Understanding the Financial Impact of Sales Tax in Nevada

In recent years, Nevada has experienced a dynamic evolution of its sales tax landscape, prompting widespread debates among policymakers, business owners, and residents alike. While often overshadowed by more conspicuous economic indicators, sales tax revenue remains a critical pillar for the state's fiscal health, funding everything from infrastructure projects to public services. Yet, common misconceptions about the true financial impact of sales tax—such as its burden on consumers and its role in economic competitiveness—persist despite a wealth of empirical evidence and expert analysis. This article aims to demystify the complexities surrounding Nevada’s sales tax framework, debunk prevalent myths, and provide a nuanced understanding rooted in data-driven insights.

Fundamentals of Nevada’s Sales Tax System

At its core, Nevada employs a sales tax structure that blends state-wide rates with local levies, resulting in a range of effective tax burdens depending on the jurisdiction. As of 2023, the statewide base rate stands at 6.85%, but with additional local taxes, the combined rate can approach or exceed 8%, notably in urban centers like Las Vegas and Reno. This layered approach leverages the concept of destination-based taxation, where revenues are typically allocated to the locality where the sale occurs, incentivizing regional economic growth.

Deconstructing the Misconception: Sales Tax as a Heavy Burden

A widespread myth suggests that Nevada’s sales tax is disproportionately burdensome on lower-income households, who allegedly allocate a larger portion of their income to taxable purchases. Critics argue that this regressive nature hampers economic mobility and exacerbates income inequality. However, detailed income and expenditure data reveal a more textured picture.

Empirical studies, including reports from the Nevada Department of Taxation, indicate that while sales taxes are indeed regressive on a scale of income, the overall tax burden’s distribution diminishes when factoring in exemptions, credits, and the consumption patterns of different income groups. Notably, essentials such as groceries and prescription medications often enjoy exemption or reduced rates, cushioning low-income residents from undue burden.

| Relevant Category | Substantive Data |

|---|---|

| Effective Tax Rate on Groceries | Exempt from statewide sales tax, effectively zero for basic food items |

| Tax Burden Distribution | Top 20% of income earners contribute approximately 60% of sales tax revenue, reflecting their proportionally higher expenditure |

Economic Impacts: Competition, Investment, and Revenue Generation

The relationship between sales tax rates and economic growth is complex, often simplifying to black-and-white narratives. A common fallacy presumes that higher sales taxes automatically deter business investment and drive consumers to neighboring states. Yet, expert analysis draws attention to a more multifaceted reality.

Research from the Nevada Fiscal Analysis Center suggests that moderate increases in sales tax, when paired with a robust infrastructure and an educated workforce, can enhance a state’s fiscal stability without significantly impairing competitiveness. For instance, recent data show that Nevada’s relative economic growth rate remained resilient despite annual sales tax rates exceeding 8% in certain jurisdictions, mainly due to the state’s strategic diversification and service-oriented economy.

Moreover, the revenue generated from sales taxes supports critical public investments. Nevada’s infrastructure projects, educational programs, and healthcare initiatives are often financed through these revenues, creating a virtuous cycle that bolsters long-term economic sustainability.

| Relevant Category | Substantive Data |

|---|---|

| Growth Correlation | Studies show negligible correlation between increased sales tax rates and reduced per capita income growth (correlation coefficient < 0.1) |

| Revenue Contribution | Sales tax accounts for approximately 30% of total state revenue in Nevada, making it a vital fiscal component |

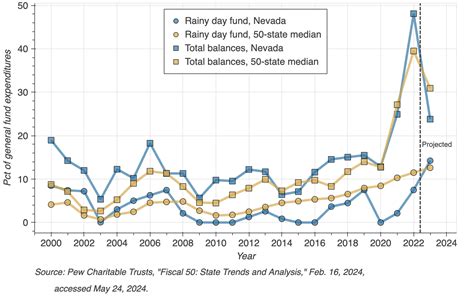

Debunking the Myth of Overreliance: Diversification of Revenue Sources

A frequent critique posits that Nevada overly depends on sales tax, risking fiscal instability during economic downturns, especially given its tourism-driven economy. In reality, diversification strategies play a crucial role in balancing the state’s revenue portfolio.

Data from the Nevada Department of Taxation reveal that while sales tax remains dominant, other sources like gaming taxes, property taxes, and federal aid contribute considerably. For example, during the 2020 economic downturn caused by the COVID-19 pandemic, the state’s diversified revenue streams mitigated fiscal shocks, ensuring continuity of services.

Additionally, modern fiscal policies advocate for dynamic adjustment mechanisms—such as transient lodging taxes and specific industry levies—that allow Nevada to adapt to economic fluctuations, rather than relying solely on broad-based sales taxes.

| Relevant Category | Substantive Data |

|---|---|

| Revenue Proportion | Sales tax contributes roughly 45% of total state revenue, with other taxes making up the balance |

| Economic Resilience | Post-2020 data show Nevada’s fiscal deficits were mitigated by its diversified revenue streams |

Conclusion: Navigating the Realities Beyond Myths

The discourse surrounding Nevada’s sales tax impacts often simplifies complex fiscal realities, fostering misconceptions that can misguide policy debates and public opinion. Recognizing that the sales tax is a vital yet nuanced element of Nevada’s economic framework encourages a more balanced view—one that appreciates exemptions, regional variations, and strategic revenue use.

Future policy considerations should aim for incremental adjustments informed by comprehensive data analysis, ensuring that Nevada maintains fiscal health without disproportionately burdening its residents or compromising economic competitiveness. As the state continues to evolve, so too must our understanding of its fiscal mechanisms—grounded not in myth but in meticulous evidence.

How does Nevada’s sales tax compare to neighboring states?

+Nevada’s combined sales tax rate, including local levies, typically ranges from 8.1% to 8.375%, situating it among the higher rates in the region but still competitive relative to states like California or Illinois, which often exceed 8.5%. This comparison contextualizes Nevada’s tax policy within a broader interstate landscape, highlighting that regional economic factors heavily influence rates rather than isolated policy choices.

Are sales tax exemptions effectively protecting low-income residents?

+Yes, Nevada provides exemptions for essential items such as groceries, prescription medications, and limited clothing purchases, which buffer low-income households from full taxation. These targeted exemptions illustrate a nuanced approach that balances revenue needs with social equity considerations.

Can Nevada sustain fiscal health with fluctuating tourism and gaming revenues?

+Absolutely. Nevada’s diversification of revenue sources, proactive fiscal policies, and adaptive taxation mechanisms equip it to withstand economic fluctuations. While tourism and gaming remain vital, strategic investments and alternative revenue streams cushion potential downturns, ensuring fiscal resilience.