Washington State Capital Gains Tax

Welcome to a comprehensive exploration of the Washington State Capital Gains Tax, a topic of significant interest for residents and investors alike. This article aims to demystify the intricacies of this tax system, offering a detailed analysis of its structure, implications, and potential impact on your financial planning.

The Washington State Capital Gains Tax, often referred to as the long-term capital gains tax, is a unique feature of the state's tax landscape. It is distinct from the federal capital gains tax and is applicable to a range of financial transactions, from the sale of real estate to the disposition of investment assets. Understanding this tax is crucial for anyone looking to make informed financial decisions within the state.

The Mechanics of Washington’s Capital Gains Tax

Washington’s Capital Gains Tax is a progressive tax, meaning the rate at which you are taxed increases as your capital gains increase. This tax is applied to the net capital gains from the sale or exchange of certain assets held for more than one year. Net capital gains are calculated by subtracting capital losses from capital gains.

Here's a breakdown of the current tax rates:

| Income Bracket | Tax Rate |

|---|---|

| Up to $5,850 | 0% |

| $5,851 - $12,450 | 2.9% |

| $12,451 - $22,500 | 3.8% |

| $22,501 - $47,900 | 4.9% |

| $47,901 - $75,750 | 6.9% |

| $75,751 - $153,750 | 7.9% |

| $153,751 - $203,750 | 8.9% |

| $203,751 - $307,500 | 9.9% |

| $307,501 and above | 10.9% |

These rates are subject to change based on legislative decisions, so it's essential to stay updated with the latest tax regulations.

Which Transactions are Subject to Capital Gains Tax in Washington?

The Washington State Department of Revenue outlines specific transactions that fall under the capital gains tax umbrella. These include:

- Sale of Real Estate: Any gain from the sale of real property, including residential or commercial real estate, is taxable. However, the state offers an exclusion for gains on the sale of a principal residence, up to $250,000 for individuals and $500,000 for married couples.

- Investment Assets: This covers a wide range of investments, such as stocks, bonds, mutual funds, and collectibles. The tax is applied to the net gain from the sale or exchange of these assets.

- Business Assets: Gains from the sale of business assets, including equipment, vehicles, and intellectual property, are also subject to capital gains tax.

- Inheritance and Gifts: If you receive an asset as a gift or through inheritance, any subsequent sale of that asset may result in capital gains tax, depending on the asset's appreciation.

Strategies for Minimizing Capital Gains Tax

Given the progressive nature of Washington’s capital gains tax, it’s beneficial to explore strategies that can help reduce your tax liability. Here are some approaches to consider:

Tax-Efficient Investing

Opt for investments that offer tax-advantaged growth. For instance, municipal bonds are a popular choice as the interest earned is generally exempt from federal, state, and local taxes. This can significantly reduce your taxable income.

Utilize Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have declined in value to offset gains and reduce your tax liability. This strategy can be particularly effective for investors with a diverse portfolio.

Capital Gains Exclusions

As mentioned earlier, Washington offers an exclusion for gains on the sale of a principal residence. This exclusion can provide significant tax savings, especially for homeowners who have lived in their property for an extended period.

Retirement Accounts

Consider contributing to tax-advantaged retirement accounts like IRAs or 401(k)s. These accounts offer tax benefits, and gains within these accounts are not subject to capital gains tax until withdrawal, typically in retirement.

Capital Gains Tax Planning

Engaging a financial advisor or tax professional can be invaluable for comprehensive tax planning. They can help structure your investments and transactions to minimize tax liability while maximizing returns.

Real-World Examples and Case Studies

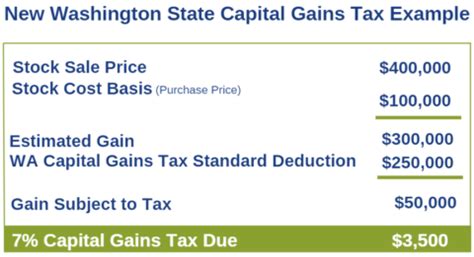

To illustrate the impact of Washington’s Capital Gains Tax, let’s consider a few hypothetical scenarios:

Scenario 1: Real Estate Sale

Sarah, a Washington resident, sells her primary residence for 600,000, which she initially purchased for 300,000. Since this is her principal residence, she qualifies for the state’s exclusion, and no capital gains tax is applicable.

Scenario 2: Investment Portfolio

John, another Washington resident, has a diversified investment portfolio. In a given year, he sells stocks with a net gain of 50,000. Based on his income bracket, he would be taxed at a rate of 6.9% on this gain, amounting to 3,450 in capital gains tax.

Scenario 3: Business Asset Sale

Emily, a business owner, sells equipment she purchased for 20,000 for 30,000. Her net gain of $10,000 is subject to capital gains tax. Depending on her income bracket, the tax rate could range from 2.9% to 10.9%.

Future Implications and Potential Changes

The landscape of Washington’s Capital Gains Tax is subject to change, influenced by economic trends, political decisions, and legislative reforms. Here are some potential future developments:

- Tax Rate Adjustments: With changing economic conditions, the tax rates may be adjusted to reflect the state's financial needs and goals.

- Expansion of Taxable Assets: There could be discussions to expand the scope of taxable assets, potentially including certain types of digital assets or intellectual property.

- Tax Incentives: The state may introduce tax incentives to promote specific investments or business activities, providing opportunities for tax-efficient strategies.

- Legislative Reforms: Washington's tax system is constantly evolving. Keeping an eye on legislative changes is crucial to stay updated with the latest regulations.

Conclusion: Navigating Washington’s Capital Gains Tax

Washington’s Capital Gains Tax is a complex but crucial aspect of the state’s tax system. By understanding the mechanics, applicable transactions, and potential strategies, individuals and businesses can make informed financial decisions. Whether you’re an investor, homeowner, or business owner, staying updated with the latest tax regulations and consulting with financial experts can help you navigate this tax landscape effectively.

Frequently Asked Questions

Are there any exceptions or exemptions for capital gains tax in Washington?

+

Yes, Washington offers an exclusion for gains on the sale of a principal residence. This exclusion can provide significant tax savings for homeowners. Additionally, certain types of investments, like municipal bonds, are exempt from capital gains tax.

How often do tax rates change in Washington?

+

Tax rates in Washington can change annually, typically as part of the state’s budgeting process. It’s important to stay updated with the latest tax regulations to ensure compliance.

Can I offset capital gains with capital losses?

+

Yes, you can offset capital gains with capital losses to reduce your tax liability. This strategy, known as tax-loss harvesting, can be an effective way to minimize your capital gains tax.

Are there any online tools or resources to calculate capital gains tax in Washington?

+

Yes, the Washington State Department of Revenue provides online tools and resources to help individuals and businesses calculate their capital gains tax liability. These resources can be found on their official website.

What happens if I sell an asset at a loss? Do I have to pay capital gains tax?

+

No, if you sell an asset at a loss, you don’t have to pay capital gains tax. However, you may be able to use the capital loss to offset future capital gains, reducing your tax liability.