Puerto Rico Tax

Puerto Rico, a vibrant Caribbean island and unincorporated territory of the United States, has a unique tax system that has garnered significant attention in recent years. With its strategic geographic location and favorable tax laws, Puerto Rico offers a compelling opportunity for businesses and individuals seeking tax advantages and economic growth. In this comprehensive article, we delve into the intricacies of Puerto Rico's tax system, exploring its benefits, structures, and implications for various entities.

Unveiling Puerto Rico’s Tax Landscape: A Comprehensive Overview

Puerto Rico’s tax regime stands out as a strategic tool for economic development, offering a range of incentives and benefits that have attracted global attention. At its core, the island’s tax system operates within the framework of the Internal Revenue Code of Puerto Rico (IRPCR), which mirrors many aspects of the U.S. Internal Revenue Code (IRC). However, it is essential to recognize the distinctive nature of Puerto Rico’s tax laws, which have been shaped by its unique political and economic status.

Key Characteristics of Puerto Rico’s Tax System

One of the most notable features of Puerto Rico’s tax system is its territorial approach to taxation. Unlike the U.S. federal tax system, which follows a worldwide tax regime, Puerto Rico adheres to a territorial system. This means that only income sourced within Puerto Rico is subject to Puerto Rican taxation. Income generated outside the island is typically exempt from Puerto Rican tax liabilities, a significant advantage for businesses operating internationally.

Another critical aspect is the Corporate Net Income Tax (CNI), which is levied on businesses operating in Puerto Rico. The CNI tax rate is competitive, standing at 37.5% for C Corporations and 15% for S Corporations and partnerships. This rate is significantly lower than the top corporate tax rate in the United States, making Puerto Rico an attractive destination for businesses seeking to reduce their tax liabilities.

Additionally, Puerto Rico offers various tax incentives and credits designed to promote economic development and job creation. These incentives are particularly beneficial for specific industries, such as manufacturing, biotechnology, and tourism. For instance, the Export Services Act (ESA) provides a 4% tax rate for companies exporting services from Puerto Rico, making it an ideal hub for service-based businesses looking to expand their global reach.

| Tax Incentive | Description |

|---|---|

| Act 20 - Export Services Act (ESA) | 4% tax rate for export services |

| Act 22 - Individual Investors Act | 0% tax on long-term capital gains and qualified dividends |

| Act 273 - Manufacturers' Incentives Act | Reduced tax rate for manufacturers |

| Act 73 - Tourism Development Act | Tax credits and incentives for tourism-related businesses |

Taxation for Individuals: A Haven for Personal Wealth

Puerto Rico’s tax system also extends favorable treatment to individuals, particularly those who qualify for specific tax incentives. The Individual Investors Act (Act 22) is a notable example, offering a 0% tax rate on long-term capital gains and qualified dividends for individuals who establish bona fide tax residency in Puerto Rico. This incentive has attracted high-net-worth individuals seeking to minimize their tax liabilities and enjoy the benefits of living in a tropical paradise.

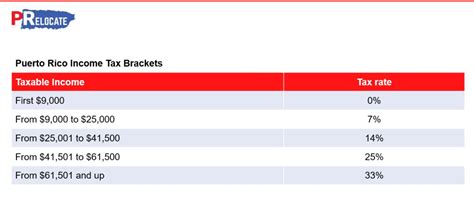

Furthermore, Puerto Rico's personal income tax rates are generally lower than those in many U.S. states. The island's top personal income tax rate is 33%, which is applicable to income over $42,000 for single filers and $84,000 for married couples filing jointly. This competitive rate, combined with the absence of a state income tax, makes Puerto Rico an attractive destination for individuals seeking to reduce their tax burden.

Impact on Local Economy and Development

The unique tax system in Puerto Rico has had a significant impact on the local economy and its development trajectory. The tax incentives and reduced tax rates have encouraged a surge in business establishment and investment on the island. This influx of economic activity has led to job creation, infrastructure development, and a boost in the local job market. Additionally, the increased tax revenues generated have contributed to the island’s fiscal stability and the funding of essential public services.

