Texas Paycheck Tax Calculator

Welcome to the comprehensive guide to the Texas Paycheck Tax Calculator, an essential tool for anyone looking to understand and manage their tax obligations in the great state of Texas. Whether you're a seasoned business owner or a recent transplant to the Lone Star State, this article will provide you with a detailed breakdown of the tax landscape and how to navigate it efficiently. From calculating payroll taxes to understanding the unique aspects of Texas' tax system, we've got you covered.

Unraveling the Complexity of Texas Payroll Taxes

Texas, with its vibrant economy and diverse industries, presents a unique set of challenges when it comes to payroll taxes. Unlike some states with straightforward tax systems, Texas boasts a diverse array of tax regulations that can be daunting for both employers and employees. This section will delve into the intricacies of Texas payroll taxes, offering a comprehensive guide to ensure you’re equipped to handle these complexities with ease.

Understanding the Texas Payroll Tax Structure

The Texas payroll tax system is a multi-faceted beast, encompassing a range of taxes and deductions that can significantly impact your take-home pay. To simplify this process, we’ll break down the key components of the Texas payroll tax structure, from federal and state income taxes to social security and Medicare contributions. By understanding these elements, you’ll be able to accurately calculate your tax obligations and ensure compliance with Texas’ tax regulations.

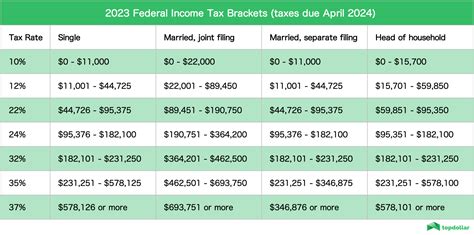

| Tax Type | Description | Rate |

|---|---|---|

| Federal Income Tax | Based on taxable income and filing status, subject to federal tax brackets. | Varies by income level |

| State Income Tax | Texas has a flat state income tax rate, applied to taxable income. | 0.00% |

| Social Security | A federal payroll tax to fund Social Security benefits. | 6.2% (Employee), 6.2% (Employer) |

| Medicare Tax | A federal payroll tax to fund Medicare healthcare benefits. | 1.45% (Employee), 1.45% (Employer) |

| Unemployment Tax | State tax to fund unemployment benefits, rates vary by employer. | Varies |

It's important to note that while Texas does not have a state income tax, it still participates in federal income tax and other payroll taxes. This means that while you may see a larger portion of your paycheck, it's crucial to understand and manage these other tax obligations.

Navigating the Texas Payroll Tax Calculator

The Texas Paycheck Tax Calculator is your indispensable ally when it comes to navigating the state’s payroll tax system. This powerful tool allows you to input your specific details, such as income, deductions, and allowances, to generate an accurate estimate of your tax obligations. By leveraging the calculator’s advanced features and user-friendly interface, you can gain a clear understanding of how your tax liability is calculated and make informed decisions about your financial future.

Let's take a closer look at the step-by-step process of using the Texas Paycheck Tax Calculator:

- Input Your Income: Start by entering your gross income, which is your total earnings before any deductions or taxes. This could include wages, salaries, bonuses, or other forms of compensation.

- Choose Your Filing Status: Select your filing status, which could be Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er). This status determines your tax rate and any applicable deductions.

- Add Deductions and Allowances: Input any applicable deductions and allowances, such as standard deductions, itemized deductions (e.g., mortgage interest, charitable contributions), or personal exemptions. These deductions reduce your taxable income and can significantly impact your tax liability.

- Calculate Federal and State Taxes: The calculator will compute your federal and state income taxes based on your income, filing status, and deductions. It will also account for any applicable tax credits or adjustments.

- Compute Social Security and Medicare Taxes: These payroll taxes are automatically deducted from your paycheck and contribute to your Social Security and Medicare benefits. The calculator will calculate these taxes based on your gross income.

- Review and Adjust: Once the calculator provides your estimated tax liability, review the results and make any necessary adjustments. You can play around with different scenarios, such as increasing deductions or changing your filing status, to see how it impacts your tax obligations.

- Save and Share: The calculator often allows you to save your calculations for future reference or share the results with your employer or tax professional. This ensures accuracy and transparency in your payroll processing.

By following these steps and utilizing the Texas Paycheck Tax Calculator, you can take control of your tax obligations and make informed financial decisions. Remember, while the calculator provides an estimate, it's always advisable to consult with a tax professional for personalized advice and guidance.

Dive Deeper: Key Considerations for Texas Payroll Taxes

As we continue our exploration of the Texas payroll tax landscape, it’s important to delve into some of the key considerations that can impact your tax obligations. From understanding the nuances of Texas’ unique tax system to exploring strategies for optimizing your payroll tax management, this section will provide you with the insights and tools you need to navigate these complexities with confidence.

Texas’ Unique Tax System: What You Need to Know

Texas stands out among US states with its unique tax system, characterized by a lack of state income tax. While this may seem like a boon for taxpayers, it’s important to understand that Texas still imposes other taxes and fees that can significantly impact your financial situation. Here’s a deeper look at the key components of Texas’ tax system and how they can affect your payroll taxes.

- Sales Tax: Texas has a state sales tax rate of 6.25%, which can vary by locality. This tax is imposed on the sale of most goods and some services, and it can have a significant impact on your purchasing power and overall financial health.

- Property Tax: Property taxes in Texas are among the highest in the nation. These taxes are levied on real estate and personal property and can vary significantly depending on the location and type of property. Understanding your property tax obligations is crucial for accurate financial planning.

