Maryland Sales Tax On Cars

In the state of Maryland, sales tax is a significant aspect of purchasing a vehicle, and understanding the tax implications can help car buyers make informed decisions. This article aims to provide a comprehensive guide to Maryland's sales tax on cars, covering the rates, exemptions, and the process of calculating and paying this tax. By exploring these topics in depth, we will uncover the intricacies of this tax and its impact on vehicle purchases in Maryland.

Understanding Maryland’s Sales Tax Structure

Maryland, like many other states, imposes a sales and use tax on the purchase of tangible personal property, including vehicles. This tax is administered by the Maryland Comptroller of Maryland and is a crucial revenue source for the state. The sales tax rate is uniform across the state but can vary depending on certain factors, as we will explore below.

The Uniform Sales Tax Rate

The general sales tax rate in Maryland is set at 6%. This rate is applicable to most retail transactions, including the purchase of vehicles. It is important to note that this rate can be subject to change, and car buyers should always refer to the most recent tax rates provided by the Comptroller’s office.

| Tax Rate Category | Sales Tax Rate |

|---|---|

| Standard Rate | 6% |

| Optional Local Tax | Up to 3% |

In addition to the standard rate, Maryland allows local jurisdictions to impose an optional local tax, known as the Local Option Tax, on top of the state sales tax. This local tax can vary from county to county and can add up to an additional 3% to the total sales tax rate. This means that in certain areas, the combined state and local sales tax rate can reach as high as 9%.

Sales Tax Calculation

When purchasing a vehicle in Maryland, the sales tax is calculated based on the purchase price of the car. This includes the base price of the vehicle, any additional options, accessories, and dealer preparation charges. The tax is applied to the total amount, and the buyer is responsible for paying this tax at the time of purchase.

To illustrate this, let's consider an example. If a buyer purchases a car with a base price of $30,000 and adds options worth $2,000, the total purchase price would be $32,000. Applying the standard 6% sales tax rate, the tax amount would be calculated as follows:

Sales Tax Amount = Purchase Price x Sales Tax Rate

Sales Tax Amount = $32,000 x 0.06

Sales Tax Amount = $1,920

So, in this case, the buyer would need to pay an additional $1,920 in sales tax on top of the purchase price.

Exemptions and Special Considerations

While the standard sales tax rate applies to most vehicle purchases, there are certain exemptions and special considerations that car buyers in Maryland should be aware of.

Trade-Ins and Rebates: When trading in an old vehicle, the sales tax is calculated based on the net purchase price, which is the difference between the new vehicle's purchase price and the trade-in allowance. Additionally, any rebates or discounts offered by the dealer or manufacturer are deducted from the purchase price before calculating the sales tax.

Military Personnel: Active-duty military personnel who are Maryland residents and purchase a vehicle while stationed out of state may be eligible for a sales tax exemption. This exemption applies to the purchase of a new or used vehicle, and the tax is waived as long as the vehicle is registered in Maryland within 90 days of purchase.

Leased Vehicles: For leased vehicles, the sales tax is typically calculated based on the capitalized cost of the lease. This cost includes the vehicle's purchase price, any down payment, and the residual value at the end of the lease term. The tax is then divided equally across the lease payments.

Vehicles for Business Use: If a vehicle is purchased primarily for business use, the sales tax may be eligible for a partial or full exemption. To qualify, the vehicle must be registered under the business name and used primarily for business purposes. The tax exemption can be claimed when filing the business's tax returns.

The Process of Paying Sales Tax on Car Purchases

When buying a vehicle in Maryland, understanding the process of paying the sales tax is crucial. Here’s a step-by-step guide to help car buyers navigate this process smoothly.

Step 1: Determine the Sales Tax Rate

Before finalizing the purchase, car buyers should confirm the applicable sales tax rate. As mentioned earlier, this rate can vary depending on the jurisdiction where the vehicle is purchased. The standard state rate is 6%, but buyers should also consider the optional local tax rate, which can add up to an additional 3%.

Step 2: Calculate the Sales Tax Amount

Using the purchase price of the vehicle, calculate the sales tax amount. This can be done by multiplying the purchase price by the applicable tax rate. For example, if the purchase price is $30,000 and the tax rate is 9% (6% state rate + 3% local rate), the sales tax amount would be:

Sales Tax Amount = Purchase Price x Sales Tax Rate

Sales Tax Amount = $30,000 x 0.09

Sales Tax Amount = $2,700

Step 3: Pay the Sales Tax at the Time of Purchase

Car buyers are typically required to pay the calculated sales tax amount at the time of purchase. This can be done through various payment methods, including cash, check, or credit card. It is important to ensure that the sales tax is paid in full to avoid any legal consequences or penalties.

Step 4: Obtain the Necessary Documentation

After paying the sales tax, the buyer should receive a receipt or documentation confirming the payment. This documentation is crucial as it serves as proof of payment and is often required for vehicle registration and other legal purposes.

Step 5: Register the Vehicle

Once the sales tax has been paid, the next step is to register the vehicle with the Maryland Motor Vehicle Administration (MVA). This process involves providing the necessary documentation, such as the vehicle’s title, proof of insurance, and the sales tax payment receipt. The MVA will then issue the vehicle registration and license plates.

Step 6: Keep Records and Receipts

It is essential for car buyers to keep accurate records and receipts related to the vehicle purchase, including the sales tax payment. These documents can be useful for tax purposes, insurance claims, and any future legal or administrative matters.

