Pay Federal Taxes With Credit Card

Paying federal taxes with a credit card is a convenient and often preferred method for many individuals and businesses. It offers flexibility and can provide certain benefits, such as rewards points or interest-free periods. In this comprehensive guide, we will delve into the process, benefits, and considerations of paying federal taxes using credit cards. From understanding the options available to maximizing rewards and managing potential fees, we aim to provide a detailed analysis for taxpayers looking for an efficient and rewarding tax payment experience.

Understanding the Process of Paying Federal Taxes with Credit Cards

The Internal Revenue Service (IRS) does not directly accept credit card payments for federal taxes. However, taxpayers can utilize third-party processors that are authorized by the IRS to facilitate this payment method. These processors provide a secure platform for individuals and businesses to pay their tax liabilities using major credit cards, including Visa, MasterCard, American Express, and Discover.

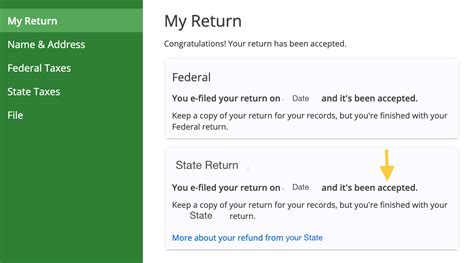

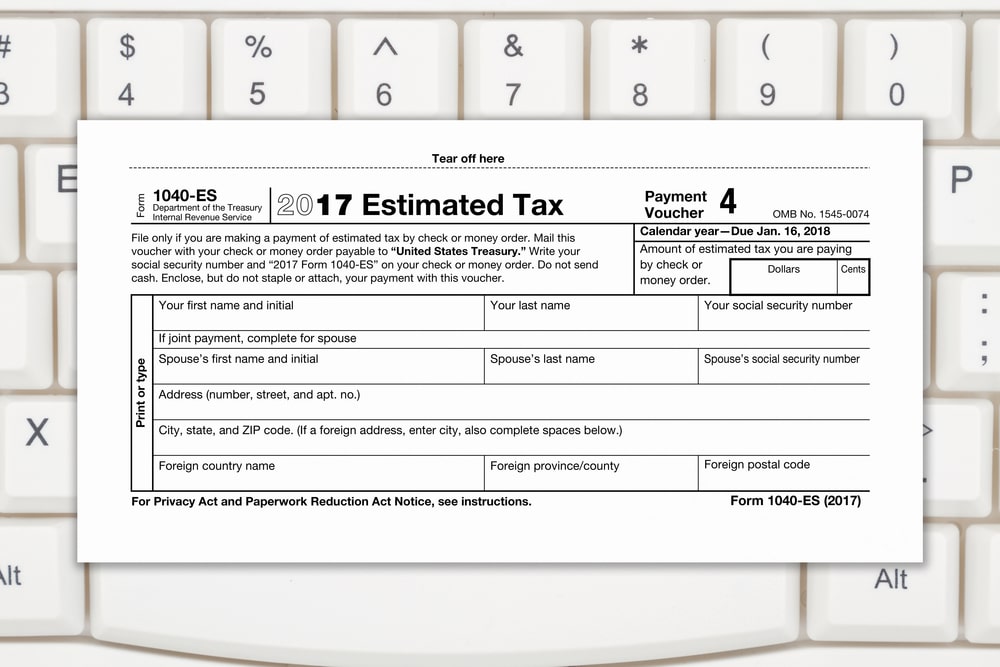

To initiate the payment process, taxpayers can visit the official IRS website, where they will find a list of approved payment processors. These processors often offer online portals or mobile apps that allow users to enter their tax information, select the appropriate tax form, and proceed with the payment. The process typically involves a few simple steps, including:

- Registration: Taxpayers may need to create an account with the chosen processor, providing basic personal or business details.

- Tax Form Selection: Users select the relevant tax form for which they are making the payment, such as Form 1040 for individual income tax.

- Credit Card Details: Taxpayers enter their credit card information, including the card number, expiration date, and CVV.

