529 Savings Tax Deduction

Planning for your child's education is a crucial financial goal for many parents and guardians. One of the most effective tools to achieve this goal is the 529 savings plan, which offers tax advantages and a dedicated path to funding future educational expenses. This article will delve into the intricacies of 529 savings plans, specifically exploring the tax deductions they provide, and offer a comprehensive guide to maximizing these benefits.

Understanding 529 Savings Plans: A Tax-Advantaged Educational Savings Vehicle

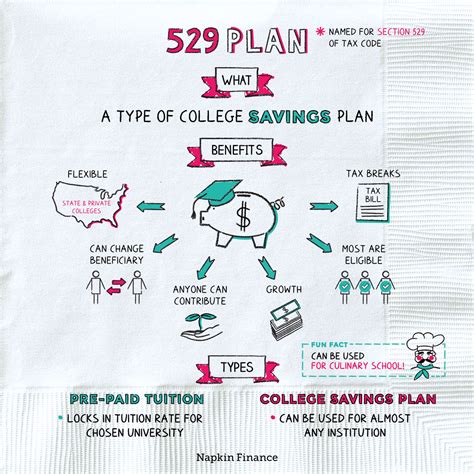

A 529 plan, named after the corresponding section in the U.S. Internal Revenue Code, is a tax-advantaged savings plan designed to help families set aside funds for future education expenses. These plans, which can be sponsored by states, state agencies, or educational institutions, offer significant tax benefits that make them an attractive option for long-term educational planning.

There are two primary types of 529 plans: Prepaid Tuition Plans and Savings Plans. Prepaid Tuition Plans allow families to purchase credits for future tuition at specific colleges or universities, often locking in current prices for future use. Savings Plans, on the other hand, function like traditional investment accounts, allowing funds to grow tax-free and be used for a wide range of qualified educational expenses.

The tax benefits of 529 plans are a key incentive for many families. Contributions to 529 plans are made with after-tax dollars, but the earnings on these contributions grow tax-free, and withdrawals for qualified educational expenses are also tax-free. This means that, over time, a family can save a significant amount in taxes, making their educational savings go further.

The Role of Tax Deductions

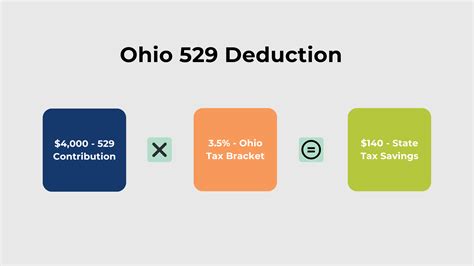

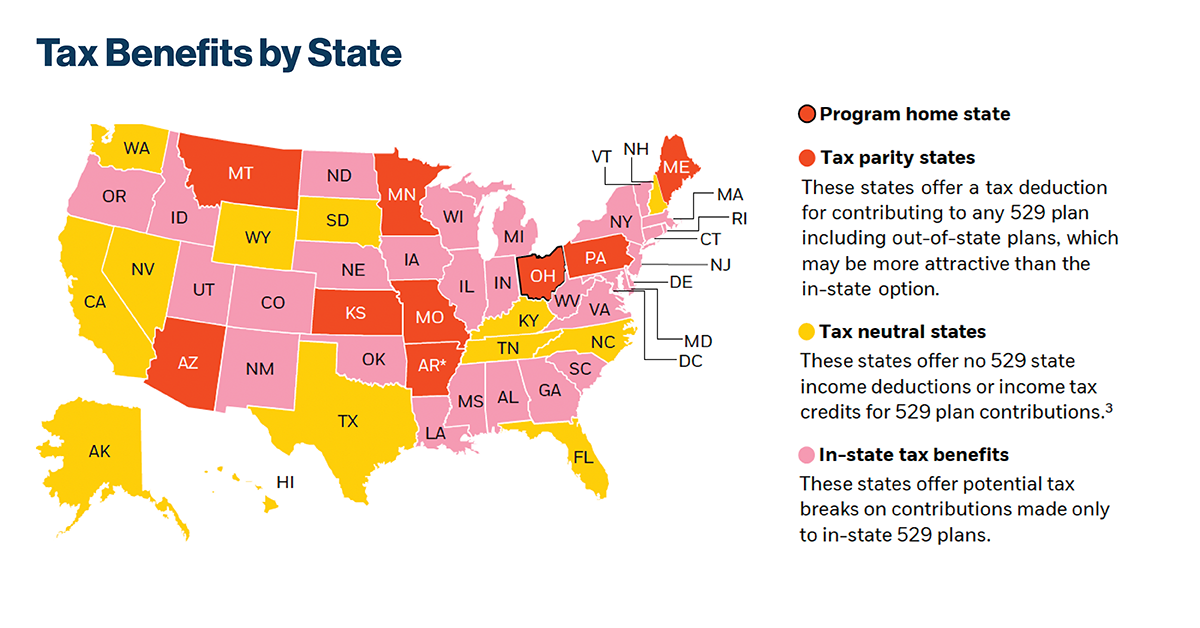

While the tax-free growth and withdrawals are significant advantages, 529 plans also offer potential tax deductions at the state level. Many states offer tax deductions or tax credits for contributions made to their state-sponsored 529 plans. These deductions can reduce a family’s taxable income, leading to potential savings on their state income tax liability.

