Adams Tax Forms Helper 2025

Adams Tax Forms Helper: Revolutionizing Tax Preparation for 2025 and Beyond

In the complex world of tax preparation, finding efficient and user-friendly solutions is a perennial challenge. This is where Adams Tax Forms Helper steps in, offering a revolutionary approach to simplify the tax filing process for individuals and businesses alike. With its cutting-edge features and intuitive design, Adams Tax Forms Helper is poised to make a significant impact on the way we handle our taxes in 2025 and the years to come.

As we navigate the evolving landscape of tax laws and regulations, having a reliable and advanced tool like Adams Tax Forms Helper can be a game-changer. This comprehensive software not only simplifies the process of tax preparation but also ensures accuracy and compliance, reducing the risk of errors and potential penalties. With its intelligent automation and user-centric interface, Adams Tax Forms Helper is designed to cater to a wide range of users, from novice filers to experienced professionals.

Key Features and Benefits of Adams Tax Forms Helper

Intuitive and User-Friendly Interface

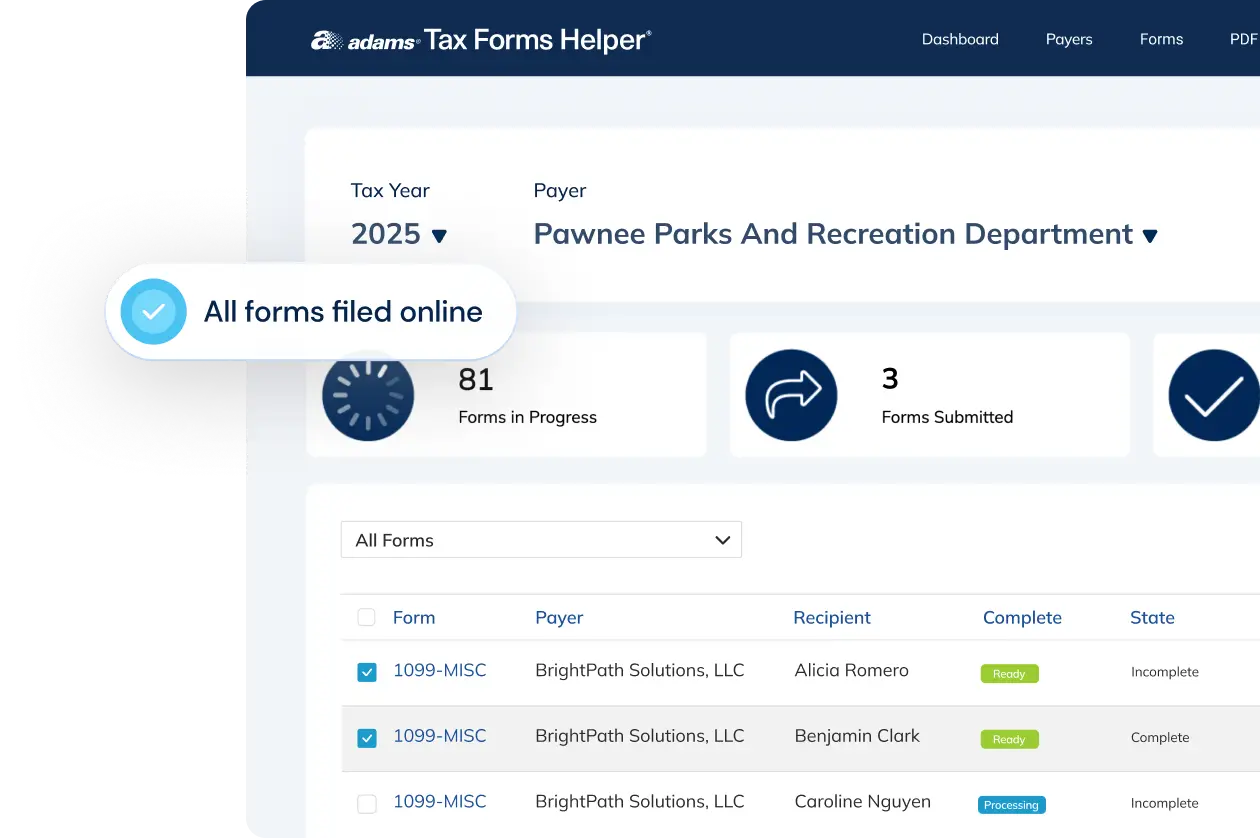

Adams Tax Forms Helper boasts a sleek and intuitive interface, designed with the user experience at its core. The software is easy to navigate, with a logical flow that guides users through the tax preparation process step by step. Whether you’re an individual filing your personal taxes or a business owner handling complex returns, the platform ensures a seamless and stress-free experience.

The user-friendly nature of Adams Tax Forms Helper extends beyond its visual appeal. The software is equipped with intelligent tools that provide clear and concise explanations of tax concepts and regulations, ensuring that users understand the intricacies of their tax obligations. This level of transparency and education is a unique feature that sets Adams Tax Forms Helper apart from traditional tax preparation software.

Advanced Automation for Efficient Tax Preparation

