Tax Free Texas

Welcome to the Lone Star State, where the spirit of adventure and entrepreneurialism runs deep. Texas, with its unique blend of rich history, diverse culture, and vibrant economy, offers an enticing prospect for those seeking tax-free living and business opportunities. In this comprehensive guide, we delve into the world of Tax Free Texas, uncovering the benefits, exploring the nuances, and providing an expert analysis of this attractive proposition.

The Appeal of Tax Free Texas

Texas boasts a robust economy, ranking among the top states in the nation for its business-friendly environment. A key factor contributing to this success is the state’s tax structure, which offers significant advantages to both residents and businesses alike. Here’s a deeper look at what makes Tax Free Texas so appealing.

No Personal Income Tax

Texas stands out as one of the few states in the U.S. that does not impose a personal income tax on its residents. This means that your hard-earned income is yours to keep, without any state-level deductions. For individuals and families, this can result in substantial savings, allowing for greater financial flexibility and the potential to accelerate wealth accumulation.

Consider the story of Sarah, a software engineer who relocated from a high-tax state to Texas. By avoiding state income tax, she was able to increase her disposable income by over 10%, allowing her to save more for her children's education and retirement.

| State Income Tax Rate | Texas: 0% |

|---|---|

| Potential Savings for High-Income Earners | Up to thousands of dollars annually |

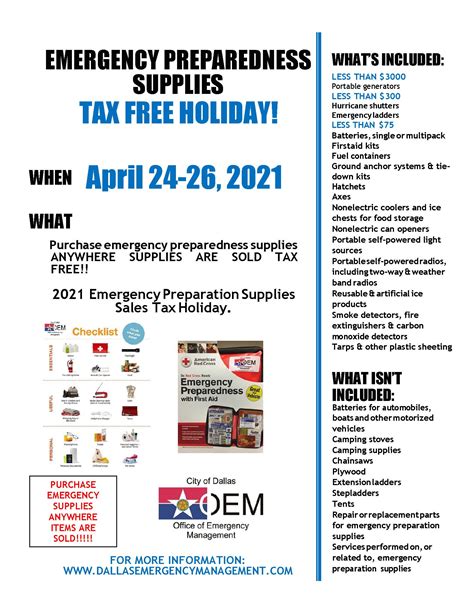

Low Sales Tax

While Texas does levy a sales tax, it is relatively low compared to many other states. The base sales tax rate in Texas is set at 6.25%, with local municipalities allowed to add their own sales tax, typically ranging from 0% to 2%. This means that the total sales tax rate can vary across the state, but it remains competitive.

For example, in the bustling city of Austin, the combined sales tax rate is 8.25%, which includes the state and local taxes. This rate is still lower than many other major cities in the U.S., making it more affordable for residents to purchase goods and services.

| State Sales Tax Rate | 6.25% |

|---|---|

| Average Combined Sales Tax Rate (with local taxes) | Varies, but typically around 8% |

Business-Friendly Tax Climate

Texas is renowned for its pro-business tax policies, which have attracted numerous companies and created a thriving economic ecosystem. The state offers a competitive tax environment for businesses, making it an ideal location for startups, established enterprises, and everything in between.

Corporate Franchise Tax

Texas has a franchise tax system for businesses, which is calculated based on a company’s total revenue. The tax rate is relatively low, starting at 0.375% for most businesses, with a higher rate of 0.75% for financial institutions. This structure encourages businesses to grow and thrive in the state without the burden of high corporate taxes.

| Corporate Franchise Tax Rate | 0.375% - 0.75% |

|---|---|

| Eligibility for Tax Exemptions | Varies based on industry and revenue |

Property Tax

Property taxes in Texas are levied by local governments, and rates can vary widely across the state. However, the state government has implemented measures to limit property tax increases, ensuring that the tax burden remains manageable for homeowners and businesses.

No Inventory Tax

A unique feature of Texas’s tax system is the absence of an inventory tax for most businesses. This means that companies can store and sell goods without incurring additional taxes on their inventory, providing a significant cost advantage over states that do levy such taxes.

Other Tax Benefits

Texas also offers various tax incentives and credits to attract and retain businesses. These include tax abatements, job creation credits, and research and development tax credits. These incentives can provide substantial savings for businesses, making Texas an even more attractive location for economic growth.

The Impact of Tax Free Texas

The tax-free status of Texas has had a profound impact on the state’s economy and the lives of its residents. Let’s explore some of the key ways in which Tax Free Texas has shaped the state’s landscape.

Economic Growth and Job Creation

Texas’s business-friendly tax policies have been a major driver of economic growth and job creation. The state’s low tax rates and incentives have attracted a diverse range of industries, from technology and energy to healthcare and manufacturing. This influx of businesses has created a thriving job market, with numerous opportunities for skilled workers and entrepreneurs.

For instance, the technology sector in Texas has seen remarkable growth in recent years. Cities like Austin, Dallas, and Houston have become hubs for tech startups and established tech giants, creating a vibrant ecosystem that has generated thousands of high-paying jobs. The absence of personal income tax has been a significant draw for tech professionals, contributing to the state's reputation as a tech powerhouse.

| Job Growth Rate (2021-2022) | 3.3% |

|---|---|

| Number of New Jobs Created (2022) | 370,000 |

Population Growth and Migration

The allure of Tax Free Texas has led to a significant population influx in recent years. People from all walks of life are drawn to the state’s vibrant economy, thriving job market, and, of course, its tax advantages. This population growth has had a positive impact on the state’s cultural diversity and economic vitality.

