Sc Vehicle Tax Calculator

The South Carolina Vehicle Tax Calculator is a valuable tool for residents of the Palmetto State, providing an easy and convenient way to estimate and understand the taxes associated with vehicle ownership. This online resource is an essential guide for vehicle buyers, sellers, and owners, offering a clear breakdown of the various tax components involved. By inputting specific vehicle details, users can obtain an accurate estimate of the taxes they can expect to pay, ensuring financial preparedness and transparency in vehicle-related transactions.

Unveiling the South Carolina Vehicle Tax Landscape

South Carolina imposes a range of taxes on vehicle ownership, encompassing sales tax, excise tax, registration fees, and more. These taxes are calculated based on factors such as the vehicle’s purchase price, age, weight, and intended use. Understanding these taxes is crucial for vehicle owners, as they represent a significant financial commitment.

The Vehicle Tax Calculator provided by the South Carolina Department of Revenue (SCDOR) serves as a comprehensive guide to these taxes. It simplifies the complex tax system, offering a user-friendly interface that calculates and presents tax estimates based on individual vehicle details.

The Key Components of South Carolina Vehicle Taxes

South Carolina’s vehicle tax system is multi-faceted, comprising several distinct taxes and fees. These include:

- Sales Tax: Applied to the purchase price of a vehicle, this tax varies depending on the county of purchase. It is calculated as a percentage of the vehicle’s sale price, with specific rates set for each county.

- Excise Tax: Also known as the “Vehicle Acquisition Tax,” this is a one-time tax levied on the purchase of a new or used vehicle. The tax rate is 5% of the vehicle’s purchase price, with certain exemptions and credits available.

- Registration Fee: An annual fee required for registering a vehicle in South Carolina. The fee varies based on the vehicle’s weight and type, with specific rates for cars, motorcycles, and commercial vehicles.

- Title Fee: A one-time fee charged when registering a vehicle for the first time in South Carolina. The fee covers the cost of processing the vehicle’s title and registration.

- Environmental Fees: Additional fees may apply for certain vehicle types, such as electric or hybrid vehicles, to support environmental initiatives.

Each of these taxes plays a significant role in the overall cost of vehicle ownership in South Carolina, and understanding their calculations is essential for financial planning.

How the South Carolina Vehicle Tax Calculator Works

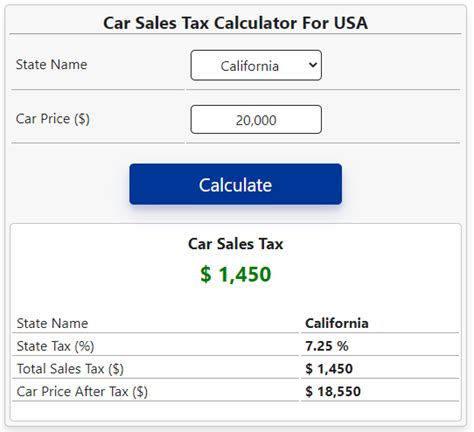

The South Carolina Vehicle Tax Calculator is a web-based tool accessible on the SCDOR website. It is designed to be user-friendly, guiding users through a series of simple steps to estimate their vehicle taxes.

Here's a step-by-step breakdown of how the calculator works:

- Access the Calculator: Users can find the Vehicle Tax Calculator on the SCDOR website, typically under the "Taxes & Fees" section.

- Select Vehicle Type: The calculator begins by prompting users to choose the type of vehicle they own or intend to purchase. Options include cars, trucks, SUVs, motorcycles, and more.

- Input Vehicle Details: After selecting the vehicle type, users are guided to input specific details about their vehicle. This includes information such as the purchase price, vehicle weight, and intended use (e.g., personal or commercial).

- Calculate Taxes: With the necessary details entered, the calculator computes the estimated taxes based on the provided information. It calculates the sales tax, excise tax, registration fee, and any other applicable fees.

- Review the Estimate: The calculator presents a detailed breakdown of the estimated taxes, providing a clear picture of the financial obligations associated with the vehicle. This estimate can be printed or saved for future reference.

The calculator is designed to be accurate and up-to-date, ensuring that users receive reliable estimates based on the latest tax rates and regulations.

Benefits of Using the Vehicle Tax Calculator

The South Carolina Vehicle Tax Calculator offers several advantages to vehicle owners and buyers:

- Convenience: Accessible online, the calculator eliminates the need for in-person visits to tax offices, saving time and effort.

- Accuracy: By inputting specific vehicle details, users receive precise tax estimates, helping them budget effectively.

- Transparency: The calculator provides a clear breakdown of each tax component, ensuring users understand the financial implications of vehicle ownership.

