Does Nc Have State Tax

When discussing the financial landscape of any state, understanding its tax system is crucial. In the case of North Carolina, a state nestled in the southeastern region of the United States, the tax system plays a significant role in its economic structure and has undergone notable transformations over the years.

The Tax Landscape of North Carolina

North Carolina, often abbreviated as NC, has indeed established its own state tax system, which encompasses various categories such as income tax, sales tax, and property tax. Each of these tax types serves a distinct purpose and contributes to the state’s revenue generation.

Income Tax in NC

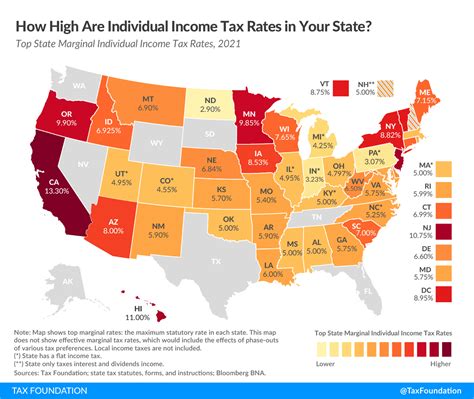

North Carolina imposes an individual income tax on its residents and nonresidents with income sourced from the state. The income tax rate in NC is progressive, meaning it varies depending on an individual’s taxable income. The North Carolina Department of Revenue outlines six tax brackets, ranging from 5.25% for the lowest income levels to 5.75% for the highest.

For businesses, NC applies a corporate income tax, which is also progressive. The tax rates for corporations vary based on the entity's taxable income, with rates ranging from 2.5% to 3% for S corporations and personal service corporations, and a flat rate of 2.5% for regular corporations.

| Tax Type | Rate |

|---|---|

| Individual Income Tax | 5.25% - 5.75% |

| S Corporation Tax | 2.5% - 3% |

| Regular Corporation Tax | 2.5% |

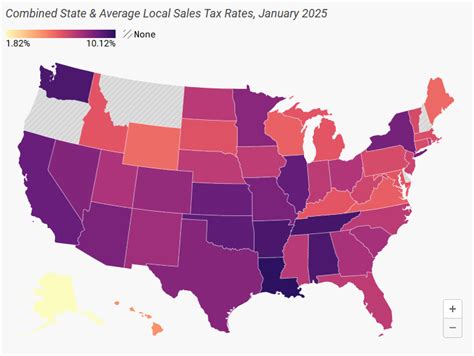

Sales and Use Tax

NC implements a sales and use tax, which is a consumption tax applied to the retail sale, lease, or rental of most tangible personal property and certain services. The base sales tax rate in North Carolina is 4.75%, and it is collected by the North Carolina Department of Revenue on behalf of the state and local governments.

Local governments in NC have the authority to impose additional sales tax rates, leading to variations in the total sales tax rate across different counties and municipalities. These local sales tax rates can range from 0% to 2.25%, bringing the combined state and local sales tax rates to a maximum of 7%.

| Tax Type | Base Rate | Potential Local Rate | Maximum Combined Rate |

|---|---|---|---|

| Sales and Use Tax | 4.75% | 0% - 2.25% | 7% |

Property Tax

North Carolina also imposes a property tax on real and personal property located within the state. This tax is administered by county tax offices and is based on the assessed value of the property. The tax rate varies depending on the jurisdiction and the type of property.

Property tax rates in NC can range from 0.3% to 1.5%, with the average tax rate being approximately 0.8%. The assessed value of a property is determined by local tax assessors, and this value is then multiplied by the applicable tax rate to calculate the annual property tax liability.

| Tax Type | Rate Range | Average Rate |

|---|---|---|

| Property Tax | 0.3% - 1.5% | 0.8% |

Tax Incentives and Programs

North Carolina is known for its commitment to supporting businesses and encouraging economic growth. As such, the state offers a range of tax incentives and programs to attract and retain businesses, promote job creation, and foster innovation.

Job Development Investment Grant (JDIG)

One of the most prominent tax incentives in NC is the Job Development Investment Grant (JDIG). This program provides performance-based grants to businesses that create new jobs and invest in economic development. Eligible businesses can receive grants of up to $45 million over a 12-year period, with the potential for additional grants based on performance.

One North Carolina Fund

The One North Carolina Fund is another initiative aimed at supporting economic development and job creation. This fund provides grants to local governments and businesses to attract new businesses and expand existing ones. The grants can be used for a variety of purposes, including infrastructure development, workforce training, and other economic development initiatives.

Rural Business Development Grant Program

NC recognizes the importance of supporting rural communities and their economic growth. The Rural Business Development Grant Program offers grants to businesses located in rural areas to assist with their expansion, modernization, and job creation efforts. These grants can be used for various purposes, such as equipment purchases, building renovations, and marketing initiatives.

Film and Television Tax Credits

The state of North Carolina also offers tax incentives to the film and television industry. The Film and Television Tax Credit Program provides a 25% tax credit for qualified production expenses incurred in the state. This program has successfully attracted numerous film and television productions to NC, contributing to the state’s economy and creating job opportunities.

Tax Reforms and Updates

Like many states, North Carolina periodically reviews and updates its tax system to ensure fairness, simplicity, and competitiveness. In recent years, the state has implemented several notable tax reforms.

Income Tax Reform

In 2013, NC underwent a significant income tax reform, reducing the top individual income tax rate from 7.75% to 5.75% and simplifying the tax brackets. This reform aimed to make the tax system more competitive and encourage economic growth by reducing the tax burden on individuals and businesses.

Sales Tax Reform

North Carolina has also made efforts to modernize its sales tax system. In 2018, the state implemented the Marketplace Fairness Act, allowing it to collect sales tax from out-of-state sellers who make remote sales to NC residents. This reform ensured a more level playing field for local businesses and generated additional revenue for the state.

Property Tax Updates

Property tax assessments in NC are subject to periodic revaluations to ensure fairness and accuracy. The state’s property tax system is designed to be equitable, and property owners have the right to appeal their assessments if they believe the value is inaccurate.

Conclusion

North Carolina’s tax system is designed to support the state’s economic growth and development while providing essential services to its residents. With a range of tax types, incentives, and reforms, NC aims to create a business-friendly environment while maintaining a stable source of revenue. Understanding the intricacies of NC’s tax landscape is crucial for individuals and businesses operating within the state.

What is the deadline for filing taxes in NC?

+The deadline for filing individual income tax returns in North Carolina typically aligns with the federal deadline, which is usually April 15th. However, this can vary based on the day of the week and other factors, so it’s essential to check the official North Carolina tax calendar for the specific deadline each year.

Are there any tax exemptions for renewable energy systems in NC?

+Yes, North Carolina offers tax incentives for renewable energy systems. The state provides a 35% tax credit for the purchase and installation of solar energy systems, with a maximum credit of 1,500 for residential systems</strong> and <strong>25,000 for commercial systems. Additionally, NC offers a 100% property tax exemption for qualified renewable energy systems.

Can I deduct my business-related expenses on my NC tax return?

+Absolutely! North Carolina allows taxpayers to deduct a wide range of business-related expenses on their tax returns. These deductions include costs associated with running a business, such as office rent, utilities, equipment, travel expenses, and more. It’s essential to keep detailed records and consult with a tax professional to ensure you maximize your deductions.