Impact of Sales Tax on Car Buying Decisions

The sales tax on cars in Maryland can significantly influence car buying decisions and overall vehicle ownership costs. Let’s explore some of the key implications and considerations.

Budgeting and Cost Considerations

The sales tax adds an additional cost to the purchase price of a vehicle, which can impact a buyer’s overall budget. For example, with a standard sales tax rate of 6% and a vehicle priced at 30,000, the buyer would need to budget for an additional 1,800 in sales tax. This additional cost should be factored into the total cost of ownership, including fuel, maintenance, and insurance.

Vehicle Price Negotiations

The sales tax can also play a role in vehicle price negotiations. Dealers may offer incentives or discounts on the vehicle’s purchase price, which can help offset the sales tax burden. Car buyers can leverage these incentives to negotiate a better deal and potentially reduce the overall cost of the vehicle.

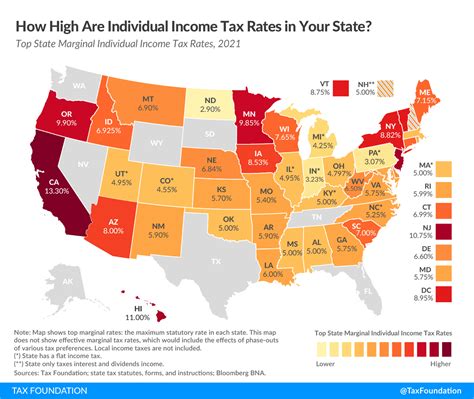

Comparison with Other States

Maryland’s sales tax rate of 6% is relatively competitive compared to other states. Some states have higher rates, while others have no sales tax on vehicle purchases. Car buyers who are considering cross-state purchases should research and compare the sales tax rates and other associated costs to make an informed decision.

Long-Term Ownership Costs

While the sales tax is a one-time cost at the time of purchase, it can have long-term implications. The higher the sales tax, the more significant the impact on the vehicle’s overall cost of ownership. This is especially true for high-value vehicles, where the sales tax amount can be substantial. Buyers should consider the sales tax as a long-term investment and factor it into their financial planning.

Impact on Used Car Market

The sales tax on cars also affects the used car market in Maryland. When purchasing a used car, the sales tax is typically calculated based on the vehicle’s current value, which is often lower than the original purchase price. This can make used car purchases more attractive from a tax perspective, as the sales tax amount is reduced. However, it is important to note that the sales tax is still applicable and must be paid at the time of purchase.

Future Outlook and Potential Changes

The sales tax on cars in Maryland, like any tax policy, is subject to potential changes and updates. While it is difficult to predict future developments with certainty, there are a few factors and trends that car buyers should be aware of.

Legislative Changes

The Maryland state legislature has the authority to make changes to the sales tax structure, including the rates and exemptions. While major changes are relatively rare, car buyers should stay informed about any proposed or enacted legislation that could impact the sales tax on vehicles. Following local news and tax-related updates can help buyers anticipate and prepare for any potential changes.

Economic Considerations

Economic conditions can also influence tax policies. In times of economic growth or budget constraints, the state may consider adjusting the sales tax rate or implementing new tax initiatives. Car buyers should monitor economic trends and any related tax discussions to understand how these factors could impact their vehicle purchasing decisions.

Technological Advancements and Alternative Fuel Vehicles

The rise of electric vehicles (EVs) and other alternative fuel vehicles has prompted discussions about potential tax incentives or changes. Some states have implemented special tax credits or exemptions for the purchase of EVs to encourage their adoption. While Maryland currently does not have such incentives, car buyers should stay updated on any developments in this area, as it could impact the future sales tax landscape.

Consumer Advocacy and Awareness

Consumer advocacy groups and organizations often play a role in shaping tax policies. These groups may advocate for changes or reforms to the sales tax structure, especially if they believe it disproportionately impacts certain groups of consumers. Car buyers can engage with these organizations and stay informed about their efforts to understand how they may influence future tax policies.

Are there any sales tax exemptions for specific types of vehicles in Maryland?

+Yes, Maryland offers sales tax exemptions for certain types of vehicles. These include vehicles purchased by active-duty military personnel stationed out of state, vehicles used exclusively for business purposes, and vehicles purchased by certain tax-exempt organizations. It’s important to consult the Maryland Comptroller’s website or seek professional advice to determine eligibility for these exemptions.

Can I finance the sales tax on my car purchase?

+Financing options for sales tax vary depending on the dealership and financing institution. Some lenders may allow you to include the sales tax in your car loan, while others may require it to be paid upfront. It’s best to discuss financing options with your lender or dealership to understand their specific policies.

Are there any penalties for not paying the sales tax on time?

+Yes, failing to pay the sales tax on time can result in penalties and interest charges. It’s important to pay the sales tax at the time of purchase to avoid these additional costs. Consult the Maryland Comptroller’s website for information on penalties and payment deadlines.

Can I claim the sales tax on my car purchase as a tax deduction?

+Generally, the sales tax on a car purchase is not deductible for federal income tax purposes. However, certain circumstances, such as using the vehicle primarily for business purposes, may allow for deductions. Consult with a tax professional to determine if you are eligible for any tax deductions related to your vehicle purchase.

What happens if I purchase a car from a private seller in Maryland?

+When purchasing a car from a private seller, you are still responsible for paying the sales tax. The sales tax is calculated based on the purchase price, and you must pay it at the time of registration. You will need to provide proof of payment to the Maryland Motor Vehicle Administration (MVA) when registering the vehicle.