Ouachita Parish Tax Records

Welcome to an in-depth exploration of the Ouachita Parish tax records, a fascinating dive into the world of property taxes and their role in shaping the financial landscape of this vibrant community. Ouachita Parish, nestled in the heart of Louisiana, presents a unique blend of history, culture, and economic activity, and understanding its tax records is key to unlocking insights into its property market and overall financial health.

Unraveling the Ouachita Parish Tax System

Ouachita Parish’s tax system is a complex yet crucial mechanism that ensures the smooth functioning of the local government and its services. This intricate system is designed to assess, collect, and allocate taxes efficiently, thereby supporting the community’s infrastructure, education, and public services.

At its core, the tax system revolves around the assessment of real property, which includes land and improvements such as buildings, roads, and other permanent structures. This assessment is an intricate process, involving the valuation of each property based on various factors, including location, size, improvements, and market conditions.

The Role of the Ouachita Parish Assessor’s Office

The Ouachita Parish Assessor’s Office plays a pivotal role in this process. Its primary responsibility is to ensure fair and accurate property assessments, which form the basis for tax calculations. The office employs a team of professionals who are well-versed in the local real estate market, ensuring that property values are assessed equitably and in line with market trends.

The assessor's team conducts regular property inspections, utilizes advanced valuation methodologies, and stays updated on market fluctuations. This proactive approach ensures that the tax assessments remain accurate, thereby maintaining fairness and transparency in the tax system.

| Assessment Cycle | Timeline |

|---|---|

| Regular Assessment | Every four years |

| Annual Review | Yearly updates based on market changes |

Tax Rates and Calculations

Once properties are assessed, the actual tax rates come into play. These rates are determined by the various taxing authorities within the parish, including the local government, school districts, and special districts like fire protection or water management.

The tax rate, expressed as "mills," is a measure of the tax per dollar of assessed value. For instance, a tax rate of 100 mills would equate to $1 of tax for every $1,000 of assessed property value. These rates are set annually by the respective authorities and are used to calculate the tax liabilities for each property owner.

| Taxing Authority | Millage Rate |

|---|---|

| Ouachita Parish Government | 45.60 mills |

| Ouachita Parish School Board | 98.50 mills |

| Special Districts (average) | 22.00 mills |

Tax Exemptions and Discounts

Ouachita Parish offers various tax exemptions and discounts to eligible property owners. These provisions are designed to alleviate the tax burden for specific categories of property owners, such as seniors, veterans, and homeowners with disabilities.

For instance, the Homestead Exemption allows eligible homeowners to reduce the assessed value of their primary residence, resulting in lower property taxes. Similarly, veterans and disabled individuals may qualify for additional exemptions, providing further relief.

Online Access to Ouachita Parish Tax Records

In an era of digital transformation, Ouachita Parish has embraced technology to enhance transparency and accessibility. The parish’s official website provides a dedicated platform for residents and stakeholders to access tax records and related information.

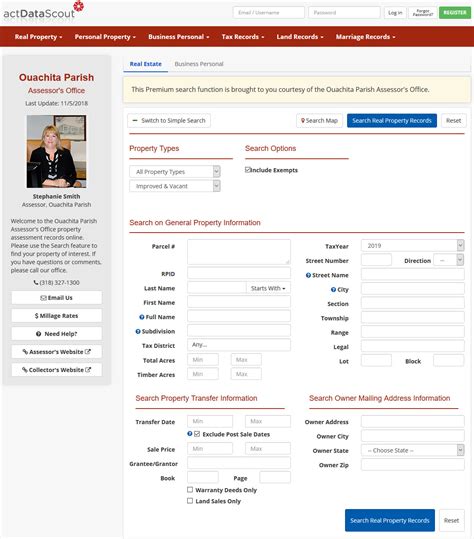

The Ouachita Parish Tax Records Portal

The Ouachita Parish Tax Records Portal is a comprehensive online resource that allows users to search and retrieve property tax information. This user-friendly platform enables users to:

- Search for property tax records by address, owner name, or parcel number.

- View detailed tax assessments, including property characteristics and valuation details.

- Access tax payment history and outstanding balances.

