Tax Exempt Walmart

The concept of tax exemption for Walmart, one of the world's largest retailers, is a topic that sparks intrigue and raises important questions about the interplay between corporate tax strategies and government regulations. While Walmart, like many large corporations, engages in complex tax planning to optimize its financial operations, the idea of a tax-exempt Walmart is a complex issue with far-reaching implications.

Understanding Tax Exemption and Walmart’s Position

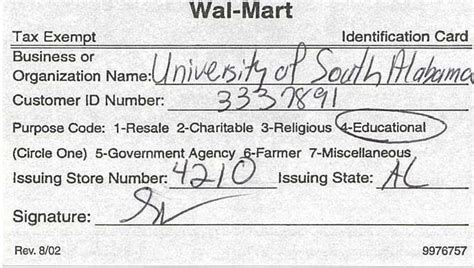

In the context of taxation, exemption typically refers to the status where an entity is relieved from the obligation to pay certain taxes. This can be granted to organizations for various reasons, often tied to their nature, purpose, or specific activities. For instance, non-profit organizations, religious institutions, and certain government entities are commonly tax-exempt.

Walmart, as a for-profit enterprise, operates under a different tax framework. Its tax obligations are determined by a multitude of factors, including its corporate structure, global operations, and the tax laws of the jurisdictions in which it operates. The company's financial reports and public disclosures provide insights into its tax strategies and contributions.

According to recent financial statements, Walmart Inc. operates under a global tax strategy that aims to minimize its effective tax rate while adhering to the laws and regulations of each jurisdiction. This strategy involves various tax planning techniques, such as utilizing tax incentives, optimizing transfer pricing, and managing intellectual property rights.

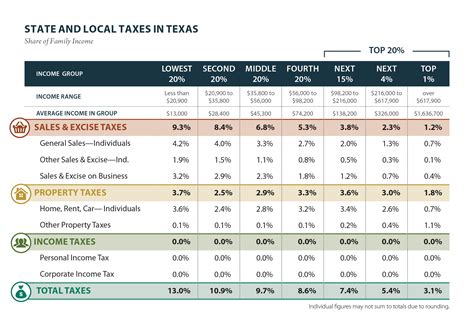

Tax Contributions and Impact

Walmart’s tax contributions are significant, both in the United States and internationally. In the U.S. alone, the company’s total tax contribution, including federal, state, and local taxes, amounted to over $6.5 billion in 2022. This figure includes income taxes, payroll taxes, property taxes, and other taxes levied on the company’s operations.

| Tax Category | 2022 Tax Contribution |

|---|---|

| Income Taxes | $1.8 billion |

| Payroll Taxes | $3.2 billion |

| Property Taxes | $1.5 billion |

Beyond direct tax payments, Walmart's economic activities contribute to tax revenues indirectly. For instance, the company's large workforce pays income taxes, and its vast supply chain and vendor network contribute to various tax categories.

The Concept of Tax-Exempt Walmart

The notion of a tax-exempt Walmart is intriguing but largely theoretical. While tax exemption is a status granted to certain entities, it is not typically associated with for-profit corporations like Walmart. Here’s a closer look at this concept and its potential implications.

Potential Scenarios and Challenges

Imagine if Walmart were to become tax-exempt. This scenario could arise through legislative changes, special tax incentives, or a fundamental restructuring of the company’s operations and purpose. However, such a transformation would present several challenges and considerations.

- Revenue Loss for Governments: Walmart's tax contributions, as outlined earlier, are substantial. If the company were exempt, governments at various levels would lose a significant source of revenue, impacting their ability to fund public services and infrastructure.

- Fairness and Equity: Granting tax exemption to a large, for-profit corporation could raise questions about fairness and the distribution of tax burdens. It might prompt a reevaluation of the tax system's fairness and potentially lead to calls for reforms.

- Impact on Consumers and Employees: A tax-exempt status could affect Walmart's pricing strategies and employee compensation. The company might pass on tax savings to consumers, but it could also choose to increase profits or reinvest in the business. Employee wages and benefits could be influenced by the new tax structure.

- Regulatory and Legal Challenges: Achieving tax-exempt status for a corporation of Walmart's scale and complexity would require significant legal and regulatory maneuvering. It might involve a complete restructuring of the company's business model and a detailed review of its operations to ensure compliance with the requirements for tax exemption.

