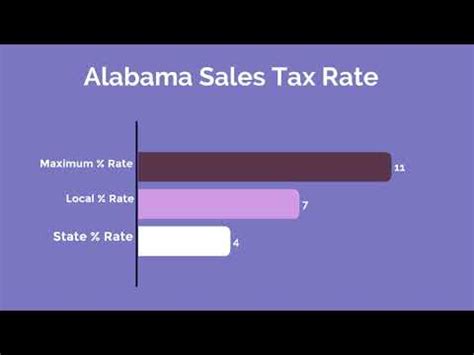

Alabama Sales Tax Rate

Welcome to a comprehensive exploration of the Alabama Sales Tax Rate, a critical component of the state's revenue generation and an essential aspect of its economic landscape. This article aims to provide an in-depth understanding of the sales tax structure in Alabama, its implications for businesses and consumers, and its role in shaping the state's fiscal policies.

Unraveling the Alabama Sales Tax Structure

The sales tax in Alabama is a crucial revenue source for the state government, funding various public services and infrastructure projects. The state sales tax rate in Alabama currently stands at 4%, one of the lower rates among U.S. states. However, this is not the full picture, as Alabama's sales tax system is a bit more intricate than a straightforward percentage.

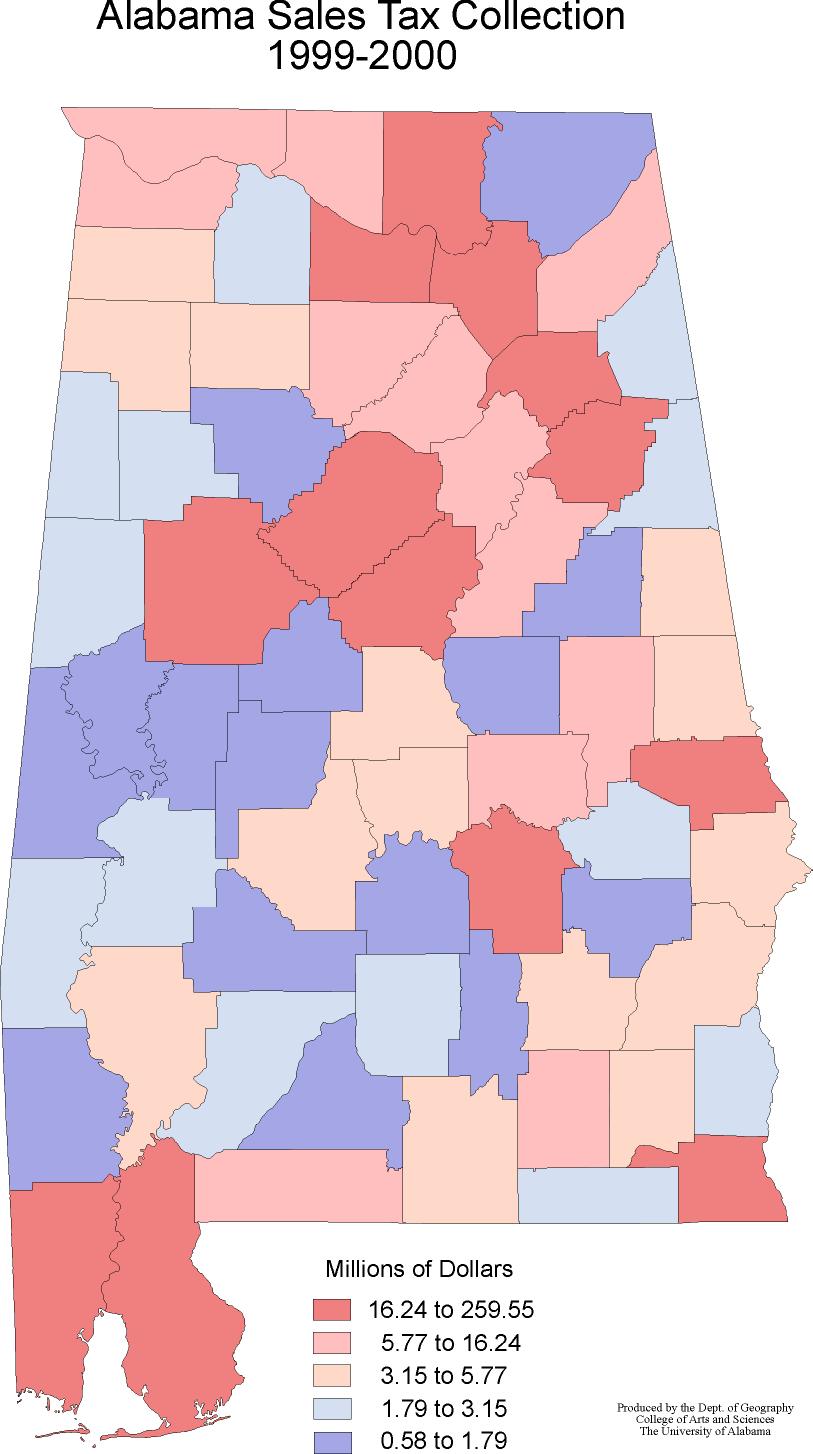

Alabama operates on a two-tiered sales tax system, comprising a state-level sales tax and an additional local sales tax. The state-level sales tax of 4% is applied uniformly across the state, while the local sales tax varies depending on the jurisdiction. These local sales taxes can range from 0% to 4%, bringing the total sales tax rate to 8% in some areas. This variability in local sales tax rates means that the effective sales tax rate can differ significantly across the state.

Understanding Local Sales Tax Variations

The local sales tax in Alabama is implemented at the county and municipal levels, with each jurisdiction having the authority to set its own rate. This means that the total sales tax rate can vary not only between counties but also between different cities within the same county. For instance, the city of Birmingham has a local sales tax rate of 5%, while neighboring Hoover has a rate of 4%. This can lead to a situation where two neighboring areas have different sales tax rates, potentially influencing consumer behavior and business strategies.

To provide a clearer picture, here's a table showcasing the sales tax rates in some major cities in Alabama:

| City | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Birmingham | 5% | 9% |

| Montgomery | 4% | 8% |

| Mobile | 4% | 8% |

| Huntsville | 4% | 8% |

| Tuscaloosa | 3% | 7% |

These variations in local sales tax rates can have a significant impact on businesses and consumers alike. For businesses, it means a complex tax landscape to navigate, with different tax rates applicable to different areas they operate in. For consumers, it might influence their purchasing decisions, potentially driving them to seek out lower-taxed areas for significant purchases.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Alabama applies to most tangible personal property, there are certain categories of goods and services that are exempt from sales tax. These exemptions can vary based on the type of item, the intended use, or the status of the purchaser.