For example, the state of New York offers a tax deduction for contributions made to the New York 529 College Savings Program. A family contributing $5,000 to this plan could potentially deduct that amount from their taxable income, which could result in significant tax savings depending on their tax bracket.

However, it's important to note that the availability and amount of these deductions vary greatly by state. Some states, like California, offer a tax deduction, while others, like Texas, do not. Additionally, the deduction amount can be limited and may only be available for a certain portion of the contribution.

Maximizing Tax Benefits

To make the most of the tax benefits offered by 529 plans, it’s essential to understand the specific rules and regulations for your state’s plan. This includes knowing the contribution limits, the deduction limits, and any other requirements or restrictions. For instance, some states may require a minimum contribution amount to qualify for the deduction, or they may have restrictions on who can claim the deduction (such as only allowing the account owner to claim it, not the beneficiary).

Another strategy to maximize tax benefits is to consider the timing of your contributions. Many states allow contributions to be made at any time during the year, but the deduction is often based on the tax year. Therefore, making a large contribution at the end of the year could maximize your tax savings for that year, especially if your income (and thus your tax bracket) is higher.

Additionally, it's worth exploring the potential benefits of rolling over existing 529 plans into a new state's plan. If you move to a new state, or if the rules and benefits of your current state's plan change, you may be able to transfer your existing 529 plan to a new state's plan without incurring taxes or penalties. This can allow you to take advantage of the new state's tax benefits, especially if they offer more favorable deductions or credits.

| State | Deduction Amount | Contribution Limit |

|---|---|---|

| New York | $5,000 per beneficiary per year | $458,000 per beneficiary |

| California | $14,000 per taxpayer (married filing jointly) | $500,000 per beneficiary |

| Ohio | $2,000 per taxpayer | $366,424 per beneficiary |

The Future of 529 Savings Plans

The landscape of 529 plans is constantly evolving, with states regularly adjusting their plans to remain competitive and attractive to families. One significant recent change was the expansion of qualified expenses under the SECURE Act, which was signed into law in 2019. This act expanded the definition of qualified expenses to include student loans, which can be a significant benefit for families with existing student loan debt.

Looking forward, there are several potential developments that could impact the future of 529 plans. One is the potential for increased federal involvement, with some advocates pushing for a federal tax deduction for 529 contributions. This could significantly increase the attractiveness of 529 plans for families across the country, though it remains a legislative proposal at this time.

Another potential development is the continued expansion of qualified expenses. As the cost of education continues to rise, and as the nature of education evolves to include more online and non-traditional options, it's possible that the definition of qualified expenses could be further expanded. This could make 529 plans even more versatile and beneficial for families.

Lastly, the potential for increased flexibility in 529 plans could be a significant development. Currently, if a beneficiary doesn't use the funds for qualified educational expenses, there are tax consequences. However, if this were to change, allowing for more flexibility in how the funds can be used without penalty, it could make 529 plans more appealing to a wider range of families.

Conclusion

529 savings plans are a powerful tool for families to save for their children’s education, offering significant tax advantages and a dedicated path to funding educational expenses. While the tax deductions offered by these plans vary by state, understanding and maximizing these benefits can be a key part of a family’s financial planning strategy. As the landscape of education and tax policy continues to evolve, the future of 529 plans looks bright, with potential for increased benefits and flexibility.

What is a 529 plan and how does it work?

+

A 529 plan is a tax-advantaged savings plan designed to help families save for future educational expenses. Contributions are made with after-tax dollars, but the earnings grow tax-free, and withdrawals for qualified educational expenses are also tax-free. There are two main types: Prepaid Tuition Plans and Savings Plans.

Are there tax deductions for 529 plans?

+

Yes, many states offer tax deductions or tax credits for contributions made to their state-sponsored 529 plans. These deductions can reduce a family’s taxable income, leading to potential savings on their state income tax liability. However, the availability and amount of these deductions vary greatly by state.

How can I maximize the tax benefits of a 529 plan?

+

To maximize tax benefits, it’s important to understand the specific rules and regulations for your state’s plan, including contribution limits and deduction limits. Consider the timing of your contributions to align with your tax year, and explore the potential benefits of rolling over existing plans to take advantage of new state benefits.

What are some potential future developments for 529 plans?

+

Potential future developments include increased federal involvement with a potential federal tax deduction, expanded qualified expenses to include more types of educational expenses, and increased flexibility in how funds can be used without penalty. These developments could significantly enhance the benefits and appeal of 529 plans.