- Authorization: After verifying the information, the processor seeks authorization from the credit card issuer to process the payment.

- Confirmation: Upon successful authorization, the processor generates a confirmation number or email, which serves as a receipt for the taxpayer.

It's important to note that the IRS does not charge any additional fees for credit card payments. However, the third-party processors typically levy a convenience fee, which varies depending on the processor and the amount of the tax payment. This fee is disclosed during the payment process, allowing taxpayers to make an informed decision.

Benefits and Considerations of Paying Federal Taxes with Credit Cards

Rewards and Incentives

One of the primary advantages of paying federal taxes with a credit card is the opportunity to earn rewards points, cash back, or miles. For individuals or businesses that regularly utilize credit cards for various expenses, this can be a significant benefit. For instance, a taxpayer who holds a credit card that offers 2% cash back on all purchases can effectively earn rewards on their tax payment, which can be redeemed for statement credits, gift cards, or other valuable rewards.

Interest-Free Periods

Credit cards often come with interest-free periods, typically ranging from 20 to 30 days. By paying their federal taxes with a credit card, taxpayers can take advantage of this grace period to avoid incurring interest charges. This can be particularly beneficial for individuals or businesses with tight cash flow, as it allows them to pay their taxes without immediately liquidating assets or disrupting their financial plans.

Improved Cash Flow Management

Paying federal taxes with a credit card can provide taxpayers with greater flexibility in managing their cash flow. Instead of allocating a large sum of money for tax payments, they can spread out the payment over a period of time, making it more manageable. This can be especially useful for businesses that experience seasonal fluctuations in revenue or for individuals who receive irregular income.

Potential Disadvantages and Fees

While paying federal taxes with a credit card offers several benefits, there are also some considerations to keep in mind. One of the primary concerns is the convenience fee charged by the third-party processors. This fee can range from 1.89% to 3.93% of the tax payment amount, depending on the processor and the card type. For larger tax payments, this fee can add up significantly, reducing the overall savings or rewards earned.

Additionally, taxpayers should be aware of potential interest charges if they are unable to pay off their credit card balance within the interest-free period. Credit cards often carry high-interest rates, and carrying a balance can result in substantial interest expenses. It's crucial to plan and budget accordingly to avoid falling into a cycle of debt.

Maximizing Rewards and Minimizing Fees

Choose the Right Credit Card

To maximize rewards and minimize fees, it’s essential to select a credit card that aligns with your spending habits and tax payment needs. If you anticipate making significant tax payments, consider a card that offers high rewards rates on all purchases or specific bonus categories, such as government expenses. For example, the ABC Platinum Card offers 3% cash back on all purchases, providing an excellent opportunity to earn rewards on tax payments.

Utilize Sign-Up Bonuses

If you’re planning to pay a substantial amount in federal taxes, you may want to consider applying for a new credit card that offers a generous sign-up bonus. Many cards provide bonuses of several thousand reward points or a significant cash back reward after spending a certain amount within the first few months of opening the account. By timing your tax payment with the sign-up bonus period, you can maximize your rewards earnings.

Compare Processors and Fees

As mentioned earlier, the convenience fee charged by third-party processors can vary significantly. It’s essential to compare different processors to find the one that offers the lowest fee for your specific tax payment amount. Some processors may also provide promotional offers or discounts for specific credit cards, so it’s worth exploring these options to minimize costs.

Consider Payment Plans

If you’re unable to pay your federal taxes in full using a credit card due to the convenience fee or other financial constraints, consider exploring IRS payment plan options. The IRS offers various payment plan options, including short-term and long-term agreements, which can help you manage your tax liabilities over time without incurring high interest charges.

Case Study: Real-World Example of Paying Federal Taxes with Credit Cards

To illustrate the process and benefits of paying federal taxes with credit cards, let's consider the case of John, a self-employed business owner. John has an upcoming tax liability of $15,000, which he needs to pay by the upcoming deadline.

