South Carolina Income Tax Brackets

When it comes to understanding taxes, it's crucial to delve into the intricacies of state-specific income tax brackets. South Carolina, known for its diverse economy and vibrant communities, offers a unique tax landscape. In this comprehensive guide, we will explore the income tax brackets of South Carolina, shedding light on the rates, thresholds, and how they impact residents and businesses alike. Get ready to uncover the ins and outs of South Carolina's tax system, as we navigate through the essential information every taxpayer should know.

Unraveling the South Carolina Income Tax Brackets

South Carolina operates under a progressive tax system, meaning that as your income increases, so does the tax rate applied to your earnings. This approach ensures that those with higher incomes contribute a larger share of their income towards state revenue. Let's break down the income tax brackets for the Palmetto State.

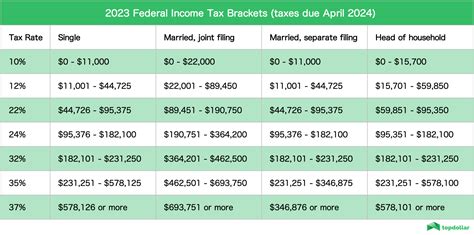

The state's income tax brackets are divided into six distinct categories, each with its own tax rate. These brackets are adjusted annually to account for inflation and changes in the cost of living. As of the 2023 tax year, the brackets and their corresponding tax rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| 0 - $2,900 | 2.5% |

| $2,901 - $5,800 | 3.25% |

| $5,801 - $10,500 | 4.5% |

| $10,501 - $16,000 | 5.5% |

| $16,001 - $23,500 | 6% |

| $23,501 and above | 7% |

It's important to note that South Carolina offers a standard deduction of $3,000 for single filers and $6,000 for married couples filing jointly. This deduction reduces the taxable income and can significantly impact the overall tax liability. Additionally, the state allows taxpayers to claim personal exemptions, further reducing the taxable income.

Understanding the Progressive Tax Structure

The progressive tax system in South Carolina ensures that individuals with lower incomes face lower tax rates, while those with higher incomes contribute a larger portion. This approach aims to promote economic fairness and provide essential state services while encouraging economic growth.

For instance, consider a single filer with an annual income of $15,000. They would fall into the second income bracket and be taxed at a rate of 3.25%. On the other hand, a high-income earner making $250,000 annually would be subject to the highest tax rate of 7%, reflecting the progressive nature of the tax system.

The Impact on Businesses and Investors

South Carolina's income tax brackets also affect businesses and investors operating within the state. Corporations and S-corporations are subject to a flat tax rate of 5%, while partnerships and limited liability companies (LLCs) are taxed at the individual level, following the same brackets as personal income tax.

For investors, the state offers a variety of tax incentives and programs to attract businesses and foster economic development. These incentives can significantly impact the overall tax liability, making South Carolina an attractive destination for businesses looking to expand or relocate.

South Carolina's Tax Incentives and Credits

South Carolina is renowned for its business-friendly environment and offers a range of tax incentives to promote economic growth. These incentives include:

- Job Development Tax Credits: Businesses that create new jobs and meet specific criteria can qualify for tax credits, reducing their tax liability.

- Research and Development Tax Credits: Companies engaged in research and development activities can receive tax credits, encouraging innovation and technological advancement.

- Film and Digital Media Tax Credits: The state offers incentives for film and media productions, attracting various entertainment industries and boosting the local economy.

- Rural Infrastructure Tax Credits: These credits aim to improve infrastructure in rural areas, encouraging economic development and job creation.

These tax incentives, coupled with the state's competitive tax rates, make South Carolina an attractive destination for businesses seeking to expand or establish operations.

