Pay After Taxes Texas

Welcome to a comprehensive exploration of the concept of "Pay After Taxes Texas", a financial strategy gaining popularity among individuals and businesses in the Lone Star State. This expert-level guide will delve into the intricacies of this tax-efficient approach, offering an in-depth analysis of its benefits, implementation, and potential implications.

Understanding Pay After Taxes in Texas

In the vibrant economic landscape of Texas, where entrepreneurship thrives and tax strategies play a pivotal role, the Pay After Taxes concept has emerged as a strategic tool. This approach, tailored to the state’s unique tax environment, allows individuals and businesses to optimize their financial decisions and maximize their after-tax earnings.

The Core Principle

At its essence, Pay After Taxes is a strategic mindset that focuses on managing finances with a post-tax perspective. It involves making informed decisions about income, investments, and expenses to ensure that the net return or profit is optimized after all applicable taxes have been considered.

Key Benefits in Texas

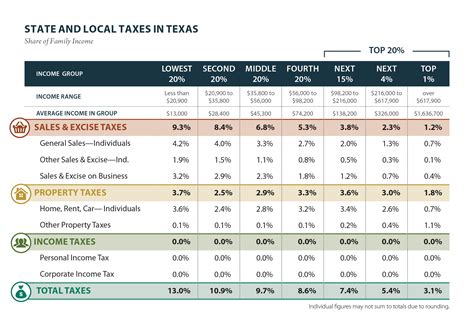

Texas, known for its business-friendly environment and competitive tax structure, offers several advantages for those adopting a Pay After Taxes strategy. Here’s a breakdown of some key benefits:

- Lower Income Tax Burden: Texas is one of the few states in the US without a state income tax. This means that individuals and businesses can keep more of their earnings, making it an attractive destination for those seeking tax efficiency.

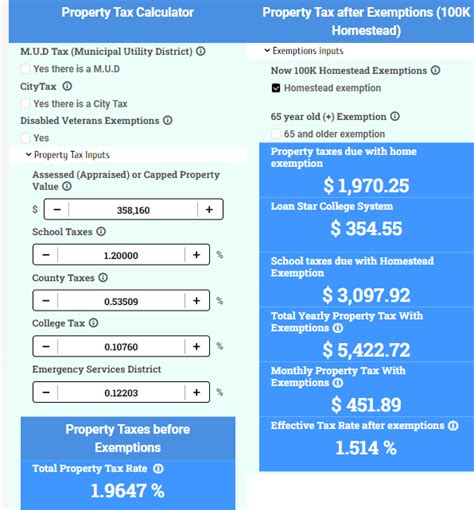

- Property Tax Incentives: The state provides various property tax exemptions and reductions, particularly for agricultural land and certain business properties. These incentives can significantly reduce the tax liability for property owners.

- Sales Tax Flexibility: Texas has a robust sales tax system, with rates varying across counties and cities. This flexibility allows businesses to strategically plan their operations to minimize sales tax impacts.

Implementation Strategies

Implementing a successful Pay After Taxes strategy in Texas requires a meticulous approach. Here are some key considerations:

- Optimize Income Streams: Analyze and structure your income sources to take advantage of Texas’ tax-free environment. Consider investing in businesses or assets that generate income with minimal or no state income tax implications.

- Strategic Real Estate Planning: If you own or plan to acquire real estate in Texas, research and understand the state’s property tax exemptions and incentives. This can include agricultural use valuation, homestead exemptions, and business property tax abatements.

- Sales Tax Management: For businesses, effective sales tax management is crucial. Stay updated on the varying sales tax rates across Texas counties and cities. Consider offering services or products that may be exempt from sales tax or have reduced rates.

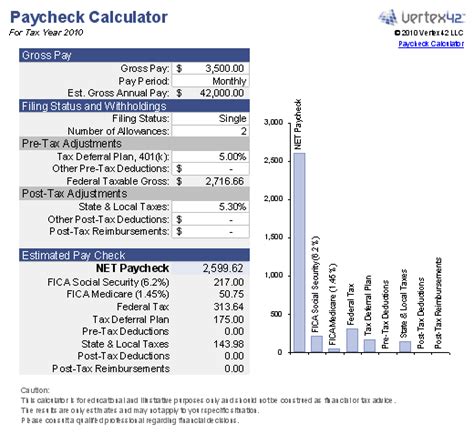

- Retirement Planning: Texas’ tax-free status on retirement income is a significant advantage. Maximize contributions to tax-advantaged retirement accounts like 401(k)s or IRAs to ensure a tax-efficient retirement.