John decides to pay his taxes using a credit card to earn rewards points and manage his cash flow effectively. He selects a credit card that offers 2% cash back on all purchases and has a $0 annual fee. By paying his taxes with this card, John can potentially earn $300 in cash back rewards, which can be redeemed for statement credits or other valuable rewards.

John visits the IRS website and chooses a third-party processor that offers a convenience fee of 2.35% for credit card payments. He registers an account with the processor, selects the appropriate tax form, and enters his credit card details. After successful authorization, John receives a confirmation email, which serves as a receipt for his tax payment.

While the convenience fee amounts to $352.50 for John's $15,000 tax payment, he still comes out ahead by earning $300 in cash back rewards. This net gain of $47.50, along with the flexibility and improved cash flow management, makes paying federal taxes with a credit card a worthwhile option for John.

Future Implications and Trends in Tax Payment Methods

The landscape of tax payment methods is continuously evolving, driven by advancements in technology and changing consumer preferences. Here are some future implications and trends to consider:

Digital Wallets and Mobile Payments

The rise of digital wallets, such as Apple Pay and Google Pay, has revolutionized the way consumers make payments. These digital wallets offer a secure and convenient method for making tax payments, especially for smaller amounts. As more taxpayers adopt digital wallets, we can expect to see an increase in their acceptance for tax payments, providing an additional layer of convenience.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies are gaining traction in various industries, including finance and taxation. While the IRS has issued guidance on the tax treatment of cryptocurrencies, the acceptance of cryptocurrencies as a valid form of tax payment is still in its early stages. However, as blockchain technology matures and becomes more mainstream, we may see an emergence of tax payment platforms that accept cryptocurrencies, offering taxpayers an alternative payment method.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various aspects of taxation, including tax preparation and compliance. These technologies can also play a role in enhancing the tax payment process. AI-powered chatbots and virtual assistants can provide taxpayers with real-time assistance and guidance during the payment process, improving the overall user experience. Additionally, ML algorithms can analyze tax payment patterns and offer personalized recommendations to taxpayers, helping them make more informed decisions.

Increased Focus on Security and Privacy

As tax payment methods become more digital and interconnected, ensuring the security and privacy of taxpayer data becomes paramount. Taxpayers are increasingly concerned about the protection of their personal and financial information. To address these concerns, tax payment platforms will need to invest in robust security measures, such as encryption protocols and multi-factor authentication, to safeguard sensitive data.

Conclusion: The Evolving Landscape of Tax Payment Methods

Paying federal taxes with a credit card offers taxpayers a convenient and rewarding option. By understanding the process, benefits, and considerations, individuals and businesses can make informed decisions to maximize their rewards and manage potential fees effectively. As technology continues to advance and consumer preferences evolve, we can expect to see further innovations in tax payment methods, providing taxpayers with even more options to choose from.

Can I pay my entire tax liability with a credit card?

+Yes, you can pay your entire tax liability with a credit card, provided you have the available credit limit. However, keep in mind that third-party processors charge a convenience fee, which can add up for larger tax payments. Consider the convenience fee and your credit limit when deciding on the payment amount.

Are there any tax benefits for paying with a credit card?

+Paying federal taxes with a credit card can offer tax benefits indirectly. By earning rewards points, cash back, or miles, you can effectively reduce the overall cost of your tax payment. Additionally, utilizing a credit card with an interest-free period can help you avoid interest charges if you pay off the balance within the grace period.

What if I can’t pay my entire tax liability within the interest-free period of my credit card?

+If you are unable to pay your entire tax liability within the interest-free period, it’s important to be mindful of the high-interest rates associated with credit cards. Consider exploring IRS payment plan options to manage your tax liabilities over a longer period, avoiding substantial interest charges.

Are there any security concerns when paying federal taxes with a credit card online?

+While paying federal taxes online is generally secure, it’s essential to exercise caution and ensure you are using a trusted and secure platform. Look for websites that use HTTPS encryption and have security badges or certificates. Additionally, keep your credit card information secure and be cautious of phishing attempts or suspicious emails.