- Franchise Tax: Texas imposes a franchise tax on businesses operating within the state. This tax is based on the business's taxable margin, which includes gross receipts, compensation, and cost of goods sold. Understanding how this tax applies to your business is essential for accurate payroll tax management.

- Local Taxes: In addition to state taxes, Texas has a multitude of local taxes, including city and county taxes. These taxes can vary significantly across different regions and can impact your overall tax burden. It's important to stay informed about these local taxes and how they affect your financial situation.

By understanding these unique aspects of Texas' tax system, you can better navigate the complexities of payroll tax management and ensure compliance with all applicable regulations. Remember, staying informed and proactive is key to successful financial management in the Lone Star State.

Optimizing Your Payroll Tax Management: Strategies and Tips

Efficient payroll tax management is crucial for any business, and Texas is no exception. By implementing strategic approaches and staying informed about the latest tax regulations, you can optimize your payroll tax processes and ensure compliance while minimizing your tax burden. Here are some key strategies and tips to consider for effective payroll tax management in Texas.

- Stay Updated on Tax Regulations: Texas tax laws and regulations can change frequently, so it's essential to stay informed. Subscribe to updates from the Texas Comptroller's office, follow tax-focused news outlets, and consult with tax professionals to ensure you're aware of any changes that could impact your payroll taxes.

- Utilize Tax Software: Invest in reliable tax software specifically designed for payroll tax management. These tools can automate many of the complex calculations and processes involved in payroll tax compliance, saving you time and reducing the risk of errors.

- Establish Accurate Record-Keeping: Maintain detailed and organized records of all payroll-related transactions, including employee wages, deductions, and tax payments. This not only ensures compliance but also provides a clear audit trail if any tax issues arise.

- Review and Adjust Payroll Deductions: Regularly review your payroll deductions to ensure they're accurate and up-to-date. This includes verifying employee withholdings for federal and state taxes, as well as contributions to benefits such as health insurance, retirement plans, and flexible spending accounts.

- Consider Tax-Efficient Employee Benefits: Explore tax-efficient employee benefits that can help reduce your payroll tax burden while enhancing your employees' overall compensation. Options such as flexible spending accounts (FSAs), health savings accounts (HSAs), and transit benefits can provide significant tax advantages.

- Seek Professional Guidance: When in doubt, consult with tax professionals who specialize in payroll taxes. They can provide expert advice tailored to your specific situation, helping you navigate the complexities of Texas' tax system and ensure compliance.

By implementing these strategies and staying proactive in your payroll tax management, you can optimize your tax obligations and ensure a smooth and compliant financial operation. Remember, effective tax management is an ongoing process that requires regular attention and adaptation to changing regulations and business needs.

Conclusion: Your Guide to Mastering Texas Payroll Taxes

In the dynamic landscape of Texas’ payroll taxes, knowledge is power. By understanding the intricacies of the state’s tax system and leveraging tools like the Texas Paycheck Tax Calculator, you can navigate these complexities with confidence and precision. Whether you’re an employer seeking to optimize your payroll tax management or an employee aiming to maximize your take-home pay, this comprehensive guide has equipped you with the insights and tools to succeed.

Remember, effective tax management is an ongoing process that requires regular attention and adaptation. Stay informed, seek professional guidance when needed, and continue to explore the evolving landscape of Texas' tax system. With the right tools and mindset, you can ensure compliance, minimize your tax burden, and make the most of your financial opportunities in the Lone Star State.

FAQ

What is the Texas Paycheck Tax Calculator, and how does it work?

+

The Texas Paycheck Tax Calculator is an online tool designed to help individuals and businesses calculate their payroll tax obligations in the state of Texas. It takes into account various factors such as income, deductions, and tax rates to provide an estimate of the taxes that need to be withheld from employee paychecks. The calculator works by inputting relevant information and applying the appropriate tax rates and deductions to arrive at a final tax liability amount.

Is Texas’ state income tax rate 0%? If so, why do I still have payroll taxes deducted from my paycheck?

+

Yes, Texas does not have a state income tax, which means that your paycheck will not be subject to state income tax deductions. However, this does not mean that you won’t have any payroll taxes deducted from your paycheck. Texas still imposes other payroll taxes, such as federal income tax, Social Security tax, Medicare tax, and unemployment tax. These taxes are mandatory and are used to fund various government programs and services.

Can I use the Texas Paycheck Tax Calculator for multiple pay periods or different income levels?

+

Absolutely! The Texas Paycheck Tax Calculator is designed to be flexible and adaptable to different scenarios. You can use it to calculate payroll taxes for various pay periods, whether it’s weekly, biweekly, or monthly. Additionally, you can input different income levels to see how tax obligations change based on your earnings. This feature allows you to plan and budget effectively, ensuring you understand the impact of income fluctuations on your tax liability.

Are there any additional taxes or fees I should be aware of in Texas besides payroll taxes?

+

Yes, while payroll taxes are a significant component of your tax obligations in Texas, there are other taxes and fees to consider. These include sales tax, which is imposed on most goods and services purchased within the state, and property tax, which is levied on real estate and personal property. Additionally, businesses may be subject to franchise taxes, while individuals may have to pay local taxes depending on their municipality. It’s important to stay informed about these additional taxes to ensure you’re complying with all applicable regulations.

How accurate is the Texas Paycheck Tax Calculator, and can I rely on its estimates for my financial planning?

+

The Texas Paycheck Tax Calculator is designed to provide accurate estimates based on the information you input. However, it’s important to note that it’s an estimation tool and may not account for all specific circumstances or changes in tax regulations. While the calculator can be a valuable resource for financial planning, it’s always recommended to consult with a tax professional or accountant for personalized advice and to ensure compliance with the latest tax laws and regulations.