Cities like San Antonio and Houston have experienced particularly rapid growth, with new residents flocking to these areas in search of opportunity. The absence of personal income tax has been a major factor in this migration, as it allows individuals to keep more of their earnings, making it easier to afford the cost of living and pursue their dreams.

| Population Growth Rate (2021-2022) | 1.5% |

|---|---|

| Net Migration Rate (2022) | 175,000 people |

Improved Quality of Life

The tax-free status of Texas has also contributed to an improved quality of life for its residents. With more disposable income, individuals and families can allocate their resources to areas that enhance their overall well-being, such as education, healthcare, and leisure activities.

For instance, the absence of personal income tax allows parents to save more for their children's education, whether it's for private school tuition or college funds. Additionally, the low sales tax rate means that residents can afford to purchase a wider range of goods and services, from everyday essentials to luxury items.

Challenges and Considerations

While Tax Free Texas offers numerous advantages, it’s important to consider the potential challenges and limitations as well. Here’s a look at some of the key considerations for those considering a move to or a business venture in Texas.

Limited Revenue for State Services

The absence of personal income tax and other revenue streams means that Texas relies heavily on sales tax and property tax for its state revenue. This can lead to challenges in funding critical state services, such as education, healthcare, and infrastructure.

To address these challenges, the state government has implemented various strategies, including allocating a portion of the state's oil and gas revenue to education funding. Additionally, the state has focused on attracting high-growth industries and businesses, which contribute significantly to the tax base.

Local Variations in Taxes

While Texas has a relatively uniform tax structure at the state level, local governments have the autonomy to impose additional taxes and fees. This can lead to variations in tax rates across different cities and counties, which may impact individuals and businesses differently.

For instance, while the state sales tax rate is 6.25%, local municipalities can add their own sales tax, ranging from 0% to 2%. This means that the total sales tax rate can vary from 6.25% to 8.25% or higher, depending on the location. It's important for businesses and individuals to research and understand the local tax landscape when considering a move or expansion in Texas.

Impact on Social Programs

The tax-free status of Texas can have implications for social programs and services. Without a personal income tax, the state relies heavily on federal funding and other sources to support social safety nets, such as Medicaid, welfare, and public assistance programs.

To ensure the continued availability of these services, the state government has implemented various initiatives to promote economic growth and job creation, which can generate additional revenue through sales and property taxes. Additionally, Texas has focused on attracting businesses that contribute to the state's tax base and provide employment opportunities for its residents.

The Future of Tax Free Texas

As Texas continues to thrive economically and attract new residents and businesses, the state’s tax-free status is likely to remain a key factor in its success. However, it’s important to consider the potential for future changes and the ongoing debate surrounding tax policy.

Potential for Tax Reform

While the current tax structure in Texas is highly advantageous for residents and businesses, there is ongoing discussion about the possibility of tax reform. Some argue that the state should consider implementing a personal income tax to generate additional revenue for critical state services and infrastructure projects.

However, proponents of the current tax-free system highlight the economic benefits it has brought to the state, including rapid job growth, population influx, and a thriving business environment. They argue that the absence of personal income tax has been a major draw for businesses and individuals, and any change to this structure could have significant economic implications.

Economic Diversification

To ensure the long-term sustainability of its tax-free status, Texas is focused on economic diversification. The state is actively attracting and supporting a wide range of industries, from technology and energy to healthcare and aerospace. By diversifying its economic base, Texas can reduce its reliance on any single industry and maintain a stable tax revenue stream.

Additionally, the state is investing in education and workforce development to ensure a skilled labor force that can support the growth of these diverse industries. This strategy aims to create a resilient economy that can weather market fluctuations and continue to thrive in the future.

Population Growth and Infrastructure

The rapid population growth in Texas has put pressure on the state’s infrastructure, including roads, public transportation, and housing. To address these challenges, the state government is investing in infrastructure projects and urban planning to accommodate the growing population and ensure a high quality of life for its residents.

For instance, the state has allocated billions of dollars towards highway expansion and public transportation projects, such as light rail and bus rapid transit systems. These initiatives aim to reduce traffic congestion and provide efficient transportation options for residents and businesses.

Conclusion

Tax Free Texas offers a unique and attractive proposition for individuals and businesses seeking a low-tax environment. The state’s tax structure, combined with its thriving economy and diverse culture, has made it a top destination for those seeking opportunity and a high quality of life. While there are challenges and considerations to keep in mind, the overall benefits of Tax Free Texas are undeniable.

As Texas continues to grow and evolve, its tax-free status will remain a key differentiator and a major draw for those seeking a prosperous and fulfilling life. Whether you're a business owner, an entrepreneur, or an individual looking for a new home, Texas's tax-free environment is an enticing prospect that opens doors to a world of opportunity.

FAQ

What industries thrive in Tax Free Texas?

+Texas is home to a diverse range of industries, including technology, energy, healthcare, and manufacturing. The state’s pro-business tax policies and skilled workforce make it an attractive location for businesses in these sectors.

How does Tax Free Texas impact property ownership?

+Property taxes in Texas are levied by local governments, and rates can vary. However, the state government has implemented measures to limit property tax increases, ensuring that the tax burden remains manageable for homeowners.

Are there any tax incentives for businesses in Texas?

+Yes, Texas offers various tax incentives and credits to attract and retain businesses. These include tax abatements, job creation credits, and research and development tax credits, providing significant savings for eligible businesses.