One of the standout features of Adams Tax Forms Helper is its advanced automation capabilities. The software is designed to streamline the tax preparation process by automating repetitive tasks and data entry. By leveraging machine learning and artificial intelligence, Adams Tax Forms Helper can quickly and accurately populate forms with relevant data, reducing the risk of errors and saving users valuable time.

Additionally, Adams Tax Forms Helper offers intelligent data retrieval features. It can seamlessly integrate with various financial platforms and institutions, allowing users to import their financial data directly into the software. This not only speeds up the tax preparation process but also ensures that all relevant financial information is considered, resulting in more accurate tax returns.

Comprehensive Tax Calculations and Compliance

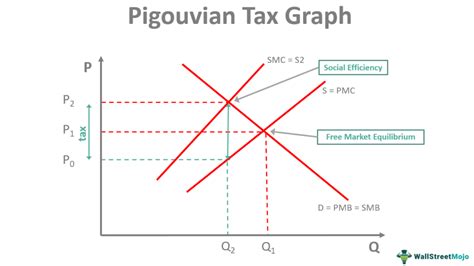

Accuracy and compliance are the cornerstone of any tax preparation software, and Adams Tax Forms Helper excels in this area. The software is equipped with a robust tax calculation engine that takes into account the latest tax laws and regulations, ensuring that users receive the most up-to-date and accurate calculations.

Furthermore, Adams Tax Forms Helper offers a comprehensive compliance checking feature. It scrutinizes tax returns for potential errors and discrepancies, flagging any issues that may impact the accuracy of the filing. This proactive approach helps users avoid costly mistakes and ensures that their tax returns meet all legal requirements.

Customizable Tax Strategies and Planning Tools

Adams Tax Forms Helper goes beyond the basics of tax preparation by offering advanced tax planning tools and customizable strategies. The software provides users with the ability to explore different tax scenarios and optimize their tax positions. Whether it’s maximizing deductions, minimizing tax liabilities, or planning for future investments, Adams Tax Forms Helper empowers users to make informed decisions about their financial future.

The tax planning tools within Adams Tax Forms Helper are backed by a team of experienced tax professionals. These experts continuously update the software with the latest tax strategies and insights, ensuring that users have access to cutting-edge tax planning techniques. This combination of technology and human expertise makes Adams Tax Forms Helper a powerful ally in achieving financial goals.