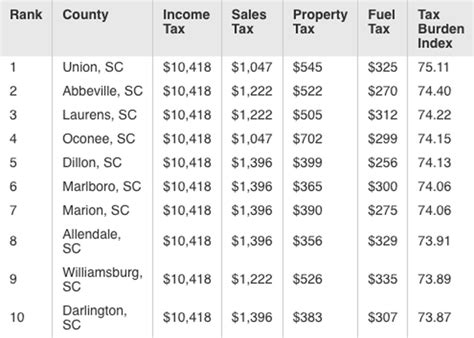

Comparison with Other States

When comparing South Carolina's income tax brackets with other states, it's evident that the Palmetto State offers a relatively competitive tax environment. Many states have higher tax rates or fewer brackets, which can result in a heavier tax burden for residents.

For instance, neighboring North Carolina has a top tax rate of 5.25%, while Virginia's top rate is 5.75%. In contrast, South Carolina's top rate of 7% is still competitive, especially when considering the state's business-friendly incentives and economic opportunities.

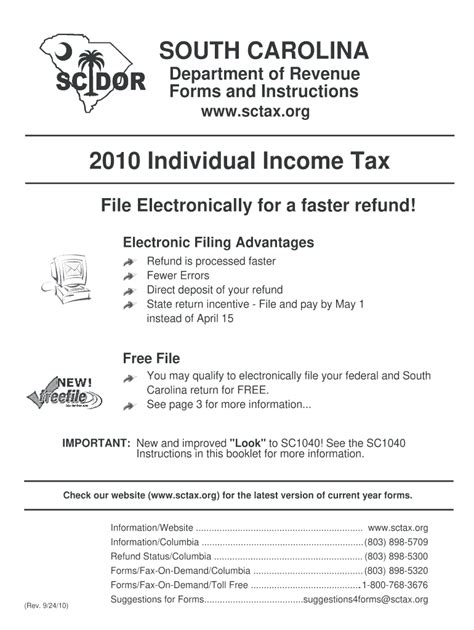

Tax Filing and Payment Options

South Carolina provides taxpayers with various options for filing and paying their taxes. The state's Department of Revenue offers an online filing system, SC Taxes Online, which allows taxpayers to file their returns electronically and pay their taxes securely.

Additionally, taxpayers can opt for direct deposit, allowing the state to deposit any tax refunds directly into their bank accounts. This convenient option eliminates the need for physical checks and reduces the risk of loss or theft.

Future Implications and Tax Reforms

As with any tax system, South Carolina's income tax brackets are subject to potential reforms and adjustments. The state's lawmakers continuously evaluate the tax structure to ensure fairness, competitiveness, and alignment with economic goals.

In recent years, there have been discussions about simplifying the tax code and reducing tax rates to attract businesses and residents. While these reforms are yet to be implemented, they showcase the state's commitment to staying competitive in the modern economy.

Frequently Asked Questions (FAQ)

What is the difference between a progressive and a flat tax system?

+

A progressive tax system, like South Carolina’s, applies higher tax rates to higher income levels. This means that as your income increases, the tax rate also increases. In contrast, a flat tax system applies the same tax rate to all income levels, regardless of how much an individual earns.

Are there any tax incentives for small businesses in South Carolina?

+

Yes, South Carolina offers various tax incentives to support small businesses. These include tax credits for job creation, research and development activities, and investments in rural infrastructure. These incentives aim to promote economic growth and attract new businesses to the state.

How often are the income tax brackets adjusted in South Carolina?

+

The income tax brackets in South Carolina are adjusted annually to account for inflation and changes in the cost of living. This ensures that the tax system remains fair and up-to-date with economic conditions.

Can I file my taxes electronically in South Carolina?

+

Absolutely! South Carolina provides an online filing system called SC Taxes Online, which allows taxpayers to file their returns and pay their taxes electronically. This system is secure and offers a convenient way to manage your tax obligations.

Are there any tax credits available for renewable energy projects in South Carolina?

+

Yes, South Carolina offers tax credits for renewable energy projects, such as solar and wind power installations. These credits aim to encourage the adoption of clean energy technologies and reduce the state’s carbon footprint.