Cincinnati Tax

In the realm of financial management and tax planning, the city of Cincinnati plays a significant role. With its vibrant economy and diverse business landscape, understanding the tax system in Cincinnati is crucial for individuals and businesses alike. This comprehensive guide aims to delve into the intricacies of Cincinnati taxes, offering expert insights and practical advice to navigate the complex world of tax regulations.

Navigating Cincinnati’s Tax Landscape: A Comprehensive Guide

Cincinnati, often hailed as the “Queen City,” boasts a thriving economy, making it an attractive hub for businesses and individuals alike. As such, it is imperative to comprehend the tax obligations and opportunities within this dynamic city. From personal income taxes to business levies, Cincinnati’s tax system presents a unique set of challenges and advantages that warrant careful consideration.

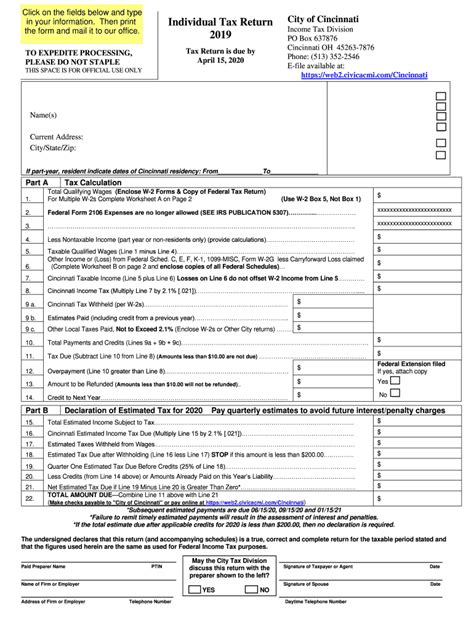

Understanding Cincinnati’s Income Tax Structure

Cincinnati imposes a municipal income tax on individuals and businesses operating within its borders. This tax is separate from state and federal income taxes, making it a unique consideration for taxpayers. The city’s income tax is calculated based on earnings derived from employment, self-employment, and certain investment activities.

The income tax rate in Cincinnati is currently set at 2.1% for residents and 1% for non-residents. This means that individuals who work or own a business in Cincinnati may be subject to these rates, depending on their residency status. It's worth noting that Cincinnati's income tax is levied in addition to any state and federal income taxes, which can significantly impact an individual's or business's overall tax liability.

| Tax Category | Tax Rate |

|---|---|

| Resident Income Tax | 2.1% |

| Non-Resident Income Tax | 1% |

Business Taxes and Incentives in Cincinnati

For businesses operating in Cincinnati, the tax landscape is multifaceted. The city imposes a Gross Receipts Tax on businesses, which is based on the total revenue generated within the city limits. This tax is applied to various industries, including retail, manufacturing, and professional services.

The Gross Receipts Tax rate in Cincinnati is 0.36% for most businesses. However, certain industries, such as utilities and telecommunications, may be subject to different rates. It's crucial for businesses to understand these distinctions to accurately calculate their tax obligations.

| Industry | Gross Receipts Tax Rate |

|---|---|

| General Business | 0.36% |

| Utilities | 0.54% |

| Telecommunications | 0.45% |

In addition to taxes, Cincinnati offers a range of business incentives to attract and retain companies. These incentives include tax credits, abatements, and grants, particularly for businesses that create jobs or invest in the local community. For instance, the Cincinnati Business Growth Incentive program provides tax credits for businesses that meet specific criteria, such as creating a minimum number of jobs or investing a certain amount in the city.

Tax Preparation and Filing in Cincinnati

Navigating Cincinnati’s tax system requires careful preparation and timely filing. Whether you’re an individual or a business, understanding the deadlines and requirements is essential to avoid penalties and ensure compliance.

For individual taxpayers, the Cincinnati Income Tax Division provides resources and guidelines for tax preparation. This includes information on deductions, credits, and filing requirements. It's advisable to consult a tax professional or utilize reputable tax preparation software to ensure accuracy and maximize potential tax benefits.

Businesses operating in Cincinnati must also adhere to specific tax filing requirements. The Cincinnati Office of Business Affairs offers guidance on business taxes, including the Gross Receipts Tax and any applicable industry-specific taxes. Businesses should stay updated on tax deadlines and consider utilizing accounting software or engaging tax experts to streamline the filing process.

Cincinnati’s Tax Climate: Opportunities and Challenges

Cincinnati’s tax system presents both opportunities and challenges for taxpayers. On one hand, the city’s tax incentives and credits can significantly reduce the tax burden for eligible individuals and businesses. These incentives encourage economic growth and job creation, benefiting the local community.

However, the complexity of Cincinnati's tax system, with its various rates and categories, can be a challenge. Staying informed about tax regulations and changes is crucial to avoid pitfalls. Additionally, the city's tax rates, particularly for income tax, can impact an individual's or business's financial planning and decision-making processes.

For businesses, understanding the tax implications of their operations in Cincinnati is vital. This includes not only the direct tax obligations but also the potential impact on pricing strategies and overall profitability. Tax planning becomes a strategic tool to optimize financial outcomes and maintain competitiveness.

Expert Insights: Navigating Cincinnati’s Tax Landscape

As an expert in tax planning and financial management, I offer the following insights for individuals and businesses navigating Cincinnati’s tax system:

- Stay Informed: Keep abreast of tax regulations and updates. Cincinnati's tax landscape can evolve, and being informed ensures compliance and maximizes potential benefits.

- Seek Professional Advice: Consult tax professionals or accountants who specialize in Cincinnati's tax system. Their expertise can provide tailored advice and strategies to optimize your tax position.

- Explore Incentives: Research and understand the city's tax incentives and credits. These opportunities can significantly reduce your tax liability and support your financial goals.

- Plan Strategically: Tax planning is a crucial component of financial management. Integrate tax considerations into your overall financial strategy to make informed decisions and optimize your tax position.

- Utilize Technology: Leverage tax preparation software and accounting tools to streamline your tax filing process. These tools can ensure accuracy and efficiency, saving you time and resources.

In conclusion, Cincinnati's tax system, while complex, offers a range of opportunities and challenges for taxpayers. By staying informed, seeking professional advice, and implementing strategic tax planning, individuals and businesses can navigate this landscape effectively. Understanding Cincinnati's tax obligations and incentives is a critical step towards financial success and compliance.

What is the deadline for filing Cincinnati income taxes?

+The deadline for filing Cincinnati income taxes is typically aligned with the federal and state tax deadlines, which is typically April 15th. However, it’s crucial to check for any specific extensions or changes for the current tax year.

Are there any tax breaks or incentives for green initiatives in Cincinnati?

+Yes, Cincinnati offers tax incentives for businesses and individuals who invest in sustainable practices and green initiatives. The Cincinnati Green Incentive Program provides tax credits for eligible projects, encouraging environmental sustainability.

How can I calculate my Cincinnati income tax liability accurately?

+To calculate your Cincinnati income tax liability accurately, you’ll need to consider your residency status and the applicable tax rate. Use reputable tax preparation software or consult a tax professional to ensure precision in your calculations.