Exempt Goods and Services

Some of the notable categories exempt from sales tax in Alabama include:

- Groceries: Most food items intended for home consumption are exempt from sales tax.

- Prescription Drugs: Medications dispensed by a pharmacist are tax-exempt.

- Certain Services: Services such as legal, accounting, and medical are generally not subject to sales tax.

- Agricultural Equipment: Sales of machinery and equipment used directly in agricultural production are exempt.

- Residential Rentals: Leases of residential properties are not subject to sales tax.

These exemptions can significantly impact the purchasing decisions of consumers and the revenue generation of the state. For instance, the exemption on groceries encourages consumers to spend more on essential items without the burden of tax, while the exemption on residential rentals can make the state more attractive for real estate investors.

Special Tax Rates and Programs

Alabama also offers certain special tax rates and programs to promote specific industries or support particular initiatives. For instance, the state has a Machinery and Equipment Tax Credit program, which provides a sales and use tax credit for purchases of certain machinery and equipment used in manufacturing, processing, or fabrication operations. This program aims to encourage investment in these sectors and support economic development.

Additionally, Alabama participates in the Streamlined Sales and Use Tax Agreement (SSUTA), a multi-state initiative to simplify sales and use tax collection and administration. This program provides a uniform sales tax base and streamlined registration and filing procedures, making it easier for businesses to comply with sales tax regulations across participating states.

The Impact on Businesses and Consumers

The Alabama sales tax rate has a significant impact on both businesses and consumers within the state. For businesses, the sales tax is a cost of doing business that can influence their pricing strategies, operational costs, and overall profitability. The varying local sales tax rates can also present a challenge in terms of tax compliance and administrative complexity.

For consumers, the sales tax rate can affect their purchasing power and decisions. A higher sales tax rate can make certain purchases more expensive, potentially influencing where and how much they choose to spend. The sales tax rate can also impact the overall cost of living in an area, particularly for essential items that are not exempt from sales tax.

