Az Tax Calculator

The AZ Tax Calculator is a powerful tool designed specifically for individuals and businesses operating within the state of Arizona. With a comprehensive set of features, this calculator aims to simplify the complex world of Arizona taxes, providing users with accurate and reliable calculations for a wide range of tax-related scenarios.

Understanding the AZ Tax Landscape

Arizona, known for its vibrant economy and diverse industries, imposes a range of taxes on its residents and businesses. From income taxes to sales and use taxes, understanding the state’s tax system is crucial for financial planning and compliance. The AZ Tax Calculator steps in to demystify this process, offering a user-friendly interface and precise calculations tailored to Arizona’s unique tax environment.

Key Features of the AZ Tax Calculator

The AZ Tax Calculator boasts an array of features that cater to various tax-related needs. Here’s an in-depth look at some of its standout capabilities:

Income Tax Calculations

For individuals and business owners, calculating income taxes is a crucial task. The AZ Tax Calculator simplifies this process by considering factors such as taxable income, deductions, and credits specific to Arizona’s tax code. Users can input their income details and instantly receive an estimate of their tax liability, aiding in financial planning and ensuring compliance with state tax laws.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $10,800 | 2.59% |

| $10,801 - $26,000 | 3.34% |

| $26,001 - $50,000 | 4.17% |

| Above $50,000 | 4.50% |

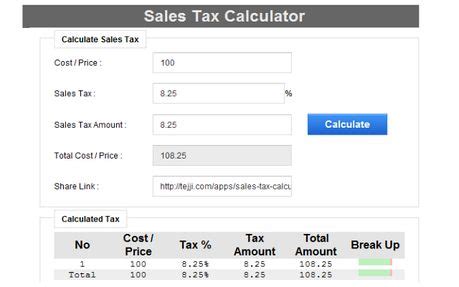

Sales and Use Tax Calculations

Arizona’s sales and use tax system can be intricate, with varying rates depending on the location and type of goods or services. The AZ Tax Calculator takes the guesswork out of these calculations. Users can input the type of transaction, the location, and the value of the goods or services to instantly determine the applicable tax rate and the total tax amount. This feature is particularly beneficial for businesses operating in multiple locations within the state.

| Location | Sales Tax Rate |

|---|---|

| Phoenix | 8.30% |

| Tucson | 7.50% |

| Scottsdale | 9.30% |

| Flagstaff | 8.15% |

Property Tax Estimator

Property taxes are an essential consideration for homeowners and property investors in Arizona. The AZ Tax Calculator includes a property tax estimator that takes into account the assessed value of the property, the applicable tax rate, and any exemptions or deductions. This feature provides users with an estimate of their annual property tax liability, helping them budget effectively and understand the financial implications of property ownership in Arizona.

Business Tax Tools

Arizona businesses face a range of tax obligations, including income taxes, payroll taxes, and transaction privilege taxes (TPT). The AZ Tax Calculator offers specialized tools for businesses, allowing them to calculate their tax liabilities accurately. Whether it’s determining the TPT rate for a specific industry or estimating payroll taxes for employees, this calculator streamlines the tax calculation process, ensuring businesses stay compliant and make informed financial decisions.

Accuracy and Reliability

The AZ Tax Calculator prides itself on delivering accurate and up-to-date tax calculations. The team behind the calculator works diligently to keep pace with any changes in Arizona’s tax laws and regulations. Regular updates ensure that users receive calculations based on the latest tax rates and rules, giving them peace of mind and confidence in the results.

User-Friendly Interface

One of the standout features of the AZ Tax Calculator is its intuitive and user-friendly interface. Designed with simplicity in mind, the calculator guides users through the tax calculation process step by step. Clear labels, easy-to-understand prompts, and helpful tooltips make it accessible to users with varying levels of tax knowledge. Whether you’re a tax professional or a first-time taxpayer, the calculator ensures a seamless and stress-free experience.

Benefits for Individuals and Businesses

The AZ Tax Calculator offers a multitude of benefits to both individuals and businesses in Arizona. For individuals, it simplifies the often-daunting task of tax planning and filing, providing accurate estimates and helping them maximize their tax savings. Businesses, on the other hand, can leverage the calculator’s precision to manage their tax obligations efficiently, minimize risks, and make strategic financial decisions.

Individual Tax Planning

For individuals, the AZ Tax Calculator serves as a powerful tool for tax planning. By understanding their tax liability in advance, individuals can make informed decisions about their finances. Whether it’s optimizing deductions, exploring tax credits, or planning for future investments, the calculator empowers individuals to take control of their financial future.

Business Tax Management

Businesses operating in Arizona face a complex web of tax obligations. The AZ Tax Calculator streamlines this process, allowing businesses to calculate their tax liabilities accurately and efficiently. By integrating the calculator into their financial management systems, businesses can ensure compliance, minimize tax risks, and focus on their core operations with peace of mind.

Future Developments and Integrations

The team behind the AZ Tax Calculator is committed to continuous improvement and innovation. Future developments may include enhanced features for specific industries, such as real estate or e-commerce, to cater to the unique tax needs of these sectors. Additionally, integrations with popular accounting and financial software could be explored, providing users with a seamless tax calculation experience within their existing workflows.

Conclusion

The AZ Tax Calculator stands as a testament to the power of technology in simplifying complex tax processes. By offering a comprehensive suite of tax calculation tools tailored to Arizona’s unique tax landscape, the calculator empowers individuals and businesses to navigate their tax obligations with confidence and precision. As Arizona’s tax environment evolves, the AZ Tax Calculator remains a trusted companion, ensuring users stay compliant and make informed financial decisions.

How often are the tax rates and rules updated in the AZ Tax Calculator?

+The AZ Tax Calculator team closely monitors changes in Arizona’s tax laws and regulations. Updates are made regularly to ensure that the calculator reflects the latest tax rates and rules. Users can trust that the calculations provided are based on the most current information available.

Can the AZ Tax Calculator handle complex tax scenarios, such as multiple income streams or business structures?

+Absolutely! The AZ Tax Calculator is designed to accommodate a wide range of tax scenarios. Whether you have multiple sources of income, own a business with complex structures, or have unique tax circumstances, the calculator is equipped to provide accurate calculations tailored to your specific situation.

Are there any additional fees associated with using the AZ Tax Calculator?

+No, the AZ Tax Calculator is completely free to use. Our goal is to provide a valuable service to individuals and businesses in Arizona, helping them navigate their tax obligations with ease and precision.