- Download tax statements and related documents.

- Track the status of tax appeals and disputes.

The portal also provides valuable tools and resources, such as tax calculators, frequently asked questions, and links to relevant tax forms and guidelines. This digital platform streamlines the process of accessing and understanding tax information, promoting transparency and convenience for property owners and investors.

Online Payment Options

In addition to providing access to tax records, the Ouachita Parish tax portal also offers secure online payment options. Property owners can conveniently pay their taxes through the portal, eliminating the need for physical visits to the tax office. This feature not only saves time but also reduces potential errors and delays associated with manual payments.

The online payment system is designed with robust security measures to protect user data and financial transactions. It accepts various payment methods, including credit cards, debit cards, and electronic checks, offering flexibility and convenience to taxpayers.

The Impact of Ouachita Parish Tax Records

Ouachita Parish tax records serve as a critical tool for understanding the economic health and real estate dynamics of the parish. These records provide a wealth of data that can be analyzed to identify trends, assess property values, and make informed decisions regarding investments, development, and community planning.

Real Estate Market Analysis

Tax records offer a comprehensive view of the real estate market within Ouachita Parish. By analyzing historical tax data, real estate professionals and investors can gain insights into property values, sale trends, and market performance over time. This data-driven approach enables them to make more accurate predictions and strategic decisions.

For instance, tracking the average annual tax assessments of residential properties can indicate shifts in property values, helping to identify emerging neighborhoods or declining areas. Similarly, analyzing tax data for commercial properties can provide insights into the health of local businesses and the overall commercial real estate market.

Community Development and Planning

Ouachita Parish tax records are invaluable for community development and planning initiatives. These records can inform decisions on infrastructure improvements, zoning changes, and economic development strategies. By analyzing tax data, policymakers can identify areas that may benefit from targeted investments or interventions.

For example, analyzing tax records can reveal areas with high concentrations of vacant or underutilized properties, which could be targeted for revitalization projects. Similarly, identifying neighborhoods with consistently high property values can inform decisions on infrastructure upgrades or amenities to enhance the quality of life for residents.

Property Ownership and Tax Equity

Ouachita Parish tax records also play a crucial role in ensuring tax equity and transparency. By providing accessible and detailed tax information, the parish promotes accountability and trust among property owners. Tax records enable property owners to verify their tax assessments, understand the calculation of their tax liabilities, and ensure fairness in the tax system.

Furthermore, tax records are essential for maintaining a transparent and efficient property ownership system. They facilitate the transfer of property ownership, support legal proceedings related to property rights, and provide a historical record of property transactions and values.

Conclusion: The Significance of Ouachita Parish Tax Records

In conclusion, Ouachita Parish tax records are a vital resource for understanding the economic landscape and real estate dynamics of the parish. These records, when analyzed and utilized effectively, can drive informed decision-making, promote community development, and ensure tax equity. The accessibility and transparency provided by the online tax records portal further enhance the value of this resource for residents, investors, and stakeholders alike.

Frequently Asked Questions

How often are property assessments conducted in Ouachita Parish?

+Property assessments in Ouachita Parish are conducted every four years as part of the regular assessment cycle. However, the Assessor’s Office also conducts annual reviews to ensure that property values remain up-to-date with market changes.

Are there any tax exemptions available for homeowners in Ouachita Parish?

+Yes, Ouachita Parish offers several tax exemptions, including the Homestead Exemption, which reduces the assessed value of primary residences for eligible homeowners. Additionally, veterans and individuals with disabilities may qualify for further exemptions.

Can I pay my property taxes online in Ouachita Parish?

+Absolutely! Ouachita Parish provides a secure online payment portal, allowing property owners to pay their taxes conveniently using credit cards, debit cards, or electronic checks. This online system offers flexibility and efficiency, eliminating the need for physical visits to the tax office.

How can I access detailed tax information for a specific property in Ouachita Parish?

+You can access detailed tax information by visiting the Ouachita Parish Tax Records Portal. The portal allows you to search for tax records by address, owner name, or parcel number. Once you locate the property, you can view assessment details, tax payment history, and other relevant information.