Strategies for Businesses

Businesses operating in Alabama need to carefully consider the sales tax rate and its variations across the state. Here are some strategies that businesses can employ to navigate the Alabama sales tax landscape effectively:

- Centralized Tax Management: Implement a centralized tax management system to handle sales tax calculations and compliance across different jurisdictions. This can help streamline the process and reduce administrative burdens.

- Price Strategies: Consider the sales tax rate when setting prices for goods and services. Ensure that prices are competitive yet reflect the additional sales tax cost.

- Exemption Awareness: Stay informed about sales tax exemptions and special programs that can benefit your business. For instance, the Machinery and Equipment Tax Credit can provide significant savings for qualifying businesses.

- Sales Tax Software: Utilize sales tax software to automate tax calculations and compliance. This can reduce the risk of errors and ensure compliance with the varying tax rates across the state.

Consumer Considerations

Consumers in Alabama should also be aware of the sales tax rate and its variations to make informed purchasing decisions. Here are some considerations for consumers:

- Compare Prices: When making significant purchases, compare prices across different retailers, both within and outside your local area. This can help you find the best deal, especially if the sales tax rate varies significantly between jurisdictions.

- Exemptions and Discounts: Take advantage of sales tax exemptions on essential items like groceries and prescription drugs. Additionally, look for sales or discounts that can offset the sales tax cost.

- Online Shopping: Consider online shopping, especially for larger purchases. This can provide more flexibility in terms of pricing and may offer opportunities to purchase from retailers in lower-taxed areas.

Future Outlook and Potential Changes

The Alabama sales tax rate and its structure are subject to change, influenced by various economic and political factors. Here are some potential future developments and their implications:

Economic Growth and Fiscal Needs

As Alabama's economy continues to grow and evolve, the state may face increased fiscal demands to support infrastructure development, education, and other public services. In such scenarios, there could be pressure to increase the state sales tax rate or explore new revenue sources. However, any significant tax changes would likely face public scrutiny and require careful consideration of their impact on businesses and consumers.

Tax Reform Initiatives

Alabama, like many other states, has considered various tax reform initiatives in recent years. These initiatives often aim to simplify the tax system, improve fairness, and enhance revenue generation. For instance, there have been discussions about consolidating the state and local sales tax rates, which could provide a more uniform tax structure but might also result in higher overall tax rates in some areas.

Impact of Online Sales

The rise of e-commerce and online sales presents a unique challenge for sales tax collection. Alabama, along with many other states, has been working to ensure that sales taxes are collected on online transactions, particularly those made with out-of-state retailers. This effort aims to level the playing field for local businesses and ensure that all retailers contribute to the state's revenue stream.

Conclusion

The Alabama sales tax rate is a dynamic and complex component of the state's fiscal system, with significant implications for businesses and consumers alike. The state's two-tiered sales tax structure, with its varying local rates, creates a unique landscape that businesses and consumers must navigate. Understanding this structure and its potential impacts is essential for making informed decisions and staying compliant with tax regulations.

As Alabama continues to evolve and adapt to economic and technological changes, its sales tax system will likely undergo further developments and reforms. Staying informed about these changes and their potential effects will be crucial for businesses and consumers to thrive in Alabama's economic landscape.

Frequently Asked Questions

What is the current state sales tax rate in Alabama?

+The current state sales tax rate in Alabama is 4%.

Are there any local sales taxes in Alabama, and if so, how much do they vary?

+Yes, there are local sales taxes in Alabama, and they can vary significantly. Local sales taxes range from 0% to 4%, bringing the total sales tax rate to 8% in some areas.

What are some common sales tax exemptions in Alabama?

+Common sales tax exemptions in Alabama include groceries, prescription drugs, certain services like legal and medical, agricultural equipment, and residential rentals.

How do the varying sales tax rates affect businesses and consumers in Alabama?

+Varying sales tax rates can impact businesses through pricing strategies, operational costs, and tax compliance. For consumers, it can influence purchasing decisions and the overall cost of living, particularly for non-exempt items.

What potential future changes could impact the Alabama sales tax rate and structure?

+Potential future changes include economic growth and fiscal needs, tax reform initiatives, and the continued evolution of online sales and their impact on tax collection.