However, it is essential to note that the benefits of Puerto Rico's tax system are not without their complexities. The island's unique political and economic status, coupled with its history of debt and financial challenges, require careful consideration. Understanding the full scope of tax implications, including potential limitations and challenges, is crucial for businesses and individuals considering Puerto Rico as a tax haven.

Navigating the Complexities: Expert Insights on Puerto Rico’s Tax System

As we explore the intricacies of Puerto Rico’s tax landscape, it becomes evident that a nuanced understanding of the system is essential for maximizing its benefits. While the island offers numerous advantages, there are also potential pitfalls and challenges that require careful navigation.

Understanding the Limitations and Challenges

One of the primary challenges of Puerto Rico’s tax system is the intricate web of regulations and requirements that accompany its various tax incentives. These incentives often come with strict eligibility criteria and compliance obligations. For instance, the Individual Investors Act (Act 22) requires individuals to establish bona fide tax residency in Puerto Rico, which involves specific residency requirements and potential lifestyle adjustments.

Additionally, the island's unique political status as an unincorporated territory of the United States introduces certain complexities. While Puerto Rico enjoys a certain degree of autonomy in its tax system, it is still subject to some federal regulations and oversight. This dual nature of the island's tax system can create complexities, especially for businesses operating across multiple jurisdictions.

Maximizing Benefits: A Strategic Approach

To fully leverage the advantages of Puerto Rico’s tax system, a strategic and tailored approach is essential. For businesses, this may involve restructuring operations to optimize tax benefits, such as establishing a presence on the island to take advantage of the territorial tax system and reduced corporate tax rates. For individuals, it could mean carefully evaluating their tax residency status and financial planning to maximize the benefits of incentives like Act 22.

Expert guidance is invaluable in navigating the complexities of Puerto Rico's tax system. Engaging with tax professionals who specialize in the island's unique tax landscape can provide invaluable insights and ensure compliance with the intricate regulations. These experts can assist in structuring business operations, optimizing tax strategies, and providing personalized advice tailored to the specific needs of individuals and businesses.

Future Prospects and Ongoing Developments

Puerto Rico’s tax system is dynamic and subject to ongoing developments and potential reforms. As the island continues to evolve and address its economic challenges, the tax landscape may undergo changes to adapt to new circumstances. It is essential to stay informed about these developments to make informed decisions regarding tax planning and strategy.

One notable recent development is the implementation of the Employee Retention Credit (ERC) under the CARES Act. This credit, available to businesses impacted by the COVID-19 pandemic, provides a valuable opportunity for eligible businesses in Puerto Rico to access additional tax benefits. Understanding the eligibility criteria and claiming process for the ERC can be a critical component of a comprehensive tax strategy.

Conclusion: A Unique Tax Haven with Strategic Advantages

Puerto Rico’s tax system presents a unique and advantageous opportunity for businesses and individuals seeking strategic tax planning. The island’s territorial tax system, competitive tax rates, and targeted incentives offer a compelling proposition for those looking to optimize their tax liabilities and contribute to the local economy.

However, it is crucial to approach Puerto Rico's tax landscape with a well-informed and strategic mindset. Understanding the intricacies, limitations, and ongoing developments is essential for maximizing benefits and ensuring compliance. By engaging with tax experts and staying abreast of the latest regulations, individuals and businesses can navigate the complexities of Puerto Rico's tax system and unlock its full potential.

What is the Corporate Net Income Tax (CNI) rate in Puerto Rico for C Corporations?

+The CNI tax rate for C Corporations in Puerto Rico is 37.5%, which is significantly lower than the top corporate tax rate in the United States.

Are there any tax incentives for manufacturing businesses in Puerto Rico?

+Yes, the Manufacturers’ Incentives Act (Act 73) provides reduced tax rates and incentives for manufacturers operating in Puerto Rico, encouraging economic development in this sector.

How does Puerto Rico’s tax system compare to other offshore jurisdictions?

+Puerto Rico’s tax system offers a unique blend of benefits, including a territorial tax system, competitive tax rates, and targeted incentives. While it shares some similarities with other offshore jurisdictions, its distinct political and economic status sets it apart.