional extension from the IRS. This can be done by filing another Form 7004 and providing a valid reason for the additional extension. However, keep in mind that multiple extensions may raise red flags with the IRS, and it’s important to demonstrate a genuine need for the additional time.