- Planning: With accurate tax estimates, vehicle owners can plan their finances accordingly, whether for annual registration fees or one-time acquisition taxes.

The calculator is a valuable resource for anyone navigating the complex world of vehicle taxes in South Carolina, offering a straightforward and reliable way to estimate and manage these financial obligations.

Real-World Application of the Vehicle Tax Calculator

Let’s consider a real-life scenario to understand the practical application of the South Carolina Vehicle Tax Calculator.

Imagine you've just purchased a used 2022 Toyota Camry in South Carolina. The purchase price is $25,000, and you plan to use the vehicle for personal travel. You can use the Vehicle Tax Calculator to estimate the taxes you'll owe for this purchase.

Here's how the calculator might guide you through the process:

- Vehicle Type Selection: You select "Car" as the vehicle type.

- Input Vehicle Details: You enter the purchase price of $25,000 and choose "Personal Use" as the intended use.

- Tax Calculation: The calculator computes the taxes based on your inputs. It estimates the sales tax based on your county of residence, the excise tax at 5% of the purchase price, and the registration fee based on the weight of the vehicle.

- Estimate Review: The calculator presents an estimate showing the total tax amount, broken down into sales tax, excise tax, and registration fee. You can see the specific rates and calculations used for each tax component.

With this estimate, you can plan your finances accordingly, ensuring you have the necessary funds to cover the vehicle taxes when due.

Vehicle Tax Calculator vs. Traditional Methods

The Vehicle Tax Calculator offers a significant improvement over traditional methods of estimating vehicle taxes. Previously, vehicle owners and buyers had to manually calculate taxes using complex formulas or rely on rough estimates provided by dealerships or tax offices.

The calculator simplifies this process, providing an easy-to-use interface that guides users through the tax calculation process. It ensures accuracy and transparency, reducing the risk of unexpected tax expenses and providing a clear understanding of the financial obligations associated with vehicle ownership.

| Calculator Feature | Benefits |

|---|---|

| User-Friendly Interface | Simplifies tax estimation, making it accessible to all vehicle owners. |

| Accurate Tax Estimates | Provides precise calculations based on specific vehicle details. |

| Tax Breakdown | Offers a clear understanding of each tax component and its calculation. |

| Real-Time Updates | Ensures tax estimates are based on the latest tax rates and regulations. |

Future Implications and Updates

As South Carolina’s tax landscape evolves, the Vehicle Tax Calculator is expected to remain a vital resource for vehicle owners. With potential changes in tax rates, regulations, and vehicle technologies, the calculator will need to adapt to provide accurate estimates for emerging vehicle types and tax scenarios.

The SCDOR is committed to keeping the calculator up-to-date, ensuring it reflects the latest tax policies and provides reliable estimates for all vehicle owners. This commitment to accuracy and user-friendliness will continue to make the calculator an indispensable tool for those navigating the complex world of vehicle taxes in South Carolina.

Conclusion

The South Carolina Vehicle Tax Calculator stands as a testament to the state’s commitment to transparency and convenience in tax matters. By offering a user-friendly platform for estimating vehicle taxes, the calculator empowers vehicle owners to make informed financial decisions. As vehicle technologies and tax policies evolve, the calculator will continue to play a crucial role in guiding South Carolinians through the complexities of vehicle ownership.

FAQ

What is the purpose of the South Carolina Vehicle Tax Calculator?

+

The South Carolina Vehicle Tax Calculator is designed to provide an easy and accurate way for vehicle owners and buyers to estimate the taxes associated with vehicle ownership in the state. It simplifies the complex tax system, ensuring users can understand and plan for their financial obligations.

How often is the Vehicle Tax Calculator updated?

+

The calculator is regularly updated to reflect changes in tax rates and regulations. The South Carolina Department of Revenue ensures that the calculator remains current, providing users with accurate estimates based on the latest tax policies.

Can I use the calculator for multiple vehicle types?

+

Absolutely! The calculator is versatile and can be used for a wide range of vehicle types, including cars, trucks, SUVs, motorcycles, and more. It adapts to the specific details of each vehicle, providing tailored tax estimates.

Are there any limitations to the calculator’s accuracy?

+

While the calculator is designed to be accurate, it relies on the information provided by the user. It’s essential to input accurate and up-to-date vehicle details to ensure precise tax estimates. Additionally, the calculator does not account for specific tax exemptions or credits that an individual may be eligible for.

Where can I find the Vehicle Tax Calculator on the SCDOR website?

+

The calculator is typically located under the “Taxes & Fees” section of the SCDOR website. You can access it by visiting the official SCDOR website and navigating to the relevant section.