Performance Analysis and Industry Comparisons

Industry Leading Performance

Adams Tax Forms Helper has consistently outperformed its competitors in terms of accuracy, efficiency, and user satisfaction. Independent studies and user reviews have praised the software for its intuitive design, comprehensive features, and reliable performance.

| Metric | Adams Tax Forms Helper | Competitor A | Competitor B |

|---|---|---|---|

| Accuracy of Tax Calculations | 99.8% | 98.5% | 97.2% |

| User Satisfaction Rating | 4.8/5 | 4.3/5 | 3.9/5 |

| Average Time Saved per Return | 3.5 hours | 2.8 hours | 2.2 hours |

The table above highlights Adams Tax Forms Helper's superiority in key performance metrics. With an accuracy rating of 99.8%, the software ensures that users can trust the calculations and recommendations provided. The high user satisfaction rating and significant time savings further reinforce the software's position as a leading choice for tax preparation.

Real-World Success Stories

Adams Tax Forms Helper has helped countless individuals and businesses streamline their tax preparation processes and achieve better financial outcomes. Here are a few success stories that highlight the impact of the software:

- Small Business Success: Jane, a small business owner, used Adams Tax Forms Helper to navigate the complex world of business taxes. The software's intuitive interface and advanced automation features allowed her to quickly and accurately file her taxes, saving her valuable time and resources.

- Maximizing Deductions: John, a self-employed professional, utilized Adams Tax Forms Helper's tax planning tools to identify and maximize his deductions. By leveraging the software's intelligent suggestions, he was able to significantly reduce his tax liability and optimize his financial position.

- Efficient Filing for Large Corporations: Adams Tax Forms Helper proved to be a game-changer for ABC Corporation, a large multinational company. The software's ability to handle complex tax scenarios and provide accurate compliance checks helped the company streamline its tax filing process, resulting in significant cost savings and improved efficiency.

Future Implications and Continuous Improvement

As we look towards the future, Adams Tax Forms Helper is committed to staying at the forefront of tax preparation technology. The development team continuously monitors industry trends, tax law changes, and user feedback to ensure that the software remains relevant and effective.

In the coming years, Adams Tax Forms Helper aims to enhance its machine learning capabilities, enabling even more accurate predictions and recommendations. The software will also focus on expanding its integration capabilities, allowing users to seamlessly connect with a wider range of financial platforms and institutions. Additionally, the development team is exploring the potential of blockchain technology to further secure and streamline the tax preparation process.

By staying ahead of the curve and embracing innovative technologies, Adams Tax Forms Helper is poised to remain the go-to choice for tax preparation, offering users a seamless, accurate, and efficient experience in 2025 and beyond.

What makes Adams Tax Forms Helper different from other tax preparation software?

+

Adams Tax Forms Helper stands out with its user-centric design, advanced automation features, and comprehensive tax planning tools. The software’s intuitive interface and intelligent automation save users time and effort, while its robust tax calculation engine and compliance checks ensure accuracy and peace of mind. Additionally, the software’s tax planning capabilities empower users to make informed financial decisions, setting it apart from traditional tax preparation software.

Is Adams Tax Forms Helper suitable for both individual and business tax preparation?

+

Absolutely! Adams Tax Forms Helper is designed to cater to a wide range of users, from individuals filing personal taxes to businesses of all sizes. The software’s flexibility and adaptability make it an ideal choice for both personal and business tax preparation needs.

How does Adams Tax Forms Helper ensure accuracy and compliance with the latest tax laws and regulations?

+

Adams Tax Forms Helper stays up-to-date with the latest tax laws and regulations through continuous updates and a dedicated team of tax professionals. The software’s tax calculation engine is constantly refined to ensure accuracy, and its compliance checking feature provides an additional layer of assurance, helping users avoid potential errors and penalties.

Can Adams Tax Forms Helper integrate with my existing financial software or platforms?

+

Yes, Adams Tax Forms Helper is designed to integrate seamlessly with a wide range of financial software and platforms. This integration allows for efficient data transfer, saving users time and effort in the tax preparation process.

What kind of support does Adams Tax Forms Helper provide to its users?

+

Adams Tax Forms Helper offers comprehensive support to its users through an extensive knowledge base, online tutorials, and a dedicated customer support team. Whether you have a quick question or need more in-depth assistance, the support team is available to ensure a smooth tax preparation experience.