Case Study: Real-World Application

Let’s explore a practical example to illustrate the effectiveness of the Pay After Taxes strategy in Texas.

Scenario: John’s Investment Journey

John, a successful entrepreneur in Texas, wanted to optimize his financial portfolio to maximize his after-tax returns. Here’s how he implemented the Pay After Taxes strategy:

- Income Diversification: John diversified his income streams by investing in a range of businesses, including tech startups and real estate ventures. This strategy allowed him to benefit from Texas’ lack of state income tax on most business profits.

- Real Estate Investment: John purchased a commercial property in a Texas city with a favorable property tax climate. He qualified for a business property tax abatement, significantly reducing his annual tax liability.

- Sales Tax Optimization: For his online business, John strategically priced his products to offer competitive rates while factoring in varying sales tax rates across Texas. This approach helped him maintain a strong market position without compromising on profitability.

- Retirement Planning: John maximized his contributions to a Texas-based 401(k) plan, taking advantage of the state’s tax-free status on retirement income. This ensured that his retirement savings grew without any state income tax deductions.

By adopting a comprehensive Pay After Taxes strategy, John was able to significantly boost his after-tax returns. His income diversification, combined with strategic real estate and sales tax planning, resulted in a more efficient financial portfolio, allowing him to achieve his financial goals more rapidly.

Data Insights: A Comparative Analysis

To further illustrate the impact of the Pay After Taxes strategy, let’s examine some real-world data. The following table compares the potential tax savings for an individual with an annual income of $100,000 in Texas versus another state with a similar income level but a higher tax rate.

| State | Annual Income | Estimated Tax Savings |

|---|---|---|

| Texas | $100,000 | $4,000 - $6,000 (varies based on deductions) |

| State with Income Tax | $100,000 | $2,000 - $3,000 (based on state tax rate) |

As evident from the table, the Pay After Taxes strategy in Texas can lead to substantial savings, especially when compared to states with higher tax rates. These savings can be reinvested or used to enhance one's financial security and well-being.

Future Implications and Considerations

While the Pay After Taxes strategy offers significant advantages, it’s essential to consider potential future developments and their impact. Here are some key considerations for the future:

- Tax Policy Changes: Texas’ tax landscape is relatively stable, but it’s crucial to stay updated on any potential policy changes. Keep an eye on legislative developments that could impact state taxes, especially income and property taxes.

- Economic Shifts: Texas’ economy is dynamic, and sectors like energy, technology, and real estate experience periodic shifts. Stay informed about industry trends to ensure your investments and income streams remain tax-efficient.

- Personalized Planning: Every individual’s financial situation is unique. Work closely with financial advisors and tax professionals to develop a tailored Pay After Taxes strategy that aligns with your specific goals and circumstances.

Conclusion: A Strategic Financial Approach

In conclusion, the “Pay After Taxes Texas” strategy is a powerful tool for individuals and businesses looking to optimize their financial outcomes. By understanding and leveraging Texas’ unique tax environment, you can significantly enhance your after-tax returns and achieve your financial goals more efficiently.

Remember, a well-planned financial strategy is key to long-term success. Embrace the opportunities presented by Texas' tax-friendly environment, and don't hesitate to seek professional advice to navigate this complex but rewarding financial landscape.

How does Texas’ lack of state income tax benefit individuals and businesses?

+Texas’ lack of state income tax means that individuals and businesses can keep more of their earnings, as they are not subject to an additional layer of taxation on their income. This makes Texas an attractive destination for those seeking tax efficiency and can result in significant savings, especially for high-income earners.

Are there any specific industries or sectors that benefit the most from the Pay After Taxes strategy in Texas?

+While the Pay After Taxes strategy can benefit a wide range of industries, certain sectors like technology, energy, and real estate, which often involve significant income and investments, can particularly thrive in Texas’ tax-friendly environment. These sectors can leverage the state’s tax advantages to boost their financial performance.

What are some potential challenges or limitations of the Pay After Taxes strategy in Texas?

+One potential challenge is keeping up with any changes in Texas’ tax policies, especially regarding property taxes, which can vary significantly across different areas of the state. Additionally, while Texas has a favorable tax environment, it’s essential to consider other factors like cost of living and business regulations when making financial decisions.