Commission And Taxes

In the intricate world of finance and business, the interplay between commission and taxes is a crucial aspect that shapes the financial landscape for professionals across various industries. Understanding how commissions are taxed is essential for financial planning and optimizing one's earnings. This comprehensive guide aims to shed light on the complex relationship between commissions and taxes, providing a detailed analysis to help professionals navigate this intricate terrain.

Understanding Commission-Based Income

Commission-based income is a prevalent model in many industries, offering a performance-based compensation structure. Sales professionals, real estate agents, insurance brokers, and various other specialists often rely on commissions as a significant portion of their earnings. This income model incentivizes productivity and rewards those who excel in their respective fields.

However, the unique nature of commission-based income also presents distinct tax considerations. Unlike traditional salaried income, commissions are often variable, dependent on sales performance and market conditions. This variability introduces complexities when it comes to tax calculations and planning.

The Taxation of Commissions

The taxation of commissions can vary depending on several factors, including the jurisdiction, the type of commission, and the individual's tax bracket. Here's a detailed breakdown of the key aspects to consider:

Income Tax

Commission income is typically subject to income tax, just like any other form of earnings. The specific tax rate depends on the individual's overall taxable income, including other sources of income such as salaries, investments, and business profits.

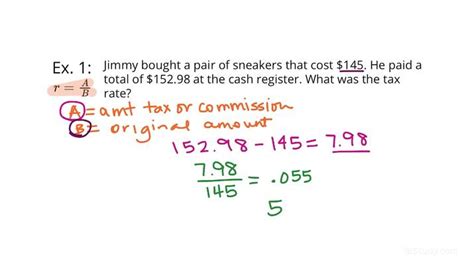

For instance, consider a sales professional who earns $50,000 in salary and an additional $30,000 in commissions. Their total taxable income would be $80,000, and the applicable tax rate would be determined based on this amount. In many jurisdictions, income tax is calculated incrementally, with higher rates applying to higher income brackets.

Self-Employment Taxes

Individuals earning commissions as independent contractors or self-employed professionals may face additional tax obligations in the form of self-employment taxes. These taxes fund social security and Medicare, similar to the payroll taxes deducted from traditional employees' paychecks.

Self-employment taxes are typically calculated as a percentage of the net earnings from self-employment. For example, if a real estate agent earns $75,000 in commissions and has $15,000 in business expenses, their net earnings would be $60,000. The self-employment tax rate is then applied to this amount.

Business Expenses and Deductions

Business expenses related to earning commissions can be deducted from taxable income, reducing the overall tax liability. These expenses may include office rent, marketing costs, travel expenses, and other necessary expenditures incurred to generate commission income.

For instance, a financial advisor might claim deductions for continuing education expenses, software subscriptions, and client entertainment costs. These deductions can significantly impact the taxable income and, consequently, the tax liability.

Withholding and Estimated Taxes

Commission-based income often requires individuals to manage their tax obligations proactively. This may involve setting aside a portion of their earnings for tax payments or making estimated tax payments throughout the year to avoid penalties for underpayment.

Some companies may withhold a portion of the commissions as a safeguard against underpayment, similar to how payroll taxes are withheld from salaries. However, it's crucial for individuals to ensure they are withholding an appropriate amount to cover their tax liabilities accurately.

Tax Treatment of Different Commission Types

Not all commissions are taxed alike. The tax treatment can vary based on the nature of the commission. Here are a few examples:

- Sales Commissions: Sales professionals often earn commissions based on their sales performance. These commissions are typically taxed as ordinary income and included in the individual's taxable income.

- Real Estate Commissions: Real estate agents may earn commissions from property sales. These commissions are also taxed as ordinary income, but there may be additional considerations, such as capital gains tax on the sale of properties.

- Insurance Commissions: Insurance brokers and agents earn commissions from selling insurance policies. The tax treatment can be more complex, as commissions may be tied to policy premiums, and there might be specific regulations governing their taxation.

Maximizing Tax Efficiency

Navigating the complexities of commission taxation requires careful planning and professional guidance. Here are some strategies to optimize tax efficiency for commission-based income:

Tax-Efficient Commission Structures

Individuals can work with their employers or clients to structure commissions in a tax-efficient manner. This might involve negotiating commissions as a percentage of gross sales rather than net sales, as it can result in a lower taxable income.

Retirement Savings

Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can help reduce taxable income and provide long-term tax benefits. These accounts allow individuals to save for retirement while deferring taxes on their contributions and investment earnings.

Business Entity Selection

For independent contractors and self-employed professionals, choosing the right business entity can have tax implications. Sole proprietorships, partnerships, and limited liability companies (LLCs) offer different tax advantages and obligations. Consulting with a tax professional can help determine the most suitable entity.

Strategic Expense Management

Effectively managing business expenses can maximize tax deductions. This involves keeping detailed records of all legitimate business expenses and ensuring they are accurately categorized and substantiated.

Case Study: Commission Taxation in Action

Let's consider the example of Emily, a successful sales representative earning commissions from multiple clients. Emily's annual commission income varies significantly, ranging from $40,000 to $60,000, depending on her sales performance.

| Year | Commission Income | Business Expenses | Net Earnings | Income Tax |

|---|---|---|---|---|

| 2023 | $50,000 | $10,000 | $40,000 | $7,000 |

| 2024 | $60,000 | $12,000 | $48,000 | $9,000 |

In this case study, we can observe how Emily's income tax liability increases as her commission income grows. The additional $10,000 in income results in a $2,000 increase in tax liability due to the progressive nature of the income tax system.

The Future of Commission Taxation

As the business landscape evolves, so too does the taxation of commissions. With the rise of the gig economy and independent contractors, tax authorities are increasingly focusing on ensuring compliance and fair taxation. This may lead to more stringent regulations and reporting requirements for commission-based income.

Additionally, advancements in technology and digital platforms have made it easier for individuals to track and report their commission income accurately. This transparency can simplify the tax process and reduce the risk of errors or non-compliance.

Frequently Asked Questions

How often should I pay taxes on my commission income?

+

If you are an employee, your employer may withhold taxes from your commissions. However, as an independent contractor, you are responsible for making estimated tax payments throughout the year. It’s recommended to consult a tax professional to determine the appropriate frequency and amount of these payments.

Can I deduct expenses related to earning commissions from my taxable income?

+

Yes, you can deduct legitimate business expenses incurred to earn your commissions. This includes office rent, marketing costs, travel expenses, and other necessary expenditures. Keep detailed records and consult a tax advisor to ensure you maximize your deductions.

What happens if I don’t pay enough estimated taxes throughout the year?

+

If you underpay your estimated taxes, you may face penalties and interest charges. It’s crucial to set aside sufficient funds for tax payments and consult a tax professional to determine the appropriate amount to withhold or pay.

Are there any tax advantages for commission-based income compared to traditional salaries?

+

Commission-based income can offer certain tax advantages, such as the ability to deduct business expenses and potentially lower self-employment taxes. However, the tax landscape is complex, and it’s essential to consult a tax advisor to understand the specific advantages and disadvantages in your situation.

How can I stay updated on changes in commission taxation laws and regulations?

+

Stay informed by subscribing to tax newsletters, following reputable tax blogs, and regularly checking government websites for updates. Additionally, consider attending tax workshops or webinars to stay abreast of the latest developments.