In summary, while the concept of a tax-exempt Walmart is intriguing, it presents a complex landscape of challenges and considerations. The potential impact on tax revenues, fairness, and the broader economy would be significant, requiring careful evaluation and planning.

Global Perspective: Walmart’s International Tax Strategies

Walmart’s tax strategies extend beyond its U.S. operations. The company’s global presence and diverse corporate structure necessitate a nuanced approach to international taxation.

International Tax Landscape

Operating in multiple countries means navigating a complex web of tax laws and regulations. Walmart’s international tax strategies aim to optimize its global tax position while complying with local laws. This involves managing tax rates, transfer pricing, and intellectual property strategies across jurisdictions.

For instance, Walmart's international operations include various corporate entities, each with its own tax obligations. These entities may be subject to different tax rates and regulations, depending on the country's tax laws. Walmart's tax team works to ensure compliance while leveraging opportunities for tax efficiency.

Tax Incentives and Strategies

Many countries offer tax incentives to attract foreign investment and encourage economic growth. Walmart, like other multinational corporations, may leverage these incentives to reduce its tax burden. This could involve setting up operations in jurisdictions with favorable tax regimes or structuring transactions to optimize tax efficiency.

For example, some countries offer tax holidays or reduced tax rates for specific industries or investments. Walmart might strategically locate certain operations or supply chain activities in these jurisdictions to benefit from such incentives. Additionally, the company may utilize transfer pricing strategies to allocate profits and costs among its international entities in a tax-efficient manner.

Future Implications and Considerations

The future of Walmart’s tax strategies and the broader tax landscape is shaped by evolving tax laws, economic trends, and societal expectations.

Tax Reform and Policy Changes

Tax policies are subject to frequent revisions and reforms. Changes in tax laws can significantly impact Walmart’s tax obligations and strategies. For instance, recent tax reforms in the U.S. have altered the corporate tax landscape, influencing the company’s tax planning.

Future tax reforms could introduce new incentives, penalties, or rates that would require Walmart to adapt its strategies accordingly. Staying abreast of these changes is crucial for the company's financial health and tax compliance.

Sustainability and Social Responsibility

As societal expectations evolve, there is a growing focus on corporate sustainability and social responsibility. This includes expectations around tax contributions and fair tax practices. Walmart, as a prominent corporate citizen, faces increasing scrutiny and pressure to demonstrate responsible tax practices.

The company must balance its tax optimization strategies with the need to maintain a positive public image and reputation. This delicate balance requires a proactive approach to tax planning that considers not only financial optimization but also the broader societal impact.

Digital Economy and Tax Challenges

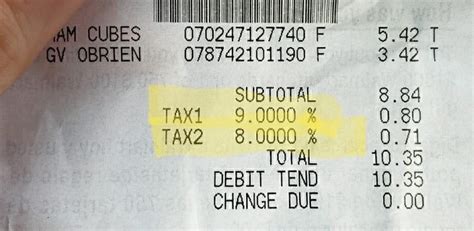

The rise of the digital economy presents unique tax challenges for multinational corporations like Walmart. The nature of digital transactions and online sales often transcends traditional borders, making it difficult to allocate tax obligations accurately. This is particularly relevant for e-commerce platforms and digital services.

Walmart, with its expanding e-commerce presence, must navigate these complexities. The company's tax strategies must adapt to the evolving digital tax landscape, which includes emerging tax policies for digital services and the ongoing debate over a global digital services tax.

How does Walmart’s tax strategy compare to other large retailers?

+Walmart’s tax strategy is comparable to other large retailers in its focus on tax optimization and compliance. However, the company’s global scale and diverse operations may give it a more complex tax landscape to navigate. While all retailers aim to minimize their tax burdens, Walmart’s strategies are shaped by its unique position in the market.

What are the key challenges Walmart faces in its international tax strategies?

+Walmart’s international tax strategies must navigate diverse tax laws and regulations across jurisdictions. The company must balance tax optimization with compliance, which can be challenging due to the complexity of global tax systems. Additionally, managing transfer pricing and intellectual property strategies internationally adds further complexity.

How does Walmart’s tax contribution impact local communities and economies?

+Walmart’s tax contributions, including income taxes, payroll taxes, and property taxes, significantly impact local communities and economies. These tax payments help fund public services, infrastructure, and community development. Additionally, Walmart’s economic activities, such as its employment opportunities and support for local suppliers